Introduction: Operating Performance

The airline’s operating performance is one of the major indicators of its health and current position in the industry. The major showings, such as cost per ASK, revenue per PRK, break-even load factor, and employee productivity, represent the degree to which the firm succeeds in performing major operations and can struggle with the major competitors (Stevenson, 2020). Emirates is one of the most cost-effective airlines globally, with perfect opportunities for further growth (Annual report 2021-2022 highlights, n.d.). For this reason, Emirates is selected for the analysis and comparison with its closest rivals.

Cost per available seat kilometre is one of the essential determinants of the group’s success. It is used to make cost comparisons between different airlines and determine their effectiveness. It is calculated by dividing operating costs by available seat kilometres (Cui and Li, 2022). Thus, for Emirates, it comprises around 8 US cents which is one of the best showings in the industry (CAPA, 2014; The Emirates Group, 2022). Its closest rival, Etihad Airways, has a CASK of around 8 US cents, which means it is also a strong carrier which is close to Emirates (Townsend, 2017). Revenue per RPK in Emirates comprises around 35.1 fils, or $9.6 cents (The Emirates Group, 2022). However, in the previous year, the company had 40 fils, which indicates a decrease (The Emirates Group, 2022). Etihad has a revenue per RPK of around $8.8 US cents, which is also a good showing (Powell, 2022). The showings are close, meaning competitors have similar performances.

The break-even load factor is another crucial determinant of the company’s function. The break-eve load of Emirates is 75,1%, which represents the company’s attempts to attain high levels of cost efficiency (Cui and Li, 2022; Saxon and Mathieu, 2017). In Etihad, the break-even load factor is 75%, which means that the competitors are close (Hazarika and Boukareva, 2016). Finally, Emirates has a high level of employee productivity of around $50 per hour, while Etihad has an employee productivity of $48 per hour (Hazarika and Boukareva, 2016; Saxon and Mathieu, 2017). These numbers show that, in general, Emirates remains cost-effective and successful. However, its major rivals hold similar positions, meaning there is a need for further improvement and the generation of competitive advantage.

Strategic Analysis

Emirates is one of the fast-evolving airlines holding leading positions in the industry. It is one of the two flag carriers of the United Arab Emirates, with the central hub in Dubai International Airport (The Emirates Group, 2022). The company offers flights to around 150 cities in 80 countries across the globe and has a fleet of about 300 aircraft (Bass, 2015). At the moment, it is the world’s fourth-largest airline regarding revenue and passenger kilometres flown (The Emirates Group, 2022). The corporation uses mainly Airbus A380 and Boeing 777, with 119 and 134 planes in service correspondingly (The Emirates Group, 2022). At the moment, the company continues to evolve and hold its leading positions. However, with the recent challenges due to the pandemic and travel restrictions, the company might face specific issues impacting performance (Grand View Research, 2022). For this reason, their strategic analysis of its external and internal environment is required to understand the existing tendencies and the current state of the company. For this reason, SWOT and PESTE tools are used to evaluate the company and its major aspects.

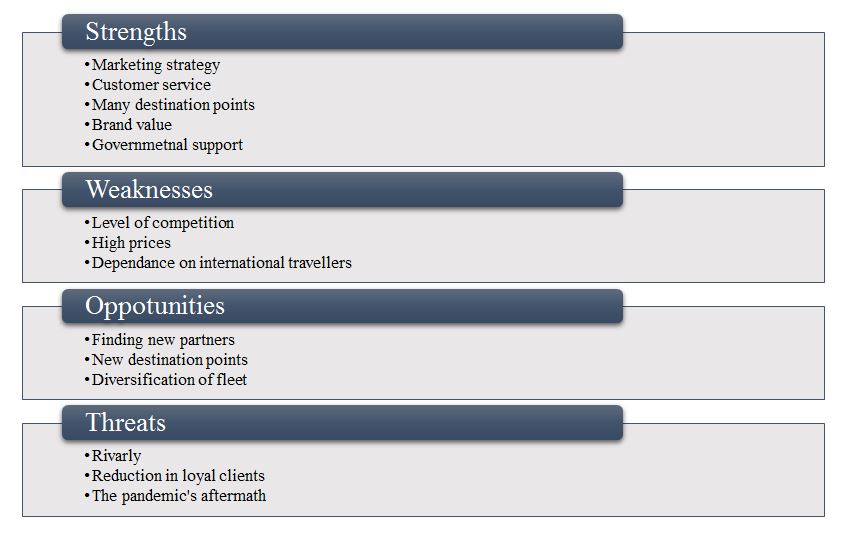

SWOT

Strengths

Emirates has several essential strengths making it one of the leaders in the sector. First, the company offers exclusive customer care, such as in-face diversion amusement, entertainment lounges, and unique clients support (The Emirates Group, 2022). Moreover, the firm’s marketing strategy is highly effective. Emirates uses social media for marketing and promotion, which helps to interact with numerous clients globally (The Emirates Group, 2022). Moreover, it sponsors significant sports events and clubs, such as Real Madrid, which attracts attention to the company’s activity and helps to popularise its services (Pinto, 2020). Moreover, it flies to numerous destination points globally, offering a premium-class experience for all loyal clients (The Emirates Group, 2022). The company’s brand value is also high, as following the official statistics, it comprised around $6,3 billion in 2020 (Babic and Pavlovic, 2016). Combined with the governmental support from the fast-evolving state, Emirates has numerous opportunities for further growth and development. It can invest in new projects and sponsor new events, attracting new clients and supporting loyal ones.

Weaknesses

At the same time, Emirates has specific weaknesses that might impact its development in the future. First of all, the level of competition in the industry continues to grow, meaning that the brand operations are organised regarding a high level of rivalry. For this reason, the brand has to invest in generating a competitive advantage and attracting new clients (The Emirates Group, 2022). Moreover, Emirates offers exclusive and luxurious services to its clients, which requires significant costs and influences ticket prices (The Emirates Group, 2022). As a result, it becomes difficult to compete with low-cost airlines, which are becoming more popular because of the increased number of air travels globally (Bouwer, Saxon and Wittkamp, 2021). The company is also dependent on international travellers, while the proportion of local individuals using the brand’s services remains low (The Emirates Group, 2022; International Trade Administration, 2022). That is why tourism and job migration are vital for the company, and the prohibition of this type of tours (during the pandemic) might be challenging for Emirates and impact its revenues significantly.

Opportunities

Emirates’ popularity and success impact the emergence of numerous opportunities for further development and progress. First of all, the brand is viewed as one of the attractive partners for other companies. It means that the corporation can build partnership relations with other airlines across different business sectors and expand the areas where it functions (The Emirates Group, 2022). It will contribute to the increased number of passengers and the further cultural exchange with other nations (Bailey, Holyoak and Snider, 2019). Moreover, Emirates might continue expanding the number of countries where its aircraft flies because of its importance for the country (IATA, 2017). New destinations will attract more passengers and guarantee that the firm will become more prevalent in a bigger number of cities (Bouwer, Saxon and Wittkamp, 2021). Moreover, the government invests heavily in supporting civil aviation, which is an opportunity for the company’s growth (International Trade Administration, 2022). Finally, the company might diversify its fleet, which consists mainly of Boeing 777 and Airbus 380 (The Emirates Group, 2022). By employing new aircraft, Emirates will reduce its dependence on these manufacturers and diversify offerings existing at the moment.

Threats

The brand also faces significant threats that are linked to the nature of the environment where it operates and to the unique aspects of its operations. First of all, the level of rivalry in the Middle Eastern region continues to grow. Etihad, Qatar Airlines, and other carriers offer similar services to passengers, meaning that Emirates’ positions might be threatened (Bhasin, 2018). The expensive tickets might be a barrier for passengers and explain their interest to other carriers. Moreover, Emirates uses only two models of aircraft, which might be a barrier to its further rise in the future. The dependence on tourism and international travel is another brand’s vulnerability. The pandemic showed that air travel restrictions might severely impact the brand’s work, meaning it is vital to focus on revitalising the local sector and increasing the number of passengers from local areas. In such a way, these threats should be addressed by the company to avoid failure in the future.

Altogether, the SWOT analysis shows that Emirates’ position is strong. The brand has a powerful marketing strategy and excellent customer service, which attracts numerous clients and guarantees their loyalty. The high brand value and support from the government are vital for the further evolution of the company and its dominance in the market. However, the high level of competition and the dependence on international travel might impact the company’s ability to evolve. The pandemic also had an impact on Emirates, which resulted in the necessity to consider the existing opportunities to create the basis for future evolution. These include diversification of the fleet, finding new partners, and attracting new clients to ensure there is no critical decline in revenue. Using available opportunities, Emirates can hold its leading positions and compete with its closest rivals.

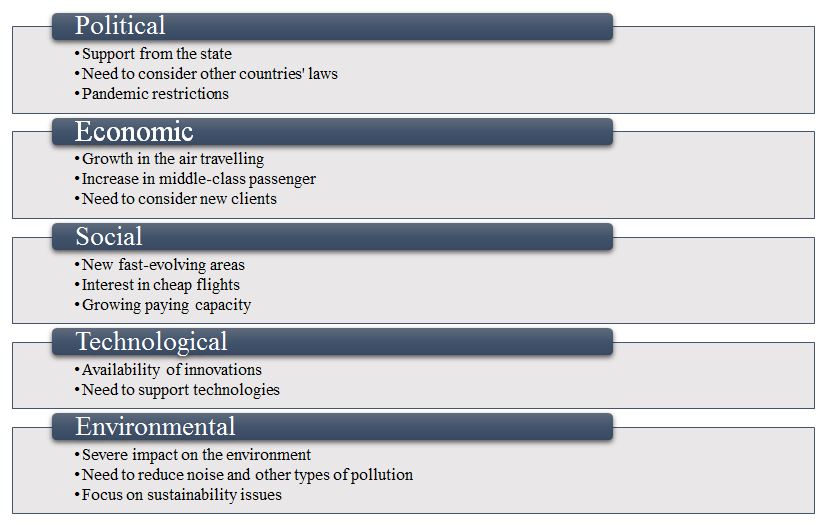

PESTE

Political

Emirates benefits from the favourable political factors that impact the company’s development. First of all, it is a state-owned flag carrier of the UAE, meaning it enjoys support and a favourable political environment (Naeem, 2014). However, it means that the corporation is subjected to the strong governmental effect and should follow decisions offered by the government, which might impact its development. The carrier flies to various destinations, meaning it has to adapt to the political factors there. In general, at the moment, most airlines, including Emirates, do not face severe restrictions on air travel because of political factors (Bouwer, Saxon and Wittkamp, 2021). The pandemic regulations introduced previously are less severe, meaning there are numerous opportunities for further development and growth. In general, Emirates’ development is not limited by any political factors. However, as far as it operates in different countries, the carrier should consider political regulations and rules in other countries to avoid claims or legal issues.

Economic Factors

The economic factors can also be viewed as favourable for Emirates. It is forecasted that the civil aviation sphere will continue to grow and generate more revenue. The International Air Transport Association forecasts that in 2030 the number of passengers travelling by using aircraft will reach around 8.2 billion (Emirates, 2022a). It means that Emirates might benefit from this unique opportunity and enter new markets. The growing number of passengers means that demand will also continue to grow, and carriers will be able to find new loyal clients. Additionally, it is expected that the world will recover after the crisis caused by the pandemic in several years, meaning that the paying capacity of individuals will grow (The Emirates Group, 2022). It provides an opportunity for Emirates to find new clients and offer its services to them. However, the brand should consider its current approach to pricing, as the high cost of tickets might serve as a barrier for new clients. In general, economic factors remain favourable.

Social

Over the last several years, the civil airline industry has been showing stable growth in the number of flights. Numerous fast-evolving regions, such as China, India, and Africa, contribute to the stable increase in the number of passengers and revenues generated by airlines every year (Fortune Business Insights, 2022). The reduction in the price of tickets attracts new clients from various areas and makes air travel more affordable for individuals (Bouwer, Saxon and Wittkamp, 2021). Combined with the growth in the middle class, these tendencies create an external environment favourable for Emirates. The company can use this trend and acquire new loyal clients. However, Emirates focuses on offering luxurious services to the premium class of passengers, while services provided to middle-class individuals are limited (Fortune Business Insights, 2022). For this reason, the carrier should consider the current social tendencies and focus on fast-evolving areas along with providing support to middle-class clients. It will help to create the basis for future excellence and avoid the reduction of loyal clients.

Technological

Emirates is one of the most innovative carriers, which focuses on making technologies part of its operations. It helps to generate a competitive advantage and compete with rivals. At the same time, the fast change in technologies impacts the emergence of new approaches and methods that might be vital for further development and growth. That is why Emirates invests in technological innovation and automation to introduce new product development rates and cycles and alter most of its operations (Emirates, 2022b). Moreover, most modern hubs also follow the tendency and establish a developed technological structure. It allows the carrier to use the latest technological advances to support its current position and offer clients outstanding and high-quality products. It also means that Emirates should continue investing in technology to guarantee it is not lagging behind competitors and can integrate innovative approaches into its functioning. In general, technological factors remain beneficial for the brand.

Environmental

The increasing importance of environmental concerns is one of the factors impacting all modern airlines. Climate change and the necessity to consider sustainability issues is the factor shaping Emirates’ politics. Civil aviation is one of the major contributors to global warming, with 12% of CO2 emissions from all transport sources (Air Transport Action Group, 2023; Ralston, 2022). Moreover, they create noise pollution and impact the lives of individuals residing close to big hubs (Ralston, W. (2022). For this reason, the further development of Emirates might be impacted by the growing public awareness about environmental issues and the necessity to minimise the harm done to the climate and planet. Emirates plans to innovate its fleet to avoid using aircraft with increased carbon footprint and noise pollution (Emirates, 2021). It focuses on sustainability issues and promotes campaigns aimed at improving the image of civil aviation and making it environmentally friendly (Emirates, 2021). However, in the future, the cost of these incentives might increase, requiring additional investment from the company to ensure it is respected by loyal clients.

Altogether, the analysis of the external factors using PESTE shows that Emirates operates in a highly competitive environment. The company should consider the regulations and legislation of the countries where it operates to avoid claims. Moreover, it has to invest in technology development to guarantee it remains a leader in the industry. At the same time, the growing number of environmental concerns requires specific measures to guarantee that the company remains attractive to clients and has a positive image. It means that external factors might have both positive and negative impacts on Emirates’ development, and there is a need for effective strategies to manage them.

Discovered Issues

The analysis of the external and internal factors performed by using SWOT and PESTE tools shows there are still some problems that should be considered. First of all, Emirates reported that its revenue per PRK comprises $9.6, which is lower than the previous year. It can be viewed as the result of pandemic regulations and restrictions. The number indicates that the services are used by fewer passengers (Baum, Auerbach and Delfmann, 2017). It also proves that Emirates is highly dependent on international traffic and tourism (Pinto, 2020). The successful management helps to preserve the desired levels of revenue per PRK; however, to avoid this tendency in the future, it is vital to look for alternatives to guarantee that any other possible crises or global challenges will not have a severe impact on Emirates and it will preserve its leading positions globally.

Second, the analysis of external factors demonstrates that, as any other airline, Emirates should consider the environmental aspects. Aircraft is one of the major pollutants because of the extremely high fuel consumption levels, carbon footprint, and noise pollution (Kearns, 2021). Another problem is that Emirates mainly uses wide-body aircraft and luxurious services, which gives rise to sustainability issues. The company has already faced several claims because of the excessive use of resources and the inability to reduce its negative impact on the environment (Overton, 2022). For this reason, the environmental factor might be one of the possible barriers to the development of the carrier in the future. At the moment, Emirates is testing new strategies to innovate its fleet, use new fuel and reduce the negative impact of climate change (Lynn, 2023). Otherwise, there is a high risk of deteriorating the brand’s reputation and a reduction in the clients’ interest.

The analysis also shows that Emirates is the carrier focusing on providing outstanding and premium service to loyal clients. For this reason, it remains attractive for people with a high level of income. However, it also means that the company lacks diversification, which might be a problem in the future. As stated above, passengers from fast-evolving regions, such as Africa and Asia, are interested in cheap and fast travel. It means that Emirates might lose an opportunity to address a potentially big segment and suffer from reduced revenues compared to its closest rivals which provide services to middle-class passengers (Kearns, 2021). It means that for Emirates, the reconsideration of its approach to pricing is vital as it might help to preserve its leading positions and broaden the target audience, which is always beneficial in times of crisis or other serious troubles.

Finally, the analysis shows that Emirates function in a highly competitive environment. The closest rivals, such as Etihad, Qatar Airways, or other carriers, offer similar services to their clients. Moreover, low-cost airlines offer services to millions of passengers globally in an attempt to meet the growing demand for air travel. There is also a high risk of a new entry as developing regions might create their own carriers to satisfy local clients. For this reason, for Emirates, it is vital to preserve its competitive advantage and dominant position in the market. It requires consideration of the fast-evolving market conditions and higher levels of flexibility to adapt to any possible changes. These issues might serve as barriers to the further Emirates’ development and holding its leading positions globally.

Conclusion

Altogether, the strategic analysis of Emirates shows that the company has the potential for remaining one of the global leaders in the civil aviation sector. It has stable financial showings indicating that the corporation can compete with its closest rivals. As one of the flag carriers of the state, it is supported by the government and has substantial resources to launch new projects. At the same time, the investigation reveals some issues. First, the growing number of rivalry is a serious problem for the carrier. Second, the environmental concerns existing at the moment might limit the further rise of the company because it has to introduce new practices to attain higher sustainability levels. In such a way, Emirates remains one of the global leaders in the sphere of air travel; however, it should consider current trends to avoid decline.

Reference List

Air Transport Action Group. (2023) Facts & figures. Web.

Annual report 2021-2022 highlights (n.d.). Web.

Babic, D. and Pavlovic, D. (2016) Consistency of the European Commission’s assessment of proposed mergers in airline sector. Web.

Bailey, C., Holyoak, A. and Snider, J. (2019) An analysis of the effects of the aviation industry in the United Arab Emirates. Web.

Bass (2015) Emirates Airlines: the international carrier. Web.

Baum, H., Auerbach, S. and Delfmann, W. (2017) Strategic management in aviation industry. London: Routledge.

Bhasin, H. (2018) Top Emirates competitors. Web.

Bouwer, J., Saxon, S. and Wittkamp, N. (2021) Back to the future? Airline sector poised for change post-COVID-19. Web.

CAPA (2014) Unit cost analysis of Emirates, IAG & Virgin; about learning from a new model, not unpicking it. Web.

CAPA (2016) CASK: Europe’s full service airlines have the world’s highest costs, US airlines the lowest. Web.

Cui, S. and Li, Z. (2022) ‘Airlines benchmarking analysis based on financial performance – Emirates, Southwest Airlines, Singapore Airlines and Lufthansa’, Academic Journal of Business & Management, 4(2), pp. 1-9.

Emirates (2021) Our environmental policy. Web.

Emirates (2022a) Emirates Group announces 2021-2022 results. Web.

Emirates (2022b) Emirates Group announces record half-year performance for 2022-23. Web.

The Emirates Group (2022) Annual report 2021-2022. Web.

Fortune Business Insights (2022) Aviation analytics market size, share & COVID-19 impact analysis, by function (finance, operations, sales & marketing, others), by application (fuel management, flight-risk, management, customer analytics, navigation service, others), by product (services and solutions), by end-use (OEM, aftermarket), and regional forecast, 2021-2028. Web.

Grand View Research (2022) COVID-19 impact on civil aviation industry size, share & trends analysis report by region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), and segment forecasts, 2021 – 2028. Web.

Hazarika, I. and Boukareva, B. (2016) ‘Performance analysis of major airline companies in UAE with reference to profitability, liquidity, efficiency, employee strength and productivity’, Eurasian Journal of Business and Management, 4(4), pp. 71-80.

The International Air Transport Association (IATA) (2017) The importance of air transport to United Emirates. Web.

International Trade Administration. (2022) Aerospace and aviation. Web.

Kearns, S. (2021) Fundamentals of international aviation. 2nd edn, London: Routledge.

Lynn, B. (2023) Emirates Completes test flight with environment friendlier fuel. Web.

Naeem, M. (2014) An analysis of the Emirates Airline operation management system. Web.

Overton, J. (2022) Issue brief: the growth of greenhouse gas emissions from commercial aviation. Web.

Pinto, M. (2020) Competitive analysis of Emirates Airline: a history and outline of success. Web.

Powell, S. (2022) Etihad Airways reports H1/2022 record-breaking US$296M core operating profit. Web.

Ralston, W. (2022) ‘How an industry built on pollution is getting a tiny bit greener – and faster’, Bloomberg (). Web.

Saxon, S. and Mathieu, W. (2017) A better approach to airline costs. Web.

Stevenson, W. (2020) Operations management. New York, MY: McGraw-Hill Education.

Townsend, S. (2017) ‘Etihad announces 6% passenger increase amid ‘tough’ conditions’, ArabianBusiness. Web.