Introduction

In the environmental vehicle (EV) industry, Tesla, Inc. is currently a global leader with high brand recognition and customer loyalty. Tesla, Inc. products are not limited to EV manufacturing and sales but also include the expansion of charging stations, next-generation batteries, and intangible assets, namely the development of EV management software, including the autopilot feature. Tesla, Inc.’s primary market is the U.S. and Canada, with a share of over 2.5% of the industry’s total size, with Tesla, Inc. also well represented in Europe (1.8%) and China (1.6%) (Kane, 2022). Notably, this figure has shown steady growth over the past six years, so Tesla, Inc. is projected to increase its presence in domestic and foreign markets. The company’s mission is to accelerate the transition of global markets to sustainable energy consumption, with the corporate vision being to create the most attractive car company of the 21st century by driving the transition to EVs (Tesla, 2022d). For this reason, the brand’s core values are conscious risk-taking and experimentation, continuous learning, and respect, caring for the environment, and maximizing effort. This strategic report aims to provide business recommendations on future development for the Tesla, Inc.’s board

External Analysis

Examining the external environment of Tesla, Inc. allows identifying the key factors that affect the corporate development of the organization and assess growth opportunities. The following subsections include specific factors regarding Tesla, Inc., which are discussed using the PESTEL, Five Forces, and partial SWOT models.

Political Factors

Under the Obama and Trump presidencies, Tesla, Inc. received government benefits and enjoyed a lucrative offer stimulated by government support. However, with the arrival of Biden’s administration, the situation at Tesla, Inc. has changed almost diametrically. Although Biden, in the summer of 2021, triumphantly announced ambitious plans for the U.S. to increase the share of EV in the country to 50 percent by 2030, in reality, it proved to be a failure for Tesla, Inc. (Grandoni and Dennis, 2021). One clear example of Biden’s anti-Tesla, Inc. policy is a $4,500 subsidy to citizens as long as they buy EV from American-made companies created by the union1 (Siddiqui, 2021). Meanwhile, Tesla, Inc. offers more environmentally friendly vehicles than gasoline or gas-powered passenger cars: as a consequence, U.S. resident users of Tesla, Inc. products are eligible to receive a tax deduction for promoting environmental safety, up to $7,500 (EPA, 2022a).

Economic Factors

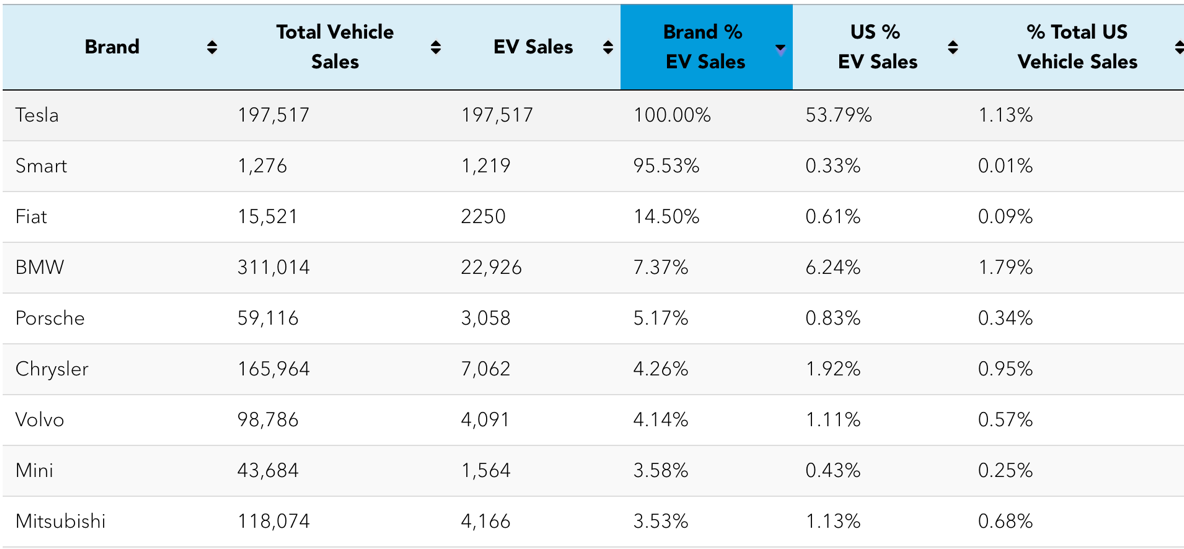

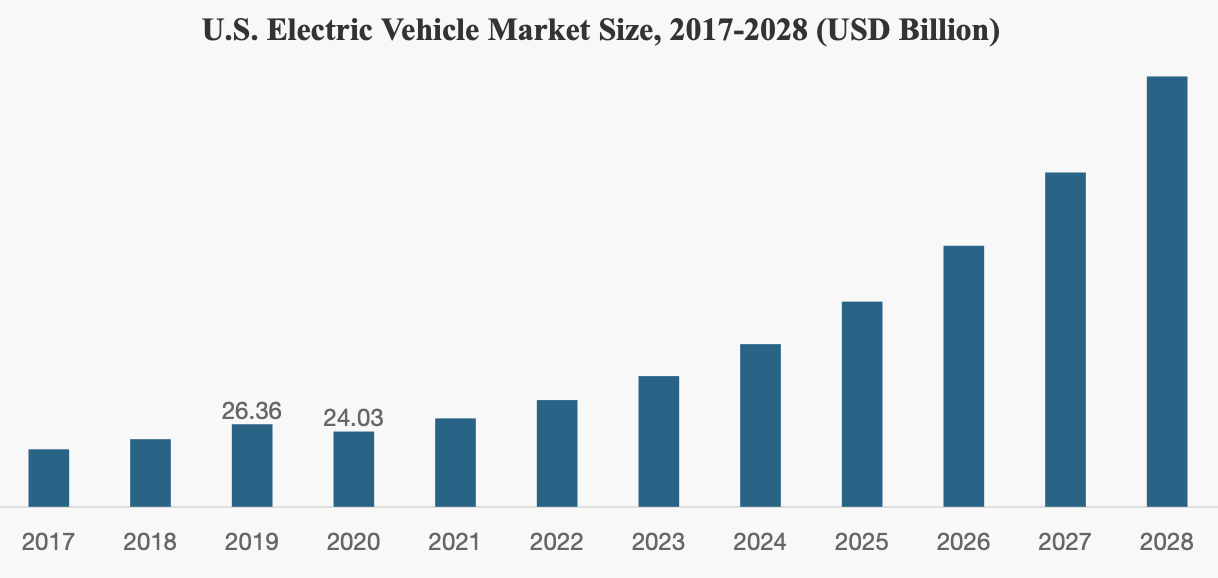

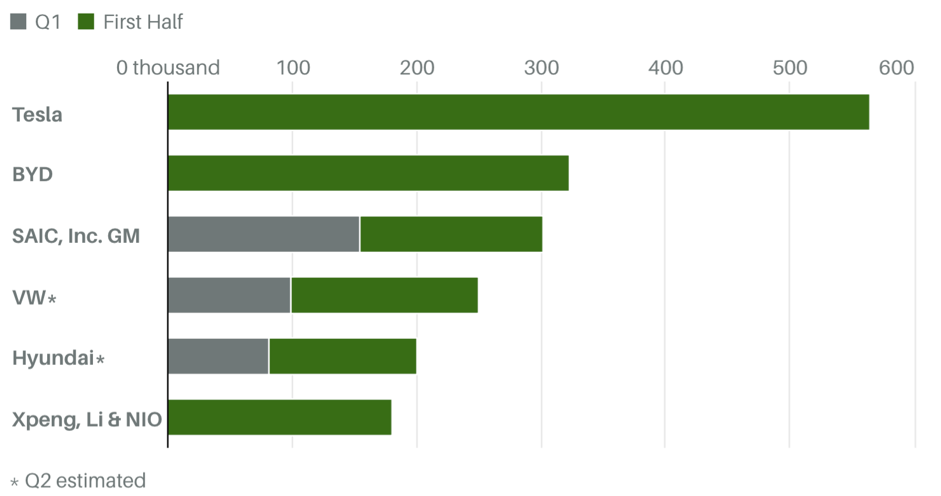

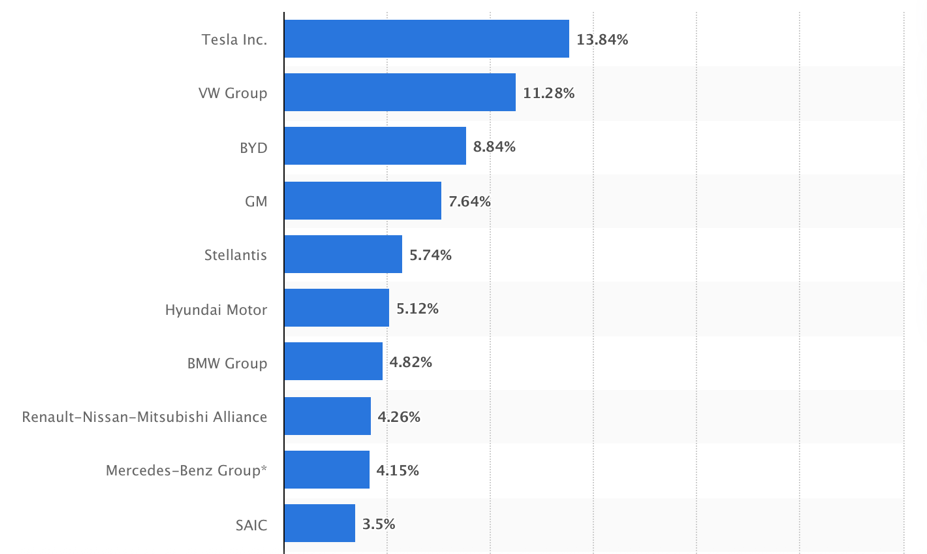

The increasing share of EV manufacturers, Tesla, Inc.’s main product, in the national and global markets hurts the company’s economic well-being. Tesla, Inc. is still at the top of the EV brand rankings, but the agenda is rapidly shifting as competitors in the industry strengthen their position (Table 1.1). Nationally, economic growth and unemployment are expected to decline, which means, eventually, Tesla, Inc. will have to pay more to employees to maintain a favorable work environment (US BLS, 2022). The effect is amplified by growing competition because, as Figure 1.1 shows, the EV market will undergo substantial growth in the coming six years.

Social Factors

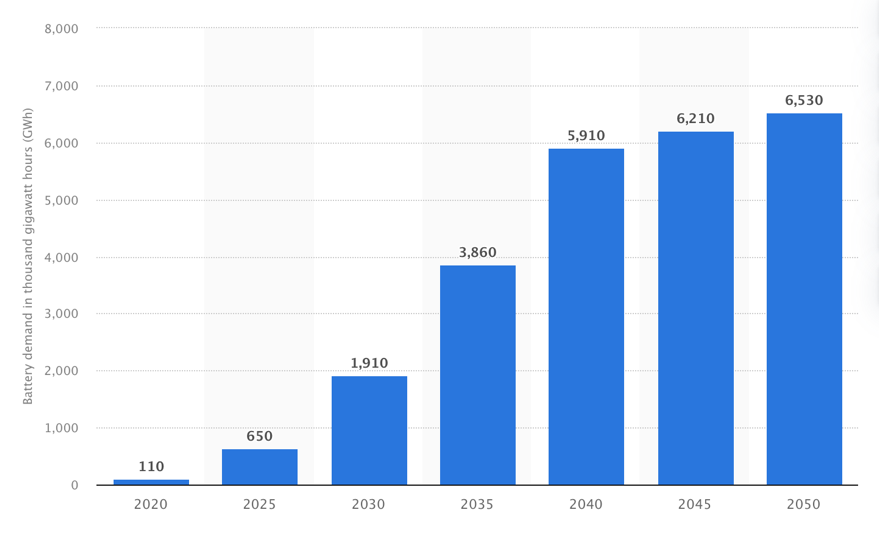

There is a steady trend toward a greening society and a culture of adequate consumption, and the Tesla, Inc. product fits well in this sense of eco-friendly vehicles (Söderholm, 2020). Global demand for EV batteries is projected to continue to grow by 2050 (Figure 1.2), creating a positive demand agenda for Tesla, Inc. (SRD, 2022). The trend toward digitalization of life is also noticeable, and Tesla, Inc. innovations, be they smart autopilot, regular software updates, and additional competitive features, are contributing to more robust demand.

Technological Factors

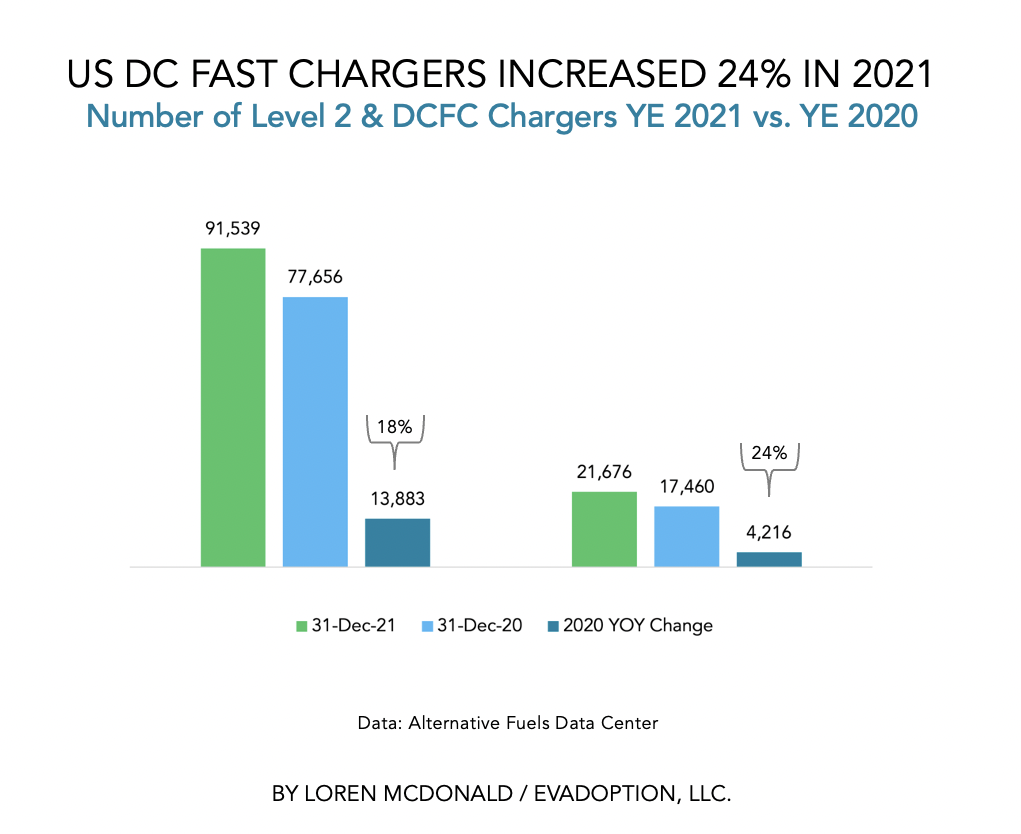

The number of charging stations for EV is constantly increasing, which creates a comfortable environment for Tesla, Inc. to purchase the product as increased opportunities for EV arise each year (Figure 1.3). Fast charging technology is also developing, as well as solar-powered stations, potentially increasing demand and creating growth opportunities for Tesla, Inc.

Legal Factors

The original U.S. company is expanding into foreign markets over time, so Tesla, Inc. must comply with regulations and laws in other countries. Even within the U.S., not all states are legally allowed to fully utilize the company’s product, as autopilots are still not permitted (AutoInsurance, 2022). The company also often faces class action lawsuits based on racial and gender discrimination in corporate practices (Wiessner and Hals, 2022).

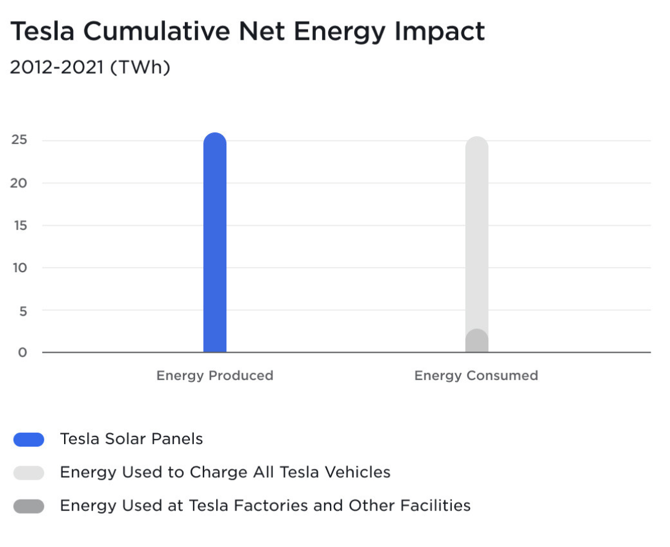

Environmental Factors

Although the Tesla, Inc. product is considered more environmentally friendly than classic passenger cars, there is a common belief that this is not the case (Widota, 2019). Incorrectly recyclable batteries threaten the environment, and if the manufacturer fails to ensure this, it is subject to fines in some states (EPA, 2022b). Tesla, Inc. has switched to clean solar energy panels (Figure 1.4) and openly states its commitment to environmental safety.

Five Forces

Based on the analysis of the Five Forces, this industry is attractive to Tesla, Inc.

Partial SWOT/Conclusion

Internal Analysis

Value Chain Model (VCM)

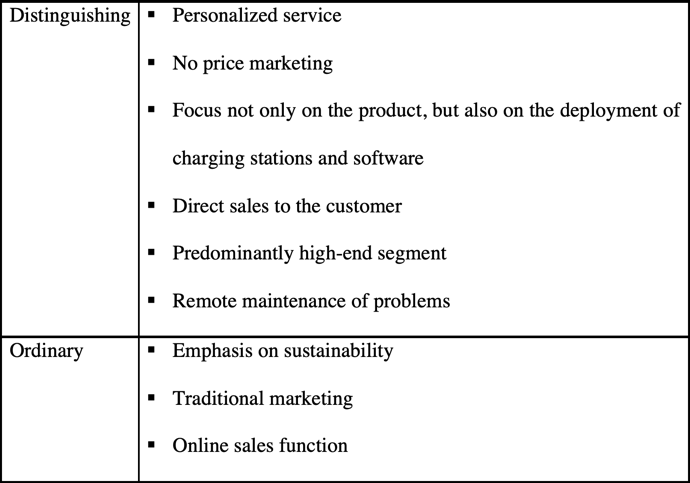

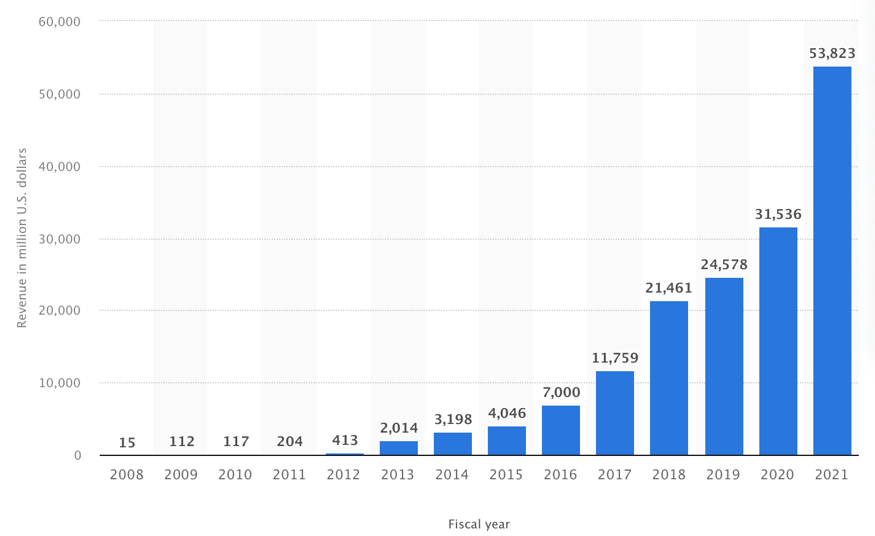

Based on VCM, the main reasons customers continue to buy from Tesla, Inc. are effective marketing, sustainability, and personalization of operations. Table 2.2 summarizes distinctive and conventional operations: it is the distinctive features that create high brand value and lead to higher profits over the past fourteen years (Figure 2.1).

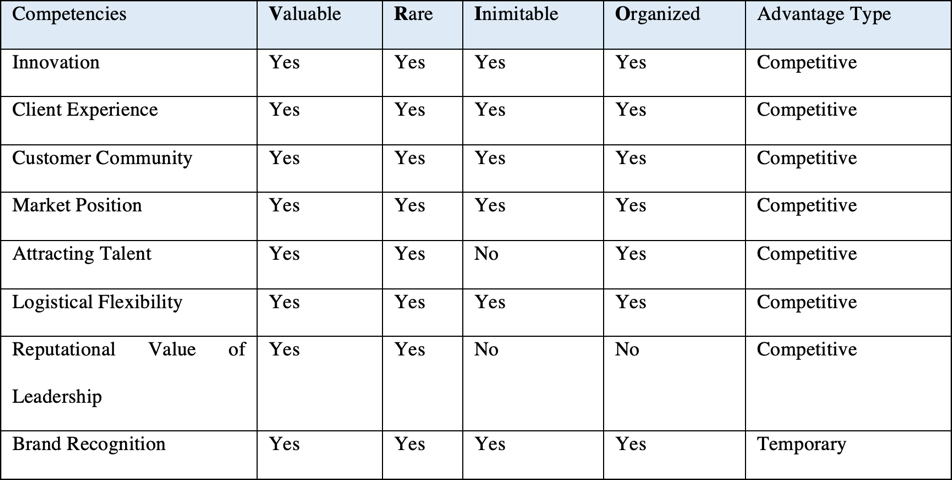

VRIO

Value

Tesla, Inc. is a valuable company because it has become one of the few companies that have surpassed a $1 billion capitalization and is also the leader in brand recognition in the EV industry (Thomas, 2021; Garsten, 2019). Musk’s impulsive management coupled with high customer loyalty to management and a developed customer community support high brand value.

Rare

Tesla, Inc. is not the only player in the EV industry (Figure 1.6) but combined with a mature community and aligned marketing that supports custom sales, Tesla, Inc. should be considered a rare brand in the industry.

Inimitability

Tesla, Inc. products, not so much the cars as the service and technology, are inimitable at the moment because the synthesis of personalization, innovation, and a largely positive customer experience for luxury EVs has not yet been surpassed. While the cars themselves can be replicated, Tesla, Inc.’s strong advantage lies in the accompanying service the company gives the customer.

Organization

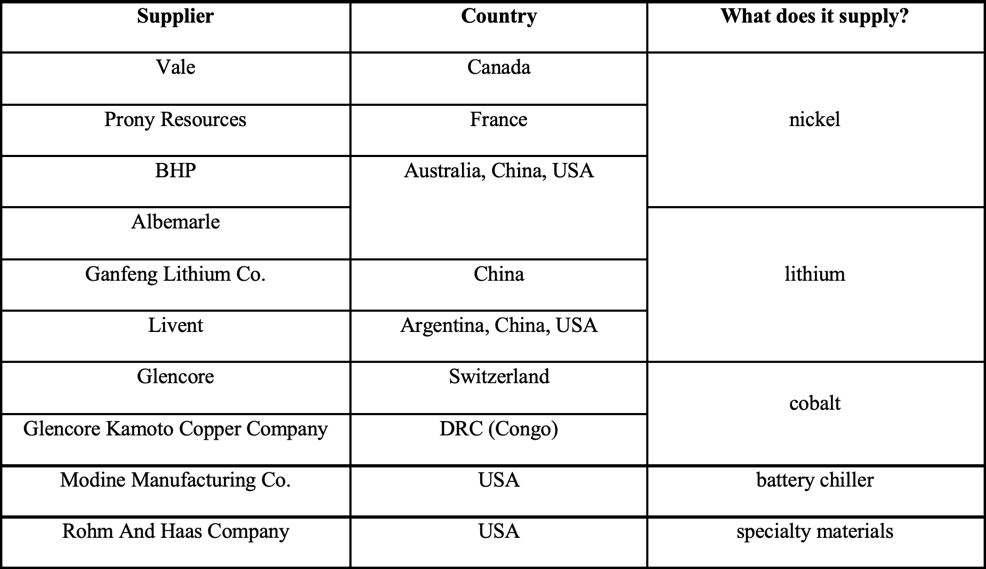

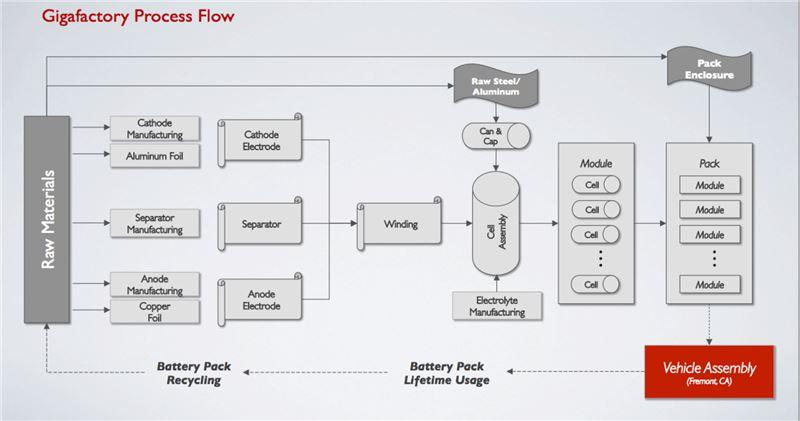

Tesla, Inc. has a well-established supply chain (Figure 2.2) and is also actively investing in creating gigafactories in the United States. The company has established a well-developed supplier system (Table 2.1) and demonstrates efficient work on customer demand. Therefore, Tesla, Inc. should be viewed as a highly organized brand.

Conclusion of the Internal Analysis

Tesla, Inc. has a central competitive advantage through valuable service and market positioning as a predominantly technology company rather than an automotive company, which qualitatively sets Tesla, Inc. apart from its competitors. However, despite the current advantages, it is not unlikely that major competitors will be able to mimic the company’s successful model and reach more consumer segments, causing Tesla, Inc. to instantly lose key advantages. Below is a partial SWOT analysis to identify the key strengths and weaknesses of the company in the context of internal analysis. It follows from the SWOT that although the Tesla, Inc. has substantial competitive advantages, it cannot remain an absolute industry leader without effectively addressing its limitations.

Business Strategy and Model

Porter’s Generic Strategy

The current key profit strategy at Tesla, Inc. is broad differentiation, in which the company actively invests in R&D and quality customer service to achieve a competitive advantage in the EV industry. Differentiation also creates secondary products — charging stations, unique technology, next-generation batteries — that encourage users to purchase the core products (Saxena and Vibhandik, 2021).

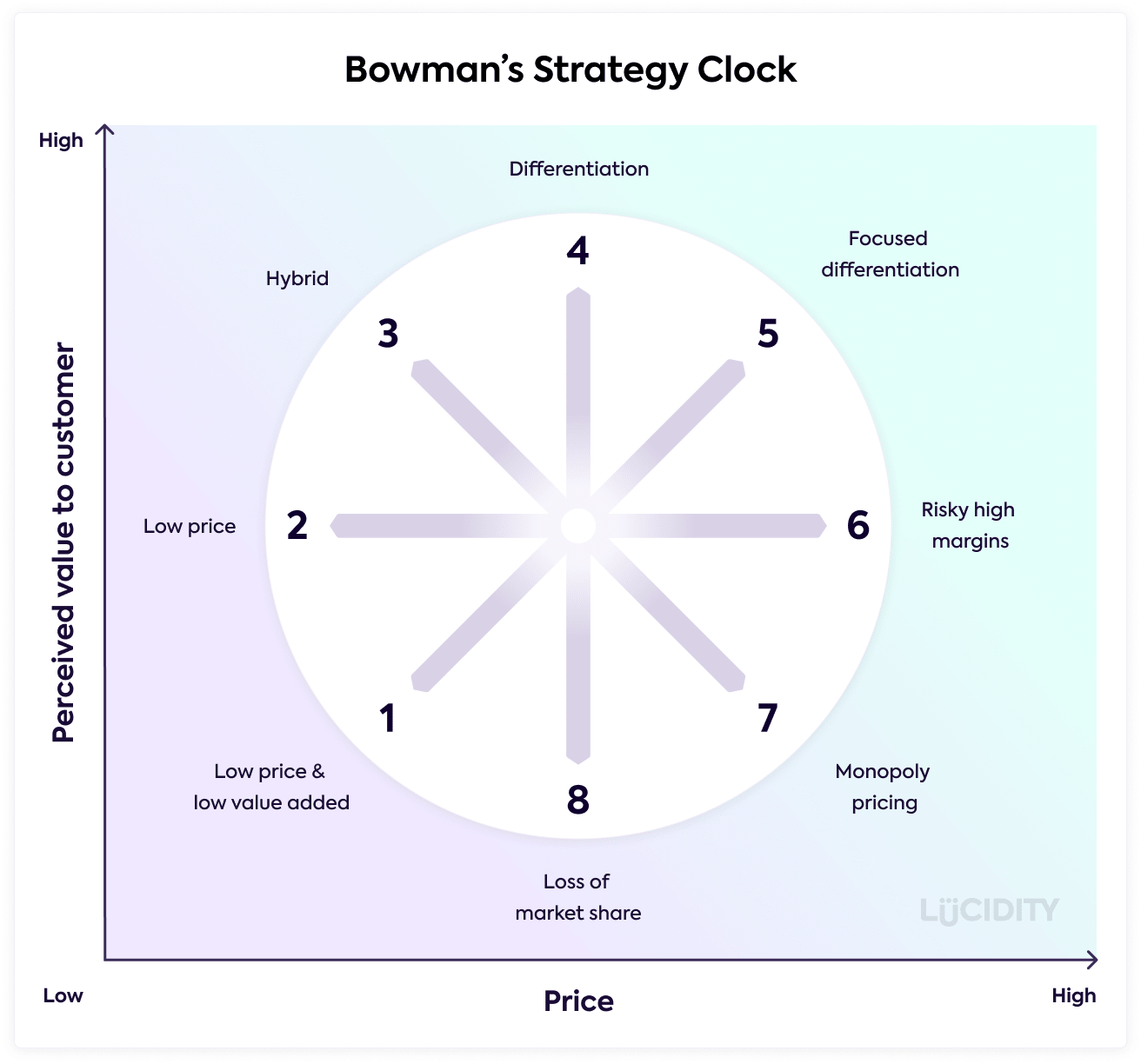

Bowman’s Strategy Clock

Bowman’s Strategy Clock (Figure 3.1) shows that Tesla, Inc.’s strategy is to create a moderately priced product with a quality competitive edge. Tesla, Inc. is focusing on wealthy customers for whom the car’s prestige is necessary because Tesla, Inc.’s EVs are not well suited for long out-of-town trips (Cristovao, 2021). Although Tesla, Inc. is trying to expand its potential customer base by lowering costs and increasing offerings, at the moment, its audience is focused and limited by technical and financial barriers. It is not profitable for the company to pursue low-price strategies because it may not justify the operating costs of creating a unique product with excellent service, which is the main competitive advantage of Tesla, Inc.

Business Model

The uniqueness of the Tesla, Inc. business model lies in creating a high-value end product and the perception of its uniqueness. Customers cannot buy the company’s EVs from dealerships or resellers, with the cars’ near-high price range deliberately limiting supply (Zucchi, 2022). Investing in secondary product development drives sales and popularity of Tesla, Inc. vehicles (Saxena and Vibhandik, 2021). For this reason, the company’s business model is based on broad differentiation, in which Tesla, Inc. has complete control over pricing and supply chain, as well as directly collected data on machine usage, which systematically maintains customer loyalty through developing tools.

Issues & Challenges and Strategic Options for Growth

Current Issues & Challenges

Based on the earlier analysis of the external and internal environment, several critical problems faced by Tesla, Inc. at the moment can be identified. First, there is the problem of rush demand: since Tesla, Inc. supplies orders only when actually placed by the user, it cannot cover excess demand, which leads to a forced restriction of the customer base and, as a result, a shift of unprepared consumers to industry competitors. The problem of insufficient production capacity also creates constraints on orders already placed, as Tesla, Inc. may cause operational logistics to slow down in an effort to increase its reach among customers. As a result, the wait for a new EV from Tesla, Inc. can be several months, and announced new products can be continually postponed indefinitely (Kane, 2022).

Second is the excessive eccentricity of Elon Musk’s leadership, which has created an agenda in which rash decisions can lead to spikes in volatility. For example, in May 2019, Musk wrote on his Twitter profile that Tesla, Inc. stock was severely overvalued (Figure 4.1), causing herd investors to sell the securities actively — the share price dropped nearly 10 percent (Musk, 2020; Yahoo! Finance, 2022). The inability to control the virtual behavior of the CEO, or rather the high loyalty of private investors to his statements, has an ambiguous effect on the market value of Tesla, Inc. and can expectedly lead to failure, which creates problems for effective strategic planning.

Third, the company faces the organizational costs of disrupted logistical communication in both the COVID-19 pandemic and geopolitical crises around the world, including the economic response to Russia’s invasion of Ukraine (Xinyi, Chen, and Bai, 2022). Any such crisis leads to an increase in the cost of EV production or secondary products, which in turn predictably affects the cost to the consumer as well. Tesla, Inc. has dozens of suppliers in Asian and European countries, so disruption of supply chains is an operational problem for the company.

Strategic Options

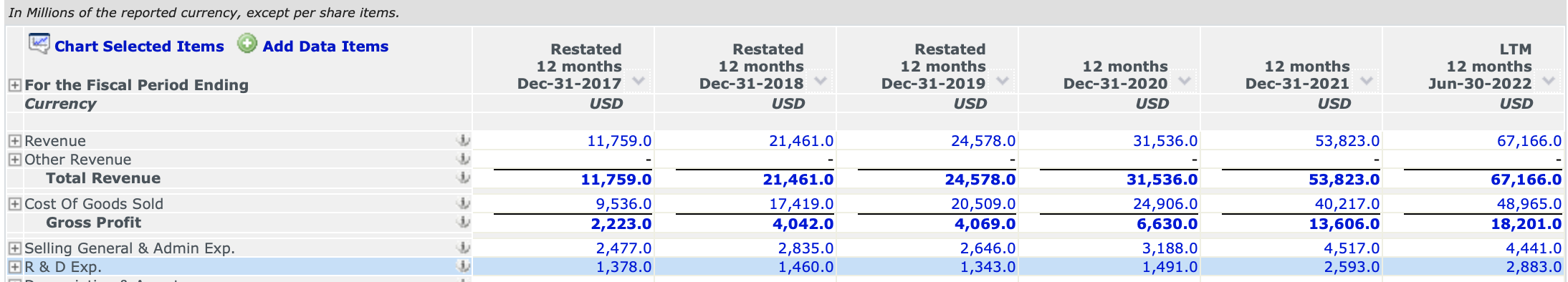

Based on the identified challenges that Tesla, Inc. is currently facing, several options for managing them should be proposed. Below is a demonstrated TOWS analysis based on preliminary statements gathered through SWOT — presented eight specific strategies that can be used by Tesla, Inc. to improve its competitive advantage and eliminate any threats. Among the most accessible is increasing the proportion of capital spent on R&D. To date, Tesla, Inc. is spending only 4.3% of total profits on R&D-related expenses (Table 1.2). Although this is the maximum among industry competitors, Tesla, Inc. should be viewed as a technology company to determine its place among the industry’s competitors. Table 4.1 compares R&D operating expenses as a total share of earnings for technology industry competitors over the past twelve months. As one can see, Tesla, Inc. is not a leader in this industry, so it has avenues for growth.

Table 4.1: R&D spending rates for large technology companies compared to Tesla, Inc. (obtained from Capital IQ).

Another development strategy is moving core production and storage to gigafactories in the U.S., which will significantly reduce the operational risks associated with global crises. Full-format assembly in the U.S., where most of Tesla, Inc.’s customers are represented, will allow the company to manage better supplies and control pricing, which will have a positive impact on the customer experience and create a competitive advantage for Tesla, Inc. (AMR, 2022). Another critical strategy for commercial development is to take control of Musk’s impulsive leadership. It is recognized that his behavior directly affects the market value and reputational appeal of Tesla, Inc., but at the same time, it is also recognized that abandoning such behavior can have disruptive long-term consequences. For this reason, Musk’s controlled conduct with respect to Tesla, Inc. is effective, dictated by the decisions of the company’s board of directors and lawyers, to avoid adverse effects on the brand but to maintain audience interest in Tesla, Inc.

Strategic Options

Increasing the share of investment in R&D

The first strategy chosen in the last step is to increase the share of spending as part of the total capital spent on innovation and research. Since the current level at Tesla, Inc. is higher than competitors in the EV industry but significantly lower than competitors in the technology industry, it is implied that the company can demonstrate growth in this parameter. From an Appropriateness perspective, this strategy seems highly acceptable, as it aims not only to grow the brand’s competitive advantage but also to increase the loyalty of innovation-prone customers. Tesla, Inc. is already strongly associated in consumer perception with technology, so this bar cannot be lowered but has positive opportunities to increase further (DeBord, 2020). For comparison, Table 5.1 shows historical data on the share of operating expenses spent on R&D — it is clearly visible that the company this value shows a generally downward trend for the last ten years, which means Tesla, Inc. is gradually moving away from a commitment to innovation, which has negative consequences for customer loyalty. It is for this reason that this strategy is Acceptable, as a gradual increase in this indicator, expressed in the development of modern technologies and tools for EV management, will be beneficial to both Tesla, Inc. and its customers. By investing in innovation, among other things, Tesla, Inc. will become more integrated into the technology industry, in which it will have to compete with new players (Apple, Google, Amazon), which means it will have access to an expanded customer base. However, if this strategy fails, when investments have been increased, but revolutionary innovations have not been provided, Tesla, Inc. risks losing its reputation and customers, which will affect profits, among other things. Finally, the strategy is entirely feasible because it affects the financial, tangible, and intangible resources the company already has.

Table 5.1: Share of R&D expenses in profit over time (obtained from Capital IQ).

Transferring Production to the U.S.

This strategy seems appropriate as tensions are gradually rising on the world stage due to pandemic and geopolitical conflicts, including between the countries with which Tesla, Inc. cooperates as suppliers. The aggravation of U.S.-China relations and Xi Jinping’s repressive policies toward local technology companies could cause severe damage to supply chains (Han, 2018). Therefore, the suitability of this strategy does not seem questionable and is consistent with growth objectives. The benefits of this strategy will prove to be long-term, as moving assembly and storage to the U.S. will allow Tesla, Inc. to manage supply chains and control pricing better, as well as reduce the production speed of new cars, which will have a positive impact on the current deficient demand management. The feasibility of this strategy is also proposed to be evaluated through a cost-benefit analysis to determine how long this project is expected to take to show break-even. On the contrary, failure of the strategy would be highly critical, as it would result in the effects of lost profits combined with needlessly wasted resources to create new gigafactories as well as deteriorating profitable relationships with current suppliers. For this reason, Tesla, Inc. management should approach the implementation of the strategy with extreme caution. The feasibility of the strategy also seems problematic since it requires significant resources, most of which are not at the disposal of Tesla, Inc. Acquiring new territories, rearranging supply chains, and hiring employees are major cost items for this strategy.

Controlling Impulsive CEO Behavior

The third proposed strategy is to curb Elon Musk’s impulsive behavior in order to manage strategic planning and minimize the adverse effects, as was the case in May 2020. However, to maintain customer interest in the brand, it is not recommended to abandon such management entirely but rather to create a pseudo-impulsive behavior in which Musk’s actions appear to be aligned with the board of directors and only benefit Tesla, Inc. The strategy seems appropriate because it is consistent with the long-term growth goals of the company, as well as maximizing the effects of Tesla, Inc.’s managerial strengths. In terms of acceptability, with proper alignment at board levels, stakeholder interests are expected to be taken into account while focusing on the ultimate goal of increasing the company’s market value. Failure of this strategy would be critical, as it could lead not only to a public conflict between the board and Musk and a potential change of CEO but also to severe reputational damage. The feasibility of this strategy does not seem complex, as it does not require any material resources, but it does require a negotiation process and agreement on further public management practices.

Conclusion

Thus, based on the SAF analysis, the optimal strategy for further development of Tesla, Inc. is to increase the share of R&D expenditures in the context of the company’s overall earnings. The expected benefits from this strategy exceed the benefits of other recommendations, and the risks of failure are not so significant. In addition, Tesla, Inc. does not need to implement new resources and tools to implement the strategy but must review current financial policies. The essential resources and processes that Tesla, Inc. will need to achieve the positive effects of the strategy are budget restructuring, opening new labs, and hiring engineers.

Conclusion

Tesla, Inc. currently remains the global leader in the EV industry but increasing competition in both global and niche markets could cause this position to deteriorate. The analysis showed that Tesla, Inc. is bound by severe constraints, whether it be crisis logistics issues, uncontrollable CEO behavior, and poor demand management. The technological sophistication of major competitors continues to grow, and more companies are beginning to develop EV devices. For this reason, Tesla, Inc. needs to consider strategies that will leverage the company’s strengths to achieve positive results. According to the SAF analysis, the most acceptable and feasible strategy was to increase the company’s share of R&D investment, which is currently only 4.3% of earnings and has shown a downward trend over the past ten years. This strategy guarantees success because it aims to intensify the critical competitive advantage of the brand and increase customer loyalty.

Reference List

Al Root (2022) Tesla still tops the list of battery-EV makers. Here’s the top 5. Web.

AMR (2022) Tesla owner demographics: income, age, gender and more. Web.

AutoInsurance (2022) Which states allow self-driving cars?. Web.

Bauer, H., et al. (2020) How the semiconductor industry can emerge stronger after the COVID-19 crisis. Web.

BAW (2020) Tesla supply chain management, what happened? Web.

Carlier, M. (2022a) Plug-in electric vehicle sales market share by producer 2021. Web.

Carlier, M. (2022b) Tesla’s revenue 2008-2021. Web.

Collins, J. (2018) Elon Musk’s increasingly erratic behavior comes at a price for Tesla shareholders. Web.

Crider, J. (2022) Tesla’s 6 factories are a new phase of its future. Web.

Cristovao, N. (2021) What to do with your Tesla when going on vacation or storing it for longer periods of time. Web.

DeBord, M. (2020) Tesla is doing something we haven’t seen since the early 20th century — rapidly building up a new industry. Here’s how. Web.

EPA (2022a) Federal tax credits for new all-electric and plug-in hybrid vehicles. Web.

EPA (2022b) Criminal Provisions of the Resource Conservation and Recovery Act (RCRA). Web.

EvaDoption (2021) EV charging statistics. Web.

EvaDoption (2022) US EV sales percentages of total vehicle sales by brand. Web.

FBI (2022) The U.S. electric vehicle market is projected to grow from $28.24 billion in 2021 to $137.43 billion in 2028 at a CAGR of 25.4% in forecast period, 2021-2028. Web.

Feiner, L. (2022) Musk says Tesla can lower car prices if inflation ‘calms down’. Web.

Garsten, E. (2019) Tesla is an EV brand awareness juggernaut compared to competition. Web.

Grandoni, D. and Dennis, B. (2021) Biden calls for half of new cars to be electric or plug-in hybrids by 2030. Web.

Han, H (2018) ‘Legal governance of NGOs in China under Xi Jinping: reinforcing divide and rule’, Asian Journal of Political Science, 26(3), pp. 390-409.

Jenson, L. (2022) Can you negotiate with Tesla? Web.

Kane, M. (2022) Tesla’s market share keeps growing and growing. Web.

Kane, M. (2022) US: survey reveals how long customers have waited for Tesla Model 3/Y. Web.

Keesee, P. (2022) How many Tesla stores are there around the world? Web.

Klender, J. (2020) Tesla to build one new Service Center per week in 2021. Web.

Lambert, F. (2022) Tesla releases list of battery material suppliers, confirms long-term nickel deal with Vale. Web.

Liang, J. (2022) A case study of marketing at Tesla based on the 4V theory. Web.

Lucidity (2021) Introduction to Bowman’s Strategy Clock. Web.

Musk, E. (2020) Tesla stock price is too high IMO. Web.

Reddit (2021) Anyone else experiencing this lately? Autopilot will not give its regular blue flashing warning before the final red warning to put your hands on the wheel. My hands are on the wheel and the red alert is flashing every few seconds driving me crazy lmao. Web.

Saxena, N. and Vibhandik, S. (2021) ‘Tesla’s competitive strategies and emerging markets challenges’, IUP Journal of Brand Management, 18(3), pp. 57-72.

Siddiqui, F. (2021) The government helped Tesla conquer electric cars. Now it’s helping Detroit, and Elon Musk isn’t happy. Web.

Söderholm, P. (2020) ‘The green economy transition: the challenges of technological change for sustainability’, Sustainable Earth, 3(1), pp. 1-11.

SRD (2022) Forecasted electric vehicle battery demand worldwide 2020-2050. Web.

Tesla (2022a) Environment. Web.

Tesla (2022b) Essentials | Model S. Web.

Tesla (2022c) Form 10-K. Web.

Tesla (2022d) About Tesla. Web.

Thomas, D. (2021) Tesla surpasses $1 trillion valuation after Hertz order. Web.

US BLS (2022) Economy at a glance. Web.

Walker, D. (2021) Industrial robots vs humans in manufacturing at Tesla. Web.

Widota, A. (2019) ‘The Tesla in the world of signs-between good and evil’, Scientific Papers of Silesian University of Technology Organization and Management Series, 35, pp. 223-234.

Wiessner, D. and Hals, T. (2022) Explainer: Do claims against Musk raise a legal issue for his companies and Twitter deal? Web.

Xinyi, L., Chen, Z. and Bai, C. (2022) Case study research in Tesla (China) marketing strategy application during COVID-19. Web.

Yahoo! Finance (2022) Tesla, Inc. (TSLA). Web.

Zucchi, K. (2022) What Makes Tesla’s Business Model Different? Web.

Footnotes

- Tesla, Inc. is currently the only company in the United States in the industry that is not unionized (Siddiqui, 2021).

- Biden’s goal is to eliminate internal combustion engine cars by 2030 (Grandoni and Dennis, 2021).