Executive Summary

Individuals and organisations should engage in activities that are viewed to promote environmental sustainability. The reason behind this is to ensure their survival, as well as that of their future generations. Increasing levels of greenhouse gases emitted into the atmosphere has mainly been attributed to industrial processes in the modern world. Motor vehicles and other machines are also major emitters of these gases. Carbon dioxide is the most commonly encountered of these harmful elements. It is produced in large quantities, especially in industrialised countries and localities. The main reason for this is that it is contained in most fuels produced today.

Increased emission of the gas into the atmosphere results in the depletion of the ozone layer above the earth surface. The result is the penetration of harmful ultraviolet radiations from the sun. The situation makes many people suffer from skin cancer and other ailments. Many people across the globe have also developed eye problems owing to these developments. Global warming resulting from the accumulation of carbon dioxide has also led to the melting of ice caps on mountains and in the Polar Regions. Consequently, there has been a rise in sea levels.

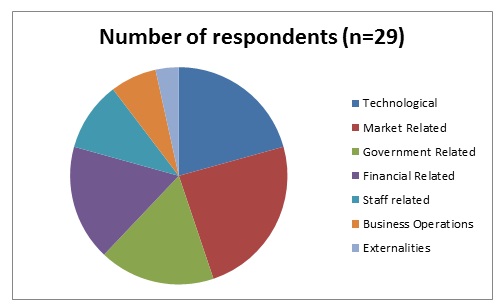

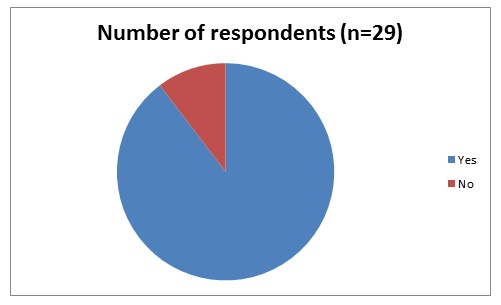

A number of measures have been adopted to manage the problem. They include, among others, promotion of the use of environmentally friendly components, such as bio-fuel. In this paper, the author analysed the use of carbon taxes to mitigate the problem. It is viewed as one of the most effective ways used by governments and other stakeholders to eradicate the problem. It entails levying taxes based on the carbon content of a product. As such, environmental sustainability is achieved. As a result, products with high levels of carbon attract higher taxes and vice versa. In this research, it was found that most organisations in Australia have strategies in place to promote environmental sustainability. However, some feel that it is the responsibility of the government to promote environmental sustainability. A number of factors affect entities in their attempts to bring down emission levels. They include technological issues, market, government, staff, business operations, as well as externalities. Majority of businesses in the country also feel that carbon taxes are effective in promoting environmental sustainability.

The current research found that social cost of carbon is one of the best parameters to determine the rates to be charged. The reason behind this is that it estimates the cost of the negative effects associated with emission of the gas. However, carbon taxes alone cannot be effective in addressing the issue of rising emission levels across the globe. The reason behind this is that the implementation of such regulations in one country results in carbon leakage. Consequently, the author recommends the use of border adjustment tariffs and bans alongside carbon taxes. The move has been associated with high success rates. The reason is that the strategy forces all countries to have emission regulations in place. Unfair competition is, therefore, discouraged. Petroleum products are also a major cause of pollution. Their taxing will be effective in promoting environmental sustainability.

Introduction

Background Information

Environmental sustainability involves making decisions and engaging in activities aimed at protecting nature (Swor & Canter 2011). Emphasis is often placed on preserving the earth’s capability to support life. Today, the subject has gained widespread popularity around the world. Governments across the globe are engaging in activities to promote a clean and healthy environment. They are encouraging their people to embrace ‘green’ technology and other measures that are friendly to the environment. People have become more aware of the impact human and industrial activities have had on the environment. Environmentalists have always associated the term with responsible behaviour. To this end, people are expected to take note of the effect of their activities on the surroundings. For example, they are made aware of the harmful impacts of using fossil fuels and polluting the environment. Consequently, they should adopt measures to reduce the adverse effects of their actions. In most cases, such activities involve the reduction of the amount of waste generated. Using less energy is also a step towards promoting sustainability in the modern world.

Over the past number of years, governments and environmental agencies have conducted extensive research on the issue of environmental pollution and sustainability. Billions of dollars have already been spent on such programs. Most of the research work is aimed at assessing the impacts of human activities on the environment. However, it has not been possible for researchers to establish the long-term effects of such undertakings. The reason is that quantification of these effects is hard. However, there is a consensus among stakeholders across the globe that the risks are serious enough to prompt immediate response (Robson 2014).

The issue of environmental sustainability has also become one of the most sought after subjects in ecological economics around the world (Robson 2014). Research has shown that increasing economic activities are to blame for the continuous environmental degradation. Businesses and other commercial establishments are seen to have contributed to these environmental issues through various activities. All the undertakings, however, eventually translate to the accumulation of greenhouse gases, which is trapped in the earth’s atmosphere. Of primary concern to environmentalists and other stakeholders is the unsustainable use of water resources. It is most evident through activities, such as overfishing in lakes, oceans, as well as rivers. Fish and other aquatic flora and fauna play a significant role in promoting biodiversity in water resources (Conefrey et al. 2013). Their waste improves the fertility of water, hence enhancing the growth of water plants. The plants play a role in the reduction of carbon, one of the greenhouse gases. Businesses have also been seen to dump their waste into water bodies. Water resources are immense, which makes them ideal for waste disposal by establishments, such as factories (Conefrey et al. 2013). The most common forms of waste disposal into water bodies include the draining of industrial effluent, as well as oil spills by shipping companies transporting cargo around the world. The two also hinder the growth of water plants, leading to the accumulation of carbon in water and, eventually, in the atmosphere.

Businesses have also played a role in the degradation of the environment through the clearing of vegetation. The practice is often aimed at creating space to support economic activities (Backus 2012). For example, vast tracts of virgin forest are cleared for the construction of industries. Others are cut down to plant industrial inputs, such as palms. Farmers play the biggest role in the destruction of vegetation. They clear grasslands, shrubs, and trees to create room for crops. Businesses, especially those in the construction sector also target forests for trees. They engage in logging activities for the production of timber and poles (Backus 2012). In so doing, they lead to the accumulation of greenhouse gasses.

The reason behind this is that trees play an important role in the absorption of carbon dioxide from the atmosphere during photosynthesis. At the same time, they give off oxygen gas, which is vital in promoting human existence (Haugen 2010). Burning of fossil fuels has also been blamed for environmental degradation. The continued use of these energy sources has over the past years raised serious environmental and health concerns. They are the largest sources of carbon dioxide in our environment today. Annually, an estimated 21.3 billion tons of the gas is released into the environment following the burning of fossil fuels (Haugen 2010). Natural processes can only absorb half of this amount. As a result, there is an annual increase in the quantity of carbon dioxide circulating in our atmosphere of close to 10.65 billion tonnes. Over the past number of years, businesses have been seen to act with little regard for the adverse effects their activities have on the environment.

It is clear that we are using our environment in an unsustainable manner. As such, we need to look beyond the short-term gains of our economic undertakings. We should seek to find long lasting solutions to safeguarding our natural world (Swor & Canter 2011). Intensive research on the issue has provided nations with valuable information on the harmful effects associated with the emission of pollutant gases. More emphasis has been put on greenhouse gases. They are the most feared when it comes to environmental degradation. They produce the greenhouse effect, which results in the exhaustion of the ozone layer (Metcalf 2008). As a result, ultraviolet rays from the sun are capable of penetrating into the earth surface. Consequently, many cases of skin cancer are reported among the world’s population. It has also resulted in damage of human eyes. As a result, nations across the globe have to set aside vast sums of money to cater to the medical needs of persons suffering from these health disorders. People across the world also have to cope with the loss of loved ones as a result of cancer. Due to the depletion of the ozone layer, sunburns have also become more severe (Metcalf 2008). People have to incur more costs protecting themselves from sun burns.

Animals are not spared either from the adverse effects of the depletion of the ozone layer. Whales have been seen to be the most affected (Das 2011). Skin biopsies have shown evidence of severe sunburns among whales residing in the Gulf of California. The effect of the destruction of the ozone layer has also been felt by farmers across the globe. Many plant species rely on bacteria for nitrogen fixation and retention. One such crop is rice. It relies on Cyanobacteria for its nitrogen requirements (Deane 2011). The bacterial species has however been found to be extremely sensitive to ultraviolet rays. As a result, increased radiation levels from the sun will lead to the death of the bacteria. The supply of food for human consumption will, consequently, go down.

At the same time, melting of ice caps especially in the arctic regions has been reported following global warming. It is a change in the climate characterised by an increase in temperatures (Haugen 2010). It is also associated with increasing levels of greenhouse gases. Carbon dioxide is the most responsible for bringing about the change. The effects are detrimental, especially for tourism. Nations have continued to lose a lot of money following declining tourism activities. The ice caps were formerly a tourist attraction in many countries that have high mountains (Swor & Canter 2011). Their melting means that no tourists are willing to visit such destinations. An increase in the levels of greenhouse gases in the environment has also been found to result in the formation of acid rain. As a result, farming has been negatively affected. Many food crops can no longer do well as was the case several decades ago. Developed countries have been the worst hit with their carbon emissions being reported higher compared to those of developing nations (Haugen 2010). Acid rain has also led to the corrosion of surfaces. Buildings have been the most affected. A lot of money is therefore spent in the maintenance of such structures.

To deal with the greenhouse gas menace across the world, governments have come up with ways to reduce their emission. Carbon dioxide is the most emitted of all the greenhouse gases (Metcalf 2008). It is mainly released as a result of burning of products that contain carbon. One ton of atmospheric carbon translated to the production of 3.7 tons of carbon dioxide gas (Hsu 2011). One of the concepts that have been developed to deal with the menace is the introduction of carbon taxes (Metcalf 2008). Many governments around the world including that of Australia have adopted the concept. Carbon taxes are mainly levied on fuels. The amount of tax levied per product depends on its carbon content. It is also viewed as a form of carbon pricing. All hydrocarbon fuels are undergoing this kind of taxing. They include natural gas, coal, and all petroleum products. The carbon contained in them is released into the atmosphere when they undergo combustion. The taxing of the fossil fuels can be done at any point of the production cycle (Hsu 2011).

Problem Statement

Carbon taxes offer governments a cost-effective means of reducing the emission of greenhouse gasses. Usually, governments assess the adverse effects that the emission of the greenhouse gases cause. The amount of money taxed on carbon should reflect on the negative consequences of these emissions (Metcalf 2008). It can also be described as a Pigovian tax. It is a form of tax applied to market activities that are viewed to have unfavourable outcomes (Aizenman 2009). The justification for the levy is to correct a particular inefficient outcome. The tax should be equal to the social cost associated with the adverse market activities. If the fees are not properly put in place to match the social cost, the market activities will not be successful (Howarth et al. 2014). Taxing of market activities tends to hinder production activities. The reason behind this is the increased cost of production owing to taxation. As such, it may have a detrimental effect on economic growth. The Pigovian tax also results in an increase of goods and services in a particular sector. As such, they become less desirable to consumers. However, it does not always negatively impact on production. The petroleum industry is a good example. Despite the taxing of the petroleum products, they are still produced on a continuous basis. The main reason behind this is the importance of the sector to world economies. Petroleum products also do not have close substitutes (Jerry 2009). As such, the industry continues to thrive despite the hefty taxes imposed.

There have also been concerns that carbon tax creates inequality. It has been described by some as a regressive tax. It includes levies that decline with a rise in the target product (Green 2008). The result is that the average rate of taxation exceeds the marginal tax. As a result, a heavier financial burden is placed on the poor compared to the rich. The relationship between the tax rate and the ability of the population to pay is inversely proportional. Such a scenario should only be observed where the poor have more chances of causing the adverse activity as opposed to the wealthy (Green 2008).

When addressing the issue of the increasing accumulation of greenhouse gases, such a tax could apply in a scenario where the activity in question is likely to be most conducted mostly by the poor. Such activities include charcoal burning and logging of trees. However, regressive taxes tend to be ineffective if it is, in fact, the wealthy who are engaging in the activity being controlled. Fossil sources of energy are major sources of the greenhouse gases. Big multinational companies are involved in most processes involved in their production. They produce in bulk and sell to smaller players in the sector. Regressive tax, in this case, will not be helpful. The reason behind this is that the tax regime will tend to encourage the production of more amounts of the controlled substance by the multinational company to further lower the marginal tax rate (Metcalf 2008). As a result, the tax regime will be viewed to encourage the emission of carbon dioxide.

A carbon tax is not imposed on actual emission of greenhouse gases. The reason behind this is that it would be difficult to quantify the gases reported. Most businesses may also not be willing to disclose the real amount of greenhouse gases that they emit into our atmosphere (Barclay 2012). As a result, many countries tend to tax based on carbon content. With information on the carbon content of products produced, governments can be able to estimate the environmental effect. The form of taxing has prompted players in the sector to produce low carbon fuels and products. It has also prompted the development of technologies that aim at reducing the energy requirement of systems (Elliot et al. 2010). The use of less energy, in this case, means that less carbon containing fuel will be burnt.

Consequently, lesser amounts of greenhouse gases will be released into the atmosphere. Other countries have resulted in the taxation of energy products and motor vehicles. Organisation for Economic Co-operation and Development member states endorse this form of taxing. Motor vehicles are seen to be the greatest sources of greenhouse gases (Green 2008). With a growing middle-income class across the globe, the number of motor vehicles is set to increase. As a result, the emission levels of greenhouse gasses will also be on the rise. The form of taxing was also found to encourage automobile manufacturers to embrace green technologies (Green 2008). As a result, there has been an increase in the production of hybrid and electric cars. Motor vehicles that emit lesser amounts of carbon dioxide are taxed less compared to heavy emitters.

Carbon taxes have been associated with a lot of successes. They have helped in the reduction of carbon dioxide emissions across the globe. However, there have been various harmful effects associated with the taxes levied by the government and other authorities. For example, there have been growing concerns that the imposition of carbon tax leads to the loss of jobs (Elliot et al. 2010). The situation is mainly contributed to by the increase in the cost of production. As a result, businesses must look for means to cut down on expenses. Downsizing is one of the most effective ways to achieve this. As a consequence, many people tend to lose their jobs. Such a situation is detrimental to the economy of many countries. In the process, many people depend on aid from the government.

Carbon taxes also tend to affect production activities in an adverse way. Through increased taxation, companies tend to reduce their production levels. As a result, fewer commodities will be available in the market. For example, carbon taxes have been seen to be one of the biggest hindrances to the production of motor vehicles. The reason behind this is that many governments across the globe have resulted to taxing them to cut down on greenhouse gases. With the taxation of fossil fuels, production activities have been further hindered (Strand 2013). Most manufacturers tend to use it as a source of energy. An increase in its prices means that many producers are discouraged from creating products. As a result of the shortcomings highlighted above, many developed countries have been observed to be shying away from carbon taxes. China, USA, and Russia have been seen to offer the most resistance to the move to impose carbon taxes (Strand 2013). They have continued to use carbon resources extensively.

Despite the increased popularity of carbon taxes across the world, the rate of accumulation of greenhouse gases has continued to rise. As a result, severe effects of climate change have continued to be felt across the globe (Jeffers 2010). Some environmentalists have expressed concern that carbon taxes have been compromised. Governments have viewed them as a source of revenue as opposed to a means to avert the harmful effects of the accumulation of greenhouse gases (Conefrey et al. 2013). For this reason, many ecologists feel that the objective has been lost. Many governments have also lost the motivation to reduce carbon dioxide emissions in their jurisdictions. They view carbon taxes as a hindrance to economic development. They feel that the revenue generated through the collection of the taxes cannot compensate for the income lost (Morozov 2012).

Significance of the Current Study

No research has also been in a position to demonstrate clearly to the world leaders the long-term impact of increasing carbon emissions. As a result, only the short-term effects are known to the global population. Few researchers have also sought to determine whether or not carbon taxes are still successful ventures capable of promoting environmental sustainability. The research was aimed at bridging this information gap. The researcher made efforts to establish the effectiveness of imposing carbon taxes in ensuring sustainability.

Research Questions

The researcher was guided by one major research question and four specific questions.

Major research question

How effective are carbon taxes in the promotion of environmental sustainability?

Specific research questions

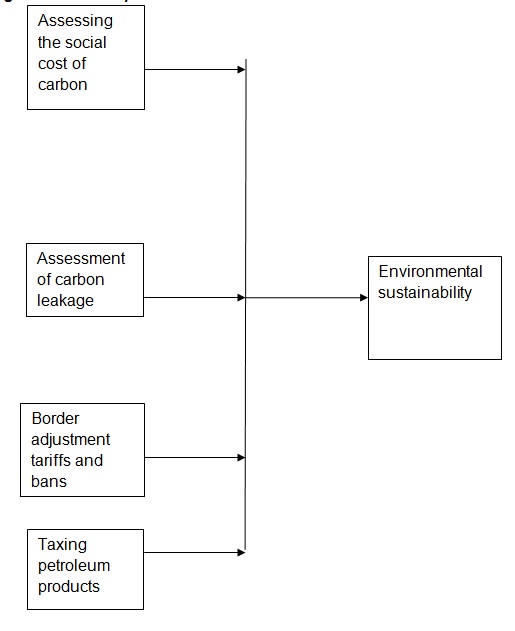

- How is the social cost of carbon effective in enhancing environmental sustainability?

- How does the assessment of carbon leakage promote environmental sustainability?

- How feasible is the use of border adjustment tariffs or bans in promoting environmental sustainability?

- How effective is taxation of petroleum products in enhancing environmental sustainability?

Objectives of the Study

The study sought to achieve various targets. The goals were in line with the research questions. To this end, answering the research questions was adequately addressing the goals of the research undertaking. To begin with, the researcher set out to critically investigate the extent to which assessing the importance of social cost associated with carbon dioxide in ensuring environmental sustainability. The research also sought to analyse the effectiveness of assessing carbon leakage in promoting environmental sustainability. The extent to which the use of border adjustment tariffs is vital in promoting environmental sustainability was also critically evaluated. The researcher also sought to establish the efficacy associated with the taxation of petroleum products with the aim of promoting environmental sustainability.

Literature Review

Introduction

The chapter is used to present a review of the existing literature on carbon taxes. It is also used to assess the role played by the levies in enhancing sustainability. The information collected was presented in two forms. The two are theoretical and empirical review. The review of literature was both descriptive and analytical. The researcher sought to summarise the literature available on the subject. Efforts were also made to cite the existing information gaps on the issue.

Theoretical Review

The current study was based on environmental sustainability with regards to economic activities in the modern world. Environmental sustainability is one of the most popular economic theories around academic circles today. According to the theoretical framework, natural capital is vital in the promotion of economic growth and development (Swor & Canter 2011). The reason is that natural capital plays an important role as a source of raw materials for many manufacturing activities. As such, its continued existence should be ensured and safeguarded. Each and every member of the society should take charge of their activities. They should ensure that nature is protected and preserved for future generations.

The use of the natural capital should also be carried out in a responsible manner. Depletion of natural resources should, as a result, be avoided at all costs. Emission of greenhouse gases leads to the exhaustion of the ozone layer (Metcalf 2008). Carbon is the most produced greenhouse gas. The reason behind this is the extensive use of carbon containing products as energy sources across the globe. It is evident that energy is an important catalyst in economic development. However, continued use of fossil fuels for the purpose of generating energy is associated with deadly consequences. If the trend does not change, a lot of harmful effects will be felt in the long-term. Deterioration of health is expected to be one of the most serious problems associated with the emission of the greenhouse gases (Metcalf 2008). Governments around the world should encourage sustainable growth to avoid such situations. Striking a balance between economic development and environmental concerns is the best way to achieve this. The application of the theory was used to assess the effectiveness of carbon taxes in ensuring environmental sustainability.

Empirical Review

The concept of a carbon tax was first proposed in 1973 by David Gordon (Elliot et al. 2010). Since then, countries gradually adopted the idea in a bid to reduce the accumulation of greenhouse gases. Any nation that wishes to impose the tax on market activities has to put in place the necessary legal frameworks to guide the implementation process. Rates also have to be formulated. The reason behind this is to ensure that taxation is done in a systematic manner. At the same time, governments can match rates with the level of pollution caused by a particular organisation. A carbon tax is also an externality that affects third parties. For this reason, it is considered to be a Pigouvian tax (Conefrey, Fitz & Malaguzzi 2007). It is seen to impose charges based on the marginal damage to the third party. In this case, the third party is the environment. The tax is levied to reduce the destruction of the environment through the continued production of greenhouse gases.

Importance of Assessing the Social Cost of Carbon in Enhancing Environmental Sustainability

It was found that the rate of carbon taxes can be estimated based on the social cost of a given product (Baylis & Fullerton 2013). Usually, assessments are made based on the marginal cost of an extra ton of carbon dioxide gas released into the atmosphere at any particular time. The evaluation of social carbon cost (SCC) starts with the estimation of the gas’s residence time in the atmosphere (Luo & Tang 2014). Its impact on climate change should also be assessed. As a result, the effects of every ton of carbon emitted into the environment can be estimated.

The use of SCC is important since business entities are charged rates that correspond to the negative effects their carbon emissions cause. Subsequently, efforts to deal with pollution effects are funded. In economic terms, a discount rate must be factored in when assessing the impact of the greenhouse gas over an extended duration of time (Howarth et al. 2014). It helps clear errors that may result from variations in time. In the past, SCC estimates have been viewed to be an important tool when it comes to the setting of a carbon tax. By establishing the SCC values, governments across the world are in a position to assess the effect of greenhouse gas emission into the atmosphere. As a result, they can set rates that match the climate change associated with the discharge. In instances where the emission of carbon dioxide gas results to adverse climatic effects, higher carbon tax rates will be set (Howarth et al. 2014).

Various scholars and economists are opposed to the use of SCC approach. They are of the opinion that the method is affected by variations in the market. They feel that disparities make SCC values unstable (Das 2011). As such, it is an erroneous method of basing carbon tax for any particular country. There are also concerns that the calculation aimed at establishing the magnitude of pollution emanating from carbon dioxide is estimated based on the mass of the gas. As a result, scientists who are involved in undertaking the assessment tend to measure the mass of the carbon dioxide molecules that are emitted into the atmosphere. The results of the evaluation give rise to a quantity of the gas referred to as a ton. For this reason, governments estimate the amount of carbon dioxide to be taxed based on the weight. Other scientists tend only to calculate the population of carbon atoms within an area where pollution is known to occur. Here, they calculate carbon atoms only. They leave out the oxygen atoms present (Repetto 2013). With the count, they can be able to estimate the level of pollution in that particular area. One ton of carbon is equivalent to four of carbon dioxide.

Scientists across the world have continued to debate on the effectiveness of using SCC for the purpose of determining carbon tax rates. Many are particularly concerned about the extensive standard deviation between actual and estimated values of the amount of carbon emitted into the atmosphere by a business at any particular time. The disparity is as a result of failure by scientists across the world to agree on various aspects associated with carbon emission and climate change (Nishida & Hua 2011). One of the most controversial issues is on the amount of carbon that can result in climate change. As a result, scientists are seen to work on mere assumptions. As a consequence, they are not able to convince many governments on the importance of setting the recommended carbon tax rates (Jeffers 2010). Governments and stakeholders in the energy sector must be convinced of the seriousness of carbon emissions on the environment before they can formulate policies on the same. The reason behind this is that carbon taxes are seen to impact negatively on economic activities.

Countries also tend to offer varying discount rates on carbon emissions (Yakao 2014). As a result, inconsistencies are a common phenomenon while attempting to compute SCC. The result is that some countries will tend to levy more taxes on the activity than others. Investors pay keen attention to such policies before moving into a country (Deane 2011). Nations that charge more for every ton of carbon emitted into the atmosphere will tend to discourage new investments. However, such a country is considered to have acted responsibility towards promoting environmental sustainability. However, other countries tend to give more attention to economic development as compared to durability. They tend to charge relatively lower taxes on the emission of carbon into the atmosphere. As a result, many companies are willing to invest in their jurisdiction (Yakao 2014). The issue of carbon taxes has not only been seen to have an impact on the new investments but also the existing ones. High carbon tax rates increase on the operation costs of the industries that are already established since they target all areas of the economy. If the charges are extremely high, it may be difficult for businesses to make profits, which make them move to other countries with fewer regulations (Deane 2011).

Variations in the calculation of SCC values have resulted in unfair competition for investments among countries (Baylis & Fullerton 2013). To avoid a situation where the estimation of SCC may disadvantage one country, the evaluation process should be harmonised. As a result, a level playing field is created which discourages unethical practices among countries. At the same time, the objective of carrying out the assessment is not lost. The sole purpose of developing the evaluation method was to reduce the effect of greenhouse gases on climate change. It was also to be an important tool in the determination of carbon tax rates. A standard formula was adopted to guide the process. As a result, the assessment criterion for SCC was initially aimed to be standardised.

However, the introduction of different discounting rates led to deviations (Wang & Zhou 2014). The situation made investment prospects in some countries to be viewed as less attractive compared to those in others. The outcome has been countries attempting to introduce measures that tend to lower their carbon taxes. The situation is evident even in the most developed countries in the world, such as the USA, Russia, as well as China. Today, there are ongoing efforts to standardise once again the assessment of SCC. With this, better results in terms of promoting environmental sustainability are set to be achieved. The reason behind this is that countries will no longer be concerned with the economic returns associated with the evaluation but the protection of the environment (Baylis & Fullerton 2013).

There have been concerns that the damage caused by a ton of carbon could be up to six times higher than the value given by most nations (Elliot et al. 2010). Three significant types of damages are associated with carbon emissions across the globe. They include decreasing agricultural yields, declining productivity among workers, and reduced human health (Wang & Zhou 2014). However, many more impacts of climate change do exist. They are often left out as a result of lack of data on monetary damages associated with them. For example, climatic changes related to carbon emission have harmful impacts on fisheries (Jeffers 2010).

They have resulted in an increase of pests that previously did not pose much threat to fishes. They have also led to an increase in the number of fish diseases. The primary cause of a rise in diseases is global warming. Increasing temperatures often results in the multiplication of pathogens. The result has been a decrease in fish production across the world. Consequently, people are deprived of a cheap source of protein. Many communities bordering sea and lake earn their income by engaging in fishing activities (Jeffers 2010). Failure to curb the issue of increasing carbon emission will deprive these communities of their only source of revenue.

Forests have also been adversely affected. Climate changes, such as global warming resulting from the emission of carbon, have led to an increase in the rate of desertification (Haugen 2010). The drying up of grasslands lands has resulted in increasing numbers of forest fires. In the process, more carbon is emitted into the surroundings. At the same time, there are no trees to help in the absorption of carbon through the natural process. Forests are also home to thousands of tree species. Some species tend to be specific to certain areas (Repetto 2013).

Forest fires can, as a result, wipe out an entire species. Natural vegetation is the habitat for wild animals. Its destruction means the migration of wild animals. For countries that depend on tourism as a source of revenue, the situation is bound to change with the increased carbon emissions. Destruction of the environment is also likely to have a harmful effect on human existence (Swor & Canter 2011). Forests tend to be water catchment areas. Their destruction, as a result, means that both humans and animals will not have a clean and reliable source of water in the future. A lot of resources are also spent in the restoration efforts. Such efforts include tree planting. Failure to take into consideration the effects of carbon released into the surroundings has led to reduced levies. The consequences are undesirable.

The melting of ice caps has also been a major effect associated with climate changing resulting from increasing levels of carbon emission (Haugen 2010). It is hard to establish the monetary value of the effect. Consequently, the effect has always been omitted when determining the SCC value. However, countries with high mountain caps have in the past earned a lot of revenues. The ice caps have acted as a tourist attraction. With their melting, this revenue source is lost. Rising sea levels also have been a major effect of climate change. The increase in sea level is as a result of a rise in temperatures. The situation has been triggered by global warming. Cutting carbon emissions is the only way to reduce the harmful effect.

A change in temperature by one degree is expected to cause a 2.3 meters rise (Haugen 2010). The increase is expected cause a significant reduction of coastal lines. Many families and businesses will also need to relocate as a result of the rising sea levels. Changes in rainfall patterns are also a major effect of climate change that should be put into consideration when computing the value of SCC. The change has resulted in the disruption of many agricultural activities. In some cases, it has resulted in floods. Poor countries are the most affected. In the event that these aspects are not omitted while attempting to assess the SCC value, and then the carbon tax levied would match the unfavourable effects. In such a situation, the carbon tax rates would be so high that some companies could go out of business (Repetto 2013). On the bright side, emission levels would be brought considerably low. It would also act as an incentive to push market players to adopt green technologies (Repetto 2013).

Many studies have shown that the effects of climate change will negatively affect both rich and poor countries. However, poor nations are the most venerable (Das 2011). The truth of the matter is that the wealthy countries are the major causes of the problem yet the effect is mainly felt by the poor ones. The reason behind this is that they lack the resources and infrastructure to shield themselves from the adverse effects of global warming (Howarth et al. 2014). In the past, these countries have showed limited ability to deal with the issue of rising sea levels. The use of SCC values to control the emission of carbon will mean a reduction of economic growth rates in both the rich and poor countries. Many developed countries are, however, not willing to compromise their economic growth for the purpose of promoting environmental sustainability. Only by becoming richer can the poor nations be able to escape the undesirable effects of environmental pollution (Howarth et al. 2014). As such, they tend to delay the emission reduction policies until they have become rich enough to shield themselves from the negative effect. However, researchers warn that as this goes on, the situation is bound to become more severe.

There is no doubt that the assessment of SCC aids in promoting environmental sustainability. The reason behind this is that it assesses the effect of carbon emission on the environment. The evaluation seeks to show the actual adverse impacts associated with carbon emissions (Baylis & Fullerton 2013). However, there are instances when governments fail to put into consideration all aspects of climate change emanating from carbon emission. As a result, lower rates of a carbon tax are set. The result is that emitters do not pay an amount equivalent to the harmful effect their activities cost (Das 2011). The inclusion of the omitted aspects, in this case, will be instrumental in further promoting environmental sustainability.

Assessment of Carbon Leakage in Enhancing Environmental Sustainability

Carbon leakage is a situation where carbon dioxide emission reductions in one country result in an increase in another (Michalek & Schwarze 2015). There are various reasons that can cause the situation to occur. One of the primary elements is when an emission policy in one country leads to an increase in local production costs. Such policies often scare away investors (Peter 2010). The reason behind this is that businesses operating there will require paying a lot of money for emission. They also have to invest in many technologies to aid in the reduction of emission. All these costs will ultimately result in reduced profitability.

In such a case, existing players will tend to flee away. They are most likely to go to a neighbouring company with fewer emission policies. The reason for this is for them to be in a position to continue serving their existing market. New investors will also shy away from investing in such a country. They feel that their businesses can thrive better in another country. In this case, another country especially that which is directly adjacent to such a nation with relaxed policies will have trading advantages (Baylis & Fullerton 2013). In the event that the demand for goods and services in the country with strict policies remains constant, many investors will tend to rush to the nation with fewer systems. The reason behind this is that production activities are cheaper there. As a result, only local carbon dioxide emission levels are reduced (Peter 2010). The global levels will however not be changed.

Another reason why carbon leakage takes place is when policies aimed at promoting environmental sustainability add a premium to certain commodities (Michalek & Schwarze 2015). Most governments that are environmental conscious tend to add premiums on fossil fuels. When the price of such a commodity goes up, it becomes less desirable to customers. People also tend to cut on the consumption of such a product. Others even result to using other close substitutes. Despite the decrease in the demand for the commodity in the country, its global supply tends to remain constant (Peter 2010). As a result, its price will tend to fall. As a consequence, it becomes more affordable to persons in other countries. The citizens in that particular company tend to overuse the controlled product since it is now readily available to them. Nations that are sharing boarders with the country where the strict regulations have been implemented particularly tend to benefit the most. The reason behind this is that suppliers in the country with strict carbon emission regulations will tend to market their products in neighbouring nations (Baylis & Fullerton 2013). They have to lower the prices of their commodities to appeal to the foreign market. The case is most evident with premiums on petroleum products. Efforts to reduce carbon dioxide emission in one country are pre-empted by unfavourable policies in another.

Carbon leakage is considered to be a ‘spill-over effect’. The reason behind this is because it occurs as a result of activity that is seemingly unrelated (Baylis & Fullerton 2013). In this context, a country puts in place policies to control the emission of carbon dioxide with the aim of promoting environmental sustainability. The policies are not only aimed at protecting it local social and economic interests but those of its neighbours. At this point, the government intentions are not to hinder economic activities (Baylis & Fullerton 2013). Governments do not also develop and implement such policies with the intention of scaring away investors. On the contrary, the government wants to ensure that growth and development are sustainable. They desire to ensure that the natural resources present can be used by future generations without being exhausted. They also want to protect future generations from having to deal with the adverse effects of environmental pollution (Michalek & Schwarze 2015).

The policies are also aimed at encouraging innovation. Most governments tend to implement them with the aim of encouraging investors to develop and adopt green technologies. However, this is not the case observed. Investors tend to view such a country as unfavourable. As such, they tend to move to other countries with fewer regulations. They decide to relocate rather than change and embrace green technologies. The reason behind this is that they view the development and adoption of these technologies as an expensive undertaking (Michalek & Schwarze 2015). They also have the option to move to other countries where they do not have to face the costs. As a result of investor flight, the economy of such countries tends to stagnate. They even lack the capability to utilise the resources at their disposal. They are also not successful in preventing pollution. The reason behind this is the increase in carbon dioxide emission in neighbouring countries (Peter 2010). Since climate changes associated with the emission of the greenhouse gases are felt on a global scale, such a country is not successful in protecting its population from resultant adverse effects. With diminishing economic activities, there will also be fewer resources to help deal with the undesirable outcomes.

There is a significant relationship that exists between carbon leakage and the choice of energy source around the world (Peter 2010). Today, many industries rely on coal and oil for energy. Other sources associated with lesser pollution, such as biogas has also been used in the past. Today, emission policies insist on the use of renewable sources. Significant effects are felt when developed countries adopt the policies. The reason behind this is that they are home to most of the energy intensive industries (Michalek & Schwarze 2015). For example, the adoption of a regulation aimed at reducing the use of coal by a developed nation can have different outcomes. The move reduces the demand for coal. As a result, its price is lowered, making it more affordable. In the event that the coal was sourced in that country, carbon dioxide emission levels could be reduced significantly (Li & Colombier 2009).

The rate of carbon leakage experienced tends to differ depending on the country that has implemented the environmental friendly policies. Leakage levels can be either below or above 100 percent (Baylis & Fullerton 2013). The primary factor affecting the carbon leakage rate is the size of the economy. Developed countries tend to have a large number of companies. The companies are in most cases energy intensive to help need the needs of the nation’s population. Developed countries also tend to import a large amount of goods produced locally to other countries. As a result, players in the economy are required to produce in bulk. The adoption of emission policies will discourage investors (Yakao 2014). The high number of companies previously operating in the country will move to other nations with less strict policies. Even as these businesses relocate, the demand for their goods in the country remains the same. A lot of efforts will be required to satisfy the desires of the country.

More emissions of carbon dioxide will tend to take place as raw materials are being transported to the foreign country for processing (Li & Colombier 2009). The finished goods will also require to be shipped back for consumption. In the process, there is an increase in carbon dioxide emission levels. The situation is, however, different when it comes to developing countries. They tend to have few industries operating in them. As a result, the implementation of policies to curb the emission of carbon dioxide will not have adverse effects. The reason behind this is that the impacts of local companies relocating is negligent (Yakao 2014). Such countries also lack energy intensive companies. They mostly depend on developed countries for technology. With the implementation of the policies, any production techniques adopted into the nation are required to have fewer pollution effects on the environment. As a result, importation activities are only from countries with similar policies. In such a case, carbon dioxide emission levels tend to go down.

Carbon leakage is associated with both positive and negative results. One of the positive outcomes associated with carbon leakage is increased innovation activities (Michalek & Schwarze 2015). Governments have become increasingly aware of the effect of implementing strict environmental regulations on their economies. As a result, they tend to invest a lot of resources on the development of green technologies. They engage in these activities before the environmental programs are rolled out. As a result, they offer an equally affordable means of production for players in their economy. In such a case, investor flight is prevented. In most cases, the green technologies involve generating of energy from renewable sources (Metcalf 2007). Such sources include wind, tidal, and solar power. The sources are cheaper compared to traditional ones that resulted in the pollution of the environment. The countries are also bound to gain significantly from the sale of such technologies to other nations.

Carbon leakage, however, tends to encourage environmental degradation (Baylis & Fullerton 2013). When one country adopts environmentally sound policies, it tends to lose investors. The situation results in the economic development of other countries as businesses relocate. In addition, the price of the commodity being regulated tends to go down. Consequently, it becomes more affordable. The situation encourages its continued use. As a result, the benefits of introducing the environmental regulations are no longer felt (Michalek & Schwarze 2015). As a result of carbon leakage, many governments do not see the need to put in place regulations aimed at reducing carbon emissions. There is a general feeling that the environment will be polluted either way. Researchers are of the opinion that such laws could only be effective if they were implemented in all countries in equal measure.

Many international communities and organisations support the introduction of policies that promote environmental sustainability. Kyoto Protocol proposed actions that if adopted would reduce carbon emissions (Yakao 2014). Consequently, environmental sustainability would be achieved. Many countries have already ratified the protocol. Those that did not adopt the policies continued to engage in market activities that were viewed not to be environmental friendly. Leakage rates associated with the adoption of the Kyoto Protocol ranged between 5 and 20 percent (Peter 2010). The leakage was associated with low price competitiveness. However, there are concerns that the rates were associated with many uncertainties. There have been allegations that energy intensive industries that adhered to the new policies were seen to make substantial progress, especially in the areas of technological development (Strand 2013). However, it is not possible to quantify these positive effects in a reliable manner.

The assessment of carbon leakage is useful in enhancing environmental sustainability (Baylis & Fullerton 2013). It helps nations to assess the effect of the environmental policies that they seek to adopt. Those policies that are viewed to cause potentially adverse spill-off effects are avoided. Measures to deal with potential negative effects are also devised prior to the adoption of regulations. For example, green technologies could be developed to in advance and introduced to investors before the adoption of the rules (Baylis & Fullerton 2013). Alternative sources of energy are also introduced into the economy before implementation of policies. By understanding concepts surrounding carbon leakage, countries can easily adopt strategies aimed at promoting environmental sustainability without necessarily hurting their economy (Peter 2010).

It is important to note that carbon emission is a global issue. As such, interventions by a single country are not enough in solving problems associated with carbon taxes. The reason is that some nations stand to gain unfairly from the efforts of others that attempt to reduce emission rates (Fisk 2010). In fact, some nations have resorted to easing of their carbon regulations with the aim of attracting investors who flee from areas where such strategies are strictly implemented. Unless all countries are committed towards reducing pollution levels within their jurisdictions, little success will be achieved. It is because some will continue to emit carbon at the expense of others. As such, carbon taxes alone in individual countries cannot be effective in dealing with emission levels. The effects of the emission also tend to be felt across the globe without discrimination. For example, global warming is experienced both in the countries that enforce strict carbon emission regulations, as well as those that do not.

The Effectiveness of Border Adjustments, Tariffs, and Bans in Promoting Environmental Sustainability

Trade liberalisation has been viewed as one of the most effective ways to promote sustainability (Tilt 2010). It is aimed at promoting prosperity among nation while at the same time ensuring that there is economic sustainability in the activities governments are involved in. Local administrations should ensure that the economic activities that their producers engage are environmental friendly (Tilt 2010). By preventing pollution, a government protects not only its interests but also those of the international community. In the past, countries that sought to implement emission regulations became disadvantaged.

The reason behind this is that investors resorted to fleeing the country to set up their operations in areas where there were no strict regulations (Barclay 2012). As such, carbon leakage was experienced. For this reason, there was a need to device measures that would help curb carbon emission at a global scale. World leaders could achieve this by trying to level the playing field in terms of trade. As such, each and every country was required to counter emission in its jurisdiction. To this day, a carbon tax has been seen as the most effective ways to achieve this. It requires nations to tax businesses for every ton of this pollutant emitted into the atmosphere. As a result, compliance with environmental sustainability measures is enhanced. A number of punitive measures have been devised to ensure that all countries would adhere to these rules and regulations. They included border tax adjustments, trade bans, and tariffs (Luo & Tang 2014).

Border adjustments are import fees that that carbon taxing countries levy on goods manufactured in nations that do not. They are also commonly referred to as border tax adjustments or assessments. For this reason, the damage resulting from carbon emission is incorporated into the cost of the imported goods. Through the tax, the prices of the goods imported from a country that does not engage in carbon taxation will tend to be similar to that of those that do (Tilt 2010). As a result, governments that fail to adhere to international environmental policies do not stand to gain owing from price competitiveness. In such a scenario, manufacturers are also discouraged from fleeing countries with strict emission regulations (Barclay 2012). The reason behind this is that their goods are eventually taxed at the international level. The concept of border adjustment was developed to promote fairness in trade. Governments that tax carbon do not, as a result, stand to lose owing to their efforts to conserve the environment. Their goods also tend to be competitive in the international market. The reason behind this is that they do not undergo further carbon taxing.

Border adjustments are an efficient way to promote environmental sustainability. The reason behind this is that they encourage countries to levy carbon taxes on economic activities within their jurisdiction (Barclay 2012). Failure to adhere to this leads to massive import fees in countries that engage in carbon taxing. As a result, governments that are non-compliant stand to lose a lot of revenue in the form of taxes. The reason behind this is that the tax that could have been collected locally is levied by a foreign government (Elliot et al. 2010). In the process, countries that do not tax carbon do not stand to gain any economic benefits.

At the same time, the competitiveness of goods produced locally is also lost. The reason behind this is that the playing field is levelled. Border adjustments also aid in the mitigation of climate change. The revenue that is generated from the import duties levied on goods that have not been subjected to a carbon tax is used to fund programs aimed at promoting environmental sustainability. Such programs often include tree planting and development of green technologies. Planting of trees helps promote the natural absorption of carbon dioxide in the environment (Backus 2012). At the same time, it aids in the establishment of suitable microclimates. A microclimate is a zone with local atmospheric aspects differing from those of the surrounding region. Through such an intervention plays a significant role in helping curb the effects of global warming. They also aid in the rehabilitation of water catchment areas that may have been destroyed in attempts by businesses to obtain fuel wood (Morozov 2012).

Through the funding of green technologies using the money collected from border adjustment, long-term solutions to the issue of carbon emission are developed. Green technologies tend to be more efficient in the utilisation of energy (Metcalf 2007). They are also associated with negligible amounts of emissions. Research has also shown that countries that levy carbon tax are likely to experience more growth and development compared to those that do not. The reason behind this is that they collect revenue from both locally produced and imported goods. Governments that do not impose carbon taxes, on the other hand, tend to lose revenues that could have been generated by taxing imports and locally produced goods. The result is that border adjustments promote the growth of economies that are committed to supporting environmental sustainability.

Trade bans have also in the past been imposed on goods manufactured in a country regarded to pay no attention to carbon emission regulation. A ban is also commonly referred to as an embargo. They involve efforts to prohibit trade in a country or group of nations either partially or wholly (Barclay 2012). They are often considered to be effective diplomatic measures. The country imposing the embargo on another seeks to promote its national interests. It is important that trade bans are not confused with blockades. Trade barriers are viewed as acts of war from one country to another which is not the case with embargoes. Some economists argue that trade bans are more or less similar to sanctions. They are both legal barriers to trading activities between countries. Bans can be aimed at barring the importation or exportation of particular goods in a particular country. For agencies to achieve this, quotas may be set to monitor the movement of goods into or out of the country. Special tolls are also often imposed.

The result is that the products become expensive for the country facing the trade embargo. With regards to carbon emissions, countries that do not adhere to the set regulations can have the importation of their goods prohibited in other nations (Barclay 2012). As such, their products can only serve the domestic population. Other countries can also regulate their manufacturers from exporting energy intensive technologies into the country. Such technologies often include motor vehicles and manufacturing plants. As a result, emission rates in the country decrease. Such bans are often most effective if they are backed by many governments. As such, the country on which they are imposed has no alternative but to change its policies. Smaller and poor nations are also more likely to give in to pressure from other countries on such matters. The reason behind this is that they lack the capability to sustain themselves economically without trading with others (Yakao 2014). They also lack capital goods to facilitate production activities. Rich nations with a large population, on the other hand, can be able to resist such trade bans for considerably long durations.

Trade bans are effective in promoting environmental sustainability. They are aimed at discouraging carbon emission activities by a particular country. Through trade bans, countries have no option but to consume their goods locally (Baylis & Fullerton 2013). In the process, production levels go down and so does emission levels. Failure by a country to adhere to the set regulations can result in more severe punitive measures being adopted. For example, other nations can desist altogether from trading with a country that is considered to be in total disregard of environmental regulations (Strand 2013). Such a move will result in the collapse of the economy on which the embargo has been imposed on (Yakao 2014). As such, emission levels are reduced significantly. Other countries are also discouraged from engaging in unsustainable practices for fear of having embargoes imposed on them too (Yakao 2014).

The use of border adjustment tariffs and trade bans is an effective way of dealing with the issue of rising carbon emissions across the globe. The reason is that they encourage all countries to adopt the regulations that are put aside. While compared to the mere introduction of carbon taxes within a particular country, border adjustment tariffs are associated with better success. While carbon tax tend to reduce emission levels in one jurisdiction, the use of border adjustment tariffs see even those countries without such regulations charged for their pollution activities (Brooks 2011). Subsequently, cases of carbon leakages are reduced. Firms operating within an area with strict regulations will desist from migrating since their goods will be taxed at the point of entry into their original market.

The Efficacy of Taxing Petroleum Products in Boosting Environmental Sustainability

Carbon emission can be evaluated directly from the amount of petroleum products that are consumed in a country (Luo & Tang 2014). They are often referred to fuels of hydrocarbon origin. They contain a significant amount of carbon. It is noted that burning these sources of fuel leads to the emission of carbon dioxide into the surrounding. In most countries across the globe today, products, such as gasoline, diesel, jet fuel, and petrol are subject to the carbon tax. Each product is taxed based on the amount of carbon it holds (Green 2008). In such a case, a fuel source with higher carbon content is charged more heavily compared to others. However, the effectiveness of taxation on petroleum products has been questioned over the years. The reason behind this is that the prices of oil products even after taxing have not deterred people from consuming them (Hsu 2011). For this reason, many environmental lobbyist and agencies have argued that the adoption of green technologies could result in better outcomes being realised. One of the efforts that have been recently proposed are the developments of lower energy consuming vehicles can work better.

However, the role that taxing of petroleum products play in promoting environmental sustainability should not be underestimated. In most countries, oil taxes fall under energy taxes (Jerry 2009). Energy taxes comprise of taxes on energy products used for both transport and stationary purposes. The most significant energy products for transport purposes are petrol and diesel fuel (Kenneth 2006). Taxing minerals and petroleum products as a means of earning revenue is a long standing tradition, especially in the western and Middle East countries. Several nations had already established taxes on the consumption of natural gas, coal, and other oils as early as in the 1850s (Linkov 2011). In most countries, tax paid on petroleum products is differentiated in two manners. Fuels can be classified by their use and type. Through classification by type, fuel can be petrol, diesel, gas, oil, kerosene, Liquid Petroleum Gas (LPG), or heavy fuel. On the other hand, when it comes to classification by use, fuel can be used either for heating or commercial purposes.

Tax revenues from petroleum products are known to rise at a slower rate. The main reason behind this is that governments view the taxes as a potential hindrance to economic growth. For example, taxing fuel would most definitely result to fewer persons buying cars. The economy of countries that manufacture automobiles would, as a result, be adversely affected. At the same time, petroleum products are used for the transportation of goods from one point to another. Excessive taxing of these products, therefore, does not affect the transport sector only but also all other industries (Deane 2011). In most cases, the rise in the cost of petroleum products often results in an increase in prices of goods and services. As such, governments must be keen to ensure that taxation on this product does not result in a downward trend in the economy.

Taxing petroleum products has in other cases been viewed as one of the easiest ways to collect revenue. Countries that produce petroleum products generate a lot of income from such taxes. The situation is most evident in the Middle East. Nations, such as the United Arab Emirate (UAE), have continued to grow rapidly owing from the taxation of such products. However, countries that import oil must be keen not to hurt their economies by imposing hefty taxes on these products. It is important to note that the petroleum products have already been taxed in their country of origin. Collecting oil taxes is also a relatively straightforward process. They can be taxed either in the form crude oil at the point of entry into a country or as a finished product (Deane 2011).

Tax theory suggests that where the government’s sole purpose is to raise revenue for public expenditure, goods whose demand is least sensitive to price increases should bear the highest rates (Metcalf 2007). Petrol is the most heavily taxed commodity, according to this policy. Substitutes to petroleum products are taxed at the same rates. Consequently, demand does not shift from the higher to the lower taxed products. In such a case, carbon emission levels can be lowered since the government discourages the use of products that pollute the environment (Kenneth 2006). Goods accounting for a larger share of the budgets for the rich than for the poor are also taxed more heavily. The reason is that failure to do so will encourage the consumption of the product by the wealthy. The purchasing power of the rich is also higher compared to that of the poor (Deane 2011). As a result, they own more vehicles. Slight increases in taxation of petroleum products are not effective in deterring their pollution activities.

While the aim of taxes levied on petroleum products is to ensure that maximum revenue is collected from petroleum products, this is not always the case. For instance, kerosene is the most problematic oil commodity when it comes to taxing. In most cases, it is taxed less since it is deemed to provide a cheap source of fuel and lighting for the poor. Failure to ease the tax rates on the commodity could be viewed as a move towards further worsening the economic situations of the poor (Kenneth 2006). Failure to heavily tax kerosene has resulted in a rise in demand, especially in the developing nations. Consequently, carbon dioxide emissions have continued to increase.

In recent times, petroleum taxes are increasingly being used all over the globe for pollution control and prevention. They have also been used in oil resource management with the aim of promoting environmental sustainability (Linkov 2011). Additionally, taxes are designed special ways. They only allow for use of petroleum products in a way that does compromise the ability of future generations to improve their lives and the environment. Some countries have even taken a step further and introduced special taxes on specific petroleum products to conserve their availability and most importantly discourage their excessive use (Kenneth 2006).

Highly taxing goods that produce significant negative externalities are known to significantly promote environmental sustainability (Deane 2011). In most cases, it is noted that the negative externalities arising from petroleum products take the form of emissions from automotive fuel use or congestion from excessive road use. The high taxes discourage consumption of these products and reduce environmental and social harm arising from them. However, as seen in past scenario, this method as not always as straight forward as it seem. For instance, emissions from diesel fuel are more harmful than those from gasoline. As a result, imposing a heavier tax on diesel would seem as the most prudent cause of action in promoting environmental sustainability. It is not always so since encouraging diesel powered mass transit would go a longer way in relieving congestion and reducing number of vehicles emitting other petroleum product fumes (Vitkūnas & Meidutė 2011).

In third world countries, petroleum products meant for the poor are lightly taxed (Jerry 2009). The reason behind this is to avoid further increasing the financial strain of the poor. Lighter taxes mean that the petroleum products are cheaper. For this reason, the products tend to be abused. For example, some people opt to use kerosene as a result of its low price for lighting purposes. Others have also gone to the extremes of using it as fuel in their cars (Jerry 2009). Kerosene produces far harmful and degrading chemicals to the environment than other fuels, such as gasoline or even diesel. Heavy taxation in such scenarios also comes in handy. However, the plight of innocent poor people would be disregarded.

Green taxes have also been seen to affect the energy sector. They are excised on environmental pollutants or on goods whose use produces harmful emissions (Metcalf 2007). Though green taxes are commonly applied to firms and organisations, they can also be applied to communities and companies that use petroleum products that cause excessive pollution. Green taxes have in the past being applied to the use of diesel as a fuel in personal cars. As such, all those who used diesel to power automobiles are encouraged to seek cleaner and environmentally sustainable alternatives (Metcalf 2008). Generally, green taxes are meant to improve the environment. They achieve this by reducing the negative impact on the environment. In the process, sustainability is enhanced.

As seen earlier, the taxation of petroleum products generate a lot of income for the government. The revenue is important for running state affairs and spear heading development projects while maintaining current ones (Deane 2011). Some states, such as Alaska and Mexico reserve a portion of the collected taxes to fund environmental groups. The activities of such groups have proven to have a positive effect on the environment. Some states fund for this environmental protection groups through severance taxes. The tax does not directly impact consumers of the petroleum goods. Rather, it targets the producers at the extraction sites (Deane 2011). Severance taxes ensure that all costs associated with resource extraction are paid for by the producers hence helping alleviate potential impacts on state and local taxpayers.

Some countries charge heftier taxes on petroleum products used for powering personal automobiles (Kenneth 2006). Diesel is one such product. Such taxes are often based on the total carbon emission. When the prices of some of these fuels are so high, most people are forced to ride on mass transit vehicles. Others have sought other solutions to the problem by building electric cars. For instance, in china, the tax charged on petrol was so high that most people adopted the cycle to work lifestyle (Martin 2012). As such taxation acted as an incentive in encouraging the people to seek for other alternatives. In the process, environmental sustainability was promoted.

Taxing petroleum products in an effort to promote environmental sustainability is associated with some degree of success. However, the use of these products to run vehicles, industries, and for heating purposes has continued over the years. The reason behind this is that they have no close substitutes. Green energy has also proved to be more expensive and unaffordable to many people, especially in developing countries (Fisk 2010). For example, most African countries lack an adequate supply of electricity for household and industrial use (Fisk 2010). As a result, it would be considered unreasonable to expect such nations to shift to green technologies, such as hybrid cars. Many governments also levy petroleum taxes for the wrong reasons. Majority considered it as a way of generating revenue. As such, the money is used in the funding of other development projects, some of which result in further carbon emissions. Environmental sustainability can, however, be achieved by investing the money generated in green technologies and dealing with effects of carbon emission, such as global warming.

Conceptual Framework

Introduction

The methodology section captured methods that were be used to carry out the study. The subsections included research design, study location, target population, sampling procedures and sample size, research instrumentation and their validity and reliability, methods of data collection, and data analysis. Each of these sections was addressed separately. Subheadings were also assigned to each section to distinguish it from others.

Research Design

There are a number of study designs that could be used in this study. They include descriptive surveys, literature review, as well as experimental study designs. Descriptive research deals with conditions that are already in existence, practices that are already held, processes that are ongoing, and developing trends (Salkind 2010). As such, it tends to show how different aspects of a particular issue are interconnected. Carbon tax is a practice that has existed for over three decades. As such, the use of a descriptive research design would be effective.

A literature review study design, on the other hand, seeks to use existing secondary data on a topic to draw conclusions on the issue in question. Use of this literature enables the researcher to gain a wider perspective of the topic. It also helps them to be aware of the current trends on the issue. Problems surrounding carbon taxation are dynamic (Ridley 2008). As such, data spanning a long period of time needs to be used. Consequently, the study will capture the changes that taken place around the issue. The use of existing literature also enables the researcher to address the topic in a neutral manner.

In experimental research designs, the researcher is interested in establishing the effects of a particular process or intervention on certain objects. As such, it is widely applied across social and natural sciences, such as engineering (Dey & Mukerjee 2012). In this study, the researcher seeks to establish the impact of carbon taxes on environmental sustainability. As such, an experimental design would be effective.

The study adopted descriptive survey research design to determine the effectiveness of carbon tax in enhancing environmental sustainability. Descriptive survey research design is considered to be the most appropriate when the study is aimed at creating a detailed description of an issue (Saunders et al. 2012). Since the study was done to look into the effectiveness of carbon tax in enhancing environmental sustainability, an already existing condition, the descriptive design was considered to be the most appropriate. Descriptive researches were also found to depict participants in the most accurate way possible. The environment is not altered in any way. As such, issues are reported as they tend to occur in reality. The use of the research design was important in preventing bias. The researcher reported issues as they were without any efforts to alter the data collected.

Target Population

The study was conducted in manufacturing industries that operated in the central district of Australia. The reason for choosing industries in one location was to ensure that they were all faced with the same issues. The selection of industries from different jurisdictions could introduce errors into the research (Saunders et al. 2012). The reason behind this is that they are faced with different regulations and environmental laws in the areas where they operate. A total of 29 industries were involved in the research. The study particularly targeted Environmental sustainability officers. Consequently, a total of 29 officers were involved in the study. The reason for their involvement was mainly informed by their vast knowledge on the issue of environmental sustainability. They were also aware of the laws that existed on the issue. The officers also had knowledge on the various international interventions that have been made to address the issue. They also had information on the regulations that can be adopted to help promote environmental sustainability. The District Environmental Sustainability Officer (DEHO) was also involved in the study. As a result, the research involved a total of 30 individuals.

Sampling Procedure

Sampling is the act of selecting a group of persons from a larger population of individuals with similar traits (Saunders et al. 2012). In this case, the population to be sampled was the 29 Environmental sustainability officers. They had similar traits in that they had the same job description and probably academic qualifications. They also acted in similar capacities in their place of work. The 29 officers were also all well-endowed with knowledge revolving around the issue of environmental regulations and sustainability. They were also well conversant with issues surrounding carbon dioxide emissions. Sample refers to the portion of the target population that is used in the study (Cooper & Schrinder 2011).

It is the group from which data is collected. Samples are aimed at helping the researcher to gather information on an issue without having to involve the entire population. They have proved to be most effective especially when a large population is involved (Cooper & Schidler 2011). Such populations would result in large amounts of data that could be hard to interpret. A lot of time and manpower could also be required to complete such studies. As a result, the use of samples aids the researcher to save on resources required to complete the study. For the case of this study, the entire population was used. The reason behind this was that it was considerably small. As a result, there was no reason to sample. As such, a total of 30 respondents were used to complete the research.

Instrumentation

Research instruments are tools used by the researcher for the purpose of collecting data from respondents (Cooper & Schrinder 2011). They include questionnaires, surveys, and tests. The type of instrument to be used depends on a number of factors. One of the major factors is the nature of the respondents. For example, in cases where the respondents are illiterate, the use of a questionnaire will be ineffective (Kothari 2008). People with physical disability may also be incapable of completing questionnaires. An interview would yield better results for such groups. The nature of the study being conducted can also determine the choice of research instrument. Those instruments that can be applicable in a qualitative research are ineffective in a quantitative one (Cooper & Schrinder 2011).

Data Collection Instruments