In 2006, Anthony Salim wants his Group to operate flexibly “in order to capture whatever opportunities may arise… on the axis between Australia, ASEAN and China” (case p. 2). Using module theory and evidence from the Salim Group case study, critically evaluate his chances of success

Introduction

In order to develop a sustainable competitive advantage, it is paramount for multinational corporations to be effective in dealing with challenges emanating from the global market (Bartlett & Beamish, 2011, p. 37). To attain this, the management team of multinational companies should enhance their multinational flexibility. This refers to a firm’s ability to exploit the opportunities available in the international market and also to deal with the risks (Chen, 2004, p. 76). The opportunities emanate from the existence of volatility and diversity within the global business environment.

Harzing and Ruysseveldt (2004, p.36) are of the opinion that diversity and volatility present both risks and opportunities to multinational corporations. The opportunities and risks arise from macro-economic factors in the business environment, for example, interest rate fluctuation, political instability, and changes in the wage rate. Other risks and opportunities originate from the available resources which include natural, human, and financial resources.

Additionally, the responses of competing firms within-host market also present a set of risks and opportunities. This question entails an analysis of the chances of Salim Group succeeding through the implementation of the concept of flexibility.

Analysis

By adopting the multinational flexibility strategy, there is a high probability of Salim Group succeeding. According to Stacey (2007, p.866), multinational flexibility enables a firm to be effective in exploiting opportunities presented in the host country. One of the ways which make this possible arises from the fact that a firm is able to perform regulatory arbitrage.

This means that a firm is able to capitalize on the existing comparative advantage between the host and the domestic country (Stahl & Grigsby, 1997, p.79). For example, by ensuring multinational flexibility, Salim Group will be able to establish its desired businesses in countries where there are no political or legal restrictions thus taking advantage of the existing business environment. This will increase the firm’s effectiveness in penetrating such a market.

In an effort to explain how a firm can develop its competitiveness in the world market, Michael Porter developed the diamond model which postulates that a firm’s competitiveness is dependent on a number of factors. These include the factor conditions, demand conditions, related and supporting industries, the firm’s strategy, rivalry, and organizational structure (Stahl & Grigsby, 1997, p.85).

Factors conditions assert that different economic sectors have a difference with regard to the availability of factors of production. By adopting the flexibility strategy, Salim Group will be able to take advantage of the resources available in the various economic sectors in the host country. For example, the firm will be able to capitalize on the available low cost of labor especially in emerging economies such as China (Merchant, 2008, p.54). The resultant effect is that the Salim Group will be able to cut the cost of operation with regard to salaries and wages.

Over the years it has been in operation, Salim Group has managed to develop core competence in various economic sectors such as telecom, food, media, and property. In implementing its multinational strategy, the firm’s main focus is on these economic sectors. The firm intends to utilize the skills and knowledge it has developed over the years to exploit the market opportunities in these sectors. Despite this, the firm does not limit its business operations to these sectors, instead, it has a policy of diversifying to other economic sectors that do not have core competence.

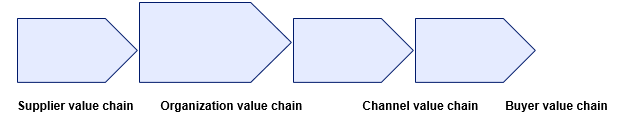

The diversification strategy is in line with the firm’s value chain which the firm has integrated. To ensure the efficiency of operation, the firm has entered into an alliance with other firms in these sectors such as the suppliers. Additionally, the firm is also committed to ensuring that its customers (buyers) are satisfied through the provision of high-quality products. This is attained through ensuring that its employees are competent in executing their duties. The firm also ensures that the customers easily access the products through the establishment of outlets in different countries hence enhancing its value chain. The efficiency within which a firm integrates its value chain increases its chance of success. The flow chart below illustrates the value chain integrated by the Salim Group.

This presents an opportunity for the firm to succeed in attaining multinational flexibility (Dieleman, 2006, p.11). In its initial phase, Salim Group’s management team intends to open small firms that are expected to grow in the long term. This increases the probability of the firm succeeding in exploiting the business opportunities presented and at the same time minimize risk.

According to the ‘diamond’ model developed by Michael Porter, a firm should conduct comprehensive market research prior to venturing into the international market. The main objective of the research is to determine the existing demand conditions. According to Stahl and Grigsby (1997, p.84), the existence of a strong domestic demand enables a firm to be effective in developing its core competencies.

This in turn contributes towards a firm being effective in penetrating a similar sector in the foreign market. For example, the firm becomes effective with regard to dealing with competition. Since its inception, Salim Group has developed core competencies in sectors such as telecom and food. This means that there is a high probability of the firm succeeding in the regional market it intends to venture.

As one of the strategies that multinational companies can adopt, multinational flexibility enables a firm’s management team to understand the diverse country-specific opportunities. The resultant effect is that the management team is able to develop strategies to deal with the challenges. For example, by establishing firms in economic sectors in which Salim Group possesses core competence within the host countries, there is a high probability of the firm being effective in hedging against risks such as the effects of interest rate fluctuation, and currency fluctuation. In addition, the firm may also be able to minimize the effects of financial risks which may affect a certain economic sector.

In an effort to attain multinational flexibility, Salim Group intends to establish small firms. According to Stahl and Grigsby (1997, p.85), the success of a firm in the international market is affected by the size of a firm. For example, small firms tend to be more suiting in countries such as Germany. In addition, a small firm is more efficient in adjusting to changes in the business environment compared to large firms. This arises from the fact that there are minimal formal channels of control which means that structural flexibility is available (Mellahi, Frynas & Finlay, 2005, p.34).

Conclusion

In summary, there is a high probability of Salim Group being successful by adopting the multinational flexibility strategy. The success of the strategy will be enhanced by the firms’ strengths with regard to diversification and integration of the concept of the value chain. By venturing into new market segments, the concept of flexibility presents an opportunity for the firm to advance. This arises from the fact that it will develop a portfolio of businesses in different economic sectors hence minimizing risks. However, the firm is faced with risk due arising from increased competition and chances of the financial crisis.

In your view, how far and in what ways does the Salim Group have an integrated network configuration? Base your answer upon evidence from the recommended case study and concepts from the module core text. Identify and explain the advantages and disadvantages of this configuration for an organization involved in international business

Introduction

In their operation, multinational companies are faced with a challenge with regard to attaining efficiency in managing the complex MNCs. This arises from the fact that these firms establish a large number of subsidiaries in the foreign market in an effort to be effective in their internationalization strategy (Johnson, Scholes & Whittington, 2008, p.35). For a firm to be successful in managing its subsidiary firm, it is paramount for the management team to design a system that provides the firm with room flexibility (Morschett, Schramm-Klein & Zentes, 2010, p. 7).

The resultant effect is that the various subsidiaries will be able to compete effectively and also exploit the market opportunities presented. In addition, the firm’s management team has to ensure that there is a certain degree of coherence between the parent company and the subsidiaries. This means that the firm should operate as one company. This means that the management team should ensure that there is a given level of synergy.

According to Morschett, Schramm-Klein, and Zentes (2010, p.7), it is important for multinational companies to adopt an integrated network. Moschetti, Schramm-Klein, and Zentes (2010, p.10) define an integrated network to include a number of interdependent organizations that have dispersed and specialized activities. However, all the firms’ activities are coordinated. Dunning and Lunden (2008, p.228) define the integrated network as a continuum of control of the firm’s subsidiaries in the foreign market. The resultant effect is that an interrelationship between the subsidiary firms is developed. The interrelationship makes it possible for these firms to be effective in coordinating activities of subsidiary firms which are dispersed in different countries.

Analysis

In its operation, the Salim Group has to a certain degree integrated the concept of an integrated network. For example, upon venturing into the international market through diversification, the Salim Group was able to develop a strong conglomerate through the establishment of firms in different economic sectors. The success of the conglomerate arose from the firm’s efficiency in controlling the various business units.

The Salim Group attained this by ensuring that all its business activities were undertaken along a predetermined value chain. For example, in its food business, the management team of the firm ensured that the business’ value chain was based on the operations of the parent company. For example, it was ensured that Indonesian basic natural resources were used in production. In addition, the distribution of the final product to the final consumer was undertaken through the firm’s retail chains (Dieleman, 2006, p. 4).

In addition, the adoption of the integrated network configuration is also evident from the Salim Group’s decision to implement the Management Information System. The core objective of implementing the Management Information System was to enable the firm to effectively in controlling the various subsidiaries (Dieleman, 2006, p.13). Implementation of the MIS has also enabled the firm’s management team to be effective in monitoring the activities of the subsidiary firms (Al-Abdul-Gader, 1998, p. 148).

According to Bartlett, Doz, and Hedlund (1990, p.118), the high rate at which globalization is occurring presents a challenge to firms in the international market. In addition, multinational companies face a challenge due to the existence of differences in government policies. To achieve global competitiveness, it is paramount for multinationals to adopt cross border integration with regard to some of their tasks. The resultant effect is that the multinational is able to attain a certain degree of strategic control (Bartlett, Doz & Hedlund, 1990, p. 118).

Integrated network configuration is an important design in the success of multinationals. For example, the network considers every subsidiary firm to be a source of capabilities, skills, knowledge, and ideas that can contribute to the success of the entire firm. According to Nonaka (1991, p. 96), attainment of knowledge can enable a firm attaining a high level of competitive advantage. In addition, the integrated network configuration can also contribute towards the firm attaining efficiency in its operation.

For example, the management team of the multinational company may decide to convert some of its efficient plants in its domestic country to be the units for producing for all the other subsidiaries (Spulber, 2007, p.67). To achieve this, all the subsidiaries have to undertake a shared decision-making process. The resultant effect is that the firm will be able to control its cost of production.

Additionally, the integrated network also gives the management teams of multinationals an opportunity of converting some of their innovative organizational units into centers of competence with regard to some of its products or processes (Mintzberg, Lampel, Quinn & Ghoshal, 2003, p.34). By adopting an integrated network, a multinational company increases its probability of being efficient in its value creation. This arises from the fact that some of the units which are efficient in undertaking some of the processes are assigned these tasks. For example, some of the units may be efficient in undertaking research and development. As a result, all the other units will benefit by cutting the cost of operation. The output is then distributed to the other units.

The resultant effect is that the firm is able to eliminate possible redundancies in some of its functions such as distribution and marketing. This greatly reduces the firm’s fixed cost. However, for the firms’ center of excellence to be effective, the management teams of MNCs must ensure that these firms have a certain degree of autonomy. An integrated network also enables a multinational corporation to be effective in responding to changes in the international market conditions.

Despite the benefits of the integrated network in MNCs, there are also some drawbacks to the model. For example, the model may not be effective in dealing with challenges such as the existence of differences with regard to culture between the host and the domestic country. In addition, the integration model also presents a challenge to multinational companies with regard to dealing with management complexity (Trautmann, Bals & Hartmann, 2008, p. 511).

Conclusion

In summary, the integrated network model presents an opportunity for a multinational company to succeed in a number of ways. For example, the firm is able to attain decentralized centralization. This means that the subsidiary firms are able to operate on their own but with a certain degree of control. In its operation, Salim Group has not been effective in decentralizing. This presents a weakness with regard to the rigidity of operation. Additionally, the firm has to deal with threats such as differences in culture which might not be effectively addressed by the integration network model. Another threat that the firm faces relate to the increase in globalization.

Critically assess the view that the Salim Group had a distinctive capability in the management of external relationships in the 1980s and 1990s. What are the main issues and options facing the firm in 2006, as it tries to sustain and develop its resource strengths for the future?

Introduction

According to Anderson (2010, p.94), the success of a multinational company is not only affected by the effectiveness with which it has established internal relationships but also the external relationships. A firm’s internal network is composed of diverse stakeholders who include the shareholders and the employees. By ensuring that there is a relationship between the top management and the low-level employees, a firm is able to create an environment conducive for working. The resultant effect is that the employees are motivated hence increasing their productivity. This can culminate in the improvement of shareholders’ satisfaction through an increment in their dividends and capital growth (Anderson, 2010, p.94).

On the other hand, external relationships include stakeholders such as the customers, the suppliers, and credit financiers. The establishment of a relationship with the customers plays a vital role in ensuring that the firm develops a high competitive advantage. This is attained by ensuring that the customers’ needs come first. However, there is a strong interrelation between a firm’s success and its external stakeholders.

Analysis

During the 1980s and 1990s, the Salim Group was effective in establishing its conglomerate. One of the factors which led to the firms’ success relates to its ability to establish organizational networks with other firms in the Southeast Asian countries. Some of the firms in which the firm established networks include the banks. As a result, the firm was able to improve its financial capital base. For example, the company established a relationship with banks in Indonesia. Through collaboration with financial institutions, the firm was able to develop its financial strength by accessing credit finance. This increased the efficiency with which the firm established subsidiary firms in the host countries.

Collaboration with other firms has enabled the firm to take advantage of the opportunities presented in the environment. For example, the firm was able to enter into a partnership with other firms in the host countries in an effort to be successful in venturing into the foreign market.

Additionally, Salim Group was able to establish a strong customer relationship. According to Mababaya (2002, p.279), the success of multinational companies is dependent on the effectiveness with which they address the customers’ needs. For example, when supplying products and services, the MNCs have to take into account a number of factors such as the nature of the local customers, their cultural needs, and values.

The Salim Group has also been effective in controlling the firms’ shareholders. To achieve this, the Salim Group ensures that it has the largest shareholding in all the major operating companies. By virtue of its shareholding, the group is able to actively control the operation of these companies. For example, the proprietor of Salim Group was able to actively take part in the firms’ decision-making process. However, to be effective, the Salim Group has hired professionals to undertake some of the activities. The firm ensured that a good relationship with the managers and other professionals was maintained. This helped in eliminating agency conflict. Despite this, the firm undertook the supervisory role.

The Salim Group was also aggressive in venturing into new market segments even if it did not have all the required resources. This made the firm to be effective in exploiting the opportunities available in the international market. One of the ways through which the firm attained this is by outsourcing some of its functions and processes from well-established companies. According to Dunning and Lunden (2008, p.231), outsourcing increases the firm’s effectiveness in penetrating the international market For example, the Group did not have a competitive edge with regard to technology.

However, to be effective in its operation through the implementation of new technology, the firm entered into a partnership with firms that have well-established technologies. For example, in its automobile business, the Salim Group entered into a partnership with Suzuki Corporation. The resultant effect is that the firm was able to venture into new market segments. Additionally, the firm also entered into joint ventures with other firms in an effort to establish their business entity.

The Salim Group’s success during this period also arose from its effectiveness in addressing the customer’s demand. This arose from the firms’ efficiency in developing synergy from the various business sectors in which it operates. As a result, the firm is able to deliver what the customers need (Barber, 2010, p. 96). Additionally, the firms’ ability in developing synergy from the various businesses it operates such as the food and media has enabled the firm to be effective in understanding the customer’s needs.

This contributed towards the firm establishing a strong relationship with the customers hence developing customer loyalty. This good customer relationship with the customers contributed and its ability to establish an interconnection with the various stakeholders contributed towards the firm’s success during the 1980s and 1990s.

Currently, one of the challenges which the firm is facing in its operation rates to increase the rate of competition. The competition has been necessitated by the high rate of globalization. Additionally, the firm also faces a challenge arising from the high rate at which firms are undertaking innovation. This is necessitated by the rate of technological advancement. To deal with these strategies, multinational firms such as the Salim Group must develop their competitive advantage. One of the ways through which the firm can attain this is by entering into mergers and acquisitions with other firms. This will increase the firm’s probability of succeeding.

Conclusion

In its operation, Salim Group has developed strengths with regard to the effective establishment of external relationships. Some of the external networks that the firm has managed to establish relate to the customers and credit suppliers. The firm has also entered into a relationship with other businesses through the establishment of strategic alliances. The integration of alliances increases the opportunity of the firm succeeding in new market segments. One of the difficulties which the firm may face relates to inefficiency in integrating the different cultures between the firms. However, the firm faces a challenge with regard to increased competition.

Reference List

Anderson, U., 2010. Managing the contemporary multinational; the role of headquarters. Cheltenham: Edward Elgar.

Al-Abdul-Gader, G., 1998. Managing computer based information systems in the developing countries: a cultural perspective. Hershey: Idea Group Publication.

Barber, J., 2010. Reshaping the boundaries of the firm in an era of global independence. Bingley: Emerald.

Bartlett, C.A. & Beamish, P.W., 2011. Transnational management: text, cases, and readings in cross-border management. New York and London: McGraw-Hill/Irwin.

Bartlett, C., Doz, Y. & Hedlund, G., 1990. Managing global firm. New York: Routledge. Chen, J., 2004. International institutions and multinational enterprises; global players-global markets. Cheltenham: Edward Elgar.

Dieleman, M., 2006. The Salim Group: the art of strategic flexibility. Asian Case Research Journal.Vol. 10, issue 1, pp. 1-25.

Dunning, J. & Lundan, S., 2008. Multinational enterprises and the global economy. Cheltenham: Elgar.

Harzing, A. & Ruysseveldt, J., 2004. International human resource management. London: Thousand Oaks.

Johnson, G., Scholes, K. & Whittington, R., 2008. Exploring corporate strategy: text and cases. Harlow: Pearson Education.

Mababaya, M., 2002. The role of multinational companies in the Middle East: the case of Saudi Arabia. London: University of Westminster.

Merchant, H., 2008.Competing in emerging markets: cases and readings. New York and Abingdon: Routledge.

Mintzberg, H., Lampel, J., Quinn, J.B. & Ghoshal, S., 2003.The strategy process: concepts, contexts, cases. Harlow: Pearson Education.

Morschett, D. Schramm-Klein, H. & Zentes, J., 2010. Strategic international management texts and cases. New York: Wiesbaden Gabler.

Nonaka, I.,1991. The Knowledge-Creating Company. Harvard Business Review. Vol. 69, Issue 6.

Spulber, D.F., 2007. Global competitive strategy. Cambridge: Cambridge University Press.

Stacey, R.D., 2007. Strategic management and organizational dynamics: the challenge of complexity. Harlow: Pearson Education.

Stahl, M. & Grigsby, D., 1997. Strategic management: total quality and global competition. Oxford: Blackwell Business.

Trautmann, G., Bals, L. & Hartmann, E., 2008. Global sourcing in integrated structures; the case of hybrid purchasing organization. Journal of Purchasing and Supply Chain Management. Vol. 1, issue 4, pp. 274-293.