Introduction

In addition to its social importance in human life, housing is also one of the primary investment instruments for investors and households in Turkey. In countries with a high population growth rate and where capital markets are not deep enough, housing investments are widely preferred by individual investors. As a result of this, in these countries, housing demand and housing prices remain generally alive, and housing prices can increase more rapidly compared to developed countries. Undoubtedly, the development of house prices is directly or indirectly affected by many factors. While the main determinants of housing prices are construction costs, the quality of building elements, location, security, transportation facilities and social facilities, macroeconomic and microeconomic factors also have a significant impact on housing prices. These external factors can sometimes cause overvaluation and bubbles in housing prices.

Statement of Problem

In order to conduct the most complete and qualitative research, it is necessary to clearly define the problem that will be investigated in scientific work. The focus of this work is the rental market in Istanbul during the pandemic. The spread of COVID-19 has had a strong impact on all spheres of human activity, including the real estate market (Ahsan and Sadak, 2021; Kaynak et al., 2021; Cin et al., 2020). This factor is particularly noted in the rapid increase in housing prices, which has spread throughout Turkey. Thus, the main problem of the study is the consideration of the impact of coronavirus disease on such an area as real estate rental and the study of steps that can be taken by the state to solve it. This topic is chosen due to personal interest in investing in the real estate of Istanbul.

Purpose of the Study

Therefore, the main purpose of this scientific study is to consider the problem that has arisen for the development of the home market in the context of the coronavirus pandemic and to study the actions that have been taken to combat it. In addition, it is of particular importance to study the measures that the Turkish state can take to resolve the problem and consider their possible effectiveness in the future. To do this, the work will compare Istanbul with another country that has also faced a similar problem. Berlin would be chosen as a good example of a country that has also experienced a fairly rapid increase in the price of rental real estate, which was influenced by several factors at once. Such an analysis will help to identify both the strengths and weaknesses of the measures taken by the European country. Thus, you can get the most valuable information that can be useful for resolving the issue related to housing marker in Turkey.

Theoretical Background

The neoclassical theory of economics was chosen as the theoretical background. This theory states that supply and demand are the main driving force of economic development. This is especially true of such aspects as pricing, production and consumption of manufactured and sold products. Thus, this postulate can be effectively applied to the real estate sector. In this market, supply, and especially demand, play a crucial role in shaping the amount of profit.

Significance of the Study

This study has significant value in several aspects. First, it explores possible steps that the Turkish government can take to limit the problem from the rental markets. Secondly, it can become a valuable source for further research on this topic. This is of particular importance, since the data provided can help in resolving such issues in the future and will contribute to reducing risks by helping to predict them in advance.

Research Question

To what extent were the measures undertaken by the governments in Istanbul and Berlin effective in terms of the prices in the corresponding rental markets?

This research question is consistent with the purpose of the study that aims at exploring the effectiveness of the measures undertaken by the government to address the problem.

Methodology

Sample

Sample that was used for this study was the population of the Turkish city of Istanbul. However, it should be noted that it was not used directly, that is, no interviews or surveys were conducted directly as part of this work. On the contrary, previous works were analyzed, which based their findings and results on the data obtained by interacting with individuals and learning their opinions about the problem of the real estate rental market in Turkey. Such a large sample for the research work has such advantages as to understand the research question better and to answer it in the best possible way. On the other hand, a large size can lead to repetitive information, which can result in the loss of a significant amount of time.

Data Collection

A mixed method design will be the most appropriate methodological approach to address the research question mentioned above. Literature review will be the primary data collection method, and the data will be taken from policy manuals, laws, regulations, government releases. Content analysis will be implemented to answer the research question regarding the measures taken. Price fluctuations will be measured by comparing the prices at the beginning of 2020, 2021, and 2022. The results will be presented in the form of tables and graphs to make the finding and conclusions easy to understand and more transparent.

As already mentioned, the main focus of this research paper will be on what steps the Turkish state can take to solve the problem of the rental housing market. Hence, for a better understanding and to get the most useful information, it is necessary to consider and analyze several types of sources. Among them, it is possible to allocate articles, news reports, peer reviewed articles, which will provide the most recent information on the studied topic. For example, Senkaya and Sevgili (2021) give insight on the ways the situation is seen by students renting apartments in Istanbul. Moreover, Xinhua (2021) focuses on the opinions of rental agents and the current situation in the market. Peer-reviewed articles, in particular, are valuable since they provide a deep analysis of the issue, measures undertaken, and the outcomes. Therefore, Tanrıvermiş (2020) examines the causes and effects of this crisis and identifies potential solutions to overcome it. Lastly, policy reports and books, which mainly discussed research methodologies, would be of great help because they obtain the necessary data concerning the problem under study.

Data Analysis

This analysis is also of particular importance when conducting scientific research. The exact choice of the method of collecting and researching the information received can significantly affect the results of the work carried out. Quantitative, qualitative or mixed research methods are used for data analysis. Due to the fact that the main emphasis of this research paper is placed on the consideration of various sources, a special method was chosen for the analysis. However, it also contained elements of a quantitative approach, as tables and diagrams were used to show statistics on the topic under study.

Study Trustworthiness

The trustworthiness of research is also an integral component of it. Thanks to this aspect, further use of the information obtained by other scientific researchers can be ensured. Thus, in order to achieve this indicator for a scientific paper, academic sources were used that were written no later than five years ago. This selection ensured the reliability and relevance of the written information, avoiding out-of-time data. Moreover, in this work, such components of the reliability of the research work as reliability, transmission capability and confirmability were observed.

Ethics Considerations

Last, but not least, there are ethical considerations that need to be taken into account in any study. In relation to this research, factors such as confidentiality, anonymity, and non-maleficence are particularly valuable. This is due to the fact that this research is qualitative and does not require the participation of individuals. Hence, the collection and analysis of information took into consideration that no personal data would be disclosed. Moreover, it was ascertained that all of the research papers, articles, and news reports reviewed complied with the condition of consent and non-injury to the nondivisions mentioned in them. Only under these conditions can ethical considerations in scientific research be fully respected.

Findings

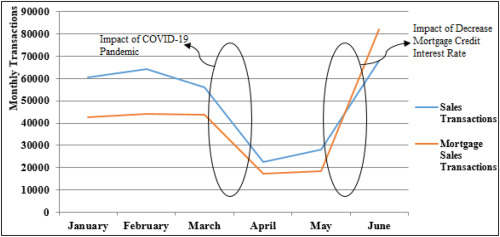

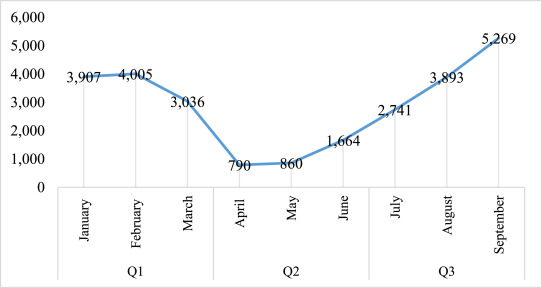

With the spread of coronavirus infection, people’s lives have changed dramatically. Many areas of activity were affected, especially the tourism industry, the provision of services, and the rental real estate market. This is due to the fact that lockdowns have been introduced in many countries, and the percentage of people moving or traveling who rent apartments has decreased significantly. Based on the information that was obtained during this study, there has been a sharp decline that occurred “during the month of April and May in 2020 in Turkey due to curfew and other related COVID-19 controlled measures” (Ahsan and Sadak, 2021, p. 218). Moreover, multiple studies provide information about a sharp increase in real estate rental prices, with a somewhat limited choice. These changes occur when the Turkish lira depreciates against the Turkish dollar. Furthermore, if this circumstance becomes a positive aspect for Americans, then for the real estate industry in Istanbul, this factor has a significant negative impact.

Moreover, several sources also note an increase in rents against the background of high demand. Such an increase, according to the theory of neoclassical economics, should contribute to improving the welfare of the country, but this is not entirely true. This is due to the fact that there are not enough buildings in Turkey for the sale or rental of housing. Moreover, due to external demand, prices have increased by half, but the fall of the Turkish lira has negatively affected the financial situation of the population. In addition, many students switch from distance learning to full-time and return to the city to continue their studies. Such an influx creates an even smaller supply and leads to a crisis situation.

Thus, one of the studies notes the struggle faced by Turkish students. Therefore, in their scientific publication, Senkaya and Sevgili say that students in Turkey cannot pay rent for housing and are in debt. The main reasons for such a negative trend are the fall in people’s living standards and the increased unemployment rate associated with the coronavirus pandemic. Moreover, the actions taken by the government to reanimate the economy after the onset of the crisis around the world have a direct impact. Thus, the increase in rental property prices is due to inflation and lower interest rates, which were introduced to stimulate the economy. This action on the part of the ruling party contributed to the fall of the lira exchange rate to a new record low and increased the information by 20% (Senkaya and Sevgili, 2019, para. 5). It is noted that residents of Istanbul believe that the flow of migrants is the reason for such an increase in rental prices (Xinhua, 2021, p. 14). Thus, the authors conclude that the government is responsible for the current situation in the country and the difficulties of students with paying rent.

Moreover, the article Kaynak, Teknigi, and Kaya, which explores the impact of COVID-19 on the Turkish economy, is of particular value for this scientific work. Hence, the authors take several basic measuring economic measures. Firstly, they conduct analysis and research of the events taking place to determine and establish abnormal profitability of housing prices. Further, the direct impact of coronavirus and measures related to it on the identified indicators is considered (Kaynak, Ekinci and Kaya, 2021, p. 623). The scientific work carried out by the authors proves the fact that the spread of coronavirus disease adversely affects the global real estate market, including buying, selling, and renting. However, regional analysis shows mainly a positive effect of COVID-19, as the level of consumer confidence increases over time.

Because the main question of the study is to suggest possible measures to solve the problem of the real estate market, it is necessary to analyze the steps taken by Berlin. In this European country, as in Istanbul, there is a relatively rapid increase in property prices, which can not be called a positive fact for some part of the population and the economy of the country. This is due to the fact that due to overcrowding, families with the lowest income are displaced.

What is more, sources say that rents are rising faster in Berlin than anywhere else in the world. This year there has been a 104 percent increase in rents, with an average of 11.60 euros per square meter. To change this situation, which certainly was also affected by the coronavirus pandemic, Berlin has adopted a new law. The new Berlin rent freeze or rent restriction law aims to combat the problem of renting in the country. Its main purpose is that when it comes into effect, rents for more than 1.5 million homes will be fixed for five years and cannot be raised above €9.80 ($10.90) per square meter (Knight, 2019, para. 2). With the measures, Berlin has thus taken more control of the country’s real estate and rental market.

The aspect that makes this national innovation so unique is that landlords cannot set the rent higher than the previous tenant paid. Additionally, if the rent exceeds the set limit, tenants can even sue to have it reduced. The introduction of something like a freeze or cap law could have a positive effect on economic development not only in Berlin but also in any other country, such as Istanbul. This is because it gives the government the opportunity to gain control of the rental market. Moreover, the housing market needs constant regulation; otherwise, there could be a lack of cheap alternatives to buy or rent.

Moreover, the positive characteristic that the Berlin real estate market has acquired and other countries should acquire is the vision that affordable housing is a fundamental human right. Thus, state ownership of apartments in the country would offer more affordable options for the population. In addition, Berlin is already taking steps towards this change, conducting dense probing or increasing development on the outskirts of the city. Another action that can change the situation in the real estate market is the purchase of private property by the state (Winck, 2021, para. 6). However, it is unlikely that it will be able to provide the proper level of efficiency to combat the issue fully.

As already mentioned, the spread of COVID-19 has affected the tourism sector, which is one of the most profitable in all of Turkey. Zogal, Domènech, and Emekli (2020, p. 1) state that “in the early stages of the pandemic, second-home owners migrated from crowded cities to low-density areas, being vectors of transmission of the virus.” Currently, the situation has changed significantly, and now there has been a transformation in the desires of consumers. Now, people prefer to rent non-resort housing away from the city, but on the contrary, in tourist-active places such as Istanbul, after reducing restrictive measures in the order of countries. This trend may seem optimistic, as it will bring more income to the tourism sector. However, the problems of high rent and lack of real estate for it can greatly undermine this positive trend. Moreover, the level of customer dissatisfaction may increase. This is since housing below the average level can be sold at a higher price, which will cause bewilderment and underestimation of tourists.

Moreover, renting housing during the coronavirus lockdown became associated with privilege, as it allowed people to leave their homes and quarantine elsewhere. However, the situation was such that with such migrations, the virus spread only faster, causing even greater economic, financial, social, and medical damage to the host country. After easing measures on the situation with COVID-19, the Istanbul government has organized specialized isolation zones and permits for people to travel for tourist purposes and rent housing.

Discussion

Therefore, based on the data obtained during the study, it can be concluded that the coronavirus has a significant negative impact on the real estate rental market in Istanbul. Moreover, the government should take specific steps to improve the situation, and Berlin could be one of the example countries. Berlin can be a good choice as this city has seen a rise in rental prices for the past five years (Twomey, 2021; Winck, 2021). The recent migration crisis and COVID pandemic issues have also caused an increase in prices. The government imposed some restrictions to balance the market and ensure its sustainable development.

The situation has had a negative influence on various groups of people, including but not confined to real estate owners, travelers, and students (Senkaya and Sevgili, 2021; Xinhua, 2021). Rising rental housing prices associated with restrictions imposed in the country undermine the financial stability of the country and its economic position on the world stage (Zoğal et al., 2020). Additionally, the rental housing problem has a negative impact on the well-being of people and their financial resilience. Moreover, it should be noted that the policy undertaken by the heads of state does not cause positive feedback from the population. On the contrary, an increase in inflation and a rise in the price of rent can lead to an increase in discontent and protests against the decisions taken.

In addition, in this paper, the impact of the spread of coronavirus infection on the rental of housing as a second home during and after the lockdown was discussed. Hence, in the early stages of the pandemic, the owners or tenants of such real estate considered it as a way to avoid the hustle and bustle of the city while traveling. In many countries, such intersections occurred not only after the restrictions were relaxed but also before and during their introduction around the world. Such actions have become a risk factor for the spread of the disease to other places. Moreover, the economic situation of countries and their level of health care was also put at risk.

On the one hand, this movement from one place to another during quarantine can be displaced for several reasons. Hence, it may be a concern to avoid infection, a desire to be isolated, or to stay away from the hearth. In addition, with such avoidance of risky situations, people were also given the opportunity to enjoy the goods of the host country and switch to the remote method of work. On the other hand, increased mobility contributed to the spread of the disease in areas with low infection rates. The main concerns about population displacement were also related to the additional pressure that the spread of the virus could put on local health systems. Moreover, it is worth noting that the coronavirus pandemic, which began in 2019, has generated many trends that will become long-term.

It is also worth emphasizing that real estate throughout Turkey has always been in high demand both for rent and for sale. This is due to the fact that the country continues to develop rapidly and is one of the most popular tourist destinations (Figure 1). However, the onset of the pandemic severely affected its economic development, which forced the government to act immediately. The decisions are taken, and the increase in inflation contributed to an increase in rental prices and an increase in the level of unemployment. To avoid further problems, Istanbul can take advantage of Berlin’s experience and establish greater control over this area. Hence, a Turkish city, like a German one, can take a more extensive account by establishing a law on freezing. This new law defines a fixed price, for which the landlord has no right to leave when renting housing.

Furthermore, it was expected that resort real estate, which is so popular with tourists and migrants, will be chartered by falling prices and declining sales. However, in real life, the situation was different. This industry, despite the difficulties, very quickly made up for accidental losses and is now growing above the previous price. An active and unceasing flow of tourists and just people who want to conduct self-isolation in a house near the sea, also be in a constant stage of growth. That is why, in Istanbul and throughout the country, there is a sale of unfinished houses and the delivery of premises in poor conditions for the average price. Real estate, which on the contrary, is characterized by falling prices, is office. This is due to a change in the form of economic activity. Moreover, it is essential to note that quarantine conditions have not affected Turkey to a substantial extent, but business in the country has reduced its efficiency and productivity.

Despite the negative trends, it is considered necessary to highlight the positive impact of rising prices for rent and real estate in Istanbul. Thus, areas that were not previously common among tourists and tenants can gain incredible popularity and interest (Figure 2). These are ancient tourist centers, such as where people are provided with many different attractive and relatively inexpensive options. Thus, Istanbul is also the most attractive shopping area for houses. This is due not only to the rich cultural heritage but also to the presence of the characteristics of the resort town. In addition, there are all kinds of real estate in the city that can be inexpensive to rent and bring benefits when buying them. Furthermore, modern Turkey is currently one of the few countries in which real estate is the main topic of interest.

Conclusion and Implications

Undoubtedly, the emergence and infection of many people with COVID-19 disease have greatly affected the development and functioning of the real estate sector. To combat the coronavirus, Turkey has completely closed air traffic with all countries of the world, and all land borders are also closed. The country has also launched a public campaign to raise funds for poor people who have been most affected by the pandemic. The entire population strictly followed the rules and did not leave their place of residence. Such correctness and humility to the laws have left an indelible imprint on the country’s economy, especially on the real estate rental and purchase industry. However, it is essential to remember that many countries have faced a similar problem, and their experience can be used as a valuable source of information.

Thus, this work examined the impact of the coronavirus pandemic on the real estate rental and sale market in Istanbul. Moreover, it investigated what measures can be taken to resolve the problem on the example of a European country like Berlin. Hence, the conclusion can be drawn that the policy of freezing the rental price and setting the bar for a monthly fee, as in a German city, can significantly improve the situation in Istanbul. However, it is worth emphasizing that in order to get rid of the problem, the government should also take measures to improve the economic well-being of the population, reduce unemployment and increase the overall standard of living of people. The main implication of this scientific work may be its use in subsequent research on this topic. This is due to the fact that it is equipped with the necessary information. In addition, this information is relevant and relevant and has been confirmed during the necessary research.

Reference List

Ahsan, M. and Sadak, C. (2021) ‘Exploring housing market and urban densification during COVID-19 in Turkey’, Journal of Urban Management, 10(3), 218-229.

Cin, K. et al. (2020) COVID-19 possible effects on Turkey’s real estate market. Istanbul: Colliers.

Kaynak, S., Ekinci, A. and Kaya, H. F. (2021) ‘The effect of COVID-19 pandemic on residential real estate prices: Turkish case’, Quantitative Finance and Economics, 5(4), 623-639.

Knight, B. (2019) Berlin’s new rent freeze: How it compares globally. Web.

Senkaya, D. and Sevgili, C. (2021). Turkish students struggle to afford rent as inflation surges. Web.

Tanrıvermiş, H. (2020) ‘Possible impacts of COVID-19 outbreak on real estate sector and possible changes to adopt: A situation analysis and general assessment on Turkish perspective’, Journal of Urban Management, 9(3), 263-269.

Twomey, J. (2021). Corporate landlordism: A view from Berlin. Web.

Winck, B. (2021) A majority in Berlin’s election just voted to strip 240,000 rentals from major landlords and fight the city’s housing crisis. Web.

Xinhua. (2021) Real estate prices go through the roof in Istanbul amid pandemic. Web.

Zoğal, V., Domènech, A. and Emekli, G. (2020) ‘Stay at (which) home: second homes during and after the COVID-19 pandemic’, Journal of Tourism Futures, 1-9.