Abstract

The strategy is a plan that describes the course of action in the future. Strategies are adopted by organizations to help them determine their course of action in the future. The strategy needs to be flexible enough to reflect environmental factors and changes. Organizations have two environments; the external and internal environment. The external environment cannot be predicted by the management, but it can be evaluated. The internal environment can be influenced by the organization. Organizations come up with strategies through their executives and teams of their executives.

These executives from the strategic thinking of the organization also integrate innovation in their strategy process. Challenges in the business environment keep changing and, therefore, the strategy has to be innovative to encompass the change. Leaders need to communicate with each other and with their subordinates to produce a good strategy for the organization. Doha Bank Qatar involves its departments together with external agencies and customer firms to incorporate innovation and focus on change to achieve success in its operations. The bank employs a comprehensive strategic approach that undertakes the strategy development process in its entirety before final implementation. The strategy is led by the business manager, but total participation is acquired through the involvement of the marketing, information technology, and sales departments.

Introduction

All organizations in the world exist to fulfill certain objectives. These objectives, however, are challenging to attain because of many environmental factors that cannot be predicted accurately on time. Thus, organizations determine their direction, as well as their scope for purposes of achieving advantage within the changing environment well in advance. This is done by configuring the resources and competencies such that the stakeholders’ expectations can be fulfilled. In essence, it is this kind of arrangement and planning that comprises the aspect of strategy and strategic thinking (Johnson, Whittington & Scholes 2011, p. 9). It is an important concept because, without a strategy, there will be no chances of achieving the objectives. Strategic leadership, on the other hand, must have the ability to translate the strategy to operational requisites. It should involve achieving a perfect alignment of the organization and strategy (Boak, 2010, p. 34). In particular, this paper extensively covers the topical issue of strategic thinking and leadership, mainly expounding on the main theories concerning strategy formulation. It also covers strategy development, implementation, and analyzes the relationship that exists between strategy and innovation. The paper analyzes the strategy process adopted at Doha Bank, Qatar in the formulation of its new products and services.

Development and Strategy Implementation: Theories

Different scholars and researchers have offered their definitions of the term strategy. Nadler (2004, p. 30) looks at strategy from four varying perspectives, which also form his definition of the concept. Firstly, he identifies strategic thinking as collecting, analyzing, and discussing the firm’s environment, as well as the competition it faces and the business design alternatives that are open to it. Secondly, he identifies strategy as a decision-making process that requires several core directional decisions. These decisions are critical choices about the business portfolio and its design, whose purpose is to provide a platform for allocating the limited resources and activities in the future. The third aspect of the strategy is strategic planning that involves the plan and budget for the organization. Finally, the strategy involves strategic execution, which focuses on implementing, examining results, and undertaking necessary corrective action.

Hamel and Prahalad (2005) define strategy as an organizational leadership position that determines the criterion to be followed in charting organizational progress. The strategy elongates the organization’s thought duration instead of simply focusing on the immediate future of the firm. The plan establishes a target, which requires personal effort as well as commitment from the employees. The management and staff play a critical role in implementing strategy and, thus, they must have its greater understanding.

Developing organizational strategy takes into consideration various approaches, with the main emphasis being on the emotional and intellectual engagement of employees. This targets developing new skills to enhance organizational competitiveness. The strategy focuses on innovation and establishing competitive advantage layers over time for sustaining the exploration of areas that the competitors could be having little considerations over. In turn, this could help in lowering costs through better working methods adopted by the employees.

On the other hand, Thompson et al. (2010, p. 33) point out that an organization needs to pursue relentlessly its ambitious strategic objective, as well as utilize the full force of resources it owns for it to achieve its strategic objective. To help expound on the point, Welch (2001) illustrates how General Electric set out its organizational objective targeting the first or second position in each market that the company served. Part of the strategy involved revolutionizing the company to achieve greater strengths but still maintain perfect leanness and agility.

A critical aspect of the strategy process is influencing others to look into the process and buy it all together. Others must be able to visualize the intended new look of the organization once the vision is achieved. As Covey (1994, p. 97) asserts, sharing of the strategy should look at the end before beginning to work backward to the organization’s current position. This involves describing the strategy and then determining the requirements in achieving it.

Development and Implementation

Strategy formulation should often focus on a clear, simple, and succinct statement that can be internalized easily. Simple statements with clear information support the conformation of behavior with business performance, making it easy for strategy implementation (Collis & Rukstad, 2008, p. 82). Three critical aspects require greater consideration during strategy development. These aspects include objective, scope, as well as advantage (Collis & Rukstad, 2008, p. 82).

Objective refers to the target that the organization plans to achieve in the end. Often, this is explained in the vision and mission statements of the organization. Advantage, on the other hand, comprises of two critical aspects that include customer value proposition statement and the set of unique activities that uniquely enable the firm to offer the said customer value proposition. This target to achieve a simple description within the strategy statement that offers a keen characterization not found in any other firm (Collis & Rukstad, 2008, p. 88).

A good strategy statement, thus, should involve the following vital steps: Firstly, it should evaluate carefully the industry landscape, where the most important aspect should be to understand the customers clearly. Secondly, it must carry out an extensive analysis of the strategies adopted by the competitors and finally carry out a rigorous assessment of the capabilities and resources available (Collis & Ruckstad, 2008, p. 90).

Mission and value statements help organizations achieve shared understanding. It eventually enables individuals to make independent decisions while avoiding working at cross-purposes (Kanter, 2008, p. 43). The presence of common values together with standards offers a chance to the people to arrive at consistent decisions under the numerous corporate challenges. For companies having disparate locations, the mission and value statements act as the binding factor in following and achieving the corporate strategy.

According to McFarland (2008, p. 69), creating an effective strategy requires uniform formulation and implementation. Individuals at the front line within the organization should execute the strategy. However, the strategy should amplify efforts by all other individuals at the organization by directly involving their contribution during its formulation.

Organizations can either adopt a comprehensive or incremental approach in developing corporate strategy (Rees and Porter, 2006, p. 356). The comprehensive approach involves developing an overall strategy before implementation. The incremental approach involves developing a strategy gradually. There is no particular strategy approach among the two that could be considered as superior to the other. However, Rees and Porter (2006, p. 354) point out to managers the need for more effort in case they adopt the comprehensive approach. Failure to adhere to the advice leads to a narrower range of practical specialists, underestimating the organizational behavior complexities, as well as the eventual adoption of a unitary perspective that ignores organizational conflicts of interest. These factors inform Rees and Porter’s (2006, p. 359) consideration of recommending the incremental approach rather than the comprehensive approach.

Nadler (2004, p. 25) provides six basic steps important for sustaining strategic thinking. His steps involve agreeing on the issue about the company’s vision, envisioning the available opportunity space, assessing the business design of the company as well as its internal capabilities, and determining the future strategic intent of the company. Other steps include developing various business design prototypes and choosing the best business design out of the various samples already developed.

An enterprise must adopt a strategy development process that relates to the type of enterprise. Mono-activity enterprises, for instance, should consider high centralization with little formalization. The top management should supervise the whole process of developing the strategy. The top management will be in charge of the process because of the level of understanding concerning each of the activities, as well as the environment in an enterprise whose activities are homogeneously diversified and with a simple-stable environment. This is opposed to an organization whose activities are heterogeneously diversified operating in a simple but stable environment. In this latter case, the top management will devote a significant part of their time to reveal the potential, as well as synergetic efforts rather than engaging in an in-depth exercise of challenging the individual strategic divisional plan (Sarrazin, 1981, p. 12).

Some companies comprise of activities that are homogeneously diversified and operate in environments considered to be complex and unstable. Such companies emphasize on control-oriented perspective rather than being oriented on planning. In such instances, the top manager is considered as the pilot whose decisions ought to determine the uncertain long-term goals together with the constraints. Equally, the decisions determine the short-term dynamic windows that are significant for the corporation’s various activities.

Another combination could see an organization made up of activities that are heterogeneously diversified and operating within an environment considered being complex and unstable. In such an instant, the top management will need to have a deeper understanding of the relationship network. The most important role in this instance is to carry out an analysis of the network and maintain viable links (Sarrazin, 1981, p. 12).

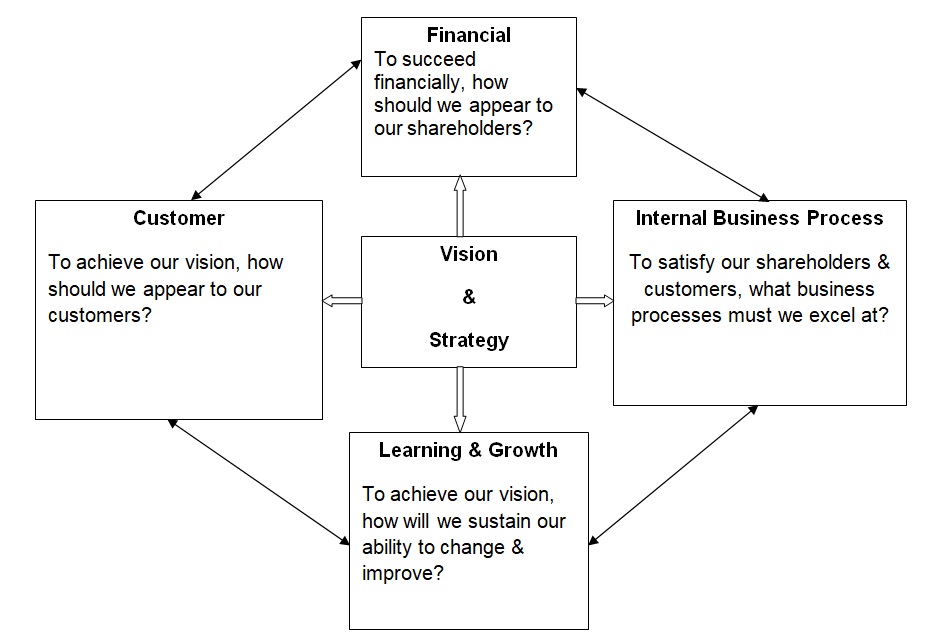

Various techniques have been proposed to assist managers to implement strategy appropriately. The balanced scorecard is one such strategy that helps in bridging the gap between the mission and strategy statements of the organization, on the one hand, and the daily operational measures on the other (Chan, 2007, p. 28). The diagram illustrates the working modalities of a balanced scorecard modality.

A new practice in contemporary organizations comprises of a newly formed corporate-led unity, which is considered as the strategy management office. Its main responsibilities involve managing strategy (Kaplan & Norton, 2005, p. 8). In particular, the strategy management office assumes the organizational owner’s position concerning the balanced scorecard. It facilitates the development and flow of the balanced scorecard throughout the organization’s hierarchical levels.

Coordination between the budgets, human resource planning, marketing programs, and investments in IT is important and requires the direct input of the strategy management office to ensure proper alignment with the strategy. The office must also take charge of identifying and transferring the best practices to be adopted within the organization.

Strategic Leadership

According to Boal and Hooijjberg (2000, p. 551), strategic leadership focuses on the leadership of the organization, instead of leadership in the organization. Strategic leaders have specific roles that they need to undertake. These include making strategic decisions, creating and informing the future vision, developing critical competencies and capabilities, developing structures and processes of the organization, and managing multiple constituencies. Selecting and growing leaders is also a task undertaken by strategic leaders. This is done to sustain sound leadership even in the future. Strategic leaders are also mandated with the role of seeing to it that the organizational culture is upheld effectively.

On their part, Hitt and Ireland (2002, p. 3) argue that strategic leadership is an important aspect of the organization since it helps in the building of a company’s resources, as well as its capabilities. It emphasizes both the human as well as social capital, all of which are intangible. Another description of strategic leadership comes from Collins and Porras (2002, p. 18). They describe it as an activity whose focus is on building the clock rather than telling the time. In other words, it is an activity that looks at the future and determines ways of making the future to be improved than the current or present time. Both Senge (1990, p. 12) and Collins (2001, p. 64) are unanimous in their definition of strategic leadership. The two scholars term it as an important function of guiding an organization for purposes of building its organizational capabilities.

From the above definitions, it can be deduced that leadership changes in its nature with the advancement of seniority. This is because the organization interacts more with the environment while rising levels of complexity also add more pressure in terms of complexity. For the leader of a small organization, the focus needs to be that of making predictions concerning future challenges that face the organization. On the other hand, strategic leaders of large corporations ought to deal with significant ambiguities, as well as complexities that exist in the environment. This is done by way of establishing priorities through the management of external relationships (Capon, 2008, p. 123).

The main role of a strategic leader in an organization is to build a more effective team. It does not concern the magic powers that an individual CEO holds in as far as his decision making and control is concerned (Pfeffer & Sutton, 2006, p. 113). As Pfeffer and Sutton further point out, strategic leadership involves the building of reliable systems that can be able to work in the same way over and over again for a considerable period. It is not really about individuals and their capabilities. Rather, it is focused on the ability to envision the company’s future and determining what will be needed in advance. Strategic leadership is about planning for a future that is not yet seen, but that which can be anticipated (Davila et al. 2006, p. 63).

Constraints affecting a Strategic Leaders’ Performance

Strategic leaders’ performances are hindered by several constraints that can be categorized as internal and external. The internal constraints consist of limited resources, a company culture that is strong and conservative, and a bureaucratic approach that is very strong. On the other hand, external constraints comprise of such aspects as product and market factors, general economic conditions, and policies of the government, as well as technological changes, among other factors (Yukl, 2002, p. 181).

Executive Teams

This also forms part of strategic leadership in an organization. Executive teams can particularly be of significant value to large organizations and require the company CEO to formulate the team (Collins, 2001, p. 64). The teams have the potential benefit of sharing the leadership burden while contributing the individual knowledge and skills that are held by each of the team’s members. The wide-range nature of a decision made by the team is more likely to offer a true representation of an organization’s diverse staff. Teams also improve the communication quality amongst individual executives, while they also promote better understanding and dedication of the executives.

However, as Yukl (2002, p. 182) points out, there is a challenge in relying on an organization’s executive team as the strategic leadership. This is because teams often differ greatly and this can have great consequences on their operations. Equally, while some teams will tend to be dominated by the CEO, some may operate in a more participative way.

Executive teams are most important, particularly during certain circumstances. These include when there is a rapid change within the organization’s environment and when the business units of an organization require being coordinated owing to their diverse but interdependent nature (Yukl, 2002, p. 196).

Boards of Directors

Company boards of directors often comprise of senior executives, as well as non-executive directors. Their role entails overseeing the CEO’s work, as well as that of the management team while ensuring that probity is achieved (The Higgs Report, 2003, p. 23). For the executive board to achieve excellent results in terms of offering strategic thinking and leadership, its chair needs to have a strong relationship that is complementary to that of the CEO and other board members. There also needs to be cultivated a culture that reflects openness and one that supports constructive dialogue. Members must trust each other and maintain mutual respect (Higgs Report, 2003, p. 23).

However, the board of directors often faces four common directorial dilemmas that must be achieved if the board’s role as strategic leaders is to be realized. The directional dilemmas include the board being entrepreneurial and having the ability to drive the organization’s business forward (The Higgs Report, 2003, p. 24). This must occur while maintaining control of the business. It must have enough knowledge about the organization’s working to be accountable but avoid the daily management work. Other directional dilemma involves being sensitive to pressures of short-term issues, as well as remaining resolute on the commercial requirements of the business. This should be done while at the same time acting responsibly towards the employees, the business partners, and the entire society (Garratt, 2003, p. 6).

Strategy, Innovation, and Change: Relationship

Innovation involves adopting a new idea for use in an organization. This aspect of innovation is important when it comes to enabling an organization to achieve a greater competitive advantage. It is widely adopted and visible, as opposed to administrative innovations that are, on the other hand, less advantageous and complex to implement (Damanpour, 1990, 127). Today’s markets have stiff competition that forces firms to be innovative to remain competitive in their respective industries (Aghion et al. 2005, p. 701).

Porter (1985, p. 54) identified the need for organizations to adopt innovation as a way of assuring differential products. Differential products offer unique and highly valued attributes to the customers. As the firms seek for differentiation of its products and services, it is compelled to expend a significant portion of its resources on undertaking research activities to determine unique product attributes while promoting brand image at the same time.

Innovation can only be achieved in instances where an organization pursues a strategy of differentiation, either for its products or for services. De Witt and Meyer (1999, p. 198) point out the need for organizations to scan the environment, as well as conduct market research to identify opportunities. In the contemporary market setup, however, firms are searching for ideas to sustain their product differential strategy through the establishment of social networks with customers and suppliers for purposes of developing product ranges that satisfy customer needs.

As Hamel (1998, p. 8) rightly points out, innovation is achieved through involving new voices, bringing together knowledge in varied ways, getting people to involve themselves in inventing the organization’s future, as well as introducing new ‘lenses’ and conducting extensive research. Flexibility is important for organizations to help them achieve and manage the change that is inherent in the organizational environment (Boak, 2010, p. 19). In particular, there are two different configurations; mechanistic and organic. These play a significant role in enabling an organization to achieve change.

Mechanistic Configuration

The mechanistic configuration comprises of technostructure as its main part, while it adopts standardization of work as its central coordinating mechanism. This configuration type prefers the use of limited horizontal decentralization. The structure gives precedence to higher formalization degrees, as well as higher specialization degrees. In terms of the decision-making process, centralization is the main feature, while the management has a narrower span. It spots relatively more levels in its chain of command, beginning with the chief executive officer to the lowest-ranked worker at the organization. There is little need for lateral or horizontal coordination, with machine bureaucracy as well as a larger support staff base being commonly integrated within the mechanistic configuration. This type of organizational configuration offers a typically stable environment, with the main objective being the achievement of internal efficiency (Lunenburg, 2012, p. 4).

Organic Configuration

This configuration type places greater emphasis on the support staff while using mutual adjustments to achieve coordination. Although it maintains decentralization, this is done selectively. Generally, the structure has lower decentralization and formalization systems. The organization’s core operations are run by technical specialists, making a smaller technostructure. The complex structure gains support from the support staff base, which is larger in this kind of organization. Organic organizations mainly undertake tasks that are non-routine and thus adopt the use of sophisticated technology. The aim of this kind of approach is for the firm to realize innovation. At the same time, the firm can adapt fast to the ever-changing business world. The organic type of organizations is medium in size and highly adaptable. Their focus should be on the efficient use of resources (Lunenburg, 2012, p. 6).

Selected Strategic Process: Doha Bank Qatar New Product Introduction

The process of formulating new products at Doha Bank Qatar undergoes three critical stages, which include collection, analysis, as well as thoroughly discussing relevant information and details concerning its environment and its competition. As Nadler (2004, p. 26) points out in his theory of strategy, Doha Bank relies on this initial information to ascertain the various design alternatives that it may employ to introduce the new products successfully. The bank has established up to five departments that are engaged in the collection, analysis, and discussion of information. They include the Business and Product Development Department, Marketing Department, Information Technology Department, Sales Unit, and the Marketing Agency.

The strategy process of the bank entails the above-mentioned departments making decisions about core directional choices that are critical about the portfolio together with its design. Doha Bank Qatar has assigned the five departments with the responsibility of drawing up the plan and its respective budget, as well as the execution of the strategy. The execution and implementation focus on result examination and the subsequent execution of corrective action to ensure the whole strategy process takes place as anticipated. The implementation and execution roles as assigned at the bank are particularly in tandem with the definition offered by Nadler (2004, p. 29) concerning strategy and its process.

The strategy process involves the relevant departments determining the actual criterion that the bank is expected to follow as it charts its organizational progress. Targets are established during the process, which acts as a guide to employee participation and operation during its implementation (Hemel and Prahalad, 2005).

Strategy Process Duration

Doha Bank Qatar takes between one and two months to undertake the strategy process and eventually finalize on the new products intended for the introduction. During this period, each of the departments involved in the process carries out extensive work, including the collection of vital information, the processing of the information, and sharing of the information with the other departments to ascertain the effectiveness. These details and information evaluate the organization’s readiness to achieve the strategic objective effectively by scrutinizing the resources of the bank to ensure its full utilization. The aspect of resource evaluation, as pointed out by Thompson et al (2010 p. 33), is critical for the success of any strategy process as it provides the firm with the ability to fully utilize the number of resources that it owns.

The five departments engaged in the strategy process mainly target to influence each other such that it may eventually be possible to buy the entire process altogether. The Business & Product Development Department formulates the new product idea and explains how its introduction will strategically enable the bank to achieve a competitive edge and growth over its competitors. As the department sells the idea to the Marketing Department, the latter evaluates its viability to ascertain whether the new idea will be easier to sell to the market and eventually enable the bank to achieve its objectives. The Marketing Department proposes changes to the new product idea that aims at improving the original idea as was formulated by the Business & Product Development Department. The IT department, on the other hand, studies the whole new idea with the view of improving its efficiency such that its implementation may omit any further barriers and increase effectiveness to the organization. For instance, the IT department may suggest programs and software enable the sales unit and the marketing agency to communicate to the marketing department from their remote locations in the field.

During the strategy process duration, the teams involved, which comprise of the five departments, prepare documentation intended for use in controlling and evaluating the progress of the entire strategy. These documents include Product Policy, Project Requirement Document (PRD), Project Initiation Document (PID), as well as the Project Tracking Document (PTD), and Test Document. These documents help in the process by testing the new product or service at every step and checking all the tested work that meets the expectations of the bank.

Other important documents that are developed during the introduction of a new product or service idea include Quality Assurance as well as User Acceptance Test. These latter documents focus on evaluating the acceptability of the new product to the market or consumers through determining their quality.

New product strategies at Doha Bank Qatar are formulated in tandem with the banking business that the institution runs. In particular, the bank comprises of heterogeneously diversified activities that are operated in a complex and stable environment. As Sarrazin (1981, p. 9) notes, such an example of an enterprise requires the top management to have a deeper understanding of how the relationship network operates. The Business Manager at the bank, in particular, is in charge of new product ideas that are formulated at the bank. The business manager, in turn, assigns the Project Manager the role of coordinating the entire strategy formulation process and ensures the work is done as planned.

The project stockholders mainly learn about their responsibilities, as well as distributing tasks expected of them through a brainstorming session that also forms part of the initial strategy process at the bank. The project manager determines each staff’s responsibility as well as routine, setting the deadline for achieving such activities as the Project Requirement Document and the Project Initiation Document. The two documents are developed as part of the process of approving authorities finalizing and initiating the strategy process.

This leads to the theoretical development of the product, which paves way for its electronic execution. This is specifically done by the information technology department under defining the project’s developers to ensure timely delivery. The IT department has to liaise with the business people after determining a reasonable timeline, as well as the deadline for delivery. The responsibility of the IT department is to ensure that the product development process is finished, from where the test environment can be conducted by the business and product development department. Equally, the quality assurance unit evaluates the progress to make the final testing.

The new product idea then moves to the Marketing Department, which is expected to design a marketing media plan. This plan, however, is only made possible after conducting extensive market research. It determines the way forward for the new product strategy in terms of whether the company needs to undertake Below The Line (BTL) or Above The Line (ATL) marketing activities. The department then finally makes the approvals once it determines that the new product idea meets all the targets of the bank concerning the market. The final stage involves the launching of the product to the public basing on the approval results of the marketing department.

The steps involved in strategy formulation at Doha Bank generally begin by evaluating the industry landscape, where the focus of the bank is in understanding the customers clearly. The involvement of the Marketing Department brings in the idea of evaluating customer response before the launch of the product. It seeks to ensure that the new product meets the expectation of the market, where customers’ desires and wishes are given priority before any other thing. To achieve this, the marketing department conducts extensive market research that enables it to draw out conclusions that accurately capture the position of the industry. Ruckstad (2008) advises on the need for companies to undertake a careful evaluation of the industry landscape to understand the customers clearly.

Doha Bank Qatar adopts a comprehensive approach in the development of its corporate strategy, where the firm begins by developing its overall strategy before carrying out its implementation. The entire strategy formulation process entails the five departments at the bank undertakes their respective strategy roles before eventually coming up with their strategic product and service ideas. The comprehensive approach, as pointed out by Rees and Porter (2006, p. 354), requires more effort from the management of the bank. This is important because it cushions the bank against instances of underestimating the behavior complexities of the organization, and against adopting a unitary position that ignores conflicts of interest within the organization.

Strategy Evaluation

Several techniques have been employed at the bank as a remedy for ensuring that the strategy meets the objectives and targets of the firm. This borrows from the balanced score scorecard technique that provides organizations with the opportunity of bridging the gap between mission and strategy statements while conducting daily operational measures (Chan, 2007, p. 28). The bank has opened up communication channels that allow its customers to provide feedback about the products and services on offer. This mainly includes social media platforms, such as Facebook and Twitter accounts, that customers can use to communicate with the bank. These channels are mainly user-friendly as they allow customers to give out their feedback details at their convenience without necessarily having to consider specific styles of communication.

The official website of the bank also offers an opportunity for consumers to interact with the firm electronically in issuing their feedback information. There are other electronic baking channels that the firm maintains, which also act as avenues for receiving feedback details from the customers. An example of such a channel includes the mobile banking platform that provides direct contact lines for customers to reach the care agents of the bank for communication purposes.

The market standings of the bank also offer perfect feedback detail from the market concerning the performance of the firm. Other feedback details are obtained through the mystery shoppers’ performance. Doha Bank Qatar has enlisted the services of numerous marketing agencies, whose main responsibilities include conducting research and collecting customer feedback on a timely basis to allow the bank’s management ample opportunity to review the feedback information. As Kaplan and Norton (1992, p. 73) identified in their balanced scorecard framework, the main aim of seeking consumer feedback is to ensure that the bank continuously focuses on the best possible ways through which it may appear to the customers such that it remains within the limits of achieving its vision.

The feedback mechanism of the bank is highly regarded, with its results regularly documented for purposes of making future reference. The bank conducts this process between 17 and 22 times each year. This underlines the importance with which it regards the whole exercise.

The Credit Card Loyalty Program Strategy

Doha Bank Qatar introduced the credit card loyalty program as part of its new product, intending to reward its customers for their support for the bank. The strategy process involved the five departments of the bank that include the Business and Product Development, Marketing, Information Technology, as well as the Sales Unit and the Marketing Agency. The new product idea by the bank was introduced to the strategy teams drawn from the five departments and a brainstorming session encouraged in ascertaining the responsibilities. The Business and Product Development manager was the overall leader of the project, charged with the responsibility of distributing tasks to the various stockholders of the project and determining the project to a manager. The main role of the project manager was to ensure that each of the teams involved in the process was coordinated effectively for purposes of sustaining the project’s progress.

The Business and Product Development Manager, who also doubles up as the strategy manager for all new processes in the bank, has his role mainly focusing on the leadership of the organization as opposed to leadership in the organization (Boal and Hooijjberg, 2000, p. 551). This implies that as the strategic leader of the organization, the Business and Product Development manager’s main responsibilities include making strategic decisions about the reward program, creating and informing the future vision of the bank to the strategy teams, as well as developing critical competencies and capabilities. The other important roles of the strategy manager at the bank include developing structures of the bank that support the strategy process and managing various constituencies within the bank. As part of the strategy process, the strategy manager has to ensure that ethical value is maintained by the strategy teams as they undertake their roles (Boal and Hooijjberg, 2000, p. 551).

The project manager’s main responsibilities entailed defining the roles that each member of staff in the strategy team was to play. The project manager was also responsible for drawing the strategy timelines, ascertaining the deadlines for the Project Requirement Document (PRD) and the Project Initiation Document (PID). The project manager’s main focus during the process was to ensure that the bank’s resources, both human and social capital, were capable of matching its capabilities (Hitt and Ireland, 2002, p. 3). Thus, as the project manager determined the specific roles for each individual and sets deadlines, his consideration lay with the specific capabilities of the individual staff.

Both the PRD and PID offered the project manager the green light to approve the project and moving its implementation to the next step. The PRD captured all the needs necessary for the credit card loyalty program. This provided an opportunity for the project manager to compare the bank’s resources and the needs of the project to determine the project’s viability. Equally, the PID enabled the project manager to determine the actual means through which the bank could initiate the project effectively following its corporate objective.

The availability of both the PRD and PID provided the indicator to the project manager of the new product’s viability. The process had so far allowed the bank to visualize it theoretically but had not been fully developed to its physical existence. The next step involved moving the process to the IT department for electronic execution. The credit card reward program development by the IT entailed creating a single database with information about all the customers of the bank, including their account numbers, account types, their names, and their branches.

The individuals placed at the frontline of the strategy formulation process, mainly the business manager and the project manager involve the contributions of others as well in a bid to ensure that the strategy amplifies contributions by others in the organization. This helps the bank to achieve uniformity in the formulation and subsequent implementation of its strategies (McFarland, 2008, p. 71). Allowing the IT department and indeed all the other departments involved in the strategy process provides an opportunity for all the staff working in the departments to contribute directly towards the strategy formulation process. Their contributions are in particular useful to the bank because they mainly focus on their areas of expertise in which they have a clearer and deeper understanding.

The IT department’s main role included defining the actual developers for the credit card reward program. As part of the bank’s strategy on innovation, the IT department scanned the environment for purposes of identifying an external developer with the right opportunity. The highly competitive business environment has opened up opportunities for firms to establish social networks with external customers and suppliers. These networks enable them to develop product ranges capable of satisfying customer needs (De Witt and Meyer, 1999, p. 198). Thus, the idea by the IT department to seek external developers in creating the credit card reward program targeted to increase the opportunity for better performance.

The IT department ascertained the main requirements needed and offered advice to the project manager concerning the best-suited developers after critically examining the whole project. The main criterion adhered to by the IT department in determining the most appropriate developers focused on the aspect of time. Once the IT department ascertained the developers’ capability in terms of delivering the new product, it produced a timeline for the entire process to help in its effective delivery. These timelines were effectively communicated to the Business and Product Development Department for purposes of achieving uniformity in the whole design process.

The IT forwarded the finished product according to the timelines it provided after receiving it from the developers. The IT department analyzed it to ensure it conformed to the expectations of the bank before forwarding the finished product to the Business and Product Development Department. The analysis aimed to ensure that the new product idea would be easy to implement. The IT department’s analysis focused on its objective, scope, as well as the advantages that it added to the bank (Collins & Rukstand, 2008). After receiving feedback from the Business and Product Development Department concerning the product, the IT department proceeded to refine it even further. The finer details included by the IT department made it possible for the new product to be executable electronically.

Once the IT-enabled its electronic execution, the new product was once again forwarded to the Business and Product Development department to analyze its effectiveness in terms of realizing the corporate objective of the bank. The business department conducted tastes on the product and identified two areas that required some review because they both failed to achieve the intended target of the product. The IT department was forced to make the amends, particularly by inputting safety measures to ensure that the new product protected customer identity while it enhanced security against fraud. The initial instance of the product did not include a limit for the number of trials that clients had to make with their Identification Numbers. Both the business and quality assurance sections of the bank felt that this would allow fraudsters to take advantage of the situation, thus requiring the IT department to review it.

Doha Bank Qatar adopts a comprehensive approach in its strategy development process. Thus, the final product needs to be fully operational and acceptable by all the departments before implementation in the market. Following Rees and Porter’s (2006, p. 354) argument, this explains why the bank involved close management scrutiny in the entire process. Every time the departments were expected to analyze the progress of the product, the respective departmental managers took the leading role in conducting tests and giving suggestions where they felt the product lacked.

The final delivery after the business department and the quality assurance gave the project a nod was forwarding it to the Marketing Department. This step offered a chance to the marketing department to determine a marketing media plan that would be appropriate for a broadcast strategy. The marketing department particularly sought a Below The Line marketing (BTL), gauging on the viability of the project as a whole. The business design approved the marketing department’s choice of broadcast strategy and communicated the same to all the departments before the credit card reward program was launched officially by the bank. The entire project design and the launch were planned to last for 60 days, with the actual project design process taking exactly 55 days before its official launch.

Recommendation

The strategy process at Doha Bank Qatar is inclusive as it considers the input of several departments during the formulation and implementation stages. However, there is a need for the firm to increase participation in the process. Targeting departmental inputs may be too general as it may only focus on the departmental heads and a few senior individuals while failing to collect the contributions of other staff members. The organization should review this process by insisting on total participation by all the employees, including conducting intra-departmental meetings where all staff is encouraged to participate in a brainstorming session as they give their contributions to the entire strategy process. This will in turn enable the bank to collect comprehensive details. This translates to comprehensive alternatives as far as the strategy options are concerned.

The comprehensive approach to strategy that has been adopted by the bank needs a review. Although an alternative to this strategy, that is, the incremental strategy approach, does not necessarily harbor any advantages over the former approach, it is evident that it requires more effort and energy to succeed. The comprehensive approach to strategy is forcing the bank’s management to put in greater efforts and control to ensure that the strategy process initiated succeeds. However, the amount of pressure and expectation raised by this approach leaves little advantage for the bank because it is more demanding. As a remedy for these risks, the bank should instead adopt the incremental strategy approach. This will address the narrower range of practical specialists at the bank and eliminate the chances of the strategy team and its leadership underestimating the behavior complexities of the organization. In the long run, an incremental strategy approach will provide an opportunity for the bank to address the problem of a unitary perspective that ignores organizational conflicts of interest.

The strategy control technique that is adopted by the bank fails to fully address all the important areas of strategy. While there are adequate feedback channels aimed at getting communication from the customers, other important areas like financial, internal business process, and learning and growth are not covered adequately. In essence, it is difficult for the bank to register overall positive performance unless it puts into place control measures in the other three critical areas of strategy. This will help in the effective achievement of the bank’s vision and strategy.

Conclusion

The strategy is an elaborate plan that ensures an organization can face the future with the hope of achieving its objectives. The formulation of strategy depends on the leadership of an organization and its ability to think strategically. The chief executive at the company must be able to visualize the company’s future and come up with plans that seek enhancement of the company’s position and performance even further.

Doha Bank Qatar involves all its major departments in the strategy formulation process. These departments include the Business & Product Development Department, Marketing Department, Information Technology Department, Sales Unit, and the Marketing Agency. The business manager, who heads the business department, also doubles up as the strategy manager. However, the project manager, who is assigned to his role by the business manager, manages the majority of the strategy formulation roles.

List of References

Aghion, et al. 2005, ‘Competition and innovation: an inverted-U relationship’, The Quarterly Journal of Economics, vol. 120, no. 2, pp. 701-728.

Boak, G 2010, An introduction to corporate strategy. Lecture Notes.

Boal, KB & Hooijjberg, R 2000, ‘Strategic leadership research: Moving on’, The Leadership Quarterly, vol. 1, pp. 515-550.

Capon, C 2008, Understanding strategic management, Pearson Education, Harlow.

Chan, YCL 2007, ‘Cascading a clear focus’, CMA Management, vol. 81, no. 6, pp. 28-32.

Collins, J & Porras, G 2002, Built to last: Successful habits of visionary companies, Harper Business Essentials, New York, NY.

Collins, J 2001, Good to great: Why some companies leap… and others don’t, Harper Business, New York, NY.

Collis, DJ & Rukstad, MG 2008, ‘Can you say what your strategy is?’ Harvard Business Review, vol. April, pp. 82-90.

Covey, S 1994, The seven habits of highly effective people, Simon & Schuster, London.

Damanpour, F 1990, ‘Innovation effectiveness, adoption and organizational performance’, In M.A. West & J.L. Fan Eds., Innovation and creativity at work. Psychological and organizational strategies pp. 125-141, John Wiley & Sons, Chichester, UK.

Davila, T, Epstein, MJ, Shelton, R & Shelton, RD 2006, Making innovation work: to manage it, measure it, and profit from it, Wharton Scholl Publishing, Upper Saddle River, NJ.

De Witt, B & Meyer, R 2005, Strategy synthesis: Resolving strategy paradoxes to create competitive advantage, 2nd edition, Thomson Learning, London.

Garratt, B 2003, Thin on top: Why corporate governance matters and how to measure, and improve board performance, Nicholas Brealey Publishing, London.

Hamel, G 1998, ‘Strategy innovation and the quest for value,’ Sloan Management Review, vol. 39, no. 4, pp. 8-8.

Hamel, G & Prahalad, C 2005, ‘Strategic intent’, Boston Harvard Business Review, vol. 83, no. 7/8, pp. 148‐161.

Hitt, MA & Ireland, RD 2002, ‘The essence of strategic leadership: Managing human and social capital’, Journal of Leadership and Organizational Studies, vol. 9, pp. 3-14.

Johnson, G, Whittington, R & Scholes K 2011, The practice of strategy from exploring strategy: Text and cases, Pearson Education Ltd, Harlow.

Kanter, RM 2008, ‘Transforming Giants: What kind of company makes it its business to make the world a better place?’ Harvard Business Review, vol. January, pp. 43-52.

Kaplan, RS, & Norton, DP 1992, ‘The balanced scorecard – Measures that drive performance’, Harvard Business Review, January-February, pp. 71-79.

Kaplan, RS, & Norton, DP, 2005, ‘The office of strategy management’, Strategic Management, vol. 87, no. 4, pp. 8.

Lunenburg, FC 2012, ‘Organizational structure: Mintzberg’s framework’, International Journal of Scholarly, Academic, Intellectual Diversity, vol. 14, no. 1, pp. 1-7.

McFarland, KR 2008, ‘Should you build strategy like you build software?’ MIT Sloan Management Review, vol. 49, no. 3, pp. 69-74.

Nadler, DA 2004, ‘What’s the board’s role in strategy development? Engaging the board in corporate strategy’, Strategy and Leadership, vol. 32, no. 5, pp. 25-33.

Pfeffer, J & Sutton, R 2006, Hard facts, dangerous half-truths and total nonsense, Harvard Business, Boston, MA.

Porter, ME 1985, Competitive advantage: creating and sustaining superior performance, Free Press: New York, NY.

Rees, WD, & Porter, C 2006, ‘Corporate strategy development and related management development: the case for the incremental approach, part 2 – implications for learning and development’, Industrial and Commercial Training, vol. 38, no. 7, pp. 354-359.

Sarrazin, J 1981, ‘Top management’s role in strategy formulation: A tentative analytical framework’, International Studies of Management and organization, vol. XI, no. 2, pp. 9-23.

Senge, PM 1990, The leader’s new work: Building learning organizations, Harvard Business Publishing, Boston, MA.

The Higgs Report, July 2003, ‘The Combined Code. 2. 3’, Internal control: Revised guidance for directors on the combined code, Financial Reporting Council, London.

Thompson, A et al. 2010, Crafting and executing strategy: The quest for competitive advantage, 17th ed., McGraw‐Hill, New York, NY.

Yukl, G 2002, Leadership in organizations, 5th edn, Prentice Hall, Upper Saddle River, NJ.