Introduction

Southampton Football Club is a sports team in the United Kingdom that competes in the English Premier League. Being among the most popular teams in the league, an investor is inquiring on whether or not the team is worth acquiring. This means that valuation is supposed to be conducted and provide insights to determine the final decision-making. The process will involve a quantitative procedure of establishing the fair value of the investment. Generally, Southampton F.C. can be valued on its own on an absolute basis or relative basis compared to others. There are various techniques that will allow determination of the financial capability of the entity. Since this is a difficult decision to make, it is essential to check the financial performance of the team over the last five years. This paper aims to discuss Southampton Football Club’s valuation with intentions of informing acquisition possibility.

Financial Performance: Profitability, Solvency, Liquidity, Operational Costs, Efficiency and Investments

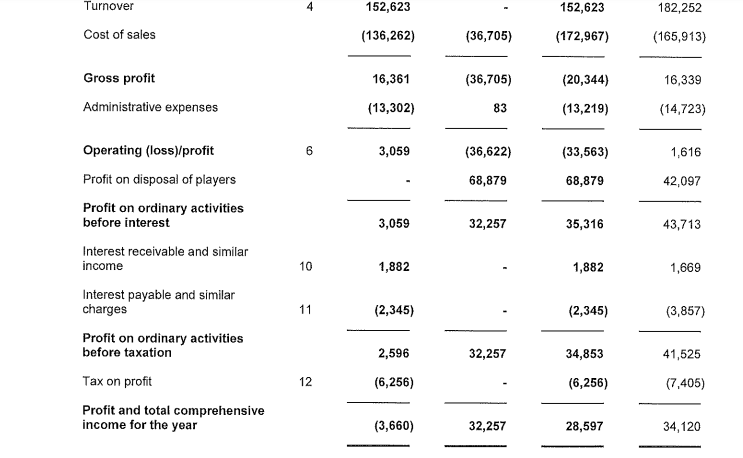

The financial performance of Southampton Football Club does not appear good as established with the ratio analysis. From 2017 to 2021, football club has faced different issues and negative results. Data shows that 2018 recorded 0:25, 2019 attained 0:53, and from there, the ratio became negative. In 2020, the team recorded 1:21 and in 2021, the ratio was 1:13. The ideal ratio is 2:1 but in the five-year period, the club has not attained that. The information on the net profit margin shows that the team has experienced negative gross. After calculation, the results are -9.38% in 2021, -49.29% in 2020, -22.79% in 2019, 18.73% in 2018 and 18.72% in 2017. Southampton has not managed to be profitable but after sometime, the management is attempting to increase the sales which will aid in profitability. Through initiatives focused on bettering club reputation and participation in more tournaments, the management aims to earn more profits.

Apart from the net profit, gross profit is another element of the business that is worth checking. Results from computation shows that the team earned -14 in 2021, -59.44 in 2020, -29.19 in 2019, -13.32 in 2018 and 8.96 in 2017. The results suggest that the organization was in the right path in 2017 but started losing money the year after that. With reference to these results, it is important for the management to think of new strategies that can aid in making more informed decisions in the future to attract investors. The financial ration calculation data was derived from Figure 1 and Figure 3 of the Appendices.

Efficiency ratio is another information that can help an investor understand whether or not to acquire a business entity. It is used in gauging how a company is utilizing its resources and assets effectively (Sakouvogui & Shaik, 2020). One can use other methods such as inventory turnover ratio, receivables turnover ratio, and the inventory days inventory ratio to determine this ratio. Upon computing turnover ratios, the results show 1.54 in 2017, 0.79 in 2018, 1.54 in 2019, 4.79 in 2020 and 18.55 in 2021. This suggests that the organization is not efficient enough to run operations of the team. More turnover in assets is observed which produces negative results.

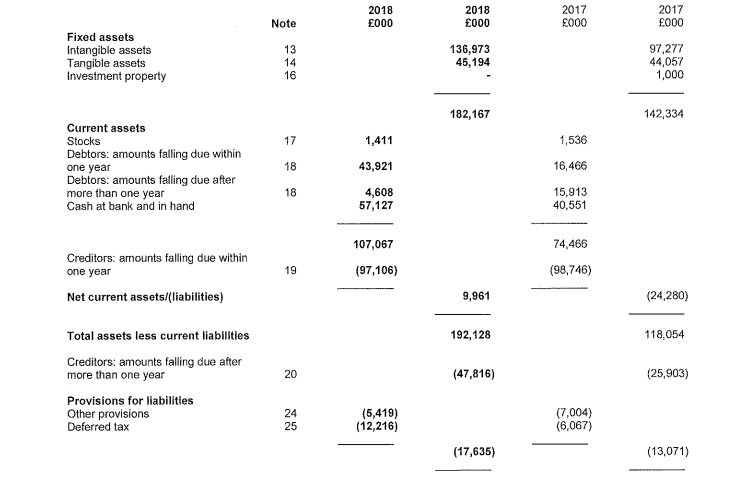

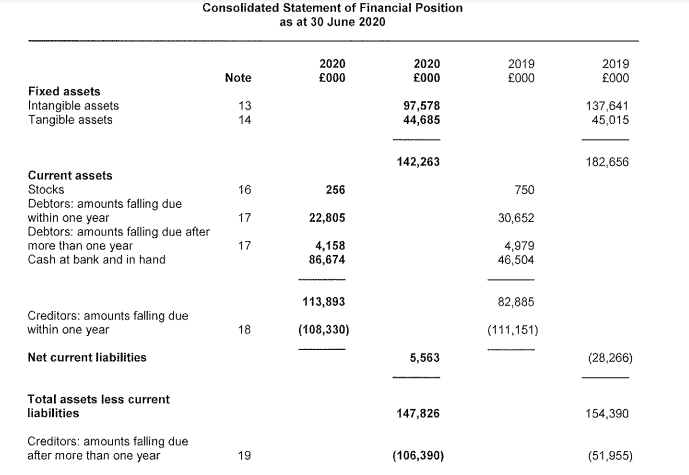

Solvency refers to the extent to which current assets exceed current liabilities. For Southampton F.C.’s case, the figure will be produced by subtracting liabilities from the shareholders’ equity (Yameen et al., 2019). In this case, for 2017, report shows that the team recorded about £ 66m, £ 109m in 2018, £ 82.7m in 2019, £ 22.9m in 2020, and £ 10.1m in 2021 (fig. 2) (Sunaryo, 2022). The figure is expected to be higher in 2022 as this would mean that its ability to meet its long-term fiscal commitments has improved, thus, stability.

While solvency helps to determine a business’ capacity to fulfill long-term fiscal commitments, liquidity helps to determine its ability with regard to short-term obligations. This can be computed by dividing current assets by current liabilities (Sakouvogui & Shaik, 2020). The 2017/18 financial statement shows net current assets/ (liabilities) to be £ 24.3m and £ 10m in 2017 and 2018, respectively (Kadim et al., 2020). Report shows that 2019 recorded £ 28.3m while £ 5.6m in 2020 (Kadim et al., 2020). Lastly, in 2021, it recorded £ 17.1m, using the original formula of current assets/ current liabilities (Kadim et al., 2020). The operating costs have been seen to drop between 2020 and 2021 as the team spent £ 150.6m in 2020 and £ 143m in 2021. Regarding investments, early this year, the Sports Republic, an investor, bought a stake worth about £ 114m (Sunaryo, 2022). All these factors contribute to the knowledge about the business’ financial performance. The calculations of the ratios are shown in Figure 4 of the Appendices.

Key Performance Indicators

The major key performance indicator for the directors is the Premier League position at the end of each season. According to (Kadim et al., 2020), the team managed position eight in 2017 and seventeenth the year. Additionally, Sunaryo (2022) reports that became better in 2021, dropped to fifteenth, a position it retained the next year. Despite failing to maintain or improve, it is important to consider that it has sustained its place out of relegation the last five years (Bateman & Mace, 2020). This means that with regard to its principal KPI, it is successful.

Adherence to Financial and Cost Control Regulations

The English Premier League has its ways of controlling teams’ costs using the Profitability and Sustainability Regulations. There are two substantive cost control thresholds. At the lower level, the organizations can make £15m loss over a 3-year rolling accounting period subject to specific conditions (Bateman & Mace, 2020). Bateman and Mace (2020) further state that it is possible for the figure to £35m of loss per season over a 3-year period. For three years, the amount is equivalent to £105m (Bateman & Mace, 2020). In case a team’s losses are beyond £15m for the stipulated period, it must provide future fiscal data to the league and proof of sufficient secure funding of up to £90m (Bateman & Mace, 2020). In the past, if a club breached the cumulative loss limit, the board had the power to compel a team to follow a defined budget and refuse to register any existing or new player contract.

The aim for doing this was to maintain competitiveness within the league. Interestingly, the latest regulations dictate that no team in respect of the 2019/20 season will be deemed to have breached the rules and be sanctioned accordingly (Bateman & Mace, 2020). Bateman and Mace (2020) reported that specific clubs and the league board had meetings concerning subject area comprising cost controls. The reports implied aligning every EFL and English Premier League break-even provision with the UEFA standard (Bateman & Mace, 2020). The strictest punishment for breaking the novel rules is points reduction (Bateman & Mace, 2020). Among the teams believed to have rejected the new stipulations include Southampton, Fulham, Manchester City, West Bromwich, Swansea City, and Aston Villa.

Most of those opposing the rules may be in fear of violating and getting punished. Southampton has adhered to the regulations concerning loss over a 3-year period (Bateman & Mace, 2020). If in 2021, the team would have experienced loss, then it would have been penalized. In 2019 and 2020, the total team loss was £96.5m. However, in 2021, the amount was offset by the profit recorded. The adherence to cost control regulations is a promising sign that the organization is responsible, and a new investor would not have to deal with pending cases.

When acquiring a business entity, individuals only desire to make profits out of it. It is difficult to achieve that goal when the regulating board such as the English Premier League front office has set to punish the club. Not only would this cost the new owner financially, but the damaged reputation would make the team unattractive to fans and other star players. Without support of this types of people in sports, it becomes even harder to continue operating or remaining in the top league.

Strengths and Weaknesses of Southampton Football Club

The football club in discussion has its strengths which can be seen in various features. This presents a competitive edge over others in the market. For instance, financial position, staff, uniqueness in addition to brand value. When conducting a SWOT analysis, one can observe that the team has a great fanbase, stability in terms of financial position, global recognition, high-quality merchandise, sponsors, and future home stadium.

Weaknesses

Southampton F.C.’s weaknesses are features that act as barrier to its growth and financial performance. Once determined, it is easier for the team to create ways on how to improve (Benzaghta et al., 2021). There are two main limitations, including less recognition when compared to its peers and lower financial capability as well. Other teams such as Manchester United and Arsenal F.C. are more popular in the United Kingdom and Europe that even foreigners attend their matches. This does not appear to be the case with Southampton F.C.

Opportunities

A brand’s opportunities can consist of areas of improvement with the aim of generating more profits or bettering the fiscal performance. This can happen through product improvement, communication, or location. Some aspects that Southampton F.C. can get better in include investing more funds on promotion to the international markets which can boost the brand equity and training or development programs for young players. Additionally, the management should scope to target places such as United States and Australia, which are increasingly gaining interest in football.

Threats

The threats for any company are features that have the capacity to negatively affect the performance and its profitability. Examples include constant change in government regulations, policies and guidelines as well as increased competition (Ahlers et al., 2019). In the case of Southampton, they consist of other teams in the league promoting themselves abroad, having more financially capable owners, and the new regulations designed by the league board.

PESTLE: Political, Economic, Social, Technological, Environmental and Legal

The PESTLE analysis can be accessed in Table 1 below. According to PESTEL analysis, the acquisition to be a great decision in terms of business. Maguire (2020) claims that the United Kingdom has in most cases experienced stability politically. Additionally, Maguire (2020) highlights that the end of 2019 resulted in a bad economic state, something visible even now. Sunaryo (2022) provides proof that in more than twelve months, the consumer prices index has risen significantly. The meaning of this is that the inflation rate has risen as well. Although the government has promised to work to change the situation, it is hard to envision the fans paying higher ticket prices.

Regarding social factor, all teams in the Premier League, including Southampton F.C., are fortunate to be in the United Kingdom, where people love watching and supporting football. Despite the losing seasons, individuals have attended home games in large numbers except when fan availability was restricted. This is encouraging as it directly impacts the profits earned every year. In terms of technological factors, the organization boasts of a technical staff that has continuously implemented the digital marketing resources present to promote the team in other countries. This has earned the business more investors, from which it has benefitted from a competition standpoint (Maguire, 2020). There have not been reported any major environmental disasters in Southampton that have caused damage to the stadium, thus, no additionally operational expenditure. As seen in previous years, the government of the United Kingdom has created policies that do not discriminate against entrepreneurs. In many years, teams have even been owned by foreigners without reports of harassment (Maguire, 2020). The fairness would allow the new owner a chance to seek justice anytime the organization is wrongfully attacked.

Table 1

Valuation

In accordance with Week 6 pptx, there are three valuation methods. These include Asset/Value Based, Income Based, and Multivariate Model, and the models and calculations are shown below.

Asset/Value Based

It is important to note that Asset/Value Based is straightforward. It uses the accounting information already available, where total liabilities are subtracted from total assets to obtain shareholders equity. From the financial statement, one can derive the equity attributable to the owner of the parent company, which is £32,148,000 of net asset value. The problem with the method is that tangible assets might reflect a true fair value or current market position. In addition, the accounts are based on historic cost figures, and depreciation and amortisation are accounting adjustments based on judgements and estimates.

Income Based

Income based methods utilise revenues to derive a valuation, and it is suited to football given the loss making nature of most clubs. The revenue value from the financial statements is equal to £126,636,000. From the Week 6 pptx, Deloitte have over time suggested a revenue multiplier of 1.5-2 applies to mid-tier Premier League clubs when sold. Thus, the calculations are as follow:

- Revenue = £126,636,000

- Multiplier #1 = 1.5

- Multiplier #2 = 2

- Valuation = Revenue * Multiplier = £126,636,000 * 1.5 = £189,954,000

- Valuation = Revenue * Multiplier = £126,636,000 * 2 = £253,272,000

- Valuation range is between £189,954,000 and £253,272,000.

Multivariate Model

Markham Multivariate Model (MMM) is a useful multivariate model, and the calculations are shown below:

- Value = (Revenue + Net Assets) x (Net Profit + Revenue) x (Stadium utilisation %/revenue)

- Revenue = £126,636,000

- Net profit = – £62,428,000

- Net assets = £32,148,000 (from Asset/Value Based method)

- Value = (Revenue + Net Assets) x (Net Profit + Revenue) x (Stadium utilisation %/revenue) =

= (126,636,000 + 32,148,000) x (- £62,428,000 + £126,636,000) x (62/91) =

= (158,784,000) x ((64,208,000) x (0.68)/ £126,636,000) =

= 158,784,000 x 1.0454 x 1.16 = £19 255 164

Capital Policy

Capital policy refers to a covered savings as well as loan holding firm’s written principles and guidelines utilized for planning, issuance, usage, and distribution of capital. This technique is valid as it represents an organization’s effective working capital structure resulting in higher profitability (Ruijs et al., 2019). Consequently, this attracts investors and shareholders and establishes market value for the business. Analysts claim that this is an area that the company has failed in implementation and might have been another cause for the large amount of losses witnessed between 2019 and 2020 (Ruijs et al., 2019). With a proper capital policy, it becomes easier to remain stable when the generated income is no longer the same.

Dividend Policy

With regard to dividend policy, the financial reports from 2017 to 2021 show that the team has had a nil amount proposed. This means that majority of the team funds remain in the accounts (Husain & Sunardi, 2020). Using this technique is among the most valid ways to determine a company’s financial situation (Yusuf & Surjaatmadja, 2018). It informs the financial strength and value, drives demand for stocks, and creates goodwill among shareholders. This infers that upon acquisition, it would be important to propose a certain percentage of the profits given to the shareholders.

Dividend policy means a policy an organization uses to structure its surplus payout to shareholders. Research suggests that the dividend policy is irrelevant since an investor can sell a portion of their shares or portfolio if they need funds (Boston, 2019). This is the dividend irrelevance notion, which infers that dividend payouts minimally affect a stock’s price. In spite of the suggestion, it is still considered to be income for shareholders. Board members are usually the largest shareholders and have the most to gain from a generous dividend policy. Most companies view a dividend policy as an integral part of their corporate strategy. Dividend decision is the third major financial decision (Boston, 2019). The financial manager must decide whether the firm should distribute all profits, or retain them, or distribute a portion and retain the balance.

The dividend pay-out should be determined in terms of its impact on the shareholders’ value. The optimum dividend policy is one that maximizes the market value of the firm’s shares. Thus, if shareholders are not indifferent to the firm’s dividend pay-out, the financial manager must determine the optimum dividend pay-out policy. Most profitable companies pay cash dividends regularly. Dividends may be considered desirable from shareholders’ point of view as they tend to increase their current return (Boston, 2019). Dividends, however, constitute the use of the firm’s funds. Cash dividend is the commonest of dividends paid. It is a return to the shareholders.

Companies intending to pay such dividends will be required to reserve sufficient cash in their bank accounts to facilitate this payment. Yameen et al. (2019) share that while a company may choose to propose a dividend policy, it is essential to consider its impact on the liquidity of the organization. If this is at stake, the company should make arrangements to borrow funds to fill the gap left by the payment of cash dividends. In all, the payment of cash dividends has the impact of reducing the company’s cash balance and thus total assets and the company’s net worth in general.

Recommendations

It would be proper not to invest in acquiring the team from its current owners due to the weaknesses it possesses. For instance, the entity is not as profitable as other teams in the league. From the earlier calculations, one can see that the organization does not have the capacity to continue supporting the team beyond 2022 especially if it does not meet its principal KPI. The only way that the team can gain more profits is through participating in more tournaments, especially the major competitions. Its current position in the league does not suggest that this will happen and there is a chance, the team would be regulated from the English Premier League if it continues to lose games.

Conclusion

This paper has discussed Southampton Football Club’s valuation and has determined that the decision to acquire would be proper. The organization has shown that it cannot be profitable. This means that it is not worth acquiring despite the various strengths highlighted in the paper. Furthermore, it is important to understand that to attract investors, one has to show an efficiency ratio that is not only positive but high as well. The results from the computation show a weakness in that area of the business. Additionally, the team management understands that it is difficult to achieve profitability when the regulating board such as the English Premier League front office has set to punish the club due to negligence. This is a major reason for the team not being penalized for disobeying league rules. A SWOT analysis has highlighted the strengths of the entity.

For instance, the team has a great fanbase, stability in terms of financial position, global recognition, high-quality merchandise, sponsors, and future home stadium. Additionally, it has an opportunity to continue earning profits as the operating costs drop year after year. The government of the United Kingdom has as well created policies that do not discriminate against entrepreneurs. In many years, teams have even been owned by foreigners without reports of harassment. The fairness would allow the new owner a chance to seek justice anytime the organization is wrongfully attacked.

References

Ahlers, M., Buck-Emden, A., & Bart, H. J. (2019). Is dropwise condensation feasible? A review on surface modifications for continuous dropwise condensation and a profitability analysis. Journal of advanced research, 16, 1-13. Web.

Bateman, I. J., & Mace, G. M. (2020). The natural capital framework for sustainably efficient and equitable decision making. Nature Sustainability, 3(10), 776-783. Web.

Benzaghta, M. A., Elwalda, A., Mousa, M. M., Erkan, I., & Rahman, M. (2021). SWOT analysis applications: An integrative literature review. Journal of Global Business Insights, 6(1), 55-73.

Boston, R. (2019). From good to great at Southampton Football Club. In The Practitioner’s Handbook of Team Coaching (pp. 481-489). Routledge. Web.

Husain, T., & Sunardi, N. (2020). Firm’s value prediction based on profitability ratios and dividend policy. Finance & Economics Review, 2(2), 13-26. Web.

Kadim, A., Sunardi, N., & Husain, T. (2020). The modeling firm’s value based on financial ratios, intellectual capital and dividend policy. Accounting, 6(5), 859-870. Web.

Maguire, K. (2020). The Price of Football: Understanding Football Club Finance. New Castle: Agenda Publishing. Web.

Ruijs, A., Vardon, M., Bass, S., & Ahlroth, S. (2019). Natural capital accounting for better policy. Ambio, 48(7), 714-725. Web.

Sakouvogui, K., & Shaik, S. (2020). Impact of financial liquidity and solvency on cost efficiency: evidence from US banking system. Studies in Economics and Finance, 37(2), 391-410. Web.

Sunaryo, D. (2022). Importance of Liquidity Indicators in Intervening the Dividend Policy. Ilomata International Journal of Tax and Accounting, 3(3), 272-289. Web.

Yameen, M., Farhan, N. H., & Tabash, M. I. (2019). The impact of liquidity on firms’ performance: Empirical investigation from Indian pharmaceutical companies. Academic journal of interdisciplinary studies, 8(3), 212-212.

Yusuf, M., & Surjaatmadja, S. (2018). Analysis of financial performance on profitability with non performace financing as variable moderation. International Journal of Economics and Financial Issues, 8(4), 125-126. Web.

Appendices