The UK automotive manufacturing Industry

The statistics show that the international manufacturers of engines have a higher tendency of locating their car manufacturing plants in the UK than other nations (Jones & Zoppo 2013). In addition, they indicate that the UK market for the electric car engines is higher than the market for the commercial vehicle engines because the number of carmakers is many when compared to the makers of commercial vehicles (Robinson 2014).

In addition, the statistics indicate that the number of brands in the UK market is higher than the number of commercial brands manufactured in the same industry per annum (Robinson 2014). Therefore, it is likely that the probability of selling a large number of electric cars is higher than the probability of selling commercial electric vehicles (Robinson, 2014). In addition, the statistics indicate that the UK market is defined by an increasing preference for electric cars while the market for the market of the electric engines for a commercial purpose is also increasing albeit slower than that of the car market (Robinson 2014).

Moreover, apart from Alexander Dennis and the Land Rover Company, all other manufacturers are foreign corporations, mainly from Japan, other parts of Europe and the United States (Robinson 2014).

In total, the UK automotive sector produces about 1.5 million cars and commercial vehicles per annum (Robinson 2014). In addition, more than 2.5 million engines are produced every year (Robinson, 2014). The automotive sector earns more than £50 billion in terms of annual turnover, which is injected in the national economy (Robinson 2014). In addition, the industry brings more than £10 billion in terms of value-added tax every year (Robinson 2014). It also employs more than 730,000 people directly or indirectly. The industry accounts for more than 10% of the country’s annual exports and over £1.3 billion in terms of R&D (Robinson 2014).

The country hosts a number of automobile manufacturers that produce vehicles in large masses (Robinson 2014). About 7 volume car manufacturers, 8 makers of commercial vehicles, 11 producers of buses and coaches and more than 100 manufacturers of premium, niche and specialist cars are located in the country (Robinson 2014). In addition, the country hosts a number of components and spare makers.

In 2012 alone, the country’s car manufacturing exported more than 1.2 million cars, an increase of more than 8% from the previous year (Robinson 2014). In fact, statistics indicate that this is the highest amount of car products to be sent to the international market in the country’s history (Robinson 2014). Similarly, the country’s total output for vehicle production increased by more than 8% in 2012 to about 1.58 million sales (Robinson 2014). The car output increased to 1.45, indicating an increase of more than 9% per annum (Robinson 2014).

The largest plants for engine production and output are located in various parts of the country (Robinson 2014). However, most companies are concentrated in England and Wales (Anderson & Anderson, 2011). In addition, it is worth noting that most of the companies are foreign to the UK, most operating manufacturing plants in the country under normal business methods such as franchising, strategic partnerships and direct entry into the market (Robinson 2014).

In addition, the distribution of the UK automotive manufacturing by the type of brands, brand model and models per annum indicates that different manufacturers prefer different models in order to target specific market segments in the country. For instance, in 2013, the number of car brands produced by each of the major manufacturing plants indicates that the leading corporations have specific tastes and preferences within the market (Plunkett 12). The statistics and analysis below describe these differences in details.

Ford Motors

Currently, the American giant Ford is the largest producer of electrical products in the UK. In particular, it focuses on producing Ford Dagenham and Ford Bridgend engines. In 2012, it produced about 812,791 Dagenham and 741,754 Bridgend engines (Robinson 2014).

BMW Motors

The German giant BMW and Honda are also important producers of engines in the UK market. In 2012, BMW made more than 385,400 BMW Hams Hall engines.

Honda Motors

About 154,228 Honda Swindon engines were produced at the Honda plant in the UK (Robinson 2014). In terms of the type of car brands produced, Honda produced more than Honda 138,812 products in 2014 (Robinson 2014). However, the number of car models produced per annum was significantly lower than Toyota, Nissan and Ford. Honda’s number of cars by model produced per annum was relatively small compared to Nissan and Mini. In addition, its production of commercial vehicles is insignificant (Robinson 2014).

Toyota UK

Toyota has established a heavy presence in the UK market since it entered the country in 1992. Its production plants are located in various parts of the country depending on the type of products involved. For instance, the vehicle production plants are located in Derby, Derbyshire and Burnsaton while the engine manufacturing plants are located in Deeside Industrial Part in Flintshire, North Wales (Robinson 2014).

In the same year, the Japanese companies Toyota and Nissan produced 124,241 and 267,839 engines in the UK (Robinson 2014). Toyota was concentrating on making and marketing the Toyota Deeside. In terms of the type of car models produced, Toyota had 179,233 products that year, making it the third-largest producer in this category (Robinson 2014). In terms of the cars produced per model, Toyota’s Auris model accounted for about 16% of the total products that year, lagging behind Nissan Juke, Mini and Qashai (Robinson 2014).

Nissan UK

Nissan was the largest producer of cars by brands with more than 500,000 products. In the same period, it produced Nissan Sunderland car models that occupied s relatively smaller section of the UK market compared to Ford and Toyota cars (SAE 2012). Nissan was the leading producer of the products by model volume, registering an annual production of more than 33% (Nissan Qashai). In terms of cars produced per model, Nissan had more models than any other company in the UK market. For instance, the Nissan Juke and Nissan Qashai took about 49% of the total car models produced that year. Nissan Juke occupied 17%, while Qashai occupied 33% of the total car models produced in 2014 (Robinson 2014).

Bentley

Bentley’s position in the production market was also significant, with the company making more than 9,000 Crewe engine models in 2012 (Robinson 2014). However, the company lagged behind others in the categories of models per annum. In addition, it does not deal with commercial vehicles, unlike its major competitors such as Ford and Land Rover (Toliyat & Kliman 2014).

Land Rover Company

The Land Rover Company produced over 340,000 cars in 2014, making it the second-largest producer by the number of car models (Robinson 2014).

Mini

The company produced Mini 174,997 in terms of the number of car bards per annum. In addition, followed by it produced 20% of the total number of commercial vehicles using an electric powered engine that year (Robinson 2014).

Vauxhall

Vauzhall was the largest brand in terms of production, taking more than 525 of the total number of commercial vehicles produced in the country. It outdid other major companies such as DAF, Ford, Land Rover and Alexander Denis in plenty in 2013.

The UK Manufacturers of the Electric Vehicles and Hybrid Drive Systems

The production of the Electric Vehicles and the hybrid drive systems (EVHDS) is a major focus for this analysis because MSF’s main target market are the companies that specialize in this line of production. The UK EVHDS production industry is of significant importance to MSF Technologies, which means that an in-depth analysis of the market is important. Statistics obtained in 2013 indicate that UK’s EVHDS production industry is dominated by a handful of large corporations that have adopted the new technology and are focusing on the growing market for the products. The companies own and operate factories in various parts of the country. For instance, the leading plants in the manufacture of electric motors are Vauxhall, Honda, Toyota, Ford and Nissan (Robinson 2014).

Vauxhall UK

Vauxhall Motors is a subsidiary of the Vauxhall Corporation, a part of the GM motors that specializes in car manufacture in various parts of Europe. Its factory produces electric motors for cars.

Toyota UK

Toyota Manufacturing UK (TMUK) is a subsidiary of the International of Japan, which operates on the international market as the leading producer of car models in the world. In this category, the company produces electric motors for small cars.

Honda

Honda owns the Honda of UK manufacturing, which also produces electric motors for small motor vehicles in the UK (Robinson 2014).

Ford

The American giant Ford Motors Company operates has some major plants in the UK owned and operated by the mother company. In the UK, the company owns a factory that produces electric motors for small vehicles.

Nissan

The Japanese giant manufacture Nissan operates the Nissan Motor Manufacturing UK (NMUK), a subsidiary of the mother company. Like the other large corporations, Nissan Motor Manufacturing UK produces electric motors for small vehicles.

Lotus Cars

Lotus is one of the only two companies that own factories for the production of Powertrain the UK market. It is a generally new venture, which explains why major manufacturers have not attempted to invest in this product category.

McLaren Mercedes

Like Lotus, McLaren Mercedes has invested in the production of Powertrain, which is powered by an Electric Vehicles and Hybrid drive System. In the UK, the Mercedes and Lotus are the only producers of this system.

Electric vehicle registration in 2014

An important aspect of this research is the volume of motor vehicles registered per annum in the UK. An analysis of the number of the registration of the new cars will provide MSF Technologies with a good and effective overview of the rate of market growth, the growth patterns and the expected market growth and direction in the future (Leitman 2014). Therefore, the analysis will provide the company with a good basis for developing effective strategies for enhancing its presence in the UK’s market for the gadgets designed specifically for the electric car products (Jones & Zoppo 2013).

Registrations for Hybrid petrol-electric

In 2014, the numbers of new registrations for vehicles indicated that the petrol-electric hybrid cars are the most popular choice for most UK consumers.

Registration for pure electric cars

The rate of registration for pure electric cars has grown by more than 100% between 2013 and 2014 (Robinson, 2014).

Hybrid-petrol/electric cars

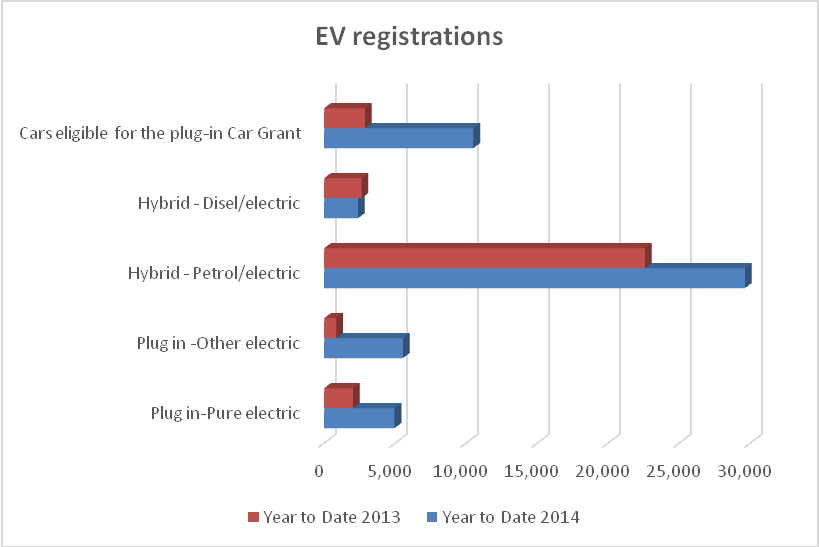

The EV registration graph for 2013 and 2014 indicates that the hybrid-petrol/electric cars were about 22,500 in 2013 but rose to 28,000 in 2014 (Robinson 2014).

Plug in-other electric cars

The plug in-other electric cars registered in the same period rose from less than 2,000 in 2013 to more than 5,000 in 2014 (Robinson 2014).

Plug in-pure electric cars

The registration of these car types rose from 2,000 to more than 4,000 per annum (Leitman 2013).

Registration of cars eligible for the plug-in

This category of vehicles experienced a rapid increase in registrations by rising from 3,000 in 2013 to more than 10,000 in 2014 (Robinson 2014).

Registration of hybrid-diesel/electric vehicle brands

The market for hybrid diesel/electric vehicle brands is not promising due to the slow growth rate. In fact, this category experienced a negative growth rate between 2013 and 2013, with the number of vehicles registered in 2014, dropping from 3,000 in 2013 to about 2300 in 2014 (Robinson 2014).

Conversion of existing vehicles

A major factor that favours the increase in the number of vehicles using the electric system in their engines is the technology for converting the existing mo0tor vehicles in order to make them diesel/petrol-electric hybrid systems, which allows users to use fuel or electricity (Robinson 2014). The technology has enhanced the market for the manufacturers of the gadgets and other items used in the hybrid engine systems (Husain 2013). MSF Technologies will focus on this market in order to expand the scope of its target market segments (Robinson 2014). In the UK, a number of companies are involved in the supply of materials and equipment needed to convert the existing vehicles to hybrid systems.

Allied ZEV

Allied ZEV is involved in the industry, where it offers a wide range of large and small commercial vans that are powered by lithium-ion batteries developed under the latest technologies. A good example of such an electric vehicle is the Ansaldo vans and minibuses (Toliyat & Kliman 2014).

The Modec Company

This company is a British corporation based in Coventry, has been producing vans powered by DC-motor engines since 2007.

Smith Electric Vehicles

Smith Electric Vehicles Company an important producer in the industry. It was founded in North England in 1920 before moving its location to Kansas City (Anderson & Anderson 2011). It supplies converted vehicles, especially trucks, which are powered by the Smith Drive systems.

Steven’s Vehicles Company

This is a manufacturer and supplier of converted cars and vans powered by twin AC induction maintenance-free and brushless electric engines. ZeVan is the company’s flagship product. It is about 1.3m long, 1.76m high and about 1.5m in width (Robinson 2014). The organization has recently been formed, but it has gained a substantial percentage of the national market.

Alexander Dennis

Alexander Dennis is the largest manufacturer of coaches and buses in the UK is also involved in the conversion industry, where it produces and sells converted coaches for public and private use. It is also found in the continental Asia and North America, especially in the US and Canada. The company produces coaches powered by the BA System’s Hybrid Drives after conversion.

Product advantages

A major aspect of consideration when determining the strategies to use in supplying products in the UK and European markets is the set of factors that makes the product more effective than those already in the market (Husain 2013). An in-depth analysis of these factors is likely to lead to the development of the most effective competitive advantage in order to compete effectively and continuously in the new market (Husain 2013).

MSF Technologies has developed the MSF Drive system that will offer a number of advantages to the users compared to the rival products in the market. For instance, the drive system will have an advantage to the consumers because its efficiency is raised by 30% above the normal systems in the market.

In addition, its weight is reduced by 30% compared to the products in the market, which means that it meets the needs of the consumers.

Moreover, consumers will find it important because it has the capacity to reduce the cost of operation and maintenance by 20% compared to products from competitors. In addition, the product’s cost of operation and maintenance will be reduced by more than 40% compared to the conventional fuel powered systems, which makes it effective not only in personal cars, but also in commercial vehicles.

A major advantage of MSF Drive System is the fact it is a “green” energy consumer. In the western world, especially Europe, the awareness of the need to reduce carbon emission is relatively higher than in other parts of the world (Jones & Zoppo 2013). Moreover, a more than 2 decades of an intensive debate for the reduction of the amounts of carbon emission and the harms associated with global warming have seen many people develop the desire to be part of the society that is applying some efforts to solve the problem (Abrahamson, E & Rosenkopf 2007). In particular, people are looking for technologies that will make them fit in this group.

The electric powered drive system is an example of such a product, which has also created “technological fads” that are increasingly making people “jump into the technological or innovative bandwagon” without the need to carry out in-depth analysis of the product’s advantages (Abrahamson, E & Rosenkopf 2007).

Therefore, the MSF Drive System will take the market advantage created by the movement towards green energy consumption and develop a sustainable competitive advantage because it has the capacity to meet the consumer demands.

In the market system, MSF Technologies will achieve a competitive advantage because the new drive system has the potential to remove the risk created when using rare earth materials, which are relatively expensive. In addition, such materials face frequent price and demand shifts, which affect the companies dealing with engines that use them.

MSF Technologies has developed an effective technology for the MSF Drive System in order to increase the profitability of firms and individuals using them in their vehicles. In this case, both the customers and the company (MSF Technologies) will have an advantage over those that use other drive systems.

References

Abrahamson, E & Rosenkopf 2007, “Social network effects on the extent of innovation diffusion: a computer simulation”, Organizational Science vol. 8, no. 3, pp. 289-309.

Anderson, C & Anderson, J 2011, Electric and Hybrid Cars: A History, McFarland, New York.

Beretta, J 2013, Automotive Electricity: Electric Drive, John Wiley & Sons, Hoboken, NJ.

Goldscheider, R & Gordon, AH 2011, Licensing Best Practices: Strategic, Territorial, and Technology Issues, John Wiley & Sons, London, UK.

Gruden, D & Berg, W 2013, Traffic and Environment, Springer, New York.

Husain, I 2013, Electric and Hybrid Vehicles: Design Fundamentals, CRC Press, New York.

Jones, KB & Zoppo, D 2013, A smarter, greener grid: Forging environmental progress through smart energy and technologies, ABC Press, New York.

Krishnan, R 2014, Switched reluctance motor drives: Modeling, simulation, analysis, design and applications, CRC Press, New York.

Leitman, S 2014, Build Your Own Plug-In Hybrid Electric Vehicle, McGraw Hill, London.

Plunkett ,JW 2012, Plunkett’s Automobile Industry Almanac: Automobile, Truck and Specialty, Plinkett Research Ltd, London, UK.

Robinson, A 2014, Overview of UK Motor Industry, SMMT, London.

SAE 2012, Vehicle electrification: So11 Nissan vehicle overleaf, SAE, London.

Toliyat, HA & Kliman, GB 2014, Handbook of Electric Motors, CRC Press, New York.