Abstract

The current research paper dwells on the critical differences between the US and Canadian economies in order to make informed conclusions regarding the gap between consumer price indexes of the two countries. So as to do that, the researcher conducted a literature review on the subjects of product pricing and manufacturing industry. Then, with the intention of analyzing the obtained data, the researcher addressed the American and Canadian food industries and markets to gain more insight into the differences between the two countries. It was found that there are certain differences but overall, Canada and the United States are almost identical in terms of the concept of consumer price index.

Introduction

Within the framework of this paper, the author expects to analyze the differences between consumer price indexes of the US and Canada. The question of interest is whether one of the countries is more beneficial than other in terms of living conditions and prices in all market segments. This particular topic is rather interesting because the variation between consumer price indexes may indicate a number of aspects that can be considered for amendments and adjustments.

The economic sectors of both sectors are currently overloaded by manufacturing burdens and import-export dilemmas. A brief review of the economic sector also showed that the majority of price tags are lower in the United States so it would be really interesting to investigate the underlying causes of Canadian inflation. The current paper features an extensive literature review on the subject intended to shed some light on the current state of affairs in both countries.

The researcher then performed a theoretical analysis of the existing evidence so as to build the base for the empirical validation of the results. In the analysis section, the author of the paper discusses the key contributors to the consumer price indexes in Canada and the US and presents relevant factual data supporting their findings.

Literature Review

The gap between the price index in the United States and its Canadian counterpart becomes wider gradually. The wallets of Canadian citizens become thinner, but there is almost nothing that is done to mitigate the transpiring differences. This unstable topic is recurrently addressed by numerous Canadian financial committees, but the outcomes do not seem to be positive (Pomfret 47).

The issues that are synthesized throughout discussions are usually presented in the form of a financial report that concentrates on the divergence of price indexes mentioned above. Due to the visible differences between the price index, Canadian citizens are no strangers to the concept of cross-border shopping because a lot of products are cheaper on “the other side.” Some of the sources even claim that the Canadian nation feels like it is being overcharged (Parkin and Bade 16).

The problem with price indexes consists in the fact that almost all kinds of products – from medication to sporting goods – cost less on the territory of the United States. One of the possible causes is the fluctuation of the Canadian dollar compared to its US counterpart. The flexibility of the exchange rate, accompanied by international monetary factors, has an incredible influence on Canadian supply and demand.

The existing data on the subject claims that almost 4 million permanent Canada residents make trips to the United States. It is also interesting that 75% out of these 4 million people tend to go back to Canada on the same day they got to the United States. This may mean only one thing – Canadian citizens are increasingly getting used to the concept of cross-border shopping so as to make the most out of the US prices that are practically much lower (Stager 101).

When we speak of the notion of consumer price index, we should realize that Canadian organizations benefit from the “country pricing” initiative which imposes critical limitations on the manufacturers and forces them to price matching goods differently. Obviously, this may be perceived as a fraud by the majority of Canadian citizens who pay much more for brand products than their US counterparts. Another variable that should be taken into consideration within the current research is the size of the consumer market. The latter is much larger in the US, and this particular factor majorly contributes to the difference in pricing strategies applied in both countries.

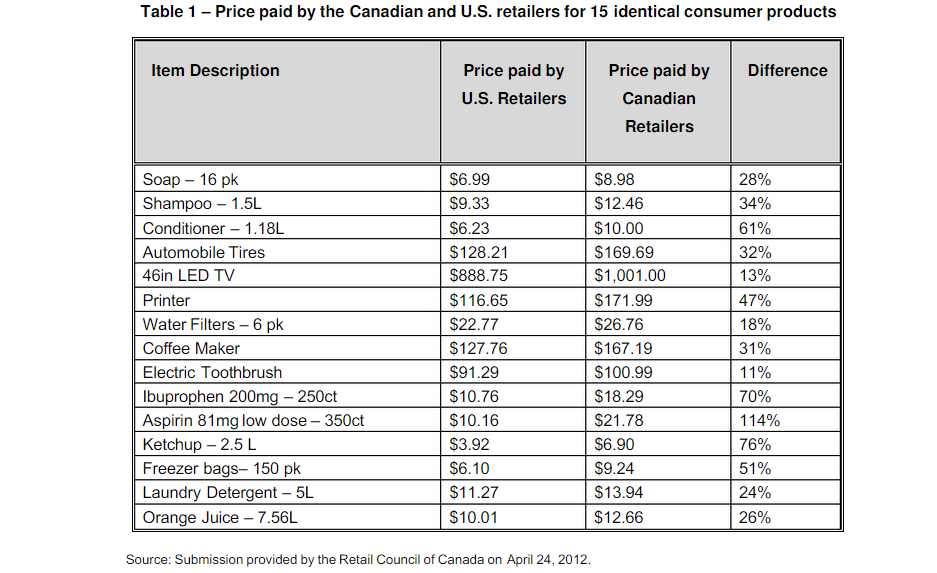

The existing evidence also shows that the net of tariffs characteristic of Canada also has a negative impact on the country’s consumer price index. The price gap between the US and Canadian manufacturers becomes obvious when one synthesizes the existing information concerning the pricing policies of the two countries (see Figure 1).

Manufacturing Sector

A rather common assessment of the Canadian manufacturing segment suggests that it is not fully developed due to the fact that is heavily banks on the utilization of natural resources. Regardless, the existing evidence reveals that the differences between the US and Canada in terms of distribution of employment are not as significant as they were expected to be (Bickerton and Gagnon 80). Both countries have a decently developed infrastructure relying on the manufacturing of tobacco, clothing, and leather.

In both Canada and the US, the industry sector makes the most out of petroleum and non-ferrous metals. If we take Canada, for example, their strong sides include transportation and manufacturing of food and paper. The country is also rather rich in wood resource. At the same time, the weak sides of Canada include a low level of chemicals and textiles. Also, Canadian industry does not possess iron and steel resources.

The current state of affairs in both the US and Canada hints at the fact that there are differences and similarities that can play a significant role in the development of industrial manufacturing. The data that is available to the researcher will make the comparison possible as the author of this paper will gain access to the value and products that are manufactured in both countries (Frisbee and Sommers 132).

Also, it is safe to say that labor inputs also significantly contribute to the differences in the level of consumer price index. Overall, the research also briefly addresses the comparison of capital stocks of Canada and the US so as to eradicate the issue of relative values inherent in common cross-country comparisons. It is also safe to say that the data that is presented in this research does not affect the perception of the results due to the fact that the differences between countries are minimal.

When speaking of consumer price index values in the manufacturing sector, we should pay close attention to the capital proxy and its correctness. The analysis of the obtained evidence showed that the capital stock and investment flows in the United States and Canada are almost identical. Overall, the Canadian output was found to be smaller than that of their US counterparts. It was also revealed that Canada only reaches approximately 10% of the US value when it comes to the total number of employees working in the manufacturing sector.

This, in perspective, may be one of the core reasons subsidizing to the growth of the consumer price index gap between the countries. On a bigger scale, Canadian manufacturing sector is way smaller than its US counterpart, and this puts the majority of retailers at a disadvantage. Another factor that may adversely impact Canadian consumer price index is the country’s dependence on the utilization of horsepower (Anastakis and Smith 99).

Surprisingly, the US does not make the best use of all the horsepower available, and this aspect majorly contributes to the variance between the countries’ capital measures. It can be claimed that Canada is more labor-intensive than the United States in terms of its manufacturing procedures even though the average size of Canadian plants is smaller than that of the United States. This question was also addressed by the researcher, and it was found that the average size of all Canadian plants is approximately 90% of all the US plants.

The difference in the approach also contributes to the consumer price index gap because the plant size disadvantage forces Canada to measure its performance in line with horsepower and not employment. Nonetheless, the latter disadvantage is rather inconsequential and does not harm the country as much as the size of the market does (Thompson 54). The population covered by the US manufacturers is way bigger than that of Canada (here, one should also take into account the fact that Canada attempts to cover all plants while the US eliminates the smallest sweatshops from the equation).

Connection to Wages and Other Costs

Another important factor that impacts consumer price index is the output prices as they are actually at least 5% higher in Canada. The two major contributors are electricity and fuel. The separation of the US and Canadian markets transpires due to the difference in the transportation costs and the tariffs that are set by the countries’ policies. In addition to that, one should always take into consideration the fact that Canadian salaries are lower than the American ones (the difference is approximately 20%).

Canadian manufacturers, in theory, would use more labor due to the lower wages but the research showed that capital costs are higher in Canada as well (Berdahl and Gibbins 151). The cost of horsepower was higher than in the United States (approximately 25% higher). Here, it is critical to take into account the cumulative capital stock and compare it to the property income in order to calculate the rate of return which, in turn, has a direct impact on the consumer price index.

It can be stated that Canadian capital is more expensive and their corporate bonds are higher than those of the United States. The prices on construction materials and industrial equipment also majorly impacted the consumer price index and the tariff rates. The acquisition price and the gross capital stock were also found to be two of the covert aspects that impacted the costs of the end product.

Therefore, we can address this evidence and conclude that the differences in the input intensity were generated by higher capital costs and lower labor. The median of the American and Canadian horsepower-labor and materials-labor relationships revealed that the countries are almost identical in terms of these variables (78% and 77% correspondingly) (Marchildon and McDowall 88).

This may hint at the fact that we cannot make conclusions regarding consumer price indexes solely on the labor productivity indexes because factor shares of the two countries are fairly analogous. This finding can be a sign of unitary elasticity that ensures that even though the factor prices are different, the overall state is relatively identical. This finding perfectly aligns with the existing data on the cost of electricity that is 24% cheaper in Canada while fuel costs at least 35% more than in the United States.

Canada makes the best use of electric motors, but the evidence that was provided in this section is not visual enough to contribute to the findings of the literature review. It is critical to address more real-life statistics that will vividly expose the current state of affairs and help the researcher to synthesize the data and draw accurate conclusions.

Empirical Analysis

The analysis within the framework of this paper will be done on the case study on the food industry. This is done in order to gain more insight into the specifics of the problem of higher prices in Canada and draw conclusions that will be based on factual data instead of assumptions. The very first thing that becomes evident throughout the synthesis of the data is that practically all consumer prices are higher in Canada.

The food industry case was chosen because here, the difference between the two countries is the most vivid. Observation of the existing data showed that the food that was purchased by Canadians in Canada was 60% more expensive than the food that was bought in the United States by the Americans (Filc and Kohler 128). The group of products that included dairy products and the meat was found to be the most expensive as the difference was approximately 75%.

If we take the existing evidence into account, it will be concluded that supply management is one of the key causes that contributed to the advent of high Canadian prices. Nonetheless, it may be necessary to make the most out of the obtained information by observing the situation from a number of different perspectives. First of all, the majority of food products lie within the US-Canada free trade territory (the only exceptions are dairy and poultry).

At the same time, the exceptions from the US side include alcohol and tobacco products. The study shows that Canada gains net weight by means of exporting quite a few products to other countries as well as some products that are more expensive in the territory of Canada than anywhere else (Lawless 96). Despite all the differences in food prices, the money that is spent on food in both the United States and Canada is almost the same. The analysis of the existing data also revealed that the Canadian markets are trying to stay competitive at all times. All the Canada-based grocery retailers are really good at mitigating the consumer price index difference when it comes to the products that they sell.

One of the important differences between the Canadian and the US food industry is that the former often offer discounts and elicit their customers to participate in sales dedicated to the brands that are not so well-known by the general public. Therefore, we should accurately address the differences between the US and Canadian markets to see if there is really a 60% difference between the consumer price indexes (Griffin and Steele 163).

Another major contributor to the overall state of the Canadian consumer price index is the presence of new trade agreements. After the analysis, it is safe to say that the price arbitrage practice should become one of the most frequently used strategies designed to mitigate the consumer price index variation between the US and Canada. The only limitation of this approach is that the brands, retail pricing, and local competition will have to be pushed into the background so as to ensure the successful future of the Canadian economics.

As long as Canadian retailers export their products at higher prices, they will be able to create an environment where lower prices will be certified by means of mitigating the transportation costs. The difference between the US and Canada in terms of the consumer price index can be easily adjusted if the dynamics of the environment are taken into consideration.

The data that is used to compile this analysis is presented by the Economic Research Services of the United States and Canada (“Prices and Price Indexes”). The consumer expenditures in the United States were carefully reviewed by the researcher so as to make consequent conclusions regarding the consumption of food and beverages at home. The results showed that the latter took at least 7% of the overall consumer expenditures while the Canadian were approximately 10%.

This data is in line with the previous findings that specified that the ultimate difference between the US and Canadian consumer price indexes could reach 60%. If we address this issue on a bigger scale, we will see that the household expenditures of Americans are around $35000, while the Canadians spend at least $27000 (“Prices and Price Indexes”). If we generalize the food expenditures, we will see that the difference between the two countries is not more than $500 ($2270 in the US against $2650 in Canada).

Not taking into consideration other industries, this leads us to the conclusion that Canadians spend $8 per week on food (which is approximately 17%) (“Prices and Price Indexes”). This difference, though, is not so visible if we take it into consideration together with the consumer spendings from other market segments.

Overall, after the analysis of all the obtain information regarding the price fluctuations within the US and Canada, the case study shows that the difference between the consumer spending is not as big as consumer price index. After reviewing this information, the researcher decided that it would also be important to investigate other perspectives on the subject and take into account the outside expenditures.

The further analysis of the statistics (Labor Statistics in the US and the Survey of Household Spending in Canada) showed that these values could also be easily compared due to the fact that the data is almost identical (Payson 152). It was also found that the consumer price index in terms of the internally consumed food was higher in both Canada and the United States. Despite the similarities, Canadians spent more on food and other products available in stores. Americans, at the same time, were found to spend more on external food sources. According to the findings of the analysis, the total expenditures were approximately 12%.

If we generalize these facts, we will see that the values of consumer price indexes are relatively the same. It is also interesting to mention that the prices in the US stayed lower than the prices in Canada even though the former suffered way more from the economic recession of 2009. Other than that, the expenditures of the citizens of the United States are expected to be higher throughout the “normal” periods.

Price Index Comparison

Continuing the empirical analysis of the case study on the food industry, we may review the factors that majorly subsidized to the formation of pricing policies in both the United States and Canada. The first particular aspect that has to be taken into account is the overall increase in grain prices that occurred through the periods of drought and influenced the food commodity price. This led to a subsequent increase in the export demand.

The pressure on the industry that was created by the recession led to the employment of new governmental policies that focused on the use of ethanol and validated an upsurge in corn costs (Houseman and Mandel 31). The problem here consisted in the fact that it led to numerous price increases within the entire grain sector and even livestock.

The second factor was the fact that Canada was also majorly impacted by the 2009 recession. This event made citizens of both countries much more cautious in terms of spending resources on different products. The consumer price indexes went up owing to the recession and the neighbor status of the United States and Canada (see Figure 2).

A thorough analysis of the information also revealed that the customers of both countries tend to look for the best deals on the marked and hunt for the lowest prices possible so as to find the most beneficial marketing channels. One of the major contributors to the changes in the consumer price indexes is the competitive approach employed by Walmart. The increasing square footage of their markets and the prevalence of mergers ended up in the creation of a downward pressure vector that is characteristic of both the US and Canada (Strawser and Ryan 185).

Ultimately, it can be drawn from the analysis that the factors that influenced the consumer price index in the two countries are nothing but similar due to the similarities inherent in the approaches used to drive the pricing strategies and in the markets in general. Also, it should be taken into account that the free trade practice is also a serious contributor to the consumer price index. Within the overall context of this research, the second factor that influenced the existing state of affairs was the price trend that fluctuated simultaneously in both Canada and the US. The data that was received from the Labor Statistics revealed that throughout the last 15 years, food prices in the US grew by almost 40%.

If we compare this variable to its Canadian counterpart, we will see that the price of their goods only grew by approximately 36% (“Prices and Price Indexes”). The third factor that subsidized to the formation of pricing policies is the fact that the baskets of consumers in the two countries are almost identical, so it is rather easy to compare them in terms of the overall consumer price index (25% increase in Canada and 30% increase in the US) (Brown 102). Despite the Canadian prices, the increase in the US food prices is much higher, and the growth process transpired at a much faster pace. One can also find out that the consumer price index increased by 10% during the last five years in both Canada and the United States (Paarlberg 123).

The magnitude of the impact, though, cannot be identified merely on the basis of the changes that happened to the consumer price indexes, but one can obviously see the differences when it is needed to compare the prices of individual products (see Figure 3). It can be identified that the only segments where Canada can compete with the United States in terms of food pricing are bacon, pasta, and orange juice (Morland 86).

A more detailed review of the US prices showed that during the last five years, the country was able to revise its food pricing policy and make prices relatively lower than from their Canadian grocery competition. From the Figure 3, we can conclude that Canadian prices are higher (overcoming the US by almost 15%) even though the pricing trends between the two countries bear numerous resemblances to each other.

The empirical analysis conducted by the researcher unveiled that consumer price index is a complex concept that cannot be addressed one level at a time (James and Kasoff 32). The case study that was conducted showed that the difference is real and has to be mitigated as it has a ubiquitous impact on Canada’s economy while the US mostly profits from the existing pricing policies elaborated by both governments.

Conclusion

Within the framework of this paper, the researcher investigated the peculiarities of consumer price indexes in the US and Canada. Numerous factors contributing to the price fluctuation were reviewed so as to draw relevant conclusions concerning the underlying causes of the variation. It was revealed that Canadians tend to travel back and forth to the United States so as to mitigate the price difference. So as to investigate the issue even further, the author of this paper addressed the prices in the food industry.

There is a very small list of products that cost less than their American counterparts. In Canada and the United States, consumer price indexes are relatively identical, but Canadian citizens spend much more on food items. This, according to the findings of this study, happens due to the presence of certain policies that favor an increase in the local prices and trigger even more cross-border shopping.

The worst thing is that Canadian residents are aware of the difference and make the most out of the US market and the government does not pass any legislations intended to close the gap between the countries. Therefore, it is critical to research the gap further so as to find ways to eradicate it. In order to do it, the researchers will have to address the underlying causes that elicit certain behaviors in the customers. Further research also should be focused on the ways of converting cross-border customers to local customers. In case if Canadian markets come up with new attractive deals, they will have the chance to compete with the US prices and equalize the consumer price index value.

Works Cited

Anastakis, Dimitry, and Andrew Smith. Smart Globalization: The Canadian Business and Economic History Experience. University of Toronto Press, 2014.

Berdahl, Loleen, and Roger Gibbins. Looking West: Regional Transformation and the Future of Canada. University of Toronto Press, 2014.

Bickerton, James, and Alain Gagnon. Canadian Politics. 6th ed., University of Toronto Press, 2014.

Brown, Molly E. Food Security, Food Prices and Climate Variability. Routledge, 2014.

Filc, Wolfgang, and Claus Kohler. Macroeconomic Causes of Unemployment: Diagnosis and Policy Recommendations. Duncker & Humblot, 2015.

Frisbee, William, and Montrose Sommers. Services in Canada. F. Cass, 2013.

Griffin, James M., and Henry B. Steele. Energy Economics and Policy. Academic Press, 2013.

Houseman, Susan N., and Michael Mandel. Measuring Globalization: Better Trade Statistics for Better Policy. W.E. Upjohn Institute for Employment Research, 2015.

James, Patrick, and Mark J. Kasoff. Canadian Studies in the New Millennium. 2nd ed., University of Toronto Press, 2013.

Lawless, Jerald F. Statistics in Action: A Canadian Outlook. CRC Press, 2014.

Marchildon, Gregory, and Duncan McDowall. Canadian Multinationals and International Finance. F. Cass, 2013.

Morland, Kimberly B. Local Food Environments: Food Access in America. CRC Press, 2015.

Paarlberg, Robert L. Food Politics: What Everyone Needs to Know. Oxford University Press, 2013.

Parkin, Michael, and Robin Bade. Economics: Canada in the Global Environment. Pearson Canada, 2013.

Payson, Steven. Public Economics in the United States: How the Federal Government Analyzes and Influences the Economy. Praeger, 2014.

Pomfret, Richard. The Economic Development of Canada. Routledge, 2013.

“Prices and Price Indexes.” Statistics Canada. 2017. Web.

Stager, David. Economic Analysis & Canadian Policy. Elsevier, 2013.

Strawser, Cornelia, and Mary Ryan. Business Statistics of the United States, 2013: Patterns of Economic Change. Bernan Press, 2014.

Thompson, James. Making North America: Trade, Security, and Integration. University of Toronto Press, 2014.