Capital budgeting is essential when evaluating a project as it helps determine the viable investment opportunity. Investors ought to have project appraisers and financial analysts who can help analyze the project’s viability. Some of the financial techniques used when evaluating the profitability of an investment comprise net present value, payback period, accounting rate of return, and internal rate of return. The case study evaluates the capital expenditure to determine whether the company can consider the current machine or purchase a new one.

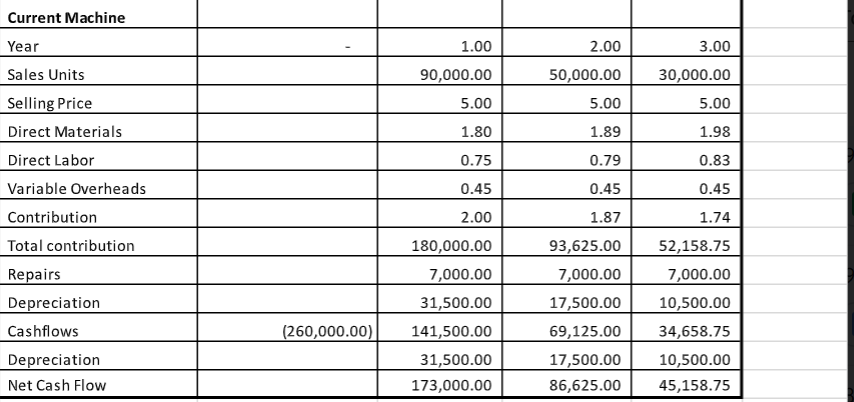

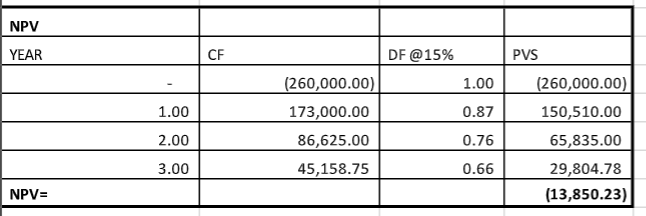

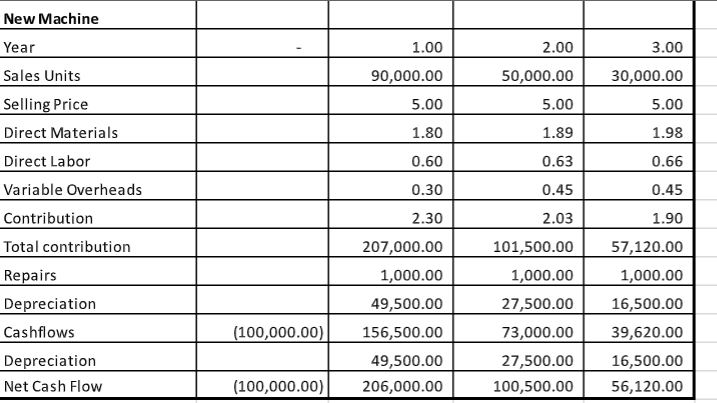

NPV- Present Net Value Computations

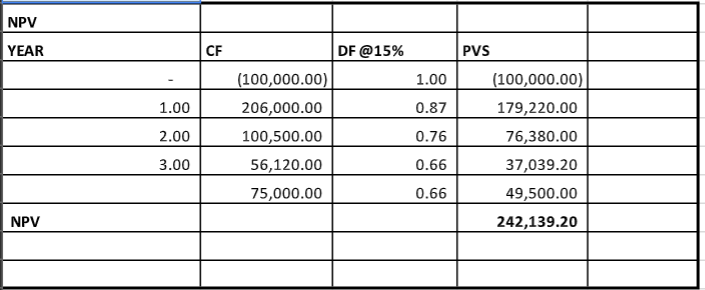

New Machine

Decision

Pietro should consider procuring the new machine since this will increase returns, as presented in the NPV computations. The NPV for the current machine is negative- (13,850.23), meaning they will suffer losses when using it. However, the NPV for the new machine is 242,139.20, which is higher, showing that more cash flows will be generated from the new machine.

Advantages and Disadvantages

NPV incorporates the time value for money, making it possible for an investor to determine the exact outputs from the investment. NPV also considers the company’s cost of capital, and through this, it is possible to make good investment decisions. However, accuracy depends on the input quality when using NPV, limiting its applicability (Marchioni and Magni, 2018). The technique may also omit hidden costs, such as organizational and opportunity costs.

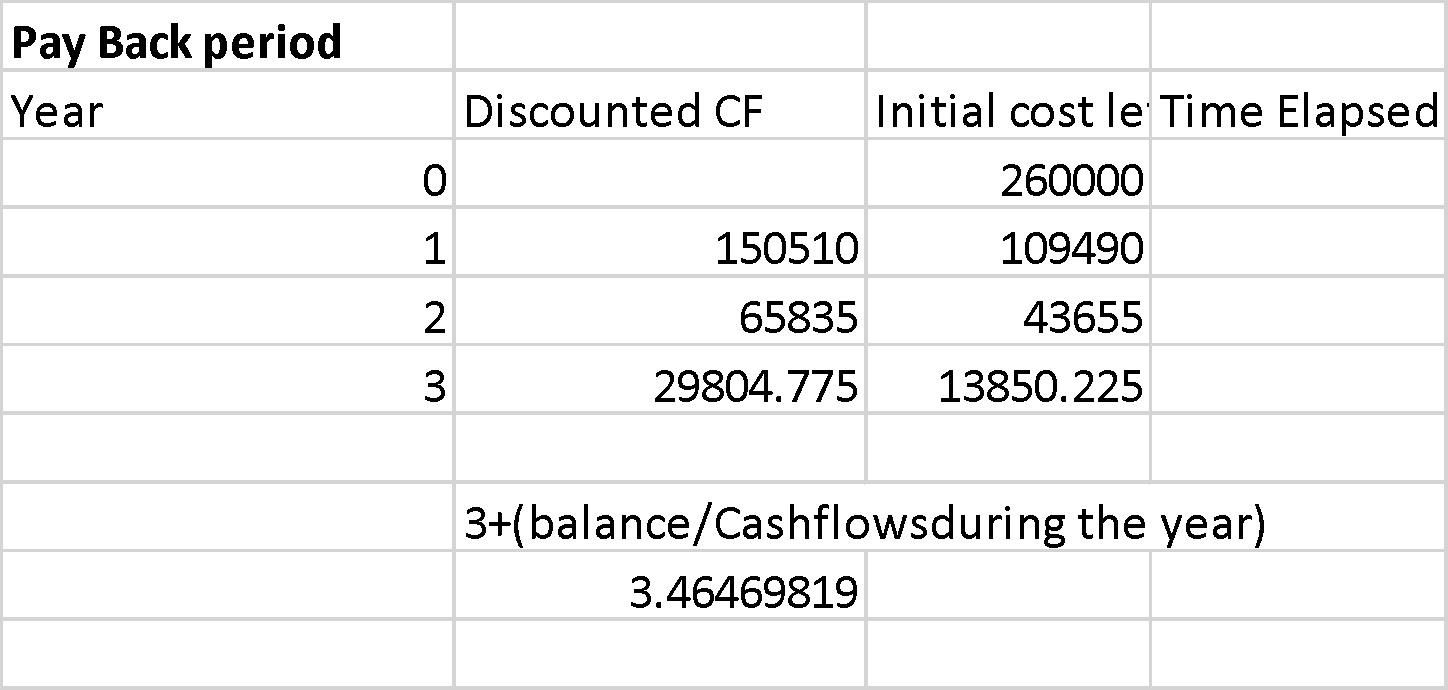

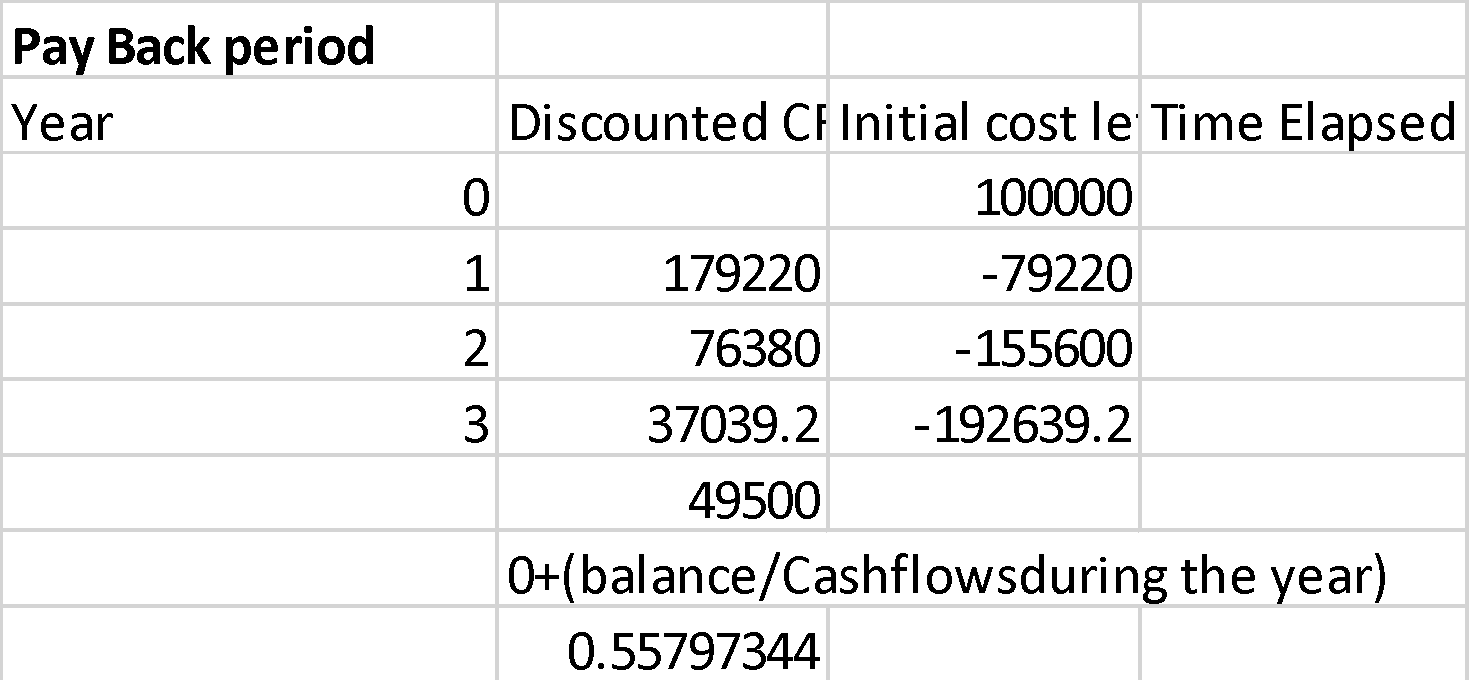

Pay Back Period Computations

Current Machine

New Machine

Based on the discounted payback period computations, the new machine is still viable since it has the shortest payback period. The company will be able to get returns in less than a year (0.6) years, unlike the current machine, which is at 3.4years.

Advantages and Disadvantages of the Payback Period

The technique is straightforward to use, making it possible for investors to determine the returns of their investments. The technique focuses on the amount of time taken for the completion of the project, while other techniques do not consider the amount of time taken for project completion (Sow et al., 2019). However, the technique does not focus on earnings attributable to investment after the initial investment is complete.

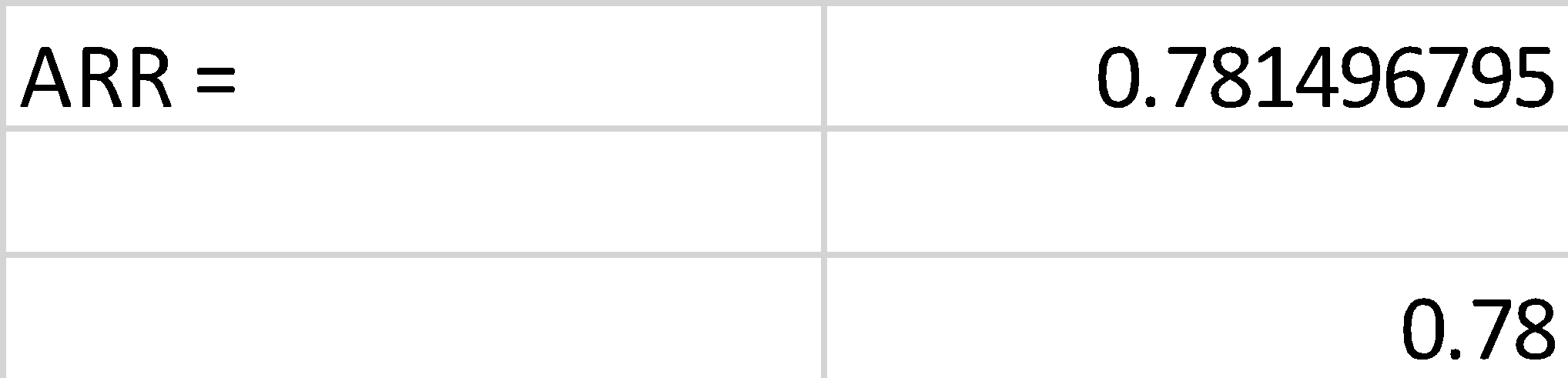

Accounting Rate of Return

AAR = Average net income from investment/ Average investment

Current

New

Based on the ARR, the company should consider the new machine as it has the highest ARR of 2.41. Account rate of return is easily applicable in project management since it does not involve complicated computations. However, the technique does not take into account the time value of money. Furthermore, the management sets the acceptance criteria, hence making the technique biased (Bawaneh, 2018). The method also involves using accounting numbers such as depreciation which only requires judgement from the accountant.

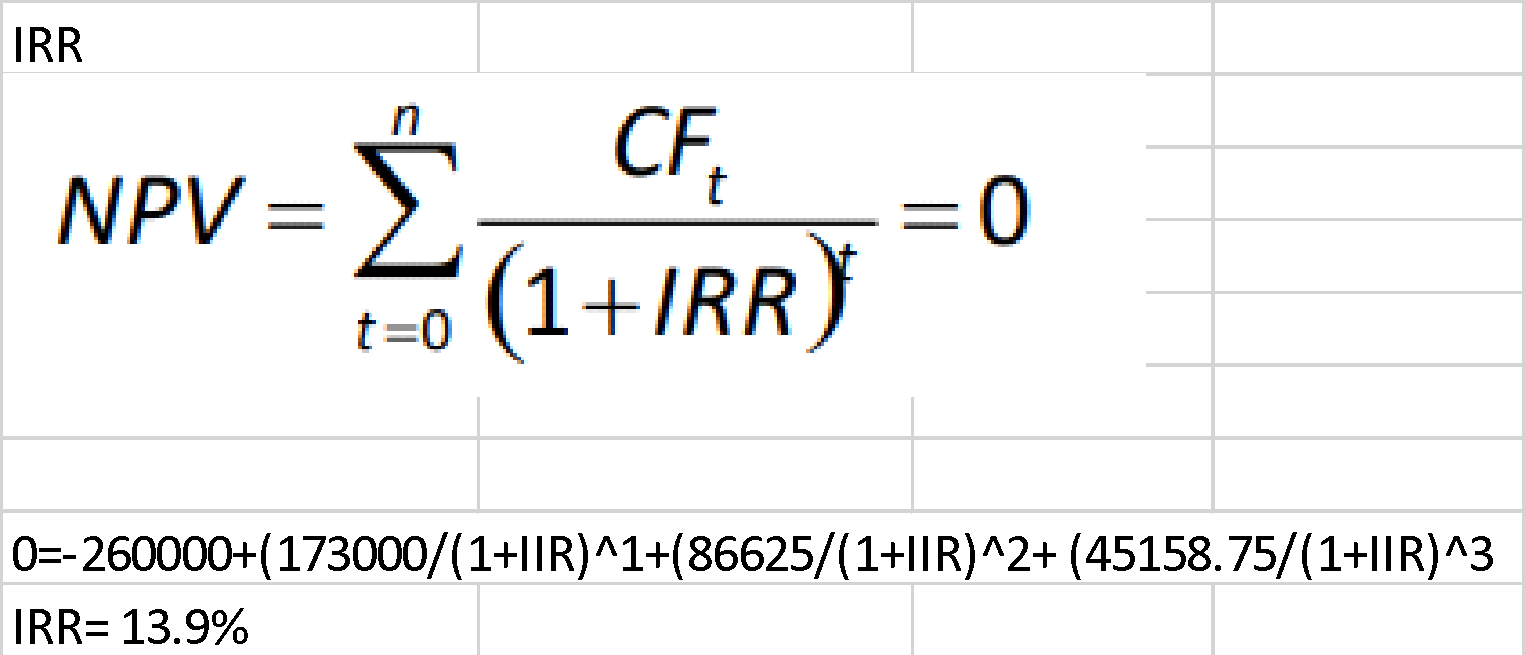

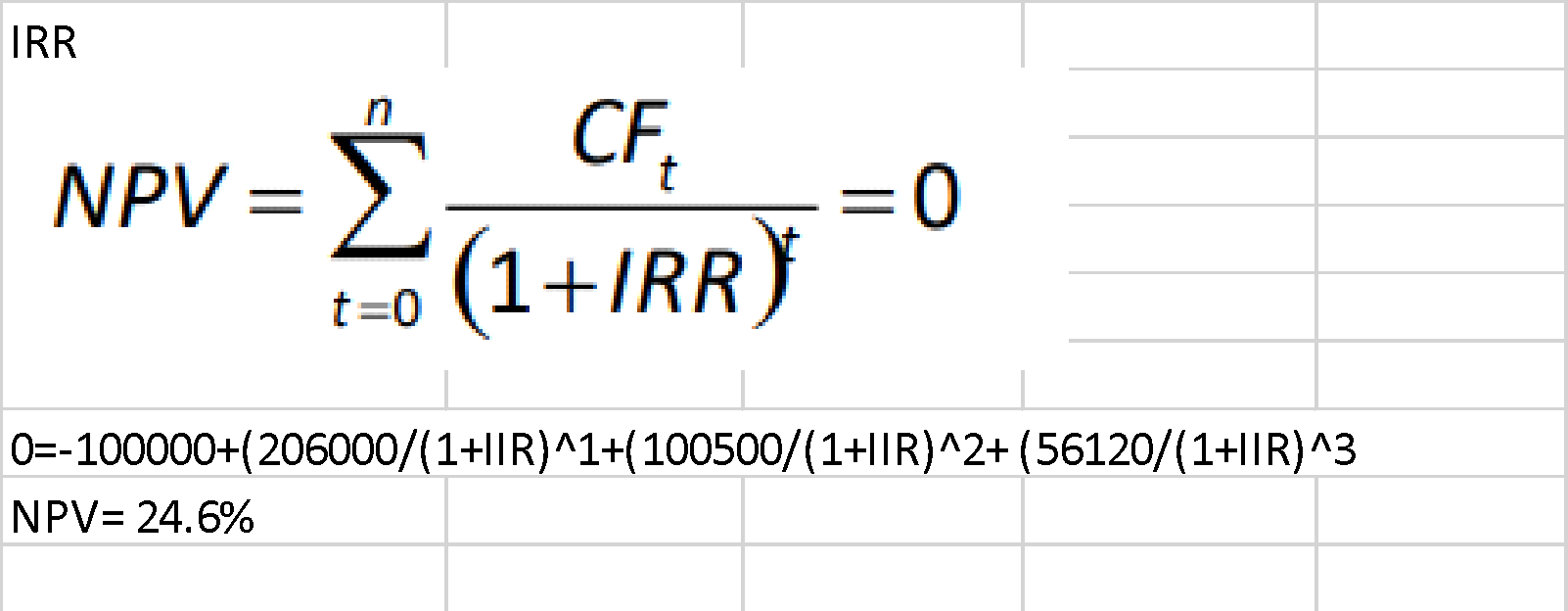

Internal Rate of Return

Current Machine

New Machine

IRR is the rate at which the NPV of the project is at zero. The company should consider using the new machine over the current one from the IRR computation. The advantage of using IRR is that it considers the time value of money hence providing the company with the best returns that can be generated at zero NPV (Hazen and Magni, 2021). However, the technique is time-consuming as many computations have to be done.

Other Factors Used in Determining Viable Machine

Other than the capital budgeting techniques, none financial factors, cost-benefit analysis, and value for money can be used to determine the best machine to adopt when investing. The cost of repairing the old machine will be higher than procuring a new one. Therefore, the company should go for the new machine. With a focus on non-financial factors, the new machine is expected to last longer than the current one, making it viable. Lastly, focusing on the value of money, it is clear that the new machine will enhance the provision of better services that will provide more returns for the project.

Reference List

Bawaneh, S. (2018). Management accounting practices: a case of Jordanian manufacturing companies. Asia-Pacific Management Accounting Journal (APMAJ), [online] 13(3), pp.25–53. Web.

Hazen, G. and Magni, C.A. (2021) Average internal rate of return for risky projects. The Engineering Economist, 66(2), pp.90–120. Web.

Marchioni, A. and Magni, C.A. (2018). Investment decisions and sensitivity analysis: NPV-consistency of rates of return. European Journal of Operational Research, 268(1), pp.361–372. Web.

Sow, A., Mehrtash, M., Rousse, D.R. and Haillot, D. (2019). Economic analysis of residential solar photovoltaic electricity production in Canada. Sustainable Energy Technologies and Assessments, [online] 33, pp.83–94. Web.