Introduction

Valentino is a luxury brand that specializes in clothing and accessories for both men and women. Valentino has achieved stable popularity all over the globe and has been growing its profits for the last few years. One of the most significant markets for the brand is in China, where the demand for luxury goods is high and growing. One of the most profitable markets in China is the cosmetics market. Valentino, on the other hand, does not produce and sell cosmetics. Expansion into China’s luxury cosmetics market would allow the brand to increase its profits and further be more effective in competing with other brands that sell luxury clothing and cosmetics, such as Dolce & Gabbana, Armani, and more. This report aims to analyze the brand and the luxury cosmetics market in China to propose a communication plan for the brand extension of Valentino.

About the Brand

The brand was founded by Valentino Garavani. Born in 1932 in Voghera, Italy, Garavani studied at two Parisian art schools, the École des Beaux-Arts and the Chambre Syndicale de la Couture Parisienne (Jones n.d.). After working as an apprentice for fashion designers, Garavani opened his own fashion house in Rome in 1959 (Jones n.d.). Valentino debuted on the international stage three years later and soon became known for its haute couture red dresses, which attracted the attention of many notable females, including Jacqueline Kennedy, Elizabeth Taylor, and Audrey Hepburn (Jones n.d.). Connection to influential women, as well as glamorous styles and high-quality materials, allowed the brand to firmly position itself in the global luxury market. In 2009, the brand also introduced a diffusion line REDValentino, which aimed to attract a wider variety of female buyers with vibrant colors and bold silhouettes. REDValentino allowed the brand to expand its target audience to younger populations, while at the same time preserving its unique brand identity and style.

Today, Valentino sells clothing, accessories, footwear, and perfumes and is positioned in the ultra-high-end market, competing with other luxury brands. The brand has been growing throughout the past few years. According to Muret (2017), the brand’s revenue exceeded a €1 billion mark in 2016, whereas in 2012, Valentino’s annual revenue was €370 million. The sales of the brand had grown by 12.4% since 2015, whereas its EBIT increased by 16.6% (Muret 2017).

Valentino has 175 mono-brand stores all over the globe and over 1000 selling points in department stores and other facilities; however, the brand’s key market remains the United States. Valentino pursues a variety of strategies to ensure continuous growth of profits; at the moment, the label is dedicated to expanding its male clothing line to obtain a higher market share in menswear (Muret 2017). Menswear currently constitutes 15% of the brand’s profits; however, the principal line of business for Valentino is accessories, the sales of which amount to half of the brand’s annual revenue (Muret 2017). Overall, Valentino is a stable high-end brand that is committed to increasing sales and enhancing its market share on a global level. Valentino shows a history of successful brand extensions, which allowed it to gather a broad and diverse target audience and grow its share in the international luxury market. China’s luxury sector is fast-growing and diverse, thus offering excellent opportunities for brand extension.

China’s Luxury Cosmetics Market Analysis

Although China is still considered to be an emerging market, its luxury market has been the target of many high-end brands. Many famous labels, such as Estee Lauder, managed to launch new products and product lines specifically for their Chinese customers. One of the key reasons why China’s luxury market is so attractive to global brands is that it offers excellent perspectives for brand growth and development. According to Knight Frank Research (2017, p. 12), “In China, despite indications that economic growth is slowing, the sheer scale of the economy, coupled with strong growth in the local high-tech, media, entertainment, and healthcare sectors, will deliver 140% growth in ultra-wealthy populations, New World Wealth forecasts”. Indeed, compared to other Asian countries, China offers more opportunities for achieving higher income and moving up the societal ladder. Kapferer and Bastien (2009) explore China’s luxury market about Indian and Japanese markets to determine what makes it more preferable for luxury brands.

In India, for instance, there is a strong caste system, which means that an increase in income does not necessarily allow a person to achieve a higher status; in China, on the other hand, people can progress to a higher social status along with the growth of their income (Kapferer & Bastien 2009). Therefore, the luxury goods market in China is much more dynamic and is likely to grow further along with the development of the country’s economy. Moreover, people in China enjoy buying luxury products. As opposed to Japanese people, who tend to be more discreet and avoid showcasing their social status, the Chinese are more demonstrative and use luxury products to support their position in the society (Kapferer & Bastien 2009). The results of the PESTLE Analysis, presented in Appendix 1, summarize all the factors impacting the introduction of Valentino’s new cosmetic line into the Chinese luxury market. Overall, the analysis showed that China offers a positive environment for brand extension, although there are some considerations. For instance, to sell cosmetics, it would be crucial for Valentino to obtain official certification and use animal testing, as these are legal requirements. Moreover, the large-scale production of cosmetic goods could create environmental concerns. Lately, the Chinese government has been making efforts to reduce air pollution, which calls for environmentally-friendly production techniques (Clark 2017).

According to the BCG (2017), the global luxury market was worth €860 billion in 2016 and continues to grow, with Chinese being the top luxury consumers by net appetite. This means that the demand for luxury goods among Chinese people will continue to grow in the future, making them an important target audience for global and local luxury brands. However, the BCG (2017) report also showed that more and more Chinese people buy luxury goods locally, and that renowned luxury shopping destinations have become less popular among Chinese nationals in recent years. This is important for luxury brands, as it shows that, to achieve higher popularity among Chinese customers, they must develop and promote products specifically in China’s luxury market. The luxury market in China is diverse and features the vast majority of world-famous brands that produce luxury goods, cars, clothing, perfumes, cosmetics, and more. However, most market researchers agree that there is room for more growth in the future.

Despite the rise of feminism and the changes to the social and gender roles of women, the beauty industry remains among the key sectors of the market in China. As explained by WGSN (n.d., p. 10), the popularization of beauty trends and ideas is tightly linked to the growth of the entertainment sector: “the love of Korean dramas, K-pop, and rising discretionary incomes has made beauty a priority, fuelling a spending boom for both women and men”. Paired with the continuous increase in wealth and social status of the population, this fuels the demand for luxury beauty products, including cosmetics. High-end cosmetics are among the key luxury markets that will continue to develop in China. Fung Business Intelligence Centre (FBIC 2015) describes the features of China’s cosmetics market in its report, noting that the sector showed stable growth in the past years. The luxury cosmetics market is growing faster than the overall market and is projected to increase throughout 2015-2020. Moreover, the demand for high-end cosmetics is now at its all-time high in China, a trend that has been recognized by some luxury brands (FBIC 2015). For instance, Gucci and Chanel both introduced new cosmetics lines to China’s market in 2014.

Brand Extension Communications Plan Development

The development of the communications plan for the proposed extension will be driven by two factors. First, the plan has to take into account the existing opportunities, obstacles, and trends evident in the target market. A SWOT analysis was prepared to review the potential factors impacting the development of a communications plan for Valentino’s brand extension strategy (Appendix 2). For example, one of the main opportunities for Valentino would be to use digital marketing to attract the target audience to its new products. It is also crucial to develop a unique selling point (USP), as the key threat to the extension is the high competition among luxury brands in the cosmetics market.

Secondly, the plan needs to be based on the same principles that apply to luxury brand marketing in other countries. Most researchers and theorists argue that luxury brand marketing should follow an inverted marketing pattern. For instance, as noted by Kapferer and Bastien (2009), mass-market brands should always try to match the demand with supply to guarantee higher sales, whereas luxury brands do not need to respond to the increasing demand. Limited supply increases the value of the product in the consumer’s eyes, thus increasing its popularity (Kapferer & Bastien 2009). Another significant principle that has to be noted in the development of communications plan is that a luxury brand needs to establish brand awareness in people outside the target audience to increase brand value: “In luxury, if somebody is looking at somebody else and fails to recognize the brand, part of its value is lost” (Kapferer & Bastien 2009, p. 69). Overall, there is a variety of differences between mass-market brands and high-end brands that have to be considered while choosing a communications plan.

Purpose

Setting out the purpose of the communication is the key to ensuring its efficiency. A distinct aim helps to ensure that the plan is focused and that no unnecessary actions or spendings are undertaken. The purpose is determined by the current goal of the brand, as the plan serves to achieve it. In the case of the proposed brand extension, the primary purpose of the communication is to establish awareness and attract consumers to buy Valentino’s new cosmetic products.

Audience

As Kapferer and Bastien (2009) explain, the audience with which a luxury brand communicates goes beyond the target customers of the brand. Valentino’s target customers would be females aged 18-35. The buying behavior of Chinese consumers has been largely impacted by the changes to the country’s laws and the economy. According to the FBIC (2015), women born under the one-child policy are likely to spend more on cosmetics than those born before the 1980s. The target consumer of Valentino’s cosmetics line would also be from the upper-middle class, as these populations buy more luxury products than others: “many young, aspiring, well-educated urban professionals buy luxury items as a status symbol or as a reward for their hard work” (Stępień et al. 2016, p. 81). Moreover, in China, the upper-middle-class represents a larger portion of the population than the high class due to the long history of socialism and communism in the country. In addition to the target customers, communication should also target the general population to establish brand awareness.

Message

The message is among the primary concerns for luxury brand communication, as it serves to establish the luxury value of the products. Luxury value, in turn, contributes to the customer’s perception of the product as luxury and thus impacts his or her buying decision (Hennigs et al. 2012). Luxury value rests on four key domains. First of all, the social value of the product is determined by conspicuousness value and prestige value (Hennigs et al. 2012). To establish a high social value of the product, it is crucial to portray products as available only to a limited audience, but still widely recognized. Next, the individual value of the product is determined by its contribution to self-identity, as well as by its hedonic and materialistic values (Hennigs et al. 2012).

It is thus essential to ensure that the message communicated to the audience depicts the pleasure of using the luxury product and its impact on self-perception. Thirdly, the luxury value is determined by the functional value (Hennigs et al. 2012). Brands can improve the functional value of their products by addressing quality, usability, and uniqueness. Finally, the luxury value is also determined by financial value or the price of the product (Hennigs et al. 2012). However, in the case of luxury products, it is not the exact price that matters, but rather the affordability of the products. Making the products affordable to a large group of consumers would decrease their luxury value; thus, luxury brands can set high prices that match or slightly exceed their competitors, as long as the prices increase continuously to prevent high affordability. Moreover, the message should ensure that the product looks more expensive than it is: according to Kapferer and Bastien (2009) if the imaginary price of the product is higher than its actual price, it adds to the luxury value.

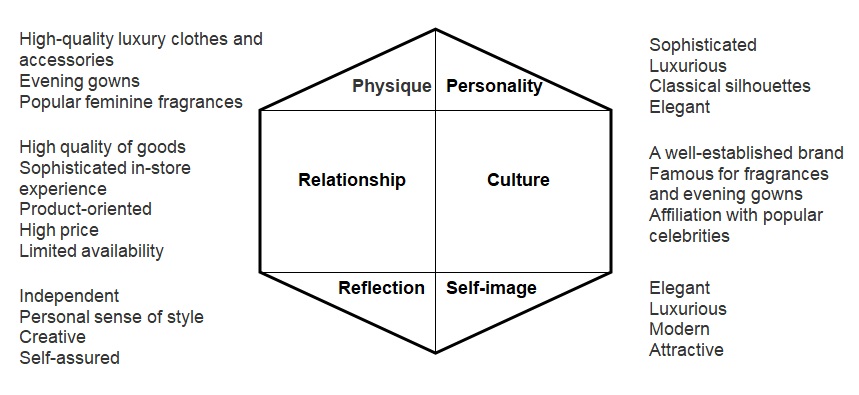

Overall, the message should be carefully planned to increase the luxury value of the product, as it would aid in creating a demand for it. Valentino’s brand message used to promote its new products should fit into the overall brand identity, as exemplified in the brand identity prism (Appendix 3). It is important to ensure that the cosmetic products produced by Valentino promote the same personality and culture as the brand’s existing products. Moreover, Valentino should aim to address the features of its relationship with the customers, including the high quality of goods, sophisticated experience in-store, and limited availability.

Distribution Channels

Distribution of luxury products is also an important concern in the process of planning a brand extension, as it directly affects the availability of the product and thus its perceived value for the target audience. For instance, selling Valentino’s new cosmetics line in local drug and beauty stores would affect the entire brand, as it would decrease its uniqueness and prestige. However, it is also crucial to take the buying trends of Chinese consumers into account. According to Atwal and Williams (2009), 38% of consumers prefer to purchase luxury goods online. There is a similar trend in China, where online retailing continues to grow (FBIC 2015). Therefore, the brand will have to balance between the two trends. For instance, it would be useful to ensure that Valentino’s cosmetic products are first sold in official mono-brand shops and department stores. After some time, they could be added to the brand’s official online store. The sale of Valentino’s cosmetics by multi-brand online stores should not be allowed. Thus, the brand will be able to balance low availability and ease of purchase, which would help to generate more value and interest in the product.

Communication Channels

Communication channels normally used by luxury brands include TV advertisements, celebrity endorsements, and visual advertisements. Given the rise of China’s entertainment industry, the same channels should be used for the marketing of Valentino’s brand extension. Also, it would be beneficial to assess the possibility of using digital marketing to target the audience. FBIC (2015) notes that popular Chinese social media sites, such as Weibo and WeChat, are used by companies in the cosmetics market to stay connected with potential customers. Social media platforms are especially useful for promoting new products, as it presents an opportunity for targeted advertising based on the user’s interests. On most platforms, it is also possible to choose the age range and gender of users, thus narrowing the audience based on the profile of the potential customers. Given that the primary users of Valentino’s cosmetics would be females aged 20-40, the brand could compose several advertisements to appeal to different age groups. For instance, users aged 20-25 might find bright and modern images to be more appealing and would respond better to a personal tone of writing, whereas women aged 30-35 would be more drawn to posts that focus on design and features of the product.

Another potential opportunity to communicate the brand extension to customers is to hold a launching event. Launching events are usually popular among existing customers, as they allow them to become more familiar with new products and offer a unique experience. As noted in the previous sections, the relationship between a luxury brand and its customers is largely based on the customers’ in-store experience. People who buy luxury brands often enjoy the process of shopping at the mono-brand stores due to the high quality of service offered. Thus, when holding a launching event, it would be important for Valentino to create a unique experience that creates a positive impression of the products and defines them as part of the existing brand identity. For instance, to ensure an individual approach to each person, the company should only offer a limited number of places. This would allow offering an exclusive experience while at the same time promoting the new products.

Controls

To ensure the effectiveness of the brand extension strategy outlined above, it is vital for Valentino’s management to establish sufficient controls that would allow monitoring the progress. Two types of controls should be used in the present case. First, financial controls, including regular financial reporting and audits, would help to identify any issues and ensure that the new product line achieves the planned profits. Secondly, market controls should be used to monitor the overall customer attitudes and market trends following the brand extension.

Conclusion

Overall, the proposed brand extension strategy would benefit the key stakeholder group – Valentino’s management and workers. However, the extension would also be valuable for customers, as the plan is designed to maintain and improve the luxury value of Valentino by improving the quality, pleasure, and prestige of its products. By extending the product range, Valentino will be able to maintain its competitive position in China’s market and achieve a higher market share over time, which would contribute to the brand’s further development.

Reference List

Atwal, G & Williams A 2009, ‘Luxury brand marketing — the experience is everything!’, Brand Management, vol. 16, no. 5/6, pp. 338-346.

The Boston Consulting Group (BCG) 2017, The true-luxury global consumer insight.

Clark, A 2017, ‘China’s environmental clean-up to have big impact on industry,’ Financial Times.

Fung Business Intelligence Centre (FBIC) 2015, China’s cosmetics market.

Jones, A n.d., Valentino brand history.

Hennigs, N, Wiedmann, KP, Klarmann, C, Strehlau, S, Godey, B, Pederzoli, D, Neulinger, A, Dave, K, Aiello, G, Donvito, R, Taro, K, Taborecka-Petrovicova, J, Rodrıguez Santos, C, Jung, J & Oh, H 2012, ‘What is the value of luxury? A cross‐cultural consumer perspective’, Psychology & Marketing, vol. 29, no. 12, pp. 1018-1034.

Kapferer, JN & Bastien V 2009, The luxury strategy: break the rules of marketing to build luxury brands, Kogan Page, Philadelphia, PA.

Knight Frank Research 2017, The wealth report, Web.

Muret, D 2017, Valentino tops €1 billion revenue mark in 2016, expects more growth in 2017.

Stępień, B, Lima, AP, Sagbansua, L & Hinner, MB 2016, ‘Comparing consumers’ value perception of luxury goods: is national culture a sufficiently explanatory factor?’, Economics and Business Review, vol. 2, no. 2, pp. 74-93.

WGSN n.d., The modern Chinese consumer, Web.

Appendix 1: PESTLE Analysis

Appendix 2: SWOT Analysis

Appendix 3: Brand Identity Prism