Introduction

J.C. Penney, a major American retail store chain, is well-known throughout the USA. It is an old company, existing since 1902 (“J.C. Penney Company, Inc. History” n. pag.).

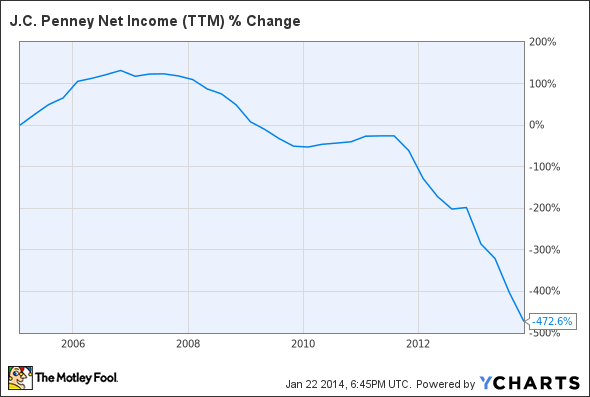

The company was doing badly over the last 6-7 years (see Appendix), but just a few years ago, the company suffered a severe blow, which was the result of the actions of a new CEO it had hired, Ron Johnson, who previously had worked for Apple Inc. and brought the company significant profits. In our paper, we, after providing some background information about J.C. Penney, are going to discuss the failure of Johnson’s policy and try to find out what led to such a disastrous outcome.

Background

J.C. Penney is a large American company that owns a number of department stores. According to the official website, it is of the biggest American retailers of home furniture and clothing, which owns nearly 1020 shopping centers on the whole (“JCPenney” n. pag.).

The business currently deals in women’s and children’s apparel (24% and 10% respectively), women’s accessories and cosmetics (12%) men’s clothes and accessories (22%), footwear for the whole family (8%), jewelry (7%), and furniture for the home (12%); the company also provides various miscellaneous services for its customers (“JCPenney” n. pag.). It is also stated that the company operates in 49 states of the US (it is not represented in Hawaii) and in Puerto Rico (“JCPenney” n. pag.).

The main office of this enterprise is situated in Plano, Texas (“J.C. Penney Company, Inc. History” n. pag.). The supply chain network of J.C. Penney consists of 25 facilities that are distributed among 14 different locations and is comprised of “11 store merchandise distribution centers, seven regional warehouses, three jcp.com fulfillment centers, and four furniture distribution centers” (“JCPenney” n. pag.).

As for the current strategy of the company, it is worth noting that currently, it is pursuing the goal to actively develop its home décor stores (Loeb par. 3). It is also pointed out that J.C. Penney has lately been making an effort to increase its online sales; there was an increase of ≈12.5% in sales via the Internet in the last quarter of 2014, compared to the total net sales increase of 2.9% (Loeb par. 4).

On the whole, the company is recovering nowadays from the major strategic mistakes that were made during the times when Ron Johnson was the CEO of the business (Loeb par. 1; Mourdoukoutas par. 1-3), but has suffered some stock cost decreases during the first quarter of 2015 (Zacks Equity Research par. 2).

The latest strategic moves include promoting its private-label and national brands, as well as innovating the interior of the stores to better the clients’ satisfaction with the process of shopping (Zacks Equity Research par. 3-4). The business expects significant growth in its EBITDA by the end of fiscal 2015 (Zacks Equity Research par. 6).

Regarding the company’s human resources, the official website states that the business employed approximately 114,000 workers in 2014 (“JCPenney” n. pag.). Clearly, it practices seasonal employment as well; for instance, it is planning to hire 650 seasonal workers in Chicago (WGN Web Desk and Associated Press par. 2).

The company’s history began when it was founded in 1902 in Wyoming. It was incorporated in 1913; by 1915, it had 83 shops, whereas in 1925, this number reached 674, and the business generated the sales of $91 million. It participated in a number of social initiatives and established the J.C. Penney Foundation. The company was able to preserve its successfulness during World War 2.

In 1954, it created the James C. Penney Foundation, for the previous one did not survive the Depression. Later, despite some difficulties in the 1980-1990s, the company was able to survive, and since 1995 it developed even further (“J.C. Penney Company, Inc. History” n. pag.).

As for the business’ current market value, it is stated that its enterprise value equals to 7.17 billion USD (as of 30 September 2015) (“JCP Key Statistics” par. 1). The market capitalization of the company equals to 2.78 billion USD (“JCP Key Statistics” par. 1).

It is also noteworthy that the business’ revenue, revenue per share, and gross profit for trailing twelve months (as of 1 August 2015) were equal to 12.39 billion USD, 40.55 USD, and 4.26 billion USD, respectively (“JCP Key Statistics” par. 2). The volume of total cash possessed by the enterprise in the last quarter (3 May – 1 August 2015) equaled to 973 million USD, whereas it total debt totaled 5.31 billion USD; the amount of total cash per share was 3.19 USD (“JCP Key Statistics” par. 2).

Management Problem

The major problem that we are going to discuss in this paper originates from the actions of Ron Johnson when he was appointed as the CEO of J.C. Penney in November 2011 and served there for 17 months, making numerous mistakes, until he was fired in April 2013 (Tuttle par. 1).

Ron Johnson was invited to become the company’s CEO after the company had suffered some losses. For instance, the company had to close every single of its nineteen catalog outlet shops and quit the catalog business (Fox Business par.1-5). Also, the gradual decrease of its net income can be seen in the Appendix.

It is stated that one of Johnson’s main blunders was the attempt to create a new brand for J.C. Penney (Tuttle par. 2). Being a person hired from outside, he positioned himself as a transformative leader that was going to innovate the enterprise and create an absolutely new retail company (Tichy par. 7). Tuttle, for instance, states that it was a mistake to cancel the old coupon system and ban all the sales and introduce a new pricing scheme that would lead to “full but fair prices” (par. 8).

It is pointed out that the customers of the retail network were not as much interested in these “fair prices” as they enjoyed buying goods using coupons and achieving various discounts on the products. Therefore, the new pricing system was not successful in luring customers, which led to a rapid decrease in sales in early 2012 (Tuttle par. 6-10).

Johnson’s course of action also alienated the majority of the clients that J.C. Penney had had before him. Upon canceling both sales and coupons, he tried to change the contents of the stores, making them into fashionable malls containing numerous boutiques; this led to the buyers’ feeling that the shop was no more viewing them as their target market. Even the re-introduction of sales was not able to bring back these lost customers (Tuttle par. 12).

In fact, it is also highlighted that Johnson had misread the existing enterprise’s brand. Unlike in “Apple” stores, the customers of J.C. Penney were not ready to pay the “full but fair” price for the product; they were used to the shop’s being a place where one could buy something at a significant discount, not just relax while shopping; the new policy scared away these old-fashioned buyers (Tuttle par. 14-15).

The effects of the new policy on the organization were devastating. Johnson’s activity led to a 26% decrease in sales, the 4 billion USD revenue decrease, which meant an annual loss of approximately 1 billion USD (Connor 64). After Johnson was gone, the company was even forced to publicly apologize for the former CEO’s policy, create a new logo that was similar to the old one, and implement the policy, which also resembled that of pre-Johnson’s times (Berfield par. 3-4).

Connor offers to look at the problem of Johnson’s activity by adopting a quantitative approach rather than a qualitative one (64-65). His theoretical perspective allows for a better understanding of the problem. According to his article, the unsuccessful CEO’s problem was the “lack of appreciation of the complexities and nuances of implementing an appropriate enterprise pricing strategy”; Johnson just tried to assess the situation from the qualitative perspective, thinking only about “fair pricing” (Connor 64).

The author explains that the price of the product is one of the variables which together influence the profit, the other two being the product’s volume and the expense of its production and storing; therefore, the pricing and revenue management are important tools for improving the company’s profits (Connor 65). First of all, Connor’s reasons, the pricing policy should have been thought over and adjusted even before Johnson “came to power,” even before the times when the company started experiencing difficulties (66).

Further, the author states that many executives of even the largest and most successful companies have not had much experience with the contemporary pricing instruments, and, therefore, often overlook their possible advantages, and fail to comprehend the basic principles that need to be the grounds for pricing (Connor 66). This occurred with J.C. Penney.

To properly create and implement a pricing policy, it is necessary to take into account a number of factors, such as “customer purchase criteria, competitive landscape, company relative share, relative supplier leverage and/or cost position, product importance, availability of substitutes, and so on”; in fact, the price should be calculated as a formula dependent on the named variables (Connor 67).

On the contrary, Johnson tried to do things in a reversed way; the process of creation of prices was based on some assumptions of Johnson’s which worked well with Apple products and the variables they were dependent on but were completely inappropriate for the kind of goods that J.C. Penney was selling.

The cancellation of sales and coupons and the implementation of fixed pricing meant that J.C. Penney suffered a significant loss in flexibility, losing the ability to match prices according to the customers’ demand; the clients went away to other retailers that offered the prices acceptable for them from time to time, thus being able to satisfy their wishes.

Our Analysis

From the above-given elaborations, it is evident that Johnson’s failure was the result of the fact that he did not understand the wishes, desires, and habits of the retail chain’s customers. The CEO was used to working for Apple Inc., Where he was extremely successful and knew the company’s target market. However, he was wrong when he tried to simply transfer the same strategies to J.C. Penney without studying its customers first.

It is clear that Apple’s clients are more likely to want to buy a high-quality piece of technology, which would last for many years; buyers of such devices are usually more willing to pay a high price for the gadget. On the other hand, sales and special offers were exactly what the customers of J.C. Penney wanted; to get an opportunity to buy a cheap piece of clothing, high-quality shoes for a relatively low price, or something similar to that.

Therefore, we would recommend to take into account the market that the business is aimed at and avoid simply transferring one’s perceptions of one market onto another market. As it follows from the article by Connor, pricing and revenue management are crucial for any company, and they are important and potent tools that can significantly improve the company’s (financial) performance (65).

Also, after assessing the market and the needs of the clients, it is very recommendable to test the newly developed policy in some way. For instance, Tuttle offers an obvious step of asking the buyers’ opinion about the new pricing policy (par. 10), which could be done in a number of ways, for instance, by simple surveys.

Conclusion

To sum up, it should be highlighted that J.C. Penney, a major American retail store chain, suffered severe losses due to the policy implemented by Ron Johnson during the 17 months of his being CEO. The main fallacy of his was the pricing policy, the complete cancellation of coupons and sales, and the implementation of “full but fair” prices on products. It is apparent that the customers of the retail store were looking for goods that could be bought at relatively low prices (unlike the former Johnson’s clients in Apple shops).

Therefore, before implementing such pricing policies, a thorough analysis of the target market is required. It is also strongly recommended to employ the pricing and revenue management approach continuously in order to keep the prices on the level that would bring the most profit (Connor 65-66, 68).

Works Cited

Berfield, Susan. J.C. Penney Erases Almost All Traces of Ron Johnson. 2013. Web.

Connor, Kevin. “Executives Beware – Are You the Next Ron Johnson of JC Penney? Is Your Company’s Low Pricing IQ Putting Your Survivability at Risk?” Journal of Revenue and Pricing Management, 13.1 (2014): 64-73. ProQuest. Web.

Fox Business. J.C. Penney to Close Stores, Exit Catalog Business. 2011. Web.

J.C. Penney Company, Inc. History. Web.

JCPenney. Web.

JCP Key Statistics. 2015. Web.

Loeb, Walter. Why J. C Penney Will Be a Winner in 2015. 2015. Web.

Moskowitz, Dan. For J.C. Penney, Poor Results Are Better than Abysmal Results. 2014. Web.

Mourdoukoutas, Panos. A Strategic Mistake that Haunts JC Penney. 2013. Web.

Tichy, Noel. J.C. Penney and the Terrible Costs of Hiring an Outsider CEO. 2014. Web.

Tuttle, Brad. The 5 Big Mistakes That Led to Ron Johnson’s Ouster at JC Penney. 2013. Web.

WGN Web Desk, and Associated Press. JCPenney to Hire 650 Seasonal Workers in Chicago Area. 2015. Web.

Zacks Equity Research. Are JC Penney’s (JCP) Strategic Initiatives Paying Off? 2015. Web.

Appendix