Explain Amazon’s core business model

People know Amazon as the world’s largest online retail store. The Amazon name traces its way to the Amazon River. In 1994, Jeff Bezos incorporated the company as an online bookstore (although the company publicly started a business the following year) (Schneider 2011). The companies headquarter is in Seattle, Washington, and its shares are floated in the New York stock exchange (NYSE). Amazon started as an online bookstore, quickly grew to incorporate other products, such as electronics, DVDs, and MP3s, to have among the most diversified product portfolios in the electronic retail business (Mennen 2010). Amazon, therefore, majors in electronic retail marketing as its main business sector.

After analyzing Amazon’s ownership structure, it is correct to say that its founder, Jeff Bezos, still controls most of the company. A close group of associates comprised of Legg Mason Capital Management, Rowe Price Associates, TCW Asset Management Company, and Clear Bridge Advisors hold other company shares. These shareholders control 20.25%, 7.5%, 5.5%, and 5.25% of Amazon, respectively (Liber 2007, p. 2). Although most of Amazon’s business is located in North America, the company has a wide market outreach (Aaramshop 2012). Indeed, Amazon has a strong market presence in several countries, such as Brazil, Japan, and China. Most of its other businesses are located in selected European countries. For example, Amazon has a different website for specific markets, like Canada, Japan, and China. This way, Amazon hopes to customize its services to suit the market dynamics of the selected markets.

Revenue Model

Amazon’s business strategy thrives on its revenue model, which stems from Amazon’s small stake in the sale of every item sold through its online platform. Therefore, in every sale made at Amazon, the company takes a small percentage of the revenue (Bygrave 2011, p. 126). A multilevel strategy that drives the company’s sales report informs the company’s sales revenue model.

Amazon’s revenue model was developed by focusing on business-to-customer relationships. This model mainly defined the company’s relationship with its customers. However, progressively, the company adopted a business-to-business relationship, where the company focused on its relationship with its suppliers. This change of tact informed the company’s realization that it was important to incorporate customer views in the product development process.

Even though Amazon today makes a lot of money, its founders did not expect to reap any returns from the company’s operations (in the first four to five years of operation) (Schneider 2011). Indeed, within the first few years of operation, Amazon’s growth was stunted. This slow growth prompted many stakeholders to complain about the company’s performance. However, after the burst of the dot.com bubble, interestingly, Amazon managed to survive the collapse of many e-companies. It later started reporting profits in 2001 (Schneider 2011). During the same year, Amazon posted revenues of about $1 billion (Schneider 2011). Although this revenue denoted modest profits, the shareholders were convinced that Amazon’s business model had the potential to be successful.

Besides getting a share of all sales made through its online platform, Amazon still generates revenue through online marketing and promotional services. For example, the company is actively involved in online advertising and co-branding (credit card agreements), as part of its main revenue-generating activities (Bygrave 2011).

Selling Point – Innovation

Apart from Amazon’s revenue generation models, the company has consistently thrived on adopting innovative practices to sustain its operations. For example, the company recently developed a platform where customers can interact with one another (customer-to-customer relationship). Through this platform, customers interact freely by selling their products and finding buyers through Amazon. Here, Amazon still gets a percentage of sales. Besides the company’s innovative strategy, Amazon created a new service, where third parties develop websites using the company’s platform (Bygrave 2011). This service has seen big e-commerce companies expand their traditional markets through Amazon’s website, even though they still have their websites. Through such innovative strategies, Amazon controls most sales in the online retail market. This way, the company leads in service innovation as its main selling point.

Financial Performance

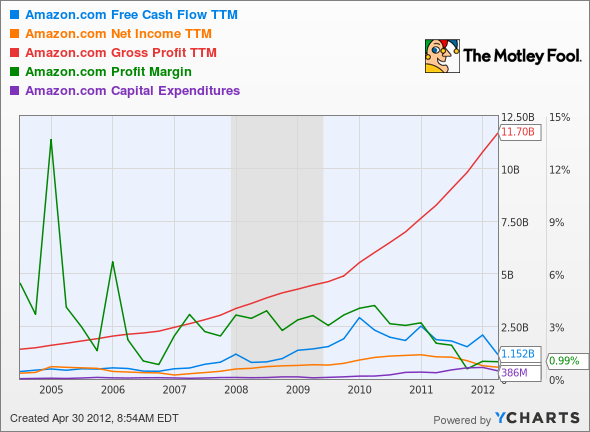

Over the past three years, Amazon reported poor financial results. Based on the financial performance for the years 2009, 2010, and 2011, Amazon reported significant declines in some of its key profitability indexes. For example, its return on equity decreased from 22.75% in 2009, 19.01% in 2010, and 8.63% in 2011 (Morningstar 2012, p. 1). Similarly, the company’s return on assets decreased from 8.15% in 2009, and 7.07% in 2010, to 2.86% in 2011. Lastly, the company’s return on investment capital also decreased from 21.36 in 2009, and 17.90 in 2010, to 7.57 in 2011 (Morningstar 2012, p. 1). These financial ratios manifest below, but they all show that the business has not been largely successful (at least, based on the financial performance of the last three years).

Who are Zara’s most critical suppliers and customers, what are the fundamental operational business processes that the company has to have to function effectively, and what are the central ways in which the company uses technology to deliver its business and satisfy its customers?

Key Operational Business Processes

From the general overview of Zara’s operational business processes, Zara keenly emphasizes adopting an efficient collection of business processes. For example, unlike other fashion companies around the world, which tend to predict future fashion trends, Zara adopts a just-in-time business approach, where it avails products only when there is sufficient demand to do so (Hitt 2008). Flat World Knowledge (2012) says that Zara’s strategy is effective and to-the-point because in the fashion business, trying to predict a future fashion trend is tricky. Moreover, there is a famous fashion saying that says, “Inventory equals death.” Therefore, as other fashion companies have a lot of inventory on their hands, Zara continues to excel by minimizing its inventory and availing products that have an established demand. Zara has therefore excelled in this regard.

Suppliers and Customers

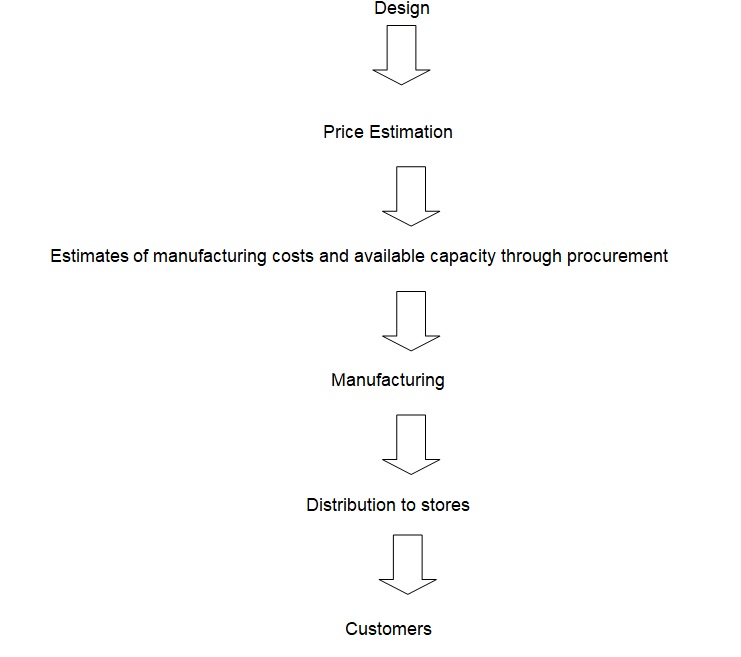

Zara’s supply chain is a vertically integrated model, where the company controls most of the value-addition processes in its supply chain (Hill 2012). Moreover, the company does not depend on external suppliers to make its products, because the company produces its clothes internally. Therefore, analysts estimate that the company controls about 60% of its supply chain (Flat World Knowledge 2012). These counterintuitive measures have demonstrated that Zara can beat its competition by simply adopting creative and daring production strategies. These strategies have seen Zara rise to be among the world’s leading fashion companies.

Zara’s supply chain operates through adjacent expansions that provide new product brands for meeting the demand of new customer groups. For example, recently, Zara introduced new product brands, such as Pull and Bear and Massimo Dutt. These brands adopt the same supply chain model for maximum production efficiency. According to the Harvard Business Review, Zara can manufacture and distribute the product in about two weeks. Zara’s supply chain, therefore, works through a fast-fashion system where new products are developed and availed to the market, fast. However, like Flat World Knowledge (2012) observes, this model works through a seamless transfer of information within all pillars of the supply chain as explained below.

Zara’s main customers are young fashion-conscious consumers that like to orient themselves with the latest tastes and designs (Fashion-Incubator 2012). Since Zara has managed to market itself as a global leader in fashion, its customers always want to stay abreast with the latest fashion trends in the market, so they feel included in the latest trends. They, therefore, buy the latest fashion and dispose of them when other fashion trends emerge. Therefore, Zara’s customers change their tastes and preferences quickly. As a result, industry analysts say Zara’s customer pool frequents their stores about 17 times (on average), while the industry average is only about 4% (Fashion-Incubator 2012).

Role of Technology in Driving Company Growth

Technology has been a crucial hallmark of Zara’s success. For Zara to function effectively, it has to depend on the ability of its employees to be technologically perceptive, so that it remains a market leader in the introduction of new products. The company’s I.T infrastructure enables it to identify trending products and stock them in their stores. This platform also allows Zara to receive feedback from its customers and predict future trends in the fashion industry. The company is therefore able to develop new products that align with these developing trends (Chaffey 2011).

The unapologetic technology-based strategies adopted by Zara have baffled many industry analysts because Zara’s strategy differs from several market approaches adopted by other fashion companies in the world. For example, Flat World Knowledge (2012) explains that Zara operates differently from its competitors because unlike its peers; the company does not spend money on advertising. Similarly, the company rarely runs sales, and unlike other fashion companies of its stature, the company controls most of its value chain processes.

One factor that directly stands out in Zara’s technology-based strategy is its efficient intelligence collection system. Based on a backdrop of other fashion company failures (like Gap’s failure to stock the right products for its customers), Zara uses information technology to identify the right products to stock. Indeed, it is common to see Zara’s managers talking to their customers regarding what they would want to see on the racks.

Interestingly, compared to its peers in the fashion world, Zara debuted on the online market scene recently. When asked why the company made such a late entry into the online marketplace, Zara’s managers said they wanted to ensure they had enough online demand first, before they could make any significant investment on the online platform (Flat World Knowledge 2012). Nonetheless, technology has been pivotal to Zara’s success.

Explain what you think are the three key strengths and weaknesses of Ocado, and suggest the top two opportunities and top two threats that it faces.

Strengths

Expansive Scalability

By collaborating with GXS manage services; Ocado has built a powerful set of services, which have enabled it to gain a strong competitive advantage in the online grocery retail market (GXS 2012). GXS provides Ocado with an effective translation capability by allowing Ocado to gain access to the largest online retail community for an easy expansion of Ocado’s market competencies in the online grocery market (GXS 2012).

High Accuracy and Availability

Merrilees (2004) says that the high accuracy of Ocado’s home delivery services and the easy availability of its services within some of the company’s key strengths show Ocado’s key strengths. Such advantages have demonstrated that Ocado’s operations have high structural competence, which accounts for the high service fulfillment accuracy of the company.

Range of quality Foods

Ocado can provide a wide range of quality foods for all its market segments. Therefore, most customers who use the company’s service find that Ocado is a market for quality products. This strength solidifies Ocado’s market base.

Weaknesses

Capacity Constraints

Ocado’s capacity constraints have dented a huge blow to the company’s operations because Proactive Investors (2011) say this weakness reduced the company’s full-year profits by 11.5% in 2011. The company has consequently experienced lower profit margins and a significant rise in employment costs from this weakness.

Reliability

Ocado has also experienced significant challenges from customers who demand prompt and steady deliveries. This customer demand has forced the company to increase its market efficiency, but as observers say, the company still experiences significant reliability challenges (GXS 2012). Part of the problem Ocado has experienced regarding its reliability challenge is the negative perception about the reliability of online retail companies to deliver goods according to their customers’ expectations. For example, many customers have complained of high product substitution levels from online grocery companies like Ocado. Similarly, customers have also complained of late deliveries by Ocado (GXS 2012). Ocado’s unreliability is therefore a key disadvantage.

Expensive Distribution Centre

Ocado’s operations have been highly dependent on Waitrose (a partner company where Ocado sources its products). However, the distance between Waitrose and Ocado is long. It is therefore expensive to transport goods between both companies. Even though Ocado claims it will be independent of Waitrose, analysts are pessimistic that the company can survive alone. Nonetheless, its co-dependence with Waitrose creates an expensive distribution center.

Opportunities

Expanding Market

GXS (2012) estimates that the online grocery market may grow to 32 billion Euros. This market share is bound to expand Ocado’s opportunities for growth because it will have an opportunity to expand its markets beyond its traditional base in England. Moreover, there are newer market opportunities that may open in other parts of the world (such as America and Australia). In the developed world, the UK leads to the prevalence of online retail (about 4% of total retail sales) (Kearny Team 2012, p. 2). Other parts of Europe still have lower online grocery sales penetration. For example, the online grocery market accounts for only about 0.2% of the total grocery sales in Germany (Kearny Team 2012, p. 2). Even as the UK leads other European countries in expanding the online grocery market, there are still many opportunities for growth in most European markets. With a market share of only 0.2% in Germany and an equal low market share of 4% of all grocery sales in the UK, there are many opportunities for Ocado to expand its market.

Innovation

Ocado’s company development started as an innovative idea to avail quality foods online. As competition increases in online food distribution, Ocado has the opportunity to adopt more innovative ways of making its services more efficient and user friendly.

Threats

Competition

The main threat characterizing Ocado’s online business is the competition coming from traditional grocery stores like Tesco and other online marketing companies (Merrilees 2004, p. 39). These online grocery markets account for most of Europe’s grocery market. Therefore, even as the online grocery market expands, there is still a lot of market dominance wielded by Ocado’s competitors. From this fierce competition, Ocado’s market growth is threatened.

Increasing costs

Company Size

Ocado’s small customer size has created a lot of concern regarding the company’s ability to survive in the future. Compared to other online home market companies, Ocado is smaller than Sainsbury and Asda. Similarly, Tesco is four times bigger than Ocado. Coupled with its financial problems, there is a growing concern about the company’s ability to survive in the future.

References

Aaramshop 2012, A summary of Amazon’s business strategy and revenue model, Web.

Bygrave, W 2011, Entrepreneurship, John Wiley and Sons, London.

Chaffey,D 2011, E-Business and E-Commerce Management (5th ed), Prentice Hall, London.

Fashion-Incubator 2012, Zara and Lean Retail, Web.

Flat World Knowledge 2012, Fast Fashion from Savvy Systems, Web.

GXS 2012, Ocado Delivers the Goods With New Online Grocery Service, GXS, London.

Hill, C 2012, Strategic Management Theory: An Integrated Approach, Cengage Learning, London.

Hitt, M 2008, Strategic Management: Competitiveness and Globalization: Concepts & Cases, Cengage Learning, London.

Kearny Team 2012, A Fresh Look at Online Grocery, Web.

Lawson, A 2012, The hope is that Ocado’s new fulfilment centre will put operational issues firmly behind it, Web.

Liber, S 2007, Who owns Amazon.com, Web.

Mennen, M 2010, Global Corporate Strategy – a Critical Analysis and Evaluation of Amazon Com, GRIN Verlag, New York.

Merrilees, B 2004, Electronic Retailing, Routledge, London.

Morningstar 2012, Amazon.com Inc., Web.

Planes, A 2012, How Long Can Amazon.com Defy Gravity, Web.

Proactive Investors 2011, Ocado slumps 11.5pct as capacity constraints hit profits, Web.

Schneider, G 2011, Electronic Commerce, Cengage Learning, London.