Introduction

The idea of expanding into the global environment and capturing an increasingly large audience is typically represented not only as a desirable goal for developing companies but also as a natural stage of corporate growth. As a rule, cross-border mergers and acquisitions (CBM/As) are regarded as essential tools in expanding globally, yet the specified framework has several problems to be aware of when building an expansion plan. Though CBM/As have been believed to produce solely positive effect on companies striving to expand into the global setting, CBM/As may entail an economic failure when performed without due control and understanding of the key external factors.

Role of Cross-Border Mergers/Acquisitions

The concept of globalization has been firmly ingrained into the sociocultural, socioeconomic, and sociopolitical contexts of most communities over the past decade. As a result, the concept of globalization, while remaining vital in business and many other spheres has become ubiquitous, losing its novelty and becoming broadly known. Verbeke et al. (2018) define globalization as “growth and broadening scope of international economic exchange relationships of any one country with all other countries around the world, as measured by trade and foreign direct investment (FDI) flows, and other types of exchanges” (p. 1101). Implying that the latter may include “capital, people, technology, ideas, effective institutional practices,” the definition above narrows the concept of globalization down to the context of economic interactions, suggesting that they should be prioritized.

However, when entering the global economy, companies need to take a tremendous range of factors into account in order to develop an effective business strategy and an adequate risk management approach. In fact, the process of globalization has been so devastating for unprepared companies that the phenomenon of de-globalization as an attempt at de-escalating the process of forcing companies into the environment of global interactions could be slowed down to an extent, giving smaller organizations a chance to prepare for the massive change (Cheng and Yang, 2017). Thus, the concept of globalization currently includes several critical needs.

Primarily, the necessity to integrate innovative technological solutions to advance the development of international collaboration should be placed at the top of priorities (Peng and Meyer, 2019). Reducing the cost of products should be included into the list of needs to be prioritized as well since the expenses associated with international collaboration slacken down the development of international business tries (Cheng and Yang, 2017). In relation to these needs, the challenges linked to data management, international recruiting, and maintenance of unique cultural characteristics should be mentioned (Peng and Meyer, 2019). So far, several successes and failures of globalization have been observed, the most notable advances being the rapid spread of innovative technology across all areas and industries (Cheng and Yang, 2017). However, in some sense, globalization has also failed since it has not helped in managing the problem of economic inequality on a global scale.

At first glance, multinational entrepreneurships (MNEs) seem to be unlikely to be affected severely by the negative impacts of globalization due to the competitive advantage that they have accumulated over time. However, large companies with an established business strategy willing to make a foray into an entirely new setting are taking substantial risks due to the challenges associated with changing the ossified business framework and the issues linked to accepting the principles of multiculturalism. Windsor (2017) defines MNEs as a “private business – whether publicly traded or privately owned – that operates in two or more (and typically multiple) national tax jurisdictions” (p. 153). Therefore, when determining the nature of an MNE, it is reasonable to emphasize the financial ramifications of the company operating in a multinational context (Cheng and Yang, 2017). In turn, Peng and Meyer (2019) define MNEs as “firms that engage in foreign direct investment (FDI) by directly investing in, controlling and managing value-added activities in other countries” (p. 5). The specified definition expands the previous one, outlining the key financial activities of MNEs. Indeed, given the challenges associated with coordinating the discrepancies between the systems of taxation and financial management, in general, observed on an international level, the specified focus is fully justified.

In the context of the global economy, creating opportunities for collaboration and economic cooperation is paramount to building a strong competitive advantage and gaining a chance at surviving the global competition. Creating CBM/As is one of the solutions to the problem of global collaboration (Peng and Meyer, 2019). To encompass the opportunities that CBM/As provide, one needs to examine the subject matter closer.

The phenomenon of a CBM/A appears to be quite simple on the surface. Peng and Meyer (2019) specify that a merger is a “combination of operations and management of two firms to establish a new legal entity”; therefore, to make a merger cross-board, one needs to perform the specified operations on an international level, namely, within the legal and economic contexts two or more countries (p. 391). Indeed, other studies also tend to focus on the international aspect of CBM/As; for example, Bose and Biswas (2019) define CBM/As as the system in which “organizational structures and styles are ‘unfrozen’ and new ones are created” (p. 13). Therefore, CBM/As can be viewed as complex systems of developing corporate structures and processes. Nevertheless, the focus on the international context in which CBM/As occur must remain in its place.

Given their international scale, CBM/As produce an understandable large impact on the extent and pace of globalization. Summarizing the broad range of intricate ways in which CBM/As shape the global context of business interactions, one could claim that CBM/As contribute to the increase in the pace and scope of globalization as an economic and cultural process (Peng and Meyer, 2019). Particularly, examining some of the recent CBM/As, one will notice the propensity toward cross-cultural collaboration and active knowledge and experience sharing, which has contributed to the general collection of knowledge regarding the theory and practice of business-making.

However, the effects that CBM/As produce on globalization are not homogenous. Although generally, the notion of a CBM/A is conducive to the enhancement of globalization due to the cross-cultural collaboration that a CBM/A typically necessitates, it may also lead to a major failure (Peng and Meyer, 2019). As a rule, unsuccessful CBM/As and the adverse effects that they have on the globalization process occur due to the failure to research the target cultural and economic environments properly, therefore, mismanaging communication or key economic transactions (Khan et al., 2021). For example, the infamous case of Hewlett-Packard attempting at acquiring Autonomy, a U.S. software producer, indicates that the failure to acknowledge cultural differences and address them prior to establishing business interactions will pave the way to the ultimate defeat (Khan et al., 2021).

Namely, failing to recognize the business strategy of Autonomy, HP attempted at inflating its value, which, when revealed, led to a major scandal causing HP to suffer eventual defeat (Khan et al., 2021). The case of HP/Autonomy process the necessity to examine the cultural, economic, and financial dimensions associated with the target company and market prior to creating a framework of cooperation. The case of HP/Autonomy can be interpreted as the inability to apply a multifaceted approach to CBM/A management. Specifically, from the perspective of Hofstede’s theory of dimensions, the inconsistencies between the long-term orientations of the companies, their power distance relationships, and the uncertainty avoidance strategies led to the eventual failure. Namely, while HP showed the propensity toward maintaining the specified dimensions at high value, Autonomy appeared to dismiss the significance thereof while taking greater risks. As a result, HP suffered substantial damage in its attempt at CBM/A.

The concept of a CBM/A has its upsides and downsides, which means that it may not be suitable for any company striving to expand into the global economy. The chance to build an economy of scale is one of the primary advantages that a CBM/A has to offer. Specifically, larger organizations are likely to gain greater success in the global market at a noticeably higher rate, which justifies the introduction of economies of scale into the process of managing organizations’ performance in the global environment. Implying the framework for coordinating the extent of costs with the increased production level as an organization enters the global economic environment, economies of scale play a vital role in assisting firms to adjust to the global market and its demands (Peng and Meyer, 2019).

For example, Flipkart acquiring Walmart represents a clear example of a company seeking to build a strong competitive advantage by building connections within the global economic community (Saraswathy, 2019). Specifically, by acquiring Walmart, Flipkart has managed to expand the scope and scale of its reach, therefore, building an economy of scale and reducing costs significantly due to an improved and enhanced infrastructure that currently includes a strong partner (Saraswathy, 2019). Therefore, the option to use economies of scale that the CBM/As provide due to the improved management of the supply chain as a direct effect of collaboration between two or more organizations must not be underrated.

Additionally, with the help of CBM/As, MNEs can address the issue of competition rather effectively. By merging with a rival company, an MNE will be able to remove the threat of being severely affected by a competitor and ousted form the target market. Instead, an MNE can join forces with its rival, thus, gain an extra competitive advantage and, therefore, accumulating power for addressing potential risks observed in the selected economic environment. For instance, Amazon’s multiple cross-border acquisitions have allowed the organization to become a part of a range of markets across the globe, therefore, expanding its reach tremendously (Onyusheva & Seenalasataporn, 2018). Specifically, Amazon’s focus on e-commerce organizations as its primary target in its CBM/A policy has helped the company to reinforce its presence in the global market by improving its digital infrastructure and gaining additional instruments for marketing to the target audiences using digital tools (Onyusheva & Seenalasataporn, 2018). Therefore, the importance of CBM/As as the means of assisting organizations to grow and integrate into the global economy cannot be doubted.

However, CBM/As also introduce several issues, primarily, in relation to legal concerns., Specifically, the process of negotiating key financial transactions and the related operations may become increasingly complicated once legal discrepancies are involved. The incongruences between the regulations established in one country and the legal standards promoted in another may serve as a serious impediment to successful management of transactions (Peng and Meyer, 2019). Therefore, CBM/As may cause a plethora of challenges in handling the tasks linked to a company’s financial performance. Specifically, Hsu et al. (2019) report that the incongruences between the financial systems and legal standards for performing financial interactions in the global context represent some of the core problems that CBM/As are likely to cause for most organizations.

Namely, the authors of the study explain that “cross-border M&As are often characterized by a high level of risks that can lead to failure or significant financial losses in realizing their expected potential” (Hsu et al., 2019, p. 428). Arguably, the described concern could be handled by incorporating a resilient approach to conducting transactions within the CBM/A context, as Hsu et al. (2019) suggest. However, the specified change implies additional challenges and delays, which may reduce the competitiveness of an organization and open it to further risks (Peng and Meyer, 2019). For instance, the infamous case of Time Warner and American Online has shown that the failure to recognize cultural differences and apply respective strategies for coordinating workplace processes seamlessly will inevitably lead to massive losses and, eventually, to a failure of a CBM/A (Malone and Turner, 2010). Therefore, when considering a CBM/As as a tool for integrating into the global market, a company needs to develop a resilient framework based on an effective risk prevention architecture.

However, despite their risks, CBM/As have become increasingly popular due to the opportunities for cost reduction and quick integration into the global market that they provide. As a result, the current trends reflect the propensity among a range of organizations to expand into the global economic environment by creating CBM/As with other companies (Kiessling et al., 2019). While some of these unions may seem as quite unfortunate, a significant portion of the existing CBM/As reflects impressive ambition and a stellar grasp of the current market reality. Among the essential trends observed in the present-day global context regarding the emergence of CBM/As and the development of the related economic ties, one must mention a noticeable rise in the number of mergers and acquisitions (Kiessling et al., 2019). Specifically, a stupendous rise in the number of planned and implemented CBM/As has been registered in 2021 according to the recent Bloomberg report (Burnett, 2021). Specifically, the 2021 aggregate value of CBM/As has amounted to $358,300,000,000, according to Burnett (2021). Therefore, the general trend toward promoting CBM/As, especially as the means of addressing the trend for digitalization of the global economy, can be seen as a notable change.

Among the key examples of CBM/As, one must mention the acquisitions made by Amazon, Uber, and Walmart made over the past decade. While not all of these acquisitions have been a stellar success, they have shown the importance of engaging in a cross-cultural dialogue when making a foray into the global economic context. The importance of CBM/As is justified by the opportunity that they provide for socioeconomic and sociocultural integration of businesses. Offering ample opportunities for collaboration, CBM/As also contribute to erasing limitations imposed on companies by legal and economic regulations. CBM/As typically face challenges due to the incompatibilities between the legal standards of the target country and the host one (Peng and Meyer, 2019). Other models suffer from similar problems, the high rates of approximation and low levels of predictability being the key points of concern (Peng and Meyer, 2019). Overall, the specified issues have a major impact on a company, exposing it to multiple opportunities in the global market and offering it a chance to expand its supply chain, developing essential connections and partnerships.

Impact of Host Country Culture on Globalization

While the organization attempts at acquiring or making a merger with another company might belong to the dominant culture, the cultural factors of the host country will inevitably take a toll on the performance of the company within a new setting. Applying the OLI model to the task of integrating an organization into the context of the host country, one will notice the presence of cultural, socioeconomic, and technological factors as the primary influences shaping decision-making. Specifically, by failing to recognize cultural differences in the perception of specific notions associated with the company or its product, marketing, branding, and promotion are doomed to a failure (Peng and Meyer, 2019). As the example of the failed merger of HP and Compaq shows, it is vital for the acquiring company to recognize the host culture, which, in the case in point, was sales-driven and relied on quick decision-making (Spatt, 2021). The characteristics of culture such as resilience and implicitness define its importance in shaping people’s perceptions of a specific organization, concept, or idea, which is why understanding culture-related issues is vital in CBM/As. Applying the OLI model to the case of HP and Compaq will show that the inability to understand competition-driven context of the host country and company doomed the deal (Peng and Meyer, 2019). Therefore, examining culture perceptions through the lens of the Hofstede Model and the OLI framework, as well as similar tools for evaluating cultural differences and discrepancies in perceptions, is vital.

Addressing the cultural differences in the perceptions of user data protection has been one of the most challenging tasks for Uber and Google. Though the two companies offer entirely different services, they have faced similar challenges. Namely, Google’s concept of data management is misaligned with the principles of information haring within the Chinese cyberenvironment guarded by the Great Chinese firewall (Zhang et al., 2018). In turn, Uber, while not technically banned in China, has failed to register legally due to the supposed dents in its management of user data as per Chinese legal; requirements. However, the presence of a major local competitor, Didi, can be seen as the actual reason for the state to dismiss Uber and its services (Zhang et al., 2018). While Uber has been favored by citizens, the presence of a strong grip on the legal changes by the Chinese government makes the further integration of the company into the Chinese setting unlikely.

Applying Hofstede’s Model of Cultural Dimensions, one will notice the difference in the impact of power distance, namely, the propensity toward embracing patriarchy, in the target cultural context. Shaping the authorities’ attitudes toward a new organization that represents a threat to a local organization, the specified issue has prevented China form accepting Uber. Likewise, the collectivist principles dominating Chinese society do not allow Chinese citizens to voice discontent (Chun et al., 2021). Finally, the presence of normative repression in the restraint vs. indulgence domain defines the company’s further inability to integrate into the Chinese market.

Analyzing the issue further, one will notice the presence of several factors increasing the gap between U.S. and China in regard to Google’s and Uber’s foray into the Chinese market. Specifically, apart from the geographic distance, there is a notable cultural distance between the U.S. and China. As shown in the analysis above, China is geared toward increased power distance, collectivism, restraint, and uncertainty avoidance, which is strikingly incongruent with the U.S. cultural model. Specifically, the focus on individualism observed in the U.S., the presence of egalitarianism, and the recognition of the importance of satisfaction as a motivation tool define the differences between the U.S. culture and that one of China (Chun et al., 2021). Therefore, the path toward acceptance in the Chinese context is likely to be quite long and painstaking both for Google and Uber in China.

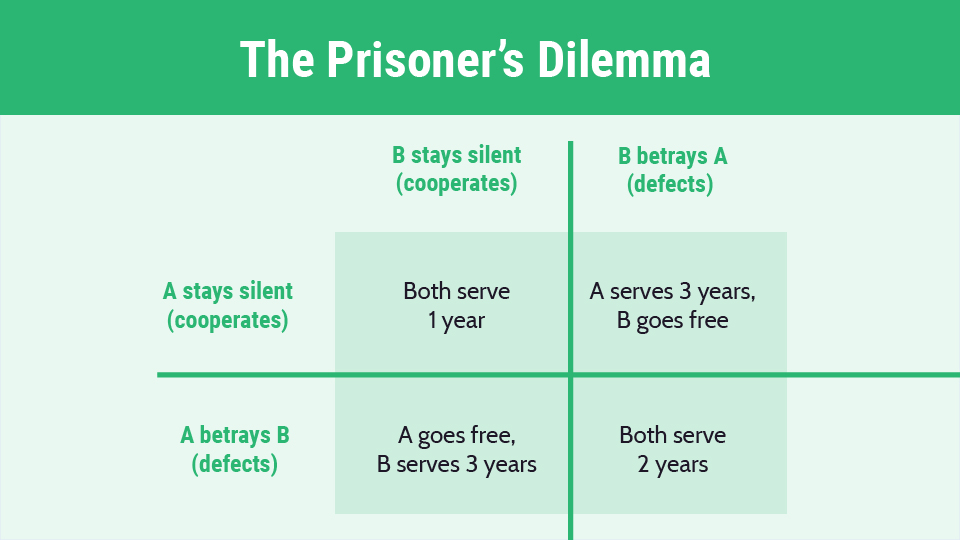

Furthermore, applying the Prisoner’s Dilemma Theory to the analysis, one will recognize the importance of having a shared perspective and goals when participating in an international joint venture ((IJV), which a CBM/ suggests. Specifically, based on the theory in question, it is vital for the two participants to have the same goal that will allow them to maintain cooperation even if their perspectives may differ drastically (Peng and Meyer, 2019) (see Fig. 4). In case of China and the U.S., namely, Google and Uber, the focus on addressing a market gap and an existing need for proper digital and transportation services could have been the objective that would unite the two partners (Peng and Meyer, 2019). However, due to the lack of common objectives, China viewing its citizens’ satisfaction and extent of freedom in choosing digital and transportation opportunities as lacking importance, both Google and Uber are unlikely to advance in the Chinese market.

Judging by the outcomes of the case under analysis, one could conclude that further re-entry does not seem possible in the foreseeable future. Remarkably, the reasons cited for both organizations to have been banned include the protection of users’ private data. Specifically, since China has a remarkably different stance on the issue of users’ data protection, which is currently incompatible with the legal standards and regulations under which google and Uber operate, neither of the companies is likely to be ever accepted in the Chinese market.

Conclusion

Despite having an essential role in advancing the development of globalization and the relationships within the global economic context, CBM/As may cause companies to fail spectacularly due to the lack of understanding of key sociocultural factors. Namely, the inability to embrace the socioeconomic and cultural outcomes of the merger and the changes that must be introduced to the company’s branding approach, business strategy, and competitive advantage may entail a tremendous failure. Nevertheless, as the cases under analysis show, the application of CBM/As is quite helpful in building relationships on an international level once a proper framework for cross-cultural business interactions is established. Therefore, CBM/As should be seen as critical mechanisms in integrating companies into new sociocultural settings retaining their competitive advantage, yet the use of appropriate tools such as distributed leadership must be promoted. Thus, effective integration will be ensured.

Reference List

Bose, I. and Biswas, S. B. (2018) ‘Cross-border mergers and acquisitions, integration of firms and human resource management issues: some reflections’, IPE Journal of Management, 8(2), pp. 8-15.

Burnett, G. M. (2021) ‘ANALYSIS: Cross-Border M&A Defied the Pandemic in a Record Q1,’ Bloomberg, Web.

Cheng, C. and Yang, M. (2017) ‘Enhancing performance of cross-border mergers and acquisitions in developed markets: the role of business ties and technological innovation capability’, Journal of Business Research, 81, pp. 107-117.

Chun, D., Zhang, Z., Cohen, E., Florea, L. and Genc, O. F. (2021) ‘Long-term orientation and the passage of time: Is it time to revisit Hofstede’s cultural dimensions?’, International Journal of Cross Cultural Management, 21(2), pp. 353-371.

Hsu, C. C., Park, J. Y., and Lew, Y. K. (2019) ‘Resilience and risks of cross-border mergers and acquisitions’, Multinational Business Review, 27(4), pp. 427-450.

Khan, Z., Rao-Nicholson, R., Akhtar, P. and He, S. (2021) ‘Cross-border mergers and acquisitions of emerging economies’ multinational enterprises — the mediating role of socialization integration mechanisms for successful integration’, Human Resource Management Review, 31(3), pp. 1-8.

Kiessling, T., Vlačić, B. and Dabić, M. (2019) ‘Mapping the future of cross-border mergers and acquisitions: a review and research agenda’, IEEE Transactions on Engineering Management, 68(1), pp. 212-222.

Malone, D. and Turner, J. (2010) ‘The merger of AOL and Time Warner: a case study’, Journal of the International Academy for Case Studies, 16(8), p. 151.

Onyusheva, I., & Seenalasataporn, T. (2018). Strategic analysis of global e-commerce and diversification technology: the case of Amazon.com Inc. The EUrASEANs: Journal on Global Socio-Economic Dynamics, 1(8), pp. 48-63.

Peng, M.W. and Meyer, K. (2019) International business (3rd edn) London: Cengage.

Saraswathy, B. (2019) ‘The Flipkart-Walmart DEAL in India: a look into competition and other related issues’, The Antitrust Bulletin, 64(1), pp. 136-147.

Spatt, C. S. (2021) ‘Proxy advisory firms, governance, market failure, and regulation’, The Review of Corporate Finance Studies, 10(1), pp. 136-157.

Verbeke, A., Coeurderoy, R., and Matt, T. 2018, ‘The future of international business research on corporate globalization that never was….’ Journal of International Business Studies, 49(9), 1101-1112.

Windsor, D. (2017). The ethics and business diplomacy of MNE tax avoidance. In International Business Diplomacy. Emerald Publishing Limited.

Zhang, W. and Mauck, N. (2018) ‘Government-affiliation, bilateral political relations and cross-border mergers: Evidence from China’, Pacific-Basin Finance Journal, 51, pp. 220-250.