The student loan forgiveness plan was initiated to assist graduate students who struggle to repay the loan they borrowed to obtain their college degrees. In August 2022, the Bidden-Harris government publicized its proposal to remove up to $20,000 in student debt for qualified borrowers to offer middle-class and working families room to recuperate from the pandemic (Di, 2022). After the planned announcement, several new aspects developed on how the program will function. The emerging details include individuals who are eligible for it and when borrowers can check their decreased loan balances.

Various loan borrowers are waiting indefinitely for the outcome of the court concerning debt relief under the student loan forgiveness plan. Borrowers’ dreams are at crossroads as they wait for the lawsuits to act. From the start, the plan encounters many issues, including court cases. This is an early sign that it will not work since several parties are conflicting. Lawmakers identified the harmful effects of the forgiveness plan on recruitment and wrote and sent letters to the President regarding their concerns (Akers, 2022). The US education Department removed the plan application procedure from the website StudentAid.gov. Once an individual tries to apply, they get a message that the student forgiveness application is blocked since courts have dispensed orders to stop the relief plan (see Figure 1). These scenarios demonstrate that the student forgiveness program faces many issues and is unlikely to be implemented.

The program is unfair since it harms the national security of the nation. The plan will destroy military service through defense-required resources draining and institutionalization of troubling extension of one-sided presidential authority. It establishes a notion that corrodes the typical American qualities of altruism and self-reliance and incorrectly proposes free freedom (Teske, 2022). The initiative discourages military service from attracting more individuals to join. Most individuals enrol the US security service to get access to the financial means and GI bill to obtain a degree. It is approximated that 75 percent of those who enlisted the service did so to get educational advantages (Looney, 2022). The program will erode the GI bill since it develops the belief that the state will offer nearly free or unpaid education in exchange for nothing. The agenda is unfair to several Americans since it is highly regressive. It only benefits individuals who graduated college, neglecting about 60 percent of them who did not attend college (Teske, 2022). It is estimated that 42 percent of the program’s benefits go to the two-fifths of the wealthiest Americans, while the bottom fifth will get only 12 percent (Akers, 2022). This indicates the discriminatory nature of the plan in serving only a few people; hence, one-sided.

Student loan forgiveness plan is costly and will be transferred to the taxpayers. According to the National Taxpayers Union, the program will cost approximately $2,500 per taxpayer (Looney, 2022). This is not a direct implication that the taxpayers will immediately incur $2,500 in increased taxes; rather, the $400 billion initiative will increase the government debt (Di, 2022). The approximated tax for every taxpayer is grounded on the presumption that policymakers need to compensate for the total sum of the agenda through tax increases, borrowing, spending cuts, or a mixture of these strategies. The National Taxpayers Union’s estimated cost is derived from the overall debt calculation cost of over 400 billion dollars divided by the number of taxpayers in the country (Looney, 2022). Consequently, the implementation of the program will make taxpayers incur more costs in taxes.

The program does not compare to any other financial aid services since the plan is expensive and utilizes federal fund disbursements that could improve other goals. The budgets involved in the loan forgiveness program exceed the total spending on various nations’ critical antipoverty initiatives decades ago. Better mechanisms exist to use the money to attain the nation’s progressive goals. Increasing expenditure on targeted programs will benefit more disadvantaged, poor, and mostly Hispanic and Black families than those standing to get assistance from student loan forgiveness plan (Di, 2022). Spending on various safety net initiatives will effectively support individuals of color and low-income people. Student loan forgiveness relief could be channeled to assist people in greater need, improve economic opportunity, and lower social inequities (Di, 2022). If the plan is to be fair, it must be directed to individuals based on post-college earnings and family income. People who borrowed to obtain college degrees and are in good-paying jobs should not benefit from the plan since it is meant to help struggling borrowers.

It is an unfair deal to start back paying others who qualified for the forgiveness loan within the past ten years. The plan was initiated recently, and if it overcomes its challenges, it will only be effective from that date. Most of those who fit the agenda within the last ten years have found better ways to settle their student loans as they are employed in various sectors (Akers, 2022). This implies they can quickly pay their borrowed loans that financed their college education. Also, if they are considered in the plan, the state may take into account increasing its budget allocation to the program; hence, the taxpayers will have to incur more as the government will be in debt.

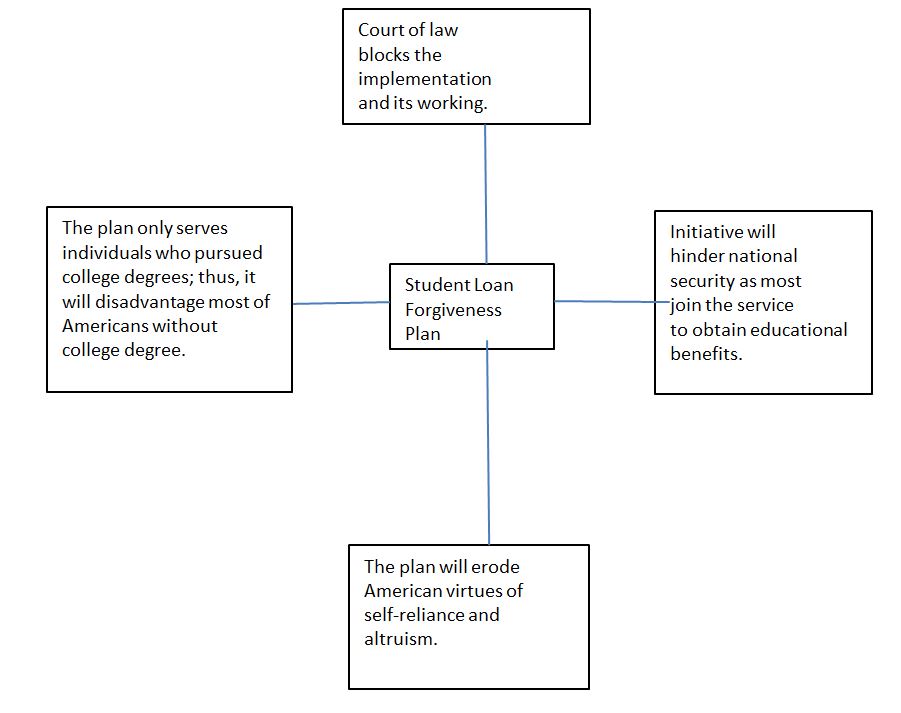

Generally, the student loan forgiveness plan is imbalanced in most cases since it benefits only a few Americans. It does not consider a group of individuals who did not attend college or joined the military service to obtain education benefits. It creates a belief that the government provides education in exchange for nothing. The interaction of the program with various aspects in the US is demonstrated in Figure 2. As a result, the program’s benefits to society are minimal since it burdens most Americans.

References

Akers, B. (2022). Anticipated student loan forgiveness plan: Costly and regressive. AEIdeas. Web.

Di, W. (2022). Biden student loan relief plan allows increased borrowing, less repayment. Federal Reserve Bank of Dallas. Web.

Looney, A. (2022). Student loan forgiveness is regressive whether measured by income, education, or wealth. Hutchins Center Working Papers. Web.

Teske, A. (2022).’ Set up for failure,’ student debt forgiveness not likely to lighten debt load. Wisconsin Law Journal. Web.