Abstract

The main purpose of this dissertation is to research on economic reality of living with a dwindling supply of oil. In order to do so, the first chapter will discuss the background of the problem like dwindling supply of oil, rationale of the research, the objective of the dissertation and scope of the research. On the other hand, theoretical framework of finite resources influence, wealth allocation of finite resources, integrated world economy with oil resources, alternatives of oil and conservation of oil resources, possible alternatives towards oil resources and how the alternatives can conservative oil resources are the main focusing issues of literature review. However, methodology chapter mainly concentrates on the research design, secondary data sources as the dissertation will follow qualitative research approach to formulate the paper. Discussion chapter will analyze global energy policy, USA & G-8 energy policy, OPEC energy policy, Energy alternatives and macroeconomic reality, UN energy outlook towards alternatives, innovation and growth alternatives, policy of developing countries, and the position of oil resource in Saudi Arabia. This dissertation will recommend and conclude considering the discussion of previous chapters those are based on the reports of the National Energy Policy Development Group, Organization of the Petroleum Exporting Countries (OPEC), Asian Development Bank (ADB), United Nations Industrial Development Organization (UNIDO), and WWF International (WWF).

Problem Statement

Introduction

This dissertation has engaged to analyze the economic reality of the dwindling supply of oil and its underpinning perceptions and opinions to assessing the impact through indicator of economic growth and competitiveness in the post-financial crisis era. The topic also discuss with empirical evidence affecting the economy of oil producing countries and the dominating global powers focusing on alternative energy sources. The present dissertation mainly deals with five major chapters and concerns sub chapters such as-

- Problem Statement: This chapter will identify the prolonged dilemmas in the area of the dissertational topic. In addition, it provides the fundamental principle as well as theoretical framework for the research while it also raises the research questions and explains the limitations and scopes of the study;

- Literature Review: – The second chapter of this dissertation starts with the chronological overview of finite resource management, dwindling supply of oil, its influence on the global economic growth and competitiveness with theoretical explanation and then describes with more up-to-date literature arguing with modern theories and implementation of success factors of alternative energy sources for sustainable economic growth. This section also explains what the present research would add to the configuration of knowledge in the field of finite resource management and dwindling oil study in context of alternative energy sources by answering the raised research questions;

- Research Methodology: This part of the dissertation would present the rationalisation on how the current research has been conducted, what would be the data gathering process, their analysis as well as treatment by explaining the course of action and states limitations and scope of the research;

- Discussion and Findings: This part would engage its efforts to analyze topic in accordance with suggested the methodological framework and apply the relevant research to strengthen the results discussing with the practical perception that support research questions; denotes unanticipated results as well as look for solid findings with business features;

- Conclusions: This is the final chapter of the dissertation that summarise the findings to construct the key recommendations and generate opinions both on practical and hypothetical application for the information lift up from this study as well as offers suggestion calibration for the research by advocating conclusions as well as allusions of this study.

Background of the Problem

The present world economy has been evidencing hardest impact of global financial crisis of 2008 while the raising oil price panicked all over the world and drawn attention of the policymakers to think with the finite resource of oil and alternative energy sources. In this era, the modern society cannot move a single step forward without oil, but the dominating global powers has overlapped the necessity of finite resources like oil and the importance of alternative energy sources for modern economy. However, there are many research those pointed out that the importance of renewable energy like hydropower, geothermal, solar power, ocean energy conversion, nuclear power, but there is no substitute alternative resource yet for petrochemicals other than oil resources.

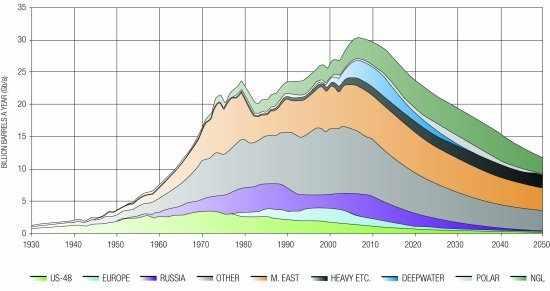

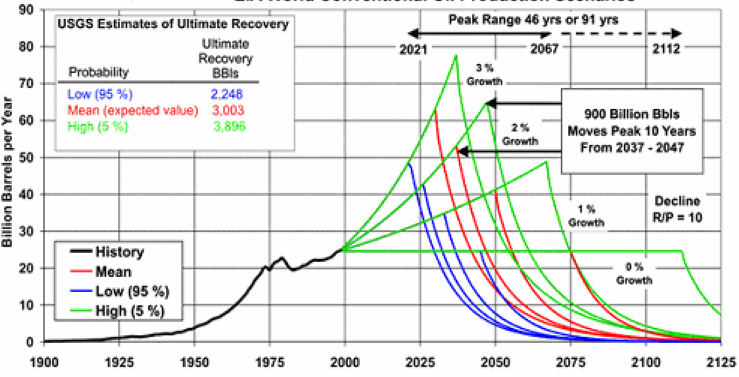

Leigh (2008) mentioned that civilisation has been quick improving for inexpensive oil as an energy resource, but in the present era with alarming evidence of diminishing oil resources, King Hubbert has presented the Peak Oil theory in extensive knock with historical data that severely interrupt the civilisation towards devastating scenario. It has projected that the economic improvement of both developed and developing countries have significantly exposed their deep linkage with inexpensive oil and the prospect of oil reduction possibly will demonstrate substantial obstacles to put a stopple to the globalisation as well as market economy.

Duncan (2001) explained that the Olduvai theory has been introduce to inform the oil producers and consumers about the diminishing finite resource of oil that concerned with the ratio of global oil production in relation to the population and the presumption affirmed that lifecycle of the Industrial society is not more than a century accounted from 1930 to 2030. The oil production evidenced huge growth for more than a century, but the real production reached its highest stage for per capita production in 1979 and from the succeeding years, it is declining. Thus, the theory denotes 1997 as a peak and arguing that oil production per capita possibly would back at the stage 1930 within 2030 while the Industrial society will touch its lifecycle of a century.

Campbell (2001) pointed out that the basic driving force of economic growth of twentieth century has been rooted with huge supply of inexpensive oil marketed by the USA while it has withdrawn the border barrier for flourishing forceful capitalism and scientific abilities while the per capita production of US oil peaked in 1930. Next to US oil peaked, the Middle East oil resources take the responsibility to meet the corresponding demand of oil worldwide but the huge oil resources of this region has trapped by the Multinationals and these nations lost their control over their finite resources of oil. During the Arab-Israel conflict in 1973, the Arabs regained control over their oil resources and used oil as a weapon against Israel that seriously shocked the global economy.

Rationale of the Research

Al-Alamy (2008) argued that it is not reasonable to keep oil price such lower when oil price reached at record peak on US$140 per barrel at the starting of global financial crisis in 2008 by contrasting with other commodities of finite resources. He added that the oil price is 52000 times lower than equal volume of platinum and 2350 times lesser than equal volume of gold though all of these are commodities are from finite resources. Most surprisingly at this stage, oil price is five times lower than any soft drinks. Brown and Ulgiati (2010) pointed out that the G-20 Summit Toronto- 2010 has concluded with forty-eight resolutions where the issue of global economic growth has addressed for sixty-seven times and sustainability issues have addressed for forty-three times, even different resources has mentioned for seventeen times, but oil or energy resources has mentioned for not a single time.

Above-mentioned two facts of lower price and negligence towards oil resources by the G-20 may raise the question, do the global leaders dream for sustainable economic growth without oil resources. Positively not, but why the G-20 leaders are reluctant to put emphasis on this finite resource? The GAAT has recognised oil as a commodity, but violating Article- XI and XXI of the General Agreement on Tariffs and Trade, WTO kept oil apart from commodity list and placed in the category of precious goods like gold, platinum and uranium and does not facilitated any trade liberalisation or uniform import duty. Consequently, there is a burdensome discrimination among the national governments to import duty of oil while the USA impose 27% duty on oil import, member countries of European Union is imposing 60% to 67% tax on imported oil that seriously hamper the essence of free market economy and globalisation and ultimately impose huge burden to the end users (Al-Alamy 2008).

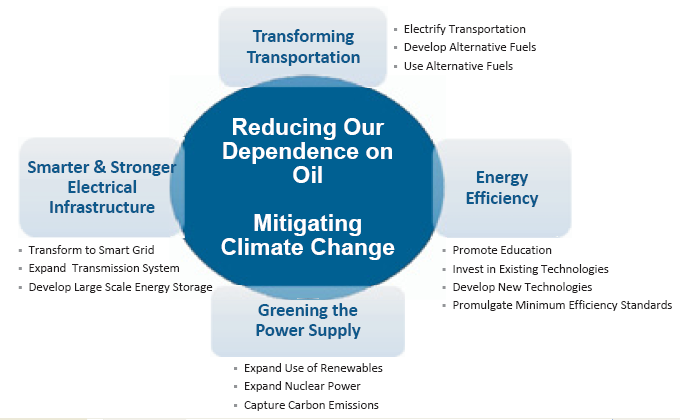

Hirsch et al (2005) expressed his concern on reducing oil resources and expanding demand to emphasise on alternative liquid fuels like IOR4 and EOR5, which are increasing oil-producing method from the existing oil fields, inferior quality oils from oil sands, coal liquefaction, and superior graded fuel by natural gas, but all these alternatives are also concerned with finite resources. Rosentrater and Al-Kalaani (2006) engaged their effort to address the gaps of renewable energy alternatives in context of escalating demand for dwindling supply of oil, which is conventionally from hydrocarbons. Due to the growing environmental awareness and found in decreasing fossil fuels, the issue of alternatives of oil resources has been getting greater than ever attention from the academia and business world. This drive of searching alternative towards finite oil resources pointed to the hydroelectric power, bio fuel, waste combustion, alcohol, nuclear, solar, windmill have started to contributing to the global energy needs though the aggregate supply from the alternative resources is not more than ten percent (Rosentrater and Al-Kalaani 2006).

Jaffe and Soligo (2008) mentioned that the Group of Eight of the leading industrialised countries presented their widespread strategies to congregate geopolitical and financial risks in context of their energy securities combining with climate changing issues to facing the high volatility scenarios of the upcoming global energy markets, but there are no indications regarding conservation of oil resources and alternatives. Although it has been identified that the global oil resources are in crisis with a number of influencing factors with the geopolitical risks presently in front of global oil markets have involved with energy securities, pricing instability, and supply postponements, transportation crisis and investment for the production while the existing global financial system is another influential factor. The outcomes of such risks collapsed the general trade norms and the industrialised countries under US leadership has generated another new dimension of threats of militarization of global oil resources that posed serious risks in depth towards policy frameworks under concurrent market arrangement without ensuring any flexibly to conservation of oil resources and it would be accelerating in near future.

There is enough research with the finite resources of oil and there are also huge studies for the alternative to the energy resources, but there is no initiative to research on conserving or preserving the finite resources like oil and no clear understanding in this regards. This dissertation would involve to gathering a theoretical framework on the conceptual development of conservation of finite resources of oil that would assist the oil producing countries, oil consumers, and scholars for further research with alternative energy sources.

ESCWA (2009, p.4) compared the demand and supply of oil and pointed out that the impact of decreasing supply of oil in the world financial market. He further added that global financial downturn has adversely affected oil prices by two ways; for instance, demand of oil dwindled while the overall financial system entered into stagnation and oil prices are expected to reduce by almost 64.0% in 2009. Many scholars have tried to find out the connection of global financial crisis with the supply and demand, and showed the impact of oil industry in the economy, but most of them did not concentrate on the dwindling supply of oil and alternative energy sources, as it is a finite resource.

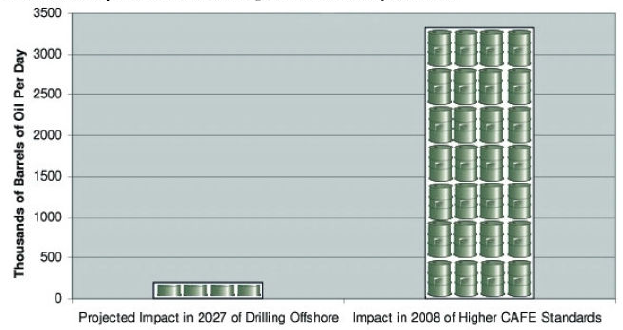

From last era, most of the contemporary researchers have concentrate on increasing demand of oil and substitute product line, but no overarching research agenda has yet been proposed in this regards. Dutzik, Ridlington, & Sargent (2005) stated that limited production capacity, limited supplies, price manipulation, Hubbert method of evaluating the annual rates of oil discovery, the technological development, peak oil, growing consumption, availability of oil reserves, and environmental challenges. However, the oil resource is limited, but consumption has escalated, so the producers and users should measure the political and economical risks due to avoid collapse of global economic structure. As a result, this dissertation will assist the multinational oil companies, academia, regulators, and investors with better understanding about the consequence of living in a dwindling supply of oil to analyze alternatives resources those can mitigate the crisis and contribute to conservation of Oil resources.

Research Question and Objectives

This dissertation aimed to investigate with the economic reality of living with a dwindling supply of oil study as a finite resource with the aim to understand how the oil supply shock could shape the world economically by focusing on alternative energy sources. To structure the aim, the dissertation has designed to respond to the following research questions, the answer to this question would enable the researcher and policymakers to organise the policy and towards a greater motivation for conserving the finite resources of oil, to classify the objective, our research questions are listed below:

- How the theoretical framework of finite resources can impact on the oil resource management;

- To what extent oil resources have close linkage with the global economy;

- How does war for oil destabilise the political economy of the countries with oil resources?

- What are the alternatives that can mitigate the crisis and contribute to conservation of the Oil resources for sustainable economic growth?

Limitations of the Study

At the time of organizing the study, the researcher had suffered some problems like –

- Primary research gives the opportunity to know the opinion of scholars, experts, and bureaucrats on the relevant research area. However, there is no scope to collect primary data for quantitative research;

- There is some limitation in terms of identification of research gaps in the proposal segment, which limits the researcher to deal with only one research objective;

- The duration of time for planning and conducting research was not sufficient to co-ordinate the paper;

- As this dissertation would be based on the secondary data sources, it is necessary to use a number of journal articles, books, and magazines. However, many journal articles also available in the internet, which are easy to access and most of sites ask high price for journal articles, thus, budget becomes one of the most important factors to conduct research only rely on secondary data;

Scopes of the Study

Besides limitations, this dissertation has scopes in following areas –

- The researcher of this dissertation has scope to broadly focus on how the oil supply shock could shape the world economically particularly Saudi economy;

- However, this dissertation has opportunity to assess positive and negative impact of oil price in the global economy;

- The world limit of this project is sufficient to depict the current situation by using secondary data sources;

- The entire study will assist to provide fruitful, realistic, and applicable suggestions and recommendations to minimize the risk of dwindling supply of oil.

- On the other hand, there were a number of journal articles upon the impact of dwindling supply of oil in the economy, which apparently seem important to researcher when reader check the executive summary, and most of the articles are applicable in this research.

Relevant Literature Review

Overview of the Topic

This literature review has integrated with the writings, researches, and scholarly opinion concerning the practice and evaluation of economic theories of finite resources in context of decreasing supply of oil, its aggression to the economic growth and competitiveness including its influence on the global financial crisis and concerned recessionary shock. The design and motivations for this literature are associated to creating value and confidence for the investors, produces, and consumers and to overcoming the threats of serious fuel crisis may rise due to aggressive dependency on oil for major source of energy resources. Another motivation of this researcher is to guide the regulators to bring healthy atmosphere in the oil market by introducing cost effective alternative resources. It provides the background for desirable evaluation of finite oil resources management with conscious drive of oil market to developing healthy atmosphere for the investors, factors are most significantly persuade the concerned to the oil resources.

The scrutiny and illumination of contemporary researchers concerning finite oil resources and its motivation towards the future energy strategy, acceptance, and effectiveness of oil resource management to preventing further energy crisis are also discussed simultaneously. The chronological theories as well as modern approaches of alternatives are also addressed form an unyielding foundation from which it will enrich this research study bringing the changes in practice.

However, this section will focus on theoretical framework of finite resources, scope and limitation of this review, fundamental looks towards oil reserves, linkage between oil and non- oil sector, Linkage between oil and stock market and so on.

Scope and Limitations of this Review

This research work replicates the authors and researchers paying full attention in the description, dimension, and evaluation of e economic reality of living with a dwindling supply of oil as well as strategy implication within the concerned counties to conservation of oil resources and its resultant effects on the global economy. The report highlights on studies those converses on the implications of decreasing supply of oil and oil producing practice, to the regularity authority’s service development, knowledge utilisation, and skills in future energy resources. The extraordinary emphasis has been adopted upon the regulation and the management excellence while both the remarkable and contemporary writings are reviewed with added concentration provided to those authors’ theories.

With massive width of literature concerning finiteness oil resource, this evaluation has been limited to the mainly sustained theories as well as established principles while it has just a prototype of the mass of dwindling supply of oil literature. Similarly, the extensive assortment of beneficial writings related to success of corporate governance where regulations are effectively necessitated, this review has taken out from principally mainstream works of time-honoured authors. The underlying assumptions for applying these limiting selections are that the energy professionals are implicated in unique, singular thoughts on dwindling supply of oil and oil producer’s motivation in this regards.

Theoretical Framework of Finite Resources Influence

Krautkraemer (2005) argued that the literature of economic growth is deeply concerned with the finite natural resources while the economists are long been in questioned with the scarcity of such resources and urged for management and redistribution on the existing resource consumption with the aim to conservation for future. Bleischwitz and Bringezu (2007) added that the management of finite resources is a conflicting area while globalisation has eased the entrance to natural finite resources, raised awareness of environmental hazards, and blessed the prospect of economic growth for the less developed countries. To administer the finite resources they suggested to raising national fund for finite resource conservation, ensuring transparency, setting national standard and certification for resource utilisation, plan for future conservation, increasing effectiveness, and productivity for the resources, and limiting the consumption through quota allocation. At the same time, in international arena it is essential to standardise sustainable resource management linking with the national policies to administering the finite resources the adopting quota system.

FAO (2003) pointed out that, 33% of finite resources of this planet from the forest to the ocean have already consumed or utilised by 1970 to 1999, the population of the globe possibly will increase more 50% than the existing within next fifty years, how terrible would be the scenario with finite resources at that stage. The possible risk with the dwindling finite resources has threatened the whole civilisation of the earth and the ultimate solution to safeguard the upcoming finite resources crisis could be resolute through appropriate resource management. The suggested policy of FAO (2003) has emphasised to administering the finite resources through strong community based finite resource management with local people’s participation. Agudo et al (2009) added another dimension to finite resource management where it is entrusting a compulsory access regulation and quota for utilising the finite resources.

Wealth Allocation of Finite Resources

In general, finite resource can be defined as that form of energy, which is not reusable forever. Thus, various kinds of resources fall under this category regarding oil, coal and natural gas etc. that are being subject of huge demand but limited reserve (Community Science Action Guides, 2011). As-

A number of factors can be identified for which global demand for such resources is increasing at an escalating rate, such as-

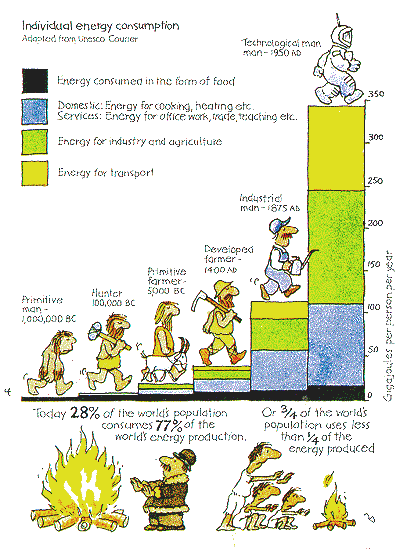

- The first reason can be identified as the global per capita energy utilisation or the volume of energy per person consumption has been increasing (Community Science Action Guides, 2011). This can be shown as-

- The second reason is that the enhanced demand is exponential development of global population due to the huge industrialisation of developing countries, the demand for more energy in the less developed countries are also rising (Community Science Action Guides, 2011).

So, finite resources are allocated among the various parts of the world and some specific regions those possess oil resources are enriching their economy while the others are not. For, example, Saudi Arabia, and middle- east countries are well- recognised for the reserve of crude oil but America is in the dwindling stage (Anny, Blackman, and Baumol, 2008).

Economics of Natural Resources

Pianegonda et al (2003) introduced very straightforward model natural resource redistribution to clarifying the operation of finite resources with coordination of agents, while every agent generates spontaneous contribution to the accessible resources with exceptionally dynamics that prolong to the truth that the poorest agents may get scope to revolutionise their economic growth. The economics of natural resources typically deal with the demand, supply, and distribution of the natural resources of the world. Here, the basic purpose is to realize the task of those resources in economy for initiating standard sustainable means of management for promising their availability to further cohorts. While the traditional approach considers forestry, fisheries, and extraction of minerals models, the modern approach also considers all sorts of environmental assets for constructing a sound economic policy (Anny, Blackman, and Baumol, 2008). The overall aspect is being discussed below-

- The economics of formal natural resource concentrates on various factors, like- managing pollution, mining and exhaustibility of resources and non- market assessment and sustainability and management of environment. Furthermore, it is also associated with energy in terms of supply and social utilisation along with entropy, fact and information (Anny, Blackman and Baumol, 2008).

- According to the expert opinion, there are 5 phases of mounting mineral resource (Anny, Blackman and Baumol, 2008). Those are-

- Production rate is sustained by the reserve resource that has already been used up;

- The exclusive growth leverages are maintained by the description between the enhanced funding needs and faster revenue generation,

- The extended growth margin with extraction although it was not economic before,

- Adoption of continues effort to discover new resources by searching with uncertain per unit cost.

- Implementation of advance technology for dealing with finite resources has incorporated at the 1st of 4 steps.

- The concept of the resource crisis could be initiated for shaping case through the introduction of substitutes (Anny, Blackman, and Baumol, 2008). As –

- Availability from local or foreign partners;

- Ownership of chemical features, functions, and strength;

- Ownership of striking alloys;

- Capability of further dealing and fabrication with existing technology;

- Replacement can also be occurred by synthesis or recycling from junk or wastage. Abundant resource is another option, which has limited utilisation of elements before mending from seawater (Krautkraemer, 2005).

- Electric steel would use for scare coal, for instance- magnesium metal and utilisation from seawater, sulphur from pyrites, copper, nickel, and zinc from Phosphoric generation and bauxite from clay and Anorthosite. One form of carbon as synthetic graphite is produced from precursors of carbon. Currently, poly- metallic sulphide reserves and “black mud” have been explored from “black smokers”. Robot mining technology is cost- effective while perpetual resources can be changed for generating pale- resource and Pennsylvania anthracite (Krautkraemer, 2005).

Fundamental Looks Towards Oil Reserves

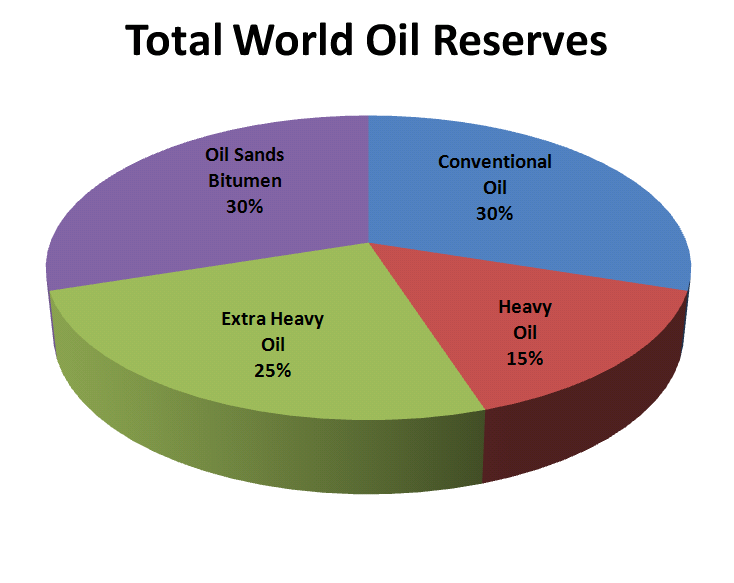

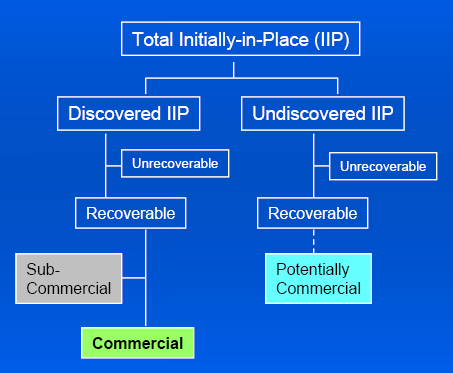

BP (2003) defines the reserves of oil at three categories as “ultimately recoverable” “proved” “probable” while there is enough gap among the others and regarding the measures of oil reserves by the official data of OPEC. Reservation of oil resources pointed to the explored or going to be explored that can also be called recovered as well as still existing. The sum of oil reserves regarding non- producible and producible is termed as oil in place (OIP). Because of a number of limitations, only a few portion of such reserve could be carried on surface, and this portion is viewed as reserves. Recovery factor is the ratio between producible oil and total oil in a specific field, which normally depends on field condition, technology, and investment. There are 4 types of oil reserves (BP, 2010). Such as-

- Exposed through one to more wells.

- Exposed through technology.

- Commercially feasible.

- Existing in soil.

Proven reserves pose a logical assurance of being recoverable under specific political, economic, and technological circumstances, which could be categorised as PUD and PD. The pattern of engineering data is similar for unproven reserves like proven although the contractual, mechanical, and regulative issues are different with 50% CL (Confidence Level). The U.S.A Energy Information Administration estimates that there exists merely 4.1 billion barrels of oil as global reserves while government maintains 1.4 billion excluding a country’s reserves (BP, 2010).

In 2007, SPE, AAPG, WPC, and SPEE had revised 1997 reserves explanations by joining contingent and prospective ones and later two extra termed were also added involving economically and technically recoverable assets. There are three common techniques for estimating reserves (BP, 2010). As-

- Volumetric: It is calculated by multiplying RF and OIP.

- Materials balance: It involves exclusive pressure- volume- temperature assessment.

- Production decline curve: In incorporates using of production information for further extraction.

Total global oil reservation for 2010 could be shown as-

According to USGS (2008), there were 13% of potential undiscovered oil in the world, among half is situated in Amerasia, Arctic Alaska, and East Greenland. It also estimates that Venezuela owned 513 billion and Cuba owned more than 9 billion barrels of oil at the same year (BP, 2010).

Existing Management of Oil Resources

Fundamental Framework of Oil Resources Management

Since oil is a finite resource of nature, management of oil resources are always suffered an uncertainty crisis therefore from the very beginning of commercial oil resources management, producers have need to aware of resources volume as similar degree of production quality and obligatory technical supports. In the global oil, resources industries have now follow aforesaid model correct assessment of oil stock, oil projects development plan and an appropriate appraisal of all operations. Additionally, this part of the paper demonstrated that existing oil resources management has required following a classification model for proper commercialisation as follow. (SPE 2007)

Present Regulatory Framework

This part of the paper has focus on oil regulatory framework both in the oil exporting regions as well as globally. Since commencement of regulatory inspection, the regulatory framework is obliged to consist of numerous performance appraisal standards, negotiation modes to make an agreement, detailed information and specific requirements of self-regulation, quantitative value of carbon emission and finally, contents of all activities during oil management. More specifically, present regulatory framework of oil management involves in

- regional and international legislations to follow a regulatory guideline,

- precise form of responsibilities as well as ethical benchmark, enforceability to follow the coherent laws, and

- adequate sanctions along with the political will to operate enforceability.

For more clarification, following are the list of existing oil regulatory legislations for both regional and global operation (UNEP, 1993).

Impact on Environment: exploration of oil and gas has great impact on global environment and these impacts are the influence of production volume, project size and scale of sensitivity, proficiency of project planning and techniques of controlling, prevention and mitigation of pollution. Here are the most significant factors of environment that have affected by current oil management.

Underpinning Linkage of Oil and Global Economy

Barnes et al (2008) argued that the developed nations like G8 have aimed to resolute the geopolitical and economic risks concerning the instability of oil market and alarmed with the circumstances of concerned factors those possibly trigger more horrible energy crisis that ultimately towards militarization of energy resources and awful financial crisis. ESCWA (2009) scrutinized with the inconsistency oil price during the recent global financial crisis and the oil export of GCC countries and pointed out that the in July 2008; the oil price reached its highest stage at the rate US$ 147 per barrel that accelerated the shocks of global financial crisis. The oil price collapsed at US$ 40 per barrel in mid 2009, the financial crisis turned into long-term recession. The underlying linkage of oil supply with global economy has evidenced the correlation inter dependency, this chapter organised to investigate this issues as-

Interdependency Between Oil and U.S Dollar

Oil along with many other goods is priced in U.S dollars from 1975 through the OPEC agreement of trading oil in terms of dollars. From 1944- 1971, the price of oil per barrel was $3 while after that period, OPEC countries were bound to enhance oil price at the rate of $40 per barrel. Recently, because of challenging factors in the oil- generating countries, demand- supply contradictions and growing demand in developing regions, the price of oil has been rose with a reduction of dollar value. From the dropping value of dollar from 2001, at several times, investors have determined to adopt Euros instead of dollar. Regarding the similar tendency of Russia and Arabian countries, demand for dollar has been reduced with a sharp climb of Euros, silver and gold. Such losses motivated other non- oil zones, like- Japan, Korea, China and Taiwan and India to vary the U.S dollars. All of these factors lead to the relative escalation of oil price by lowering dollar rate. Additionally, several specialists also predict that within few years, per barrel of oil would be sold by $100. Thus, if there is no supply problem, global political conditions, and terrorist threats are adequate for the climbing price of oil at diversified dollar value (Barisheff, 2005). Thus, the integrated dollar, oil, and gold relationship can be presented as-

Today, there is common trade pattern in the market with a thought of “short the dollar, long commodities” that basically focuses on the negative movement between oil and dollar value. According to Marc Chandler, recognised as the head of Brown Brother Harriman’s exchange strategy, per week variation in crude oil price was integrated with the variation in Euros beside dollar at merely 20% than the previous 5 years. Some other industry analysts also believe that this interrelationship is a coincidence since this extra variation in financial markets would be the intensifying runs in crude oil and depositors are not keying off one another. Moreover, fall in dollar price is an economic disruption of U.S economy but the price of oil is increasing for the extensive global demand. Thus, it can be said that the relationship between dollar and oil price has particularly enhanced although it is not specifically strong. It can be assessed for having a random linkage rather than conjoined twins while during the 1st six months of 2008, there was 40% correlation and the later half had experienced 57% correlation (Gaffen, 2008).

Linkage Between Oil and Non-Oil Sector

The significance of oil sector is great in international economy regarding both oil and non- oil criteria. For example, jumps in oil price create inflationary pressure and reversely pressure those countries especially, which are dependent on oil. Additionally, increased oil price tends to raise transportation charges, expenses for hitting and utility, purchasing costs of finished goods, foods and other necessary commodities (Barisheff, 2005).

Thus, the non- oil sector had achieved a growth rate of 9% from 2004- 2008 while the major oil producing regions had gained tremendous real earnings with diminished poverty, like- Nigeria and Saudi Arabia. Less price of oil have created stress on monetary and other external aspects. The monetary equilibrium at the joined public level is established to turn from an extra of 4% of GDP during the year, 2008 to a shortage of 9% of 2009 GDP because of the fall in oil income. So, the non- oil shortage is predicted to limit by 4% to 27% of non- oil GDP of 2009 through reserved raise in expenditure at U.S government level is more than balancing through expense compression at other levels. The BP (Balance of Payments) has also felt with a reverse private investment flows in 2008 when the Nigerian economy has experienced huge withdrawal of capital by the overseas investors. As a result, the banking sector that is one of the most viable parts of non- oil sectors has faced a serious challenge through asset class deterioration. Sluggish economic development also lowered the equity market indicators (IMF, 2009).

Linkage Between Oil and Stock Market

Like many other economic factors, there is close relationship between oil and stock market situation. Here, the financial experience of oil importing and exporting countries is totally different. That means, because of increase in international oil price, the oil importing nations have to suffer the negative balance of trade, which is liable for more current account discrepancy by diluting net overseas asset condition. Similarly, higher price of oil also lowers private disposable earning along with organizational profit margin by lessening local demand and stock prices. On the other hand, the fuel exporting countries, like- OPEC tends to enjoy trade surplus with higher growth and higher stock prices (Abdelaziz, Chortareas, and Cipollini, 2008).

By implementing the co- integration model of Johanson, one research has explored that there is an empirical indication of long- run integration between 5 domestic stock market directories and oil prices along with real consumption, money and outcome. The basic theme of such analysis is there is a negative relation between the prices of oil and stock. Rise in oil prices enhance manufacturing cost and lower aggregate economic function. Apart from this, it can negatively impact on industrial manufacturing and rate of employment which formally suggest the finishing of depressing returns of stock value, like- Greece (Mehmet Eryiğit, 2009).

According to the study of Sadorsky, following the year, 1986, oil prices elaborated a great fraction of the predicted error volatility in the real stock outputs than the interest charges. Furthermore, there was an indication that the oil price changes had asymmetric impacts on the real economy. One expert group, named as Basher and Sadorsky implemented a global multi- factor model for exemplifying the empirical relationship between oil and stock. Such model involves both unconditional as well as conditional risk components for assessing the mentioned integration.

Their findings resulted with a logical proof of oil price risk issues can influence stock price outputs in rising markets, like- India along with the developed regions, like- U.S.A. According to Sadorsky and Henriquez, 4 variables can be commonly used for applying vector auto- regression model. They explained that there is Grainger cause between oil and stock values with the substitute energy organization’s stock values. Further research has also been conducted to disclose the interactive correlation between oil price pressures and stock market in China. Here, multivariate vector auto- regression has been implemented which assesses that oil price has important impacts on several manufacturing along with oil corporation indices. It has also discovered that oil price shocks have been responsible to dilute stock value of oil companies in that country. Many other researchers have also agreed with this similar incidence of oil companies’ depression of long- run stock value in relation with stock price volatility (Mehmet Eryiğit, 2009).

More than those, there is a non- linear feedback linkage between stock market and oil. Many analysts think that it is possible to assume oil prices from the information after 1973 related with the macro- economic factors of U.S.A. Therefore, if both the linking factors rely on the components of discount issue, the price increases take part a major role in the transmission procedure. Thus, inflationary pressure tends to impact both oil and stock price as an integrated mechanism. Other study has also found out that the relationship between oil and stock market was more correlated during the period of 1990 through the linear Granger causality (Ciner, 2001).

Integrated world economy with oil resources

The historical international scenario is highly integrated with one of the most important form of finite resources as oil or crude oil. Thus, the entire economic situation can be discussed with the light of some specific arena (Claes, 2010). Such as-

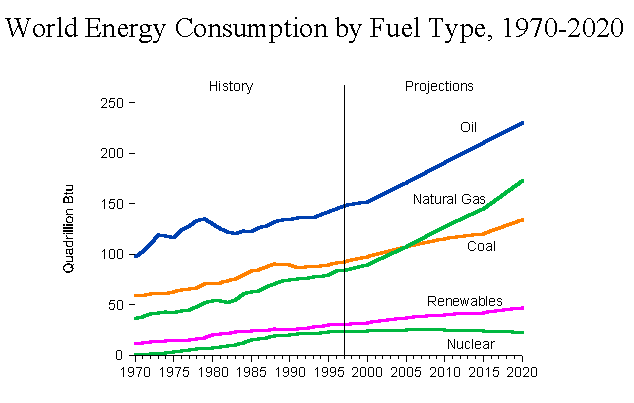

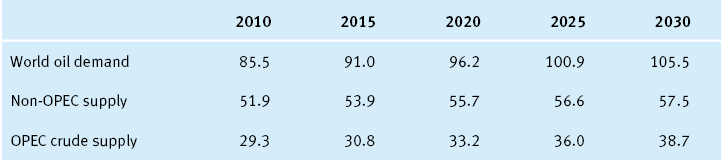

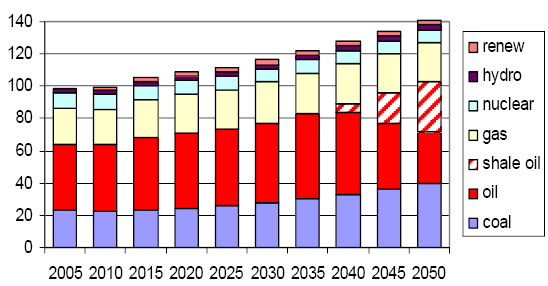

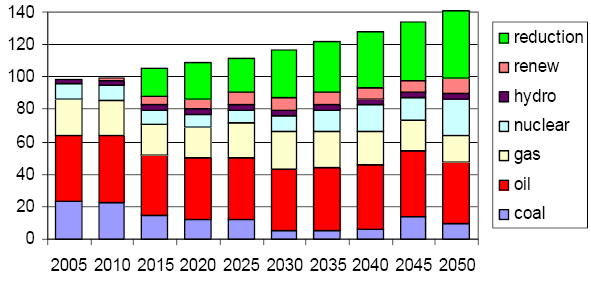

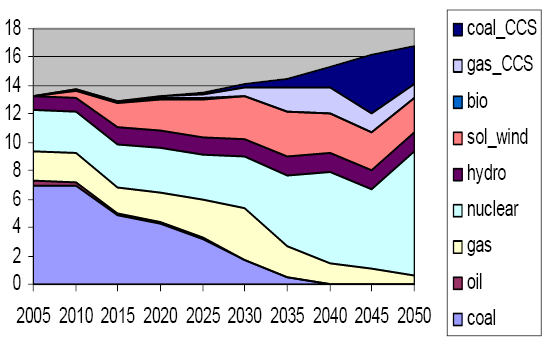

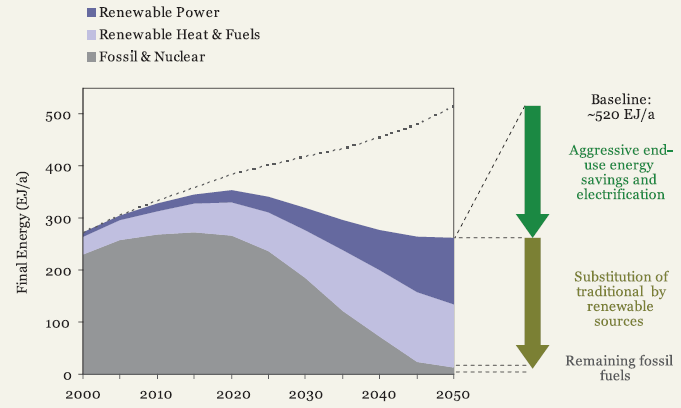

- Integrated energy resources: As mentioned earlier, because of a rise in oil price, during the period from 2003- 2008, the global economy has been facing the problem of adequate oil reserves. As there is fixed amount of oil reserves, increased demand is denoting oil as a scarce resource that is closely adjusted with geological advantage of some particular regions of the world. There is tremendous fall in oil consumption rate throughout the world in 2008, 2009, and 2010 with 1.7% while the average oil price has been recorded as $43.45 in 2009. So, it is getting more difficult to predict oil price because of it high volatility (Claes, 2010). Global demand for oil can be shown as-

- Up to 1970, there was a trend when the international demand and supply of oil was reflected as an integrated chain, which could be managed by a single organization with the highest influence of OPEC (Chima, 2007). However, within 1970- 1980, the situation had been changed with an introduction of spot market. Recently, this trend of future markets influence also exists for setting prices with some integral problems regarding price volatility. During the most recent time, global oil entities are formulating investment decisions regardless any control over price incorporating OPEC also. Thus, there is a single policy of controlling price is to altering the businesspersons view of the forecasted oil price (Claes, 2010).

- Political issue is another concern, which is highly practiced in assessing world economy regarding oil. However, globalization of oil is the first factor that can be elaborated under several dimensions (Claes, 2010). Those are-

- Development of global oil companies with multi- national capital movements regarding funding and margin.

- Bargaining power of reserving countries towards the trading companies in terms of distinct political power through the creation of sunk costs,

- Geo- political issues are highly influential in the global oil industry since they occupy a regional impact regarding U.S boycott by Iran. It has suggested the companies to be introduced in central Asia and Caucasus.

- In case of global policy implementation, the role of U.S.A and EU/ European energy strategies are most prominent. Different political incidents, like- Second World War had created a dramatic change in U.S policy formation structure with its high demand function. It is also one of the most interesting arguments that whether a single nation could achieve such power of consuming the significant amount of a finite resource by political means. For this, many analysts have identified this issue is responsible for attacking Iraq by U.S.A which holds merely 10% of global reserves of oil. It is also though that, still now, the country is manipulating the political situation of Middle East for the similar goal. On the other hand, relatively 65% of energy consumption of EU countries is associated by gas and oil. This zone occupies 0.5% of total global oil reserves and 2.6% of oil production (Claes, 2010). Therefore, EU’s external policy making of oil can be reflected by the following strategies-

Therefore, there are 3 major issues of EU’s oil globalization policy (Claes, 2010). Such as-

- Enhancement of FTZ (Free Trade Zone) with oil exporting countries;

- Outsourcing of oil reserves from FTZ by implementing political means;

- Deduction of external dependency of oil supply either by deducing demand or by increasing production through alternative means, like- nuclear power.

Alternatives of Oil and Conservation of Oil Resources

This sub-chapter identifies the concerned alternatives those would positively contribute to the conservation of finite oil resources, the alternatives are –

Possible Alternatives Towards Oil Resources

Currently, oil is the supreme resource of energy supply where nearly 38.70% of aggregate energy supply of global demand has fulfilled by oil resources. For instance, in USA 27.20 % of aggregate oil stock is utilised for the transportation industries where as 97.0 % energy supply is mitigate by the oil based energy resources. On the other hand, globally oil is the most required energy resource since of its numerous unique features but being a finite resource, now oil industries, as well as its users have essentially needed to consider alternative energy resources to mitigate future oil crisis.

Considering the point this part of the paper has enlisted potential alternatives with their future prospect as well as demerits. Many researchers have analysed that more than 63 % of global oil stock is now reserved in the Middle Eastern countries and the forthcoming days have waiting to facing outstrip demand of oil rather than its supply. Meanwhile, China and India have become more aggressive than before to grasp major oil resources either by long–term contracts or by purchasing famous oil companies. Before describing alternate resources towards oil, it should to quote that rather than transportation industry, scarcity of oil will have made a severe crisis for all type of users with enormous technological and social interactions though current alternative resources have not yet enough secured and additionally not customised proficiency than that of the oil resources (Mast, 2005).

Biomass

At present, biomass energy production is the fourth global energy resource that has admirable potentiality to resolve 47 % global energy demand annually and an essential equipment of producing renewable fuels. Commonly, biomass production required four equipments where agricultural wastes are prior first while producing fuel. In short, biomass resources have crafted energy contents from the plant photosynthesis and this way solar energy in formed into the biochemical energy. Global energy policyholders have declared vision 2020 as of following table where biomass has optimistic potentiality to be termed as a customised energy supplier (Felmy, et al. 2003).

Key limitation of the biomass energy production is required high financial support as well as time–consuming and complex technological infrastructures though agricultural wastes along with the forestry wastes are great source of producing ethanol in a satisfactory volume. Besides limitation of high production costs, following are the most significant and useful biomass forms those have emergent demand in global energy markets.

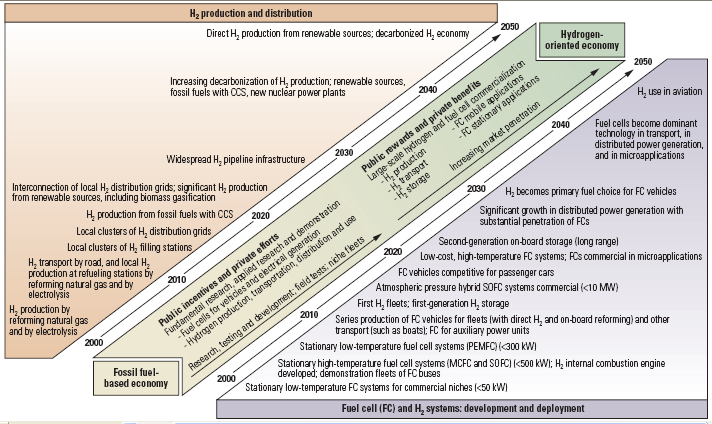

Hydrogen

Since an essential ingredient of water, hydrogen has superior prospect to developing future energy system in alternate of oil–based resources. Future energy economy and supply cycle of the hydrogen has eager to focus more on its sustainability as well as prospect of environmentally friendly. Alternatively, in defining availability in air, hydrogen covered only 0.00005 % amongst aggregate gas ingredients therefore, major limitations of endorsing hydrogen as a core energy supply are scarcity of its volume, threat of global warming potentiality since its a passive greenhouse gas and lack of technological support in order to replacing current fossil fuel energy supplies. On the other hand, during last decade, potentiality of hydrogen economy has diversified significantly and hence invention of refineries has successfully reduced depressing impact on environment. In short, key attributes in favouring hydrogen economy and the hydrogen energy supplies to endorse, as a major energy resource is included low cost guarantee, have keen prospect to transform into hydrogen economy in large volume, modern refineries to reducing CO2 emission, inexhaustible and easy to use. (Niculescu, Anghel & Stefanescu, 2010)

Battery Power Energy

The battery power energy is an effective storage device that conveys stable and reliable electric energy supply as well as ensured power quality as an alternative of oil resources. Day by day, the battery power energy have enabled to attract vehicle industries to resolve challenges of dawn dill of oil energy supply and more significantly, yet have no threat of environment pollution during application on valuable utilities as well as recent innovation flywheel vehicle technologies. Considering these two advantages of battery power energy is now successfully having taken place in the research centre of alternative of oil resources. Alternatively, other than prototype energy devices, the battery has also attributed through continuous technology improvement, cost effective and performance appraisal scope for ensuring more effectiveness during utilisation of energy utilities. (Ribeiro et al. 2001)

Converse to the previously mentioned profile, battery energy power is also termed as renewable energy resource that entailed through two alternative sources namely, a) wind generation and b) the solar power and common task of these devices to store energy supply at peak demand. For instance, recently in Australia, a group of energy researchers has developed a new energy storage battery that termed as the Redox Flow Battery featuring Vanadium Bromide and key function of this device is to make faster energy flow as well as a supportive tool of existing battery devices.

On the other hand, performance test of the new battery demonstrated that the Redox can easily recycled more than ten thousand time without hampering operation flow where as typical lead acid and nickel cadmium batteries attributed through limited number of chargeability, greatly affected operation flow and haven’t yet enough efficient to deliver large scale of energy supply. More specifically, the Redox Flow Battery required only USD $ 1.0 million investment to commercialise its devices which proficient to demonstrate 5.0 kilowatt more power energy as well as 80 % more effective to reserve produced electricity compared to those typical batteries as well as oil based energy storages. On the other hand, solar power or wind storage devices have frequently suffered a crisis of availability but transmission grid of the Redox Flow Battery can able to resolve these uncertainty most of the cases (CEGT, 2005)

Coal

Towards the vision of non-fossil generation, coal is another most significant alternative of oil although is also a fossil-based power energy supplier. Most of the case, coal is utilised for electricity production as an alternative of oil and natural refine gases. Alternatively, at beginning of twentieth century, coal was the king of fuel as well as power energy supply and after end of Second World War; coal lost its demand in the industry of power energy. Oppositely, recent oil crisis inspired the energy industries to shift towards the conversion of coal into synthetic gasoline or alternatively, the ‘synfuel’. For instance, currently Germany has more than 14 ‘synfuel’ plants for energy power supply. On an opposite side, critics have defined the coal as an expensive energy tool compare to the other alternatives and additionally, high emission of chemical during conversion of coal is a great threat of greenhouse effect prevention as well as high volume of carbon-di-oxide (CO2) in air resists clean fuel vision. Finally, good news is that coal would be a great alternative of oil if plants have able to produce low sulfur electric power plants (Pile, 2005).

Nuclear Energy Supply

Previous three global recessions are the effects of high oil resources costs and additionally, from the beginning of 21st century to its first decade until now price of oil resources have increased more than 235 % than prior. On the other hand, recovering inflation effects as well as decrease of current exorbitant interest rates has consequently influence global economic growth. Despite down dill supply of oil resources, considering all the correlated influence on global economy, nuclear energy has selected as a revival dynamics against future oil crisis. Consumer countries of nuclear energy argued that besides other alternatives to oil resources, nuclear has attributed low cost of production with greater efficiency in generating electricity without any greenhouse effects on environment. For instance, 24.0 % of aggregate electric demands of the OPEC members have supplied through nuclear plants and within next 15 years, China has planned to generate 40.0 million kilowatts of electricity from 40 nuclear plants. However, nuclear plants have not yet adverse impact on environment but its not quite problem free and major crisis here is management of wastages (Wharton Universia, 2006).

How the Alternatives can Conservation Oil Resources

Platform of the Oil Supply Crisis

NDU (2003) reported that in this globalisation era, global operational energy and industrial functions have not continued without supply of oil and related petroleum hence, motto of the paper have assigned to illustrate economic certainty and concern in regarding to reducing global oil supply. To resolve current and potential oil crisis this part of the paper has recommended several energy supply resources as an alternative of oil and related petroleum. Meanwhile, IAGS (2004) argued that, 40 % or 875 billion barrels of current oil supply has utilised for the global energy where as 96 % required for transportation energy. Moreover, within 2020 – 25 global oil consumption for energy supply will be required 60 % though oil producers has reserved only 1, 000 billion barrels to recover crisis but emerging growth rate of industrialised countries like China and India would be a strategic threat to generating alternate of oil resources globally. Conversely, in the non Middle-Eastern countries has suffered from rapid depletion in both production and reserve of oil. For instance, Middle-Eastern nations has yet reserve for next 80 years whereas non Middle-Eastern has only for 15 years and in addition, Middle-Eastern regimes have the competency to keep 83 % of global oil reserve till 2030.

Sense of Alternatives to Conservative Oil Resources

Commonly, both domestic and international energy policy makers have emphasise on three major aspects during production of energy resources and they are i) adoption of modern technologies, ii) accurate regulation and iii) economic incentives. On the other hand, common objectives of alternate oil resources are required to occupy flexible affordability, economical and durable energy supply. In this part, summary of key potentialities of alternative energy resources have illustrated to apprise whether those alternatives would conservative oil resources and already this paper has overviewed several famous alternatives (Leonard, 2009)

Affordable and Clean

Common alternatives are cost effective as well as harmless to the environment compared to the oil resources. For instance, oil alternatives are enough efficient to reveal fuel efficiency as well as economical during utilisation of transportation fuel.

Convention Capability

Renewable and convention capability is another feature of alternatives that make them flexible as well as cheap. In this way, alternatives have competent to reduce oil addiction in different sector and business industries.

Hybrid Technological Support

Since 1999, hybrid technology has placed in the market of oil resource industry that has a set of potentiality to save fuels as well as production and consumption costs. Another key feature of hybrid technology is that improved gradually to reduce cost of utilisation.

Plug–In Hybrid Technological Support

In comparison to hybrid technology as well as oil recourses, plug in hybrid technology has proficient to replace gasoline utilities along with the electronic devices thus vehicle and other oil depended industries can easily be addicted free of oil and switch towards gasoline power energy in conjunction with electricity.

Cellulosic Ethanol

The cellulosic ethanol is a biomass fuel that conveys most effective environmental advantages compared to all alternatives of oil resources. For example, the Cellulosic Ethanol is effective to control 7.0 % lower carbon emission and other harmful gases to prevent green house effects.

Research Methodology

Introduction

In order to measure the economic position in case of dwindling supply of oil and to understand how the oil supply shock could shape the world economically and focus on alternative resources, this dissertation only consider secondary data resources. The main aim of this chapter is to consider how the researcher would formulate this dissertation and select the proper research method for this paper. However, the researcher has designed four questions based on dwindling supply of oil, future of oil supplies, alternative resources and economic condition.

Research Design

According to the view of Saunders, Thornhill, and Lewis (2003, p.33) and Malhotra (2009, p.29), two main important research approach are qualitative and quantitative research approach. However, Marshall and Rossman (1999) and Sekaran (2006, p.5) argued, “qualitative approach is playing crucial function when some issues are known to the researcher, but additional information is required for developing a feasible theoretical structure”. On the other hand, Cohen, Manion & Morrison (2007, p.75) pointed out that quantitative research method help to deliberate the paper on a specific conclusion by quantifying the collected primary data from selected respondents.

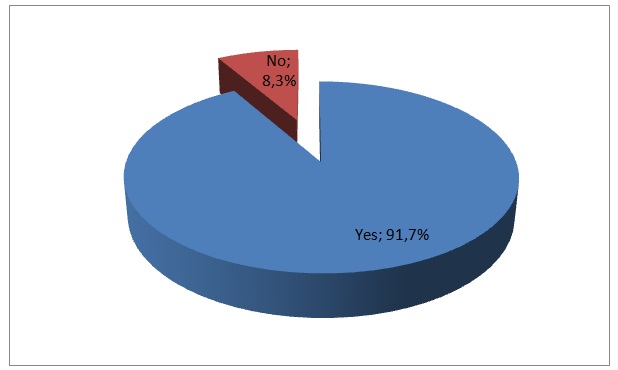

However, the researcher of this dissertation would like to use only qualitative research approach due to lack of time as well as sufficient fund to conduct field survey. On the other hand, many scholars have already been conducted field survey to find out the position of oil reserves and the future of economy as oil is a finite resource. For instance, Leckie (2007) stated that increasing costs and dwindling supplies of oil become a severe problem for economy of the developed countries while alternative fuel failed to solve these dilemmas because there are many alternative fuels but none of these products is able of replacing oil. However, present researcher would like to consider qualitative research because most of the previous research on this topic area deals with the problem of alternative resources, for example, small starting base for alternate fuel production, increasing demand of oil, the implications of Peak Oil, and so on.

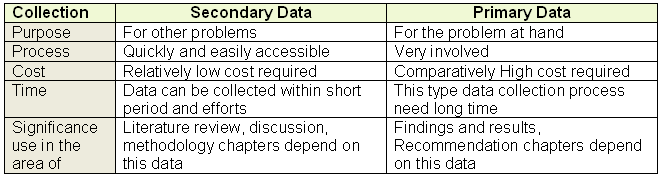

Secondary Data

Saunders, Thornhill, and Lewis (2003, p.86) pointed out that secondary data means already published data that means “second hand”, which is suitable in consultancy research project, and Zikmund (2006, p.63) stated that secondary data assists to develop the understanding of the research problem and find out the research gaps. According to the view of Cohen, Manion & Morrison (2007), these sources are more dependable while data has accepted by the renowned publishers or universities. On the other hand, Yin (2003, p.36) expressed that secondary data may contain inaccurate information as there is no way to measure correctness, data may be outdated, specific information may not available, and existing data may not sufficient to serve the purpose. Furthermore, Malhotra (2009, p.107) and Saunders, Thornhill, and Lewis (2003, p.87) concentrated on the advantages of secondary data by arguing that this data is economical and saves our efforts and valuable time.

As a result, the researcher of this dissertation would rely on secondary data in order to organise this paper by considering both advantages and disadvantage of this type of data sources. However, the researcher would collect information from official documents like- it would use report of the OPEC, and International Monetary Fund and EU reports on oil resources along with the survey report of the multinational oil companies.

Simultaneously, the author would utilise other documents, such as, journal articles on the dwindling supply of oil, management books, magazine, and other published reports, statistical data sources, relevant case studies, conference and prior thesis papers to develop the quality of this paper. However, secondary data sources like Ralston’s “peak oil: the eventual end of the oil age” is one of the most useful secondary resources for this dissertation as it includes crucial data related with energy policy, and the future demand and supply of oil from Saudi Arabia. At the same time, WWF report “The Energy Report 100 % Renewable Energy By 2050” was a great source of information as it contains numerous guidance for the oil producing countries and other developed countries to face any future challenge with dwelling supply of oil and to take initiatives accordingly. On the other hand, Reilly and Paltsev’s research document “The Outlook for Energy Alternatives” mainly concentrated on the US energy market but they revealed that the impact of finite resources is not limited on the US market but it will create problems in global economy. As a result, they further added that the energy policy should be based on the global context; however, this research concentrated more on the volatility of oil price, present situation, the potential for alternatives and Emissions Prediction and Policy Analysis (EPPA) model.

Qualitative Data Analysis Procedure

Marshall and Rossman (1999) stated that the researcher should follow three major steps in order to analyze qualitative data such as data reduction, restructuring data and verifying the ultimate results and outcomes. However, Miles & Huberman (1994) pointed out that data reduction involves a number of interconnected procedures; for instance, classification and coding, hypothesis development and negative case analysis.

Importance of Secondary Data

This dissertation would consider only secondary data because this data is quickly and easily accessible, most of the relevant data sources are available at lower price, and data collection is easer than interviewing method (Cohen, Manion & Morrison, 2007). On the other hand, Malhotra (2009) pointed out that this type of data can be collected within short period while it should require long time and efforts to generate primary data. According to the view of GAO (2007, p.48), it is essential to measure the prospective of technologies in order to moderate the consequences of a peak and decline in oil production by scrutinizing options to improve the use of alternative fuels and technologies to decrease energy consumption, which will diminish the risk of economic disaster like present global financial crisis. Therefore, the researcher will concentrate more on the alternative resources to analyze the economic reality of living with a dwindling supply of oil. However, the following figure compares the advantages of primary data and secondary data –

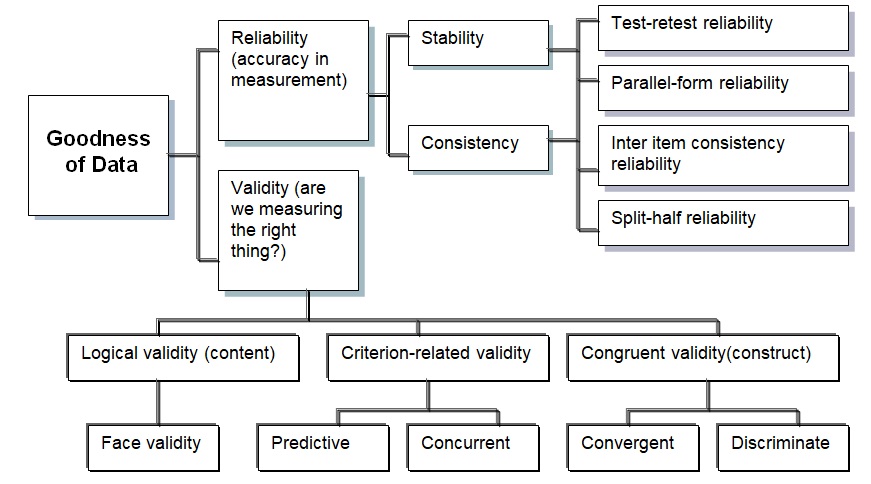

Reliability and Validity of Data

Sekaran (2006, p.204) stated that the reliability of a measure point outs the extent to which it is without bias or it is an indication of the stability and consistency with which the instrument measures the thought and assists to assess the “goodness” of a measure by applying test-retest reliability and parallel-form reliability. However, Susan (1994) expressed that consistency and validity of quantitative data is measurable numerically by addressing same issues again and asked same questions to the previous respondents to check reliability. On the other hand, Miles & Huberman (1994) stated that the reliability and validity of qualitative data is based basically on the rigor of the method because in case of quantitative research it should require to follow few steps like data editing, cleaning includes consistency checks and treatment of missing responses.

Discussion

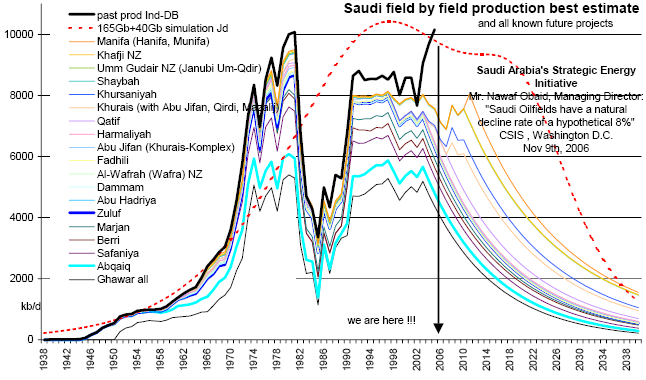

A Case Study of Saudi Oil Resource Reducing (Peak Oil) Scenario

Saudi Arabia is a crucial OPEC member that has seized highest oil reserves amongst global oil producing countries and currently, emphasise more on production capacity for moderate pricing strategies as well as reduction of oil addiction of the industrialist countries. On the other hand, recent Nigeria violence drastically reduced oil export as a result, demand for oil production in Saudi climbed proportionately. Meanwhile, increased scope of oil production cannot satisfy global oil demand since of untenable OPEC reserve outline. Moreover, current turmoil in Middle East regions has revealed extreme ominous signs that it would not be easier for Saudi to pull out global demand as well as patronize economy (Ralston, 2008 & Jud, 2006)

Outlook of Saudi Oil Shock and Impact on Global Economy

SPE has recently reported that Saudi has more than twenty oilfields where Ghawar is largest for prior fifty years. More specifically, capacity of Ghawar was enough efficient to produce greater than half of aggregate Saudi oil production but now in recent time, Ghawar has severely injected through increasing water volume and for that reason, production capacity of the plant has drastically reduced. Conversely, Ghawar has situated in a complex geological location and in addition, re–drilled, switch of plant location is exceedingly costly, and risky that notified potentiality stick down the plant forever. Moreover, not in Saudi domestic production also in international market Ghawar is a unique plant in size and production volume to replace efficiency of Ghawar as a result, climbing peak oil crisis cannot materially meet current oil production target in Saudi. Here is the comparative scenario of Ghawar among other Saudi oilfields.

Lack of Advance Technology and Thirst of Oil, Money and Power of the Industrialists

it has well known that there has an intimate affiliation with oil and US dollar (USD) and modern technology is the earnest demand of this century and regarding this need, Saudi has now in great crisis of sufficient modern technology for necessary oil exploration. For this reason, similarly non-OPEC region, Saudi, as well as rest of OPEC members has suffering proved oil stagnation and additionally, it has rather narrower of new oilfield discover than before. Hence, greedy industrialist has enforced ably entered into the Saudi oil industry with multi domestic policies those sucking prime oil production, revenue as well as authoritative power to occupy their oil dependency.

Lack of Modern Oil Recovery Tools

Since 2001, oil, recovery mechanism has gradually reduced such a status consequently, conventional oil extraction, risk dynamics of investment, materialistic constrain as well as costs of production prohibitive at an extreme stage and additionally, prompt change of applicable oil exploration equipment considerably reduced supply of required oil volume. This attribute has now noticed that limitation of oil recovery tools mad the Saudi oil production unpredictable and kept tough threat towards future demand and supply equilibrium.

Global Energy Policy

During WW II, increasing demand for natural resources as well as alarming commodity price fluctuation was an undeniable issue for the European zone. On the other hand, at the last quarter of 1930s, the US consequently commencing the factual economic commodities towards the global emerging countries likes Japan. Finally, July 1941, USA was deliberate a complete petroleum trade embargo in order to roll over the East Asia by compiling a geopolitical block with a strategy of securing significant energy resources like oil. Regarding this view, following are the three indispensable global energy policy zones with energy policy recommendations (Friedrichs, 2010).

USA & G-8 Energy Policy

The motto of the G8 members’ energy policy is to focus on future demand but should not hamper the existing demand of energy resources and additionally, develop a sound stock of natural energy resources along with potential alternatives considering manners of environmentally friendly. Regarding this vision, common energy policy of USA and G8 members have segmented into three broader forms namely,

- long–term energy strategy to efficiently administrating both existing and future oil crisis.

- Energy policy should to be enough modern to deliver greater energy supply than before as well as easier to waste management for a clean atmosphere along with scope of optimal alternative energy resource utilisation. and

- current energy policies are enough conscious to improve living standards of common people of members countries and reduce addiction on oil resources as a result, national policy of G8 members would easily integrate their energy, environment and economic strategies on a common platform.

These three broader segments advocates to strategically executing significant country objectives therefore US and other G8 members would undoubtedly enjoyed five major national improvements. And they are

- modernise conservation attributes,

- modernise energy infrastructure,

- vast improvement of alternative energy supplies rather than traditional,

- key focus on curing damages of environment and

- pay more attention on domestic energy security system (NEPD, 2001 & IEEE–USA Energy Policy Committee, 2010).

Key Challenges: During execution of energy policies Major challenges of the G8 members are principally involved with three issues

- significantly elaborate economic branches,

- rising population number and

- climbing standard of living of common people.

Considering these three attributes, G8 members are in great challenge of sustainable energy supply and utilization. More specifically, producing, promote and nursing of environmentally friendly alternative energy resources therefore, growth of economic expansion of the G8 members would be stable for long. On the other hand, damage repair of the existing energy supply framework and modernisation of green energy supply to reduce influence of climate change through high carbon-di-oxide (CO2) emission (NEPD 2001 & IEEE–USA Energy Policy Committee, 2010).

OPEC Energy Policy

Currently, OPEC members are largest oil supplier globally specially in the developed region and since oil is a finite energy resource, both oil exporter and importer are worried about stock and pricing strategy of oil resources in the international market. The OPEC members consider direct and passive influences of oil market fluctuation during participation in global energy policy analysis. In brief energy policy of OPEC includes

- though oil is a costly commodity then it has urgent now to modernise oil derivatives performances as well as recommend low interest rates.

- High oil price is a great challenge for the oil industry but not an obstacle for global financial escalation and hence, it should fruitful to formulise moderate and durable pricing strategy of oil.

- World economy has recovered quickly than assumption but has strong potentiality be fragile very soon, for this reason; it has emergence a unique and stimulus measure of GDP globally.

- Emphasise on demographic economic growth it has vital to draw a durable economic growth infrastructure for a robust global economy.

- Mass R&D of the oil industry illustrate that there has absent of significant supply and demand dynamics those strappingly affiliated with prompt climate change as well as GHG emission and hence, energy policy of OPEC has significant focus on environmental uncertainties.

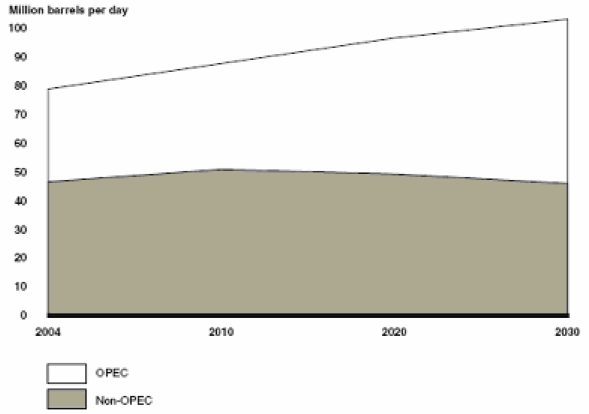

- Gradually, demand for energy resources increased significantly and several case analyses reported that, within 2030 global energy demand will increased by 40 % compare to those existing, since of vast development of the developing countries. However, modern energy services could not able to resolve energy poverty and for this reason OECD has recommended developing countries to emphasise on average per head energy use to reduce energy poverty.

- Other than traditional energy resources, OPEC has also pay significant attention on alternative energy supply like fossil fuel and additionally, has expected to occupied and supply 80 % amongst aggregate energy demand through alternatives.

- Alike alternative oil energy resources OPEC has also a significant focus on natural gas to explore future energy mix and additionally, considerable interest of Europe and China for shale gas as well as LNG for rapid change in economic development.

- With swift recovery of global financial downturn, oil demand has also climbing high dramatically and two third of aggregate global economic growth has expected to occupy in the Asia Pacific Region as well as in China. Regarding this issue, OPEC has earnestly tried to adopt protectionism model to rescue from potential global imbalances.

- Road, aviation and marine are three major transportation networks along with major areas of oil and energy resources demand growth. Considering the issue, for optimal stable oil resources demand OPEC has enthusiastic to penetrating most modern technologies to restructuring transportation policies, which would favour alternative cost effective resources than traditional in anticipation of 2030 (OPEC, 2010).

Energy Policy of Developing Countries

Similar to the developed industrialist countries, key focus of the energy policy of the emerging countries keep an eye on three major issues and they are social status, sustainable economic growth and environmentally friendly. For last two decades, climate change is climbing high and consequently compare to the developed regions, global developing areas are greatly affected. Considering this point, energy policies of the developing nations especially in the Asian and Pacific Region countries have key focus on controlling of greenhouse gas emission. On the other hand, these areas are in threat of high population density as well as social and economic improvements and hence, energy demands in these areas are high as well than before. More specifically, increasing industrialization and urbanization leads towards greater economic activities as well as living standards improvement forced to high consumption of energy resources in both households and business sectors.

As regards this view, energy policies of the developing regions required to drastically conscious on matter of energy securities, costs of supply and sustainability of energy resources. Conversely, point should to be note that inferior population of the world has inhabited in the South Asia and sub–Saharan Africa where largest portion of global poorest people lived under threat of climate change in a parameter of most vulnerably. During structure of energy policies, policyholders of developing region has also surfacing to resolve these challenges and hence, in recent time policy analyst has recommended an strategic vision namely, the Strategy 2020 to acquiring low carbon economic system, reduction of poverty as well as modern energy security system. In short, key objectives of developing nations energy policy is to occupy accessible energy for all, promoting energy reforming through alternatives resources as well as promoting on efficiency of new entrance, develop sustainability and finally, ensure good governance (ADB, 2009).

Energy Alternatives and Macroeconomic Reality

Since of finite attribute industrialist nations as well as oil rich countries are now in great crisis of alarming stock of oil resources and hence, both developed and developing regions are move forward to alternative of oil resources. On the other side, tragedy of oil rich countries is that, yet now they are not enough economically sound than those have not. More specifically, global economic performances as well as macroeconomic dynamics are intimate at certain level as a result, in broader form six major economic functions have surged significantly. The economic forces are

- inflation of global commodity price,

- volatility,

- permanent crowding compare to manufacturing growth rate,

- underprivileged institutions,

- enduring un-sustainability and

- significant cyclical difference of cash flows or cyclical Dutch Disease.

Meanwhile, it has urgent for the alternative energy resources market; draw more focus on the commodity export regions for an accountable and transparent commodity funds where as traditionally, monetary policy and fiscal regulations are structured in exchange of oil resources. For the reason that, the monetary regulations have outlined to more focus on global and domestic commodity pricing strategies as well as distribution modes and conversely, negative effects of the natural energy resources on environment has also urgent to possession significantly. Regarding this demand, this part of the paper has presented an outlook of significant geopolitical view on alternative energy resources along with their effects on macroeconomic areas. In this regard, here are the six key unfavourable influences of oil and other natural energy resources on global economy.

Firstly, hypothetically, long-term commodity pricing has neutralized through an optimistic assumption but in practice, not yet there has no alternative finding, which may deliver a durable and positive commodity-pricing structure. Secondly, greater instability in commodity pricing proportionately mobilise transaction charges as well as risk profile. Third, rich mineral stock hampered national development since of high civil war potentiality. Fourth, in accordance with the historical evidences, moral decays have encouraged through commodity endowments and hence, oil and other energy resources has inhibited sovereign as well as democracy practice that hindrance economic growth. Sixth, significant cyclical gap, high commodity price, moderate balance of payments, increase of national expenditure including non traded goods and services have also resulted as a negative influence of oil energy resources as a result, government of energy resources suppliers have tie up with high debt liability along with wilt manufacturing industry (Frankel, 2010).

Global Outlook towards Alternatives

During defining competitive scenario of alternative resource over energy market, global view towards the energy alternatives along with macroeconomic efficiency of those has mostly emphasize on fuels price in future. More specifically, energy markets like electricity supply, assist in agricultural functions has cyclically faced massive disturbance after every 20–30 years. By analyzing previous 40 years statistics of energy market, it has easier to draw portrait of future alternative energy features and two major environmental issues

- emissions of greenhouse gases and

- climate policy as well.

Taking into account the matter following are major focus of global view towards alternative energy market (Reilly & Paltsev, 2009).

Greenhouse Gases