Introduction

The field of leadership is one area of academic research that has evolved and fundamentally shifted its paradigm. The understanding of effective leadership has progressed from the orthodox transactional epoch point of trait, behavioral and contingency theories towards the existing leadership paradigms of charismatic and transformational leadership. This report tries to explicate the degree of diffusion of transformational and transactional leadership across the banking sector in Pakistan and its subsequent impact on innovation and organizational citizenship behavior that entails ramifications on employee perception of organizational commitment.

Pakistani Financial Sector: An Overview

Financial Sector in Pakistan contains a wide range of financial institutions. They include Commercial banks, specialized banks, national savings schemes, and insurance companies. They also include development finance institutions and investment banks as well as stock exchanges. The corporate brokerage houses and leasing companies are part of them. In addition to them, the discount houses and micro-finance institutions, and Islamic banks also constitute part of banking organizations in Pakistan. They offer a whole range of products and services both on the assets and liabilities side. Financial deepening has intensified during the last several years but the commercial banks are by far the predominant players accounting for 90 percent of the total financial assets of the system.

The aggression shown in the sector of banking development in Pakistan has, perhaps very few parallels in the world. Starting virtually from scratch in 1947, the country today possesses a full range of banking and financial institutions to cope with the multifarious needs of a growing economy. At the time of partition, the total number of commercial banks in Pakistan was 38. Out of these, the Pakistani banks were 2, Indian banks 29, and exchange bank 7. Since 1990 the Government of Pakistan (GOP) has introduced various reforms in the financial services sector enhancing the level of autonomy enjoyed by the SBP. The number of banks operating in Pakistan has increased, which in turn has resulted in increased competition. The banking sector, in general, has shown good progress during the last few years. During the previous five years, the combined total assets of domestic banks, showed an average annual increase of 22 percent, while combined deposits have recorded an increase of 27 percent per annum.

Twenty-one foreign banks operating in Pakistan are playing a significant role by incorporating new technologies and providing better quality services. Policies of privatization, foreign exchange reforms, and structural adjustments, have increased the inflow of foreign resources through direct and portfolio investment. Most foreign banks in Pakistan have branches only in big commercial/industrial centers, unlike local banks, which also operate in small towns.

In trade financing, the role of foreign banks is even more significant, as approximately 30 percent of the total trade of the country is transacted through them. A major portion of the trade financing is for importers to establish letters of credit.

Pakistan is a developing country and having a relatively low level of income, is required growth rate is low as there is hardly any savings. The standard of living along with the quality of life is the newer concept in Pakistan, which emphasizes individual aspects of human nature. These have led to foreign aids, which has been the holding force to bridge the gap for us between our savings and investments. Nevertheless, these aids have become the drowning force for our country. By being a member of the most western aid consortium, the famous IMF occupies a pivotal role in our economic sphere by influencing our international financial transactions and creates the pace of our development policies. IMF’s main objective for Pakistan is to maintain stable exchange rates, a multilateral credit system, and international liquidity to recover the country from its worst economic crisis. However, Pakistan’s economic problem can mainly be aspired by internal development and avoidance of any major international role.

The structure of the Pakistani banking sector has substantially changed in the last decade, particularly following the privatization of the state-owned banks. In 1990, the banking system was dominated by five commercial banks, which were all state-owned. The structure of the Pakistani banking sector has substantially changed in the last decade, particularly following the privatization of the state-owned banks. In 1990, the banking system was dominated by five commercial banks, which were all state-owned. Amendments done in 1990 to the Banking Companies Ordinance launched the process of financial sector reforms by allowing privatization of the state-owned banks.

The privatization of state-owned banks has been accompanied by the liberalization of the financial system and the openness to domestic and foreign competition. The number of commercial banks and various nonbank institutions grew rapidly in the early 1990s (the number of commercial banks increased to more than 40 by thenyeart1995). Worried by the health and soundness of the newly entering smaller banks, the authorities imposed a moratorium on the starting of banks in 1995, until they sought to consolidate banking by a certain capital from 2001. While the ownership and management of the banks by a private sector are one pillar of the reforms, the other pillar is a strong regulatory environment. The Central Bank in Pakistan has strengthened its capacity by acquiring new skills, upgrading the quality of the existing human resources base, adopting technology, and re-engineering business processes.

Pakistan’s Banking Sector can be classified under the following broad categories:

Overview

Leaders are seen as visionaries who stir motivation in cohorts elating performance echelons subsequently accomplishing the strategic corporate goals. Companies rely on leaders to steer businesses and instill growth and profitability. Globalization has brought along an era of fierce competition marking a shift from transactional paradigms to transformational paradigms to cope with market volatility and to grasp consumer perspectives.

Aims and Objectives

This research study aims to explore the subjective meaning practitioners ascribe to leadership in Pakistan’s banking sector and how it impacts innovation and organizational citizenship behaviors subsequently influencing organizational commitment.

- To garner an understanding of the leadership concept.

- To understand the transformational leadership ideology in the context of the unique national and organizational cultures in the banking sector of Pakistan.

- To identify challenges that may exist in institutionalizing transformational leadership in the Pakistani banking sector.

- To develop a framework that represents the varied aspects of leadership that entail transactional and transformational traits.

- To analyze critically the empirical findings of transformational leadership and compare them with existing theoretical models of transformational and transactional leadership.

- To study the impact of leadership style on innovation and organizational citizenship behaviors in the context of the banking industry.

- To explicate the influence of varied traits of leadership on employee perception of organizational commitment.

Scope of Study: The scope of the study is to review the present influence of western leadership theories on Pakistan’s banking sector. In addition to that, the applicability of the transformational leadership style on the future of the Pakistani banking sector also finds a place in the discussion.

Research Questions

- To what extent the presence of foreign banks influenced the working style of local banks in Pakistan?

- What are the influence of openness and democratic working style of Western banks on Pakistani local banks?

- Is there any change in leadership style that is being followed in local banks in Pakistan due to the influence of Western banks?

- What is the future of Pakistan’s banking industry if it learns from foreign banks in the country?

Literature Review

Leadership Definitions

“Successful leaders inspire ordinary people to achieve extraordinarily.” Christopher Rodrigues – Group Chief Executive, Bradford and Bingley Building Society

Leadership has been defined in terms of individual traits, behavior, influence over other people, interaction patterns, role relationships, occupation of an administrative position, and perception by others regarding the legitimacy of influence(Yukl, 2006).

Martin Luther King, while defining leadership said “People are often led to causes and often become committed to great ideas through persons who personify those ideas. They have to find the embodiment of the idea in flesh and blood to commit themselves to it.”

Leadership is “a particular type of power relationship characterized by a group member’s perception that another group member has the right to prescribe behavior patterns for the former regarding his activity as a group member.” (Janda, 1960, p. 358). Leadership is “the process of influencing the activities of an organized group toward goal achievement.” (Roach & Behling 1984, p.46). Leadership is “interpersonal influence, exercised in a situation, and directed through the communication process, toward the attainment of a specific goal or goals.” (Tannenbaum et al., 1961, p. 24)

(Table of definitions from leadership enhancing the lessons of experience by Hughes, Ginnett and Curphy, pp. 7).

Leadership Vs Management. (TABLE from the tools of leadership ).

Managers do the right thing; leaders do things right (Bennis, 1989 as cited in Hughes, Ginnett and Curphy, pp. 9, 2006)

“Remember the difference between a boss and a leader: a boss says, ‘Go!’ – and a leader says, ‘Let’s go!’ “… (E.M.Kelly as cited in leadership enhancing the lessons of experience by Hughes, Ginnett and Curphy, pp. 6).

Thus there is a difference between asking to do and doing along with the group members. That difference can be termed as leadership and thus there exist some factors that affect it.

Factors Determining Leadership Style (No Single Recipe for effective leadership)

To remain at the cutting edge leaders are moving towards organic forms creating new paradigms that incorporate the essential radical changes from hierarchies to linear forms, from rigid mindsets to innovativeness, from power struggle to team building, from quantitative results to performance, and from centralization to collaborative attributes. Leaders are trying to inculcate the values and character of organic forms in the very core of organizational culture.

To garner an understanding of this shift we take a look at IBM a multinational computer technology and IT consulting corporation founded in the late 19th century that currently employees 388,000 people, a market giant that adhered to an orthodox style of leadership with rigid culture. But to keep pace with the fiercely intense competition and global dynamics IBM brought about radical changes in the orthodox way of doing things to gain strategic competitiveness in the global economy. The company underwent a cultural shift to stimulate innovation to maintain steady growth (Business Week, 2002). With the feudal style of leadership and bureaucratic culture, IBM was losing its competitive position in the market with $ 8 billion lost in one year it was time to shake the company from top to bottom. And that’s where IBM brought in Louis V. Gerstner Jr. a visionary leader and a strategist as CEO of the company in 1993 who with a striking speed was able to reduce costs while keeping the company intact (Lohr, 2002). Gerstner revitalized the dysfunctional culture of IBM. He realized that to remain at the cutting edge it is vital to incorporate collaborative behaviors, an informal and supportive environment where people enhance their creativity and foster team building.

Researchers assert that it has to be a combination of traits and characteristics taken from all different styles of leadership prevalent to determine effective leadership style. The following table adapted from Randeree and Chaudhry (2007) highlights a few types of research that focused on the determining factors of the preferred leadership style in an organization.

Leadership Styles (Anatomy of leadership…The tools of leadership by Max Landsberg)

Early researchers believed that leaders have inherent qualities that differentiate them from the rest paving way for trait theories as Banner and Blasingame(1988) assert that leaders are born not made. Robbins et al (2004) highlighted people like The Virgin Group CEO Sir Richard Branson and Woolworth’s CEO Roger Corbett as charismatic and enthusiastic leaders. In the 1940s academics started looking for unique behaviors among leaders, and this led to behavioral theories of leadership. This school of thought implied that people can acquire traits; they emerge over time (Banner and Blasingane, 1988). Researchers found no consistent pattern of character and behaviors in leaders but some studies exhibited six unique rhetoric attributes that people admired in leaders; honesty, forward-looking, inspiring, competent, fair-minded, and supportive (Kouzes and Posner 1993, cited in Cacioppo 1997).

As times changed researchers proposed another theory called Contingency Theory bringing to fore the argument that certain situations and circumstances help people evolve as leaders widely known as Situational theory. Various authors wrote about leadership development concerning contingent environments. Fiedler’s contingency model proposed that the degree of optimal performance depends upon the balance between the leader’s style and the degree to which the situation gives control to the leader (Roskin, 1983). Another approach that gained popularity among researchers in various fields was path-goal theory classifying leadership behaviors into four categories (Yiing, 2009). The first one is Directive leadership associated with traits like initiating, structure, and task-oriented where leaders communicate that is required of subordinates. The second one is Supportive leadership where a leader is seen as considerate and people-oriented. The third one is Participative leadership requiring subordinates to be interactive in decision making. And the fourth one is Achievement-oriented leadership that delegates challenging goals. The following table gives a comparison of all the above-mentioned theories.

Transformational Vs Transactional Leadership

Transactional forms prevailed till information technology revolutionized the business paving way for organic forms. Historically organizations carried hierarchies, rigid cultures and leaders behaved as dictators converging profitability with success. Transactional leadership scholars have focused on command, coordination, delegation, and resource acquisition (Zhu et al, 2005).

In the words of Zhang and Coleman, 2000, “Transactional leadership occurs when the leader rewards or disciplines the follower, depending on the adequacy of the follower’s performance.” (Zhang and Coleman, 2000: 369; as cited in Bass and Riggio, 2006)

Characteristics of Transformational and Transactional Leaders: Bass B. M pg. 22. (From Transactional to Transformational leadership: learning to share the vision).

The response of organizations is to keep up with the radical changes that are taking place. The response was in the form of changing orthodox cultures and by integrating linear structures. The supportive cultures that were brought as a substitute for orthodox ones encouraged collaborative teams, which can show innovation in working. Leaders remained at the forefront in inculcating these values at the very core of the organizational philosophy. Transformational leadership focuses on the broader spectrum in terms of organizational strategic goals. Followers rise beyond personal goals and vested interests to convene towards team building, organizational and environmental convergence (Cacioppe, 1997).

Bass (1990 ??) emphasize that transformational leaders not only influence employees and stakeholders within an organization but also have implications for corporate image:

“A firm that is permeated with transformational leadership from top to bottom conveys to its personnel as well as to customers, suppliers, financial backers, and the community at large that it has eyes on the future; is confident; has personnel who are pulling together for the common good; and places a premium on its intellectual resources and flexibility and development of its people. ”

(Bass, 1990: 25)

Avolio and Bass (1991, as cited in Bass, 1999… 2 decades of research and development in transformational leadership) deduced that every leader exhibits factors of both transactional and transformational leadership as quantified through Multifactor Leadership Questionnaire (MLQ) with the difference that each leader profile display more of one and less of other. Their empirical study manifested that more effective leaders are more transformational and less transactional. Bass (1990..) also believes that transformational leadership traits and values can be inculcated across all management levels through effective organizational and human resource policies.

Researchers also have a consensus that there is a correlation between transformational leadership, transactional leadership, organizational commitment, job satisfaction, and job performance. The extent of correlation can be tested by reviewing the leadership theories in contemporary times (Bass, 1985; Bass et al., 1987; Savery, 1991; Yammarino and bass, 1990).

Leadership in Contemporary Times

With globalization, the field of leadership evolved and transformed in a fundamental way ensuring that leaders must have the essential adroitness to tap into ever-changing facets of organizations by being visionaries, charismatic, and innovative. The paradigm has shifted to inculcate these changing environments towards transformational leadership. Contemporaries advocate

“…transformational leadership is about change, innovation and entrepreneurship…we see the corporate transformation as a drama that can be thought about in terms of a three-act play: Act I revitalization – recognizing the need for change; Act II creating a new vision; Act III Institualizing the change.”

(Tichy and Devvana, 1986, as cited in Banner 1995, pp 58).

In recent times scholars have written numerous pieces on rhetorical traits and attributes of transformed leaders. Sankar (2003) explicitly writes organizational values and character must be delegated along with a well-formulated vision by a leader within the organizational realm. He continues to write that these values evolve and develop through a value-based relationship, a relationship between leader and follower based on shared and institutionalized values that are not just advocated by a leader but also acted upon (Sankar, 2003).

It means that the transformational leadership activities include implementation along with advocating a principle. This aspect of considering the actions as well as proposals of a leader constitutes a significant difference between transformational and transactional leadership. One can term motivation and enabling the team members to reach the goals as one important aspect of a transformational leader. Avolio, B. J. & Bass, B. M. (Eds) (2002, p.12) explicitly state that the leaders who motivate and enable the group members strive to create a sense of alignment. They also provide a direction that can be shared by colleagues as well as the followers. Regarding this, they quote the example of Southwest Airlines that has shown the best results in the US airline industry. Avolio et al., (Eds) (2002, p.13) attribute that credit to CEO and founder Herb Kelleher, who emphasized humor in the organization.

The authors further appreciate Kelleher’s business strategy based on simplicity, efficiency, and effectiveness that made employees of the airlines helpful to one another. In this regard, Avolio et al. tried to show the difference between southwest airlines and its competitors that also made profits. They explain that just making use of deregulation by the governments may not result in the sustenance of an organization. In this regard, they cite the example of Eastern airlines, which took advantage of deregulation in the 1980s but out of business in the time being. However, that is not the case with southwest airlines, and it slowly moved towards increasing levels of profitability over time. Explaining this, Avolio et al (2002) cite the way the CEO Kelleher and his employees attribute the credit to each other. This aspect of attributing credit of success to followers by the leader and vice versa could be an example of the atmosphere that a transformational leader can create (Avolio, B. J. & Bass, B. M, 2002). The type of leadership exhibited by Kelleher can also revitalize the strategy of a company and enables it to survive in the market. The case of Timmer’s success in Phillips is the best example of that type.

Karsten et al (2009) wrote how the president of Phillips Jan Timmer announced a total revitalization strategy to survive and made a comeback in the market. Timmer’s success was attributed not just to his style but also to his effort to connect to views and visions embedded in Phillip’s practices. Most of the scholars have consensus over the fact that the role of leaders has changed from the directive and prescriptive style to one of the power delegations – empowering; that has taken organizations toward linear structures, flexibility, and team working (King, 1994).

“…Transformational leadership – occurs when leaders broaden and elevate the interests of their employees when they generate awareness and acceptance of the purposes and mission of the group, and when they stir their employees to look beyond their self-interest for the good of the group. ” (Bass 2001, pp 21)

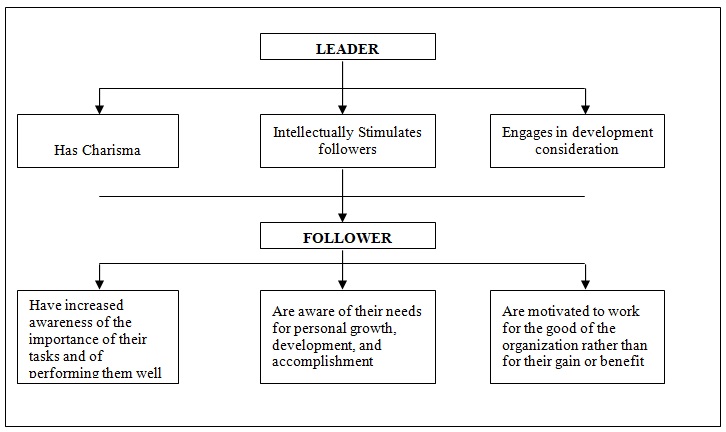

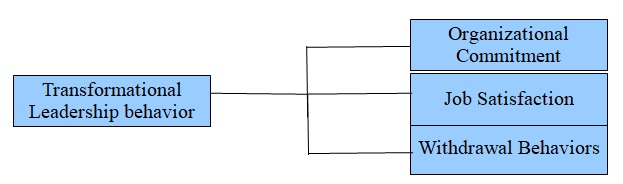

Various studies have been conducted to understand the concepts behind the effectiveness of transformational leadership on variables like job satisfaction, commitment, motivation, and organizational behaviors within the realm of an organization. To understand the relationship of leader’s various attributes and their subsequent impact on followers, Bass (1990 as cited in Senior and Fleming, 2006) proposed the model 2.3.1.

Different styles of transformational leadership

The aspects of transformational leadership discussed until now brings to fore the culture of an organization. It does not only substantiate the cohesion of an organization but also depicts the prevailing leadership style and attitude. However, it does not mean that the organizational culture always develops the leader. At times, the leadership is so influential that it changes the culture of an organization. This is the basic trait of a transformational leader. Where transactional leaders set their functional parameters within the laid down standard operating procedures of the existing culture, transformational leaders believe in the cultural building by creating a vision for the organization that is based on strategic thinking, which is constituted on 4 I’s; idealized influence, inspirational motivation, intellectual stimulation, and individualized consideration. These 4 I’s help the transformational leaders in ensuring that the employees perform beyond expected levels of their performances. One of the the4 I s, idealized influence can be understood in the context of knowledge creation within the organizations.

The increase of sway of knowledge in an organization could result in open-mindedness norms as well as leader-member exchange. Regarding this, M Tse, H. H., & Mitchell, R. J (2010, p.1) cited Mc Fadyen & Cannella, Jr (2004) and Un & Cuervo-Cazurra (2004) about the influence that knowledge can create and also do upsurge the interest of exploring factors. They opine that knowledge creation should be characterized as a product. By doing so, the organization can enrich the function of social capital. This enhancement of social capital is crucial to organizational development. This can also increase the effectiveness of the employees. To know the effect of transformational leadership in the way of idealized influence, organizational learning, as well as creativity, is necessary. Learning and creativity arise from the knowledge and vice versa. Regarding the confluence of knowledge and idealized influence, the authors cite Troukas (1996) and Berson et al (2006) about the distribution of knowledge systems in an organization. They explain that the knowledge systems are the ones that are constituted by individuals, who are capable of creating knowledge using the relationships between them. The relationships between individuals result in social interactions when the organization deals with a larger social collective network which needs idealized influence also (M Tse, H. H., & Mitchell, R. J 2010).

Proposition

The presence of Western banks can also diversify banking activities in Pakistan. For example, investment banking activities may increase. Before reviewing about breaking of the old culture in an organization, it will be useful to discuss 2nd ‘I’. This is because inspirational motivation can also explain the efficacy if the leadership is of transformational style. Inspirational motivation arises from the integration of effective and communicative mechanisms. The former will be used by the leaders to induce positive emotional experiences in the employees and the latter is used in communicating the vision of the organization to the followers and stakeholders. According to Ilies, R., Judge, T., & Wagner, D (2006) the integration of the above two mechanisms results in the direction of action, the intensity of effort, and effort persistence in the employees due to motivation that is drawn by the inspiration that will be inculcated by the leader in the followers.

This trait can be found ineffective leaders as they prefer motivation to command. Ilies, R et al (2006) also cite Locke (1991) and Bass (1990) about the comprehensive treatment of leadership that explains the term motivation. As per this comprehensive treatment, the leader behaves in a manner to create heightened motivation in followers to extract the designated outcomes necessary for an organization. During motivating the employees with inspiration the leader yet times follow the path-goal theory which can enhance the psychological states of the subordinates. This enhancement results in motivation that enable the employees to perform. In other words, leadership and motivation are linked to each other and the second ‘I’ works in that way (Ilies, R., Judge, T., & Wagner, D, 2006).

The third ‘I’ is intellectual stimulation that can be created from principal leadership behaviors. According to Einstein, W. O., & Humphreys, J. H (2001) change initiation and management can help in the diagnosis of leader-follower relationships. This also includes the climate, personal style preferences of a leader. Including these aspects in the functional style of a leader can further lead to causal relationships between leadership and innovation as well as change. The type of situation that arises due to the existence of causal relationships between leadership and innovation results in support for intellectual stimulation.

In this regard, Einstein, W. O., & Humphreys, J. H (2001) cited Bass’s (1985) model of leadership, which states that it can install confidence in employees and strengthen the intention of followers to deliver their best. Thus Bass asserts that a leader who thinks innovative is necessary to achieve long-term goals. The new type of thinking results in innovation, which is impossible without intellectual stimulation in the employees. This can be made possible by broadening and elevating the interests of the employees by generating awareness and acceptance of the goals of the organization. The employees act according to the goals of the organization when they look beyond their self-interests. So the leader should act in a manner to install confidence in the employees whom their interests will be met. When that happens, they look beyond the personal interests and start thinking about the goals and mission of the organization (Einstein, W. O., & Humphreys, J. H, 2001).

Thus goals of the organization will be the goals of the employees acting and thinking collectively when the leader explicitly conveys the individualized consideration to employees. When a transformational leader does it, the employees see a great person in their leader and act accordingly. Consequently, focussing on the behavior of leaders, the crux of leadership can be found in individualized consideration of the employees. Marshall Sashkin William Rosenbach (1998, p.65) placed the aspect of individualized consideration after inspiration in the list of the traits of a leader. As employees draw inspiration from the behavior of the leader, the ‘I’ that symbolizes the individualized consideration follows the ‘I’ that represents inspiration. When the inspiration exists in the employees, the high expectations don’t matter as they draw energy from the leader and knowledge from the organizational systems. The presence of such a climate in any organization will be due to individualized consideration only and Marshall Sashkin William Rosenbach (1998, p.65) terms it as the notion of relationship behavior. This is possible with the personal attention the leader can give to his/her followers. In doing so, the leader builds personal considerate relationships with employees.

As a result, they cannot deny or reject the leader’s proposals during work-related activities. However, this is not so easy and the leader has to concentrate on employees’ needs to create an atmosphere of individualized consideration. This attitude of a leader can help followers to learn and develop as they get encouragement to their responsibility as the leader exhibits trust and respect, which make the followers feel toward the leader. Thus the fourth ‘I’ individualized leadership depends on the leader-follower relationship and all the four ‘I’s thus affecting the culture of the organization. Hence, the transformational leadership that concentrates and exhibits all the four ‘I’s can bring a change in the organization by changing its culture (Marshall Sashkin William. Rosenbach, (1998). This may result in the process of breaking away from the old culture. This requires a clear and absolute vision created based on comprehensive and methodical research and review, perseverance, and optimism. Transformational leaders build culture through devolution of power, wherever required, and encourage employees at the personal level to develop followers. Although flexibility is critical, any routine procedure or activity that does not contribute towards achieving the objectives contributing towards the implementation of a new culture is abolished. However, any changes in the culture are brought by keeping in view the past strategies and vision and implementing the ideas in an existing culture that support the new vision, to maintain the continuity and ensure the stability of the organization.

Pay and Job Satisfaction

Even though a leader is a visionary and exhibits a transformational style of leadership, the absence of pay and job satisfaction in employees may not lead to innovation, and performance may also be affected badly. However, the pay and job satisfaction was found in the employees after the transformational leadership styles were introduced in some foreign banks. This resulted in a mixed style of transactional and transformational in local banks and also introduced the pay and job satisfaction aspects in the perceptions of the job seekers as well as the employees. According to Kamal., Yasir & Hanif (2009, p.3), a decade ago there is no concept of job satisfaction in the Pakistani corporate world, and organizations, including banks, used to be sanctuaries for the employees. However, after the introduction of transformational leadership styles by foreign banks, the organizations started to treat employees as the assets of the organization and HR replaced personnel as the first step of inclination to transformational leadership in the place of transactional leadership (Kamal., Yasir & Hanif, 2009). Consequently, prevalent organizational cultures usually are extensions of national cultures, historical trends, or evolve over some time.

Historically dominant cultures were marked with command relationship between leader and subordinate. Culture is a multi-faceted concept that embeds over time and inculcates shared values, beliefs, norms, assumptions, patterns of relationships, myths, stories, and legends that are passed on from founders and top management to new entrants and guide their behaviors and attitudes (Odem et al, 1990; Yiing and Ahmed, 2009; Lund, 2003 and Akash, 1993). Schein (1990) reiterated culture as a synchronizing factor that influences and keeps the subsidiaries and parent companies appear integrated. Hofstede et al (1990) characterized culture as being ‘holistic, historically determined, and anthropological concepts, socially constructed, soft and difficult to change’. Kerr and Solcum (1987) also conformed to the notion that culture is a phenomenon that is pervasive and hard to alter.

Yiing and Ahmed (2009) assert that within the organizational paradigm leaders are charged with the responsibility of synergizing the organizational cultures to stir in the spirit of shared values to provide a sense of direction and translate visions into attainable goals. Organizations that foster a culture where ample autonomy is given to employees yield higher levels of organizational commitment and job satisfaction. Empowering employees also enable organizations to hold on to valuable employees in times of downturn when the focal point remains cost-effective (Savery et al, 1997). Risk-taking refers to the degree to which organizations allow employees to take initiative and encourage creativity. According to Lund (2003) cultures that proclaim innovation and creativity experience higher employee satisfaction. Kirkman and Shapiro (2001) argue that organizational cultures that endorse collaborative team working enhance employee job satisfaction but vary depending on the nature of work and societal perception on collectivism.

When societal perception of collectivism has to be discussed in the context of collaborative teamwork, Kelly, J (1998, p.66) cites Mancur Olson’s ‘The Logic of Collective Action (1971). Kelly opines that this logic has been effective in a wide range of disciplines. The logic found its place even in psychology also. This theory propagates the rational choice models of organizational behavior by starting at a point that the individual maximizes his/her interests. The maximization of the interests of individuals will be done here by acting according to the goals and mission of the company. The theory prefers collective organization by abandoning the mobilization theory. This has to be done by linking the individual interests of the employees with group behavior. This is a theory that provides some insight into problems that come in the way of developing relations in an organization.

By using this logic theory, the leader identifies the conditions that workers become collectively organized. Hence, this theory found much use in trade union relations rather than organizational activities. Hence, it is important to take recourse in rational choice theory that deals with individuals as the proper unit of analysis. In this regard, Kelly, J (1998, p.67) mentions ‘all social phenomena’ with their structure as well as change. By doing so, the properties, goals, and beliefs, as well as actions of individuals, can be considered in making decisions by a transformation leader. Thus this choice views the actors as self-interested agents and sees the situation from the perception of the employees also. Regarding this aspect, Kelly, cites Hardin (1982) and Hindess (1988), and Taylor (1988) about a statement that implies the motivation of the employees. Consequently, the leader has to link the interests of the employees with those of the company. Thus, when employees act according to their self-interest, the company’s goals will also be met (Kelly, J, 1998).

This drives the leaders’ actions towards the human resources (HR) perspective to avoid collective actions of employees who harm an organization’s interests. The HR practices focused mainly on selection, performance, appraisals, compensation, and compliance with legal requirements (Zhu et al, 2005). It is asserted by Zhu et al (2005) that transformational leadership and human capital enhancing HRM work collectively to enhance organizational effectiveness and performance to serve the strategic interests of the organization. Their empirical study manifests distinctly that collaborative efforts of transformational leadership and HRM will proclaim more cohesion, commitment, trust, motivation, and performance in the new organizational environment. In an interview for Harvard Business Review (1999) Jacques Naseer CEO of Ford Motor categorically expressed his views over bringing about a change in the company’s mindset to entrench it strategically. in the global market. He can be viewed as a transformational leader who for the first time brought a cultural shift in the company since its inception 95 years ago. He talked about his endeavor to synergize the very roots of Ford to embed a culture of a global mindset, initiative knowledge of customers, and a strong belief in leaders as teachers and mentors.

The embedding the global culture and initiation of knowledge are important for some researchers to influence employees towards the realization of organizational goals(Robin et al 2004) and for some contemporary academics leadership is about articulating a strategic vision, then inspiring associates through persuasive communication of this vision to achieve required goals and targets. (Zhu et al 2005). In today’s dynamic markets leaders are charged with the inevitable task of revitalizing the organizations to keep pace with the business hostilities. The revitalizing of the organization depends on the relationship of employees with an organization. In saying so, one has to understand that the relationship is with the leader they are dealing with within the organization. The leader’s actions constitute a series of conversations, and this leads the employees to develop a relationship with the organization. This relationship prompts the employees to act according to change and in this regard, Herriot, P (2001, p.161) mentions the range of difference in organizational forms that approaches to changes in the activities.

One of the revitalization aspects is the use of IT and the interconnection of stock and money markets in the globalized market. These aspects when combined with alliances that manage the supply chain better and achieve economies of scale will bring vigor to the organization. However, these are the external factors that can be used by a leader to revitalize the organization. There are internal factors such as reducing the levels of hierarchy for devolution of responsibilities and also increases interactions between employees and leaders. When these two aspects have combined the activities and relationships in an organization will be flexible and this activity can be improved with new employment contracts. Nevertheless, these changes should be easily noted and adapted by employees and the activities of a leader should be common responses to the drivers of change. Regarding this, Herriot, P (2001, p.162) mentions middle management that is offered tempting targets regarding cutting costs and to get a greater outcome in terms of workload. To do so, if leaders want to get labor flexibility, the employees may see it as job insecurity. Hence, the first step in revitalizing the organization is to remove insecurity in employees. This in turn develops interaction with a leader and thus causes the enhancement of relations (Herriot P, 2001).

Hence, organic forms of leadership like transformational types provide organizations with the opportunity and viability to institutionalize essential changes in the organizations that keep organizations at the forefront. This will be possible when leaders think progressively.

Transformational leadership and corporate structures

As discussed earlier, leaders have to think progressively to cope with radical internal and external changes. This progressive and adaptive thinking calls for simplified, team-oriented, spontaneous and flexible structures with the lateral direction of communication and collegial decision making. According to Bass (1990) companies facing a turbulent marketplace, where a product life span is limited, every member has to be a transformational leader within the realm of the organization. And it can be achieved with minimal structured layering, sapiential authority, creating learning environments, and incorporating informal cultures. Mitsubishi website says that Mitsubishi Motors revised its organizational structure in 2004 by bringing 230 departments down to 131 to speed up decision making and to make the job delegation process simple. This enabled employee participation and opened vistas for innovation.

Transformational Leadership and Innovation

As discussed earlier organizations today operate in extremely volatile and dynamic environments, it has become imperative to constantly innovate and be more creative to hold and grasp large market shares. Transformational leadership influences creativity entailing enhanced innovation at an individual as well as at an organizational level (Gumusluoglu and Ilsev, 2009). According to Gumusluoglu and Ilsev (2009), transformational leaders provide supportive supervision, which is a vital determinant of intrinsic motivation in an employee leading to creativity. Transformational leaders facilitate skill development and continuous learning of their employees and convene ways to guide subordinates towards the achievement of goals through intellectual stimulation ensuring employees exhibit enhanced interest in their tasks. Gumusluoglu and Ilsev (2009) research validated that transformational leaders not only promote creative activities within the realm of their organization but also ensure the market success of innovations. It can be deduced from Jung, Chow, and Wu (2003) empirical research that transformational leaders assert positive influence in enhancing organizational innovation and creativity through institutionalizing a culture that empowers employees and provides them with an opportunity to experiment with innovative ideas and approaches. For innovation to sustain top management must be committed to changing and inculcate values that encourage individual growth and development.

Success of Organisation

The success of an organization is determined by the extent of adeptness at institutionalizing and fostering innovations and the banking industry being a service-oriented sector is aware of the need for improved innovative processes and services to compete in the marketplace (Sciulli, 1998). The following table has been adapted from Sciulli’s (1998) work the divides innovation for banks into four broad categories.

It is asserted that incremental innovations focus on economies of scale and mass-market development and does not necessarily require special motivation. However, academic researchers believe that transformational leaders exert influence on innovation through organizational characteristics such as culture, strategy, structure or through their charismatic flair that impacts employees’ behavior subsequently asserting influence on their motivation and creativity that stimulates their intellect and broadens interest in assigned tasks (Gumusluoglu and Ilsev, 2009).

Proposition

Transformational leadership accentuates innovative behaviors among employees that determine the opportunities to add value to existing practices and is capable of leading to citizenship behavior.

Transformational Leadership and OCB

Citizenship behavior cannot be directly inculcated into the employees. It develops from within the culture based on the employees’ satisfaction level, their organizational commitment, perception of fairness in the managerial decisions, and their trust in the leaders with regards to their support and assistance. These perceptions and behaviors generally revolve around the seven behaviors stated below.

- Helping Behavior: Voluntarily helping others

- Sportsmanship: Willingness to tolerate inevitable inconveniences without complaint

- Organizational Loyalty: Promoting organization to outsiders, defending against external threats, and remaining committed to the organization in adverse times

- Organizational Compliance: Acceptance and adherence to organizational rules and regulations

- Individual Initiative: Volunteering for taking extra responsibility, and encouraging others to do the same

- Civic Virtue: Commitment to the organization as a whole, and looking for its interest even at personal cost

- Self Development: Improving knowledge, skills, and abilities through training courses, research, and studies

Many factors can contribute to the determination of Organizational Citizenship Behaviour which includes Altruism (helping co-workers), Conscientiousness (doing an exceptional job on one’s role), Civic Virtue (following company policies), Sportsmanship(not complaining about little inconveniences in the workplace), and Courtesy (being kind to coworkers) (Bokhari, 2008; Ali et al., 2008). Several types of research have shown that dispositional variables like agreeableness, conscientiousness, positive and negative affectivity are indirect contributors to OCB. Whereas role perceptions that include role ambiguity and role conflict, directly affect altruism, courtesy, and sportsmanship but have no or lesser impact on conscientiousness and civic virtue. However, gender in particular has no material impact on OCB.

In this regard, task characteristics can be considered. They are regarding individual behaviors that are observed in the social and psychological context. The social and psychological contexts are capable of affecting the performance of an employee. In this situation, OCB acts as a lubricant. This is necessary for the machinery of any organization. In this regard, Todd, S. Y., & Kent, A (2006) cite Podsakoff, Mackenzie, Paine, and Bachrach (2000) who outlined the OCB with a range of variables that influence it. This can be observed in work-related outcomes and these depend on the relationship with the OCB construct in an organization. Hence, the situation of functional activities demands a relevant relationship between task variables in an organization with OCB. Todd and Kent opine that the real problem in this situation is the undefined nature of the relationships mentioned above. The presence of transformational leaders results in making use of the correct relationship by developing them during the time in an organization. This situation that rises between leadership and OCB has been mentioned by Todd, S. Y., & Kent, A (2006) as a serendipitous discovery. Thus the relationship between OCB and tasks gives rise to substitutes for conventional or transactional leadership.

However, the task variables related to OCB cannot be ignored. They can also have an indirect effect and are challenging. This situation is due to a lack of proof for the direct effects of task variables. As only previous literature can help in mediating between task and OCB, this situation arises. However, there exists a direct effect model that suggests the direct relationship between task and OCB. In this regard, Todd, S. Y., & Kent, A (2006) cite Settoon and Mossholder who tested a model that establishes quality and relationship as antecedents of citizenship behavior in an organization. Nevertheless, this argument depends on the assumption that the central positions in an organization have to process adequate levels of knowledge and information. As a result, transformational leaders play a critical role in developing citizenship behaviors by organizing the information as knowledge in an organization.

The culture they develop based on their vision has a consistent impact on the behavior of the employees. If transformational leader also carries a general perception of giving due consideration to OCB’s while evaluating their employees for rewards, then these rewards also influence the OCB’s. Hence personal evaluation comes to the fore in this situation and OCB has a considerable positive relationship with performance evaluation, job dedication, and the contextual performance of the employees in an organization when it comes to a managerial decision on the overall evaluation. Organizational performance and success are also directly related to OCB and determines the effectiveness of an organization to a fair extent. Helping behavior that enhances the performance of employees also has a positive impact on organizational performance and success.

This helping nature in the employees can be inculcated by a leader when he/she affects the subordinate motivation by improving the ways that make the attainment of outcomes easier. In this course of action when a transactional leader gives coaching and guidance, the transformational leader attaches the employees’ self-concept to vision. According to Chemers, M. M (1997, p. 90) this link can be attained when the leader states the vision of the company in ideological terms. When the leader is successful in doing so, the goals of the company are placed in the moral and spiritual context for the employees. Simultaneously, the organization also raises the attention of collective interests and group goals. The authors claim that these activities can further enhance the self-esteem of the employees and maintain a personal identity for them along with the intrinsic value of effort. When these aspects are raised simultaneously in employees, they help each other in the activities of the company to attain goals. The leader also will do his/her best in making employees each other by making use of symbolic communication.

When the employees engage themselves in self-concept and increase the intrinsic valence of goal accomplishment and act collectively, mutual helping can take place whenever necessary. The collective goal accomplishment combined with mutual helping is part of goal-directed efforts by the leader and the employees. This further states the leader’s confidence in follower’s abilities and this cannot be observed in leadership forms observed in Pakistan as they follow transactional leadership styles. In this regard, Chemers, M. M (1997, p.91) cites House and Shamir, who maintained that the charismatic leader’s vision is not negotiable. They mean that the basic features of the leader’s personality cannot be changed, and thus they influence the employees with the values inculcated. The authors further cite House’s contingency leadership theory that can lead to charismatic effects of vision, which can arouse motivation in the employees. The presence of motivation makes them draw inspiration from the leader and will make the individual perceptions of the employees compatible with that of the leader (Chemers, M. M, 1997). As a result, individual considerations and inspirational motivation are provided by transformational leaders to their employees (Chemers, M. M, 1997).

The inspiration and motivation can lead to the positive influence of leaders on employees’ organizational citizenship behavior (Cho and Dansereau, 2010; Ali et al., 2008). Cho and Dansereau’s (2010) study on a large multinational bank in South Korea revealed that transformational leaders individually considerate behavior that entails recognition of varied needs and capabilities of followers and provision of tailored support for the employees yield higher and positive organizational citizenship behaviors by the follower. They also promulgate that charismatic leadership behaviors that encompass articulation of a compelling vision and provision of inspiration for collective identity and spirit ensure followers view themselves as equal and consistent parts of a whole subsequently leading to group cohesion. Cho and Dansereau’s (2010) study findings also supported the theoretical notion that transformational leadership is universally effective leadership behavior. Hence, the proposition from the review till now is as follows.

Organisational Commitment

Researchers have been striving for years now to explicate the significance and determinants of developing commitment within the organizational realm. Organizational commitment is vital for the success of any organization. Enjoy et al (1998, p 243) affirm this phenomenon that

“…the success of any organization depends not only on how the organization makes the most of the human competence but also how it stimulates commitment to an organization.”

In recent decades commitment has emerged as an imperative for enhanced organizational performance (Suiman and Iles, 1999). Commitment is viewed as an attitude that is an extension of employee participation and willingness to remain in that organization (Silverthorne, 2004). Though this paper focuses on commitment holistically it is critical to look at the component conceptualization of commitment. That will make us understand the fundamental impacts of these components on employee perception of commitment in a position to his bonding to the organization.

Suliman and Iles (1999) highlight four approaches to conceptualizing organizational commitment.

- The Attitudinal Approach: according to this approach employee develops a feeling of belongingness that keeps him glued to the organization.

- The Behavioral Approach: this approach asserts that the employee evaluates the costs associated with leaving the organization and this investment keeps him committed to the organization.

- The Normative Approach: this approach focuses on employee values and organizational goals. This can make an employee feel obligated. It supports retention.

- The Multidimensional Approach: this approach suggests that commitment should be viewed as a combination of emotional attachment, perceived investment, and obligation. All these concepts together form a holistic view of organizational commitment.

While talking about organizational commitment and four approaches, the review of HRM by a leader is important. Regarding this aspect, Sheehan, C., & Scafidi, A (2005) cite Fisher et al (1999) and Michelson & Kramar (2003) about strategic HRM by analyzing the content of wording. This content used by a leader while doing his/her job seeks to attract relevant or suitable applicants in the context of recruitment (Sheehan, C., & Scafidi, A, 2005).

In this regard, Hasbullah, N. (2008) asserts that organizational commitment has three basic components: Faith and acceptance of the organizational goals and values (identification), willingness to make efforts on behalf of the organization (involvement), and strong intent to remain with the organization (loyalty). After recruitment, looking at the work climate to assess the degree of various elements determining organizational commitment first to gain attention is the corporate culture. Organizational cultures have a great impact on people’s perceptions regarding goals, performing tasks, and administration of resources to achieve these goals and tasks and ultimately exerting influence on organizational commitment and satisfaction (Lok and Crawford, 2003). According to Lok and Crawford (2003), innovative and supportive cultures have a positive influence on levels of commitment.

The prevailing style of leadership also is a vital factor that can affect the commitment of employees. Bass (1990) implies that to elate commitment among employees leaders should develop a well-articulated vision shared by all and then communicate it to all levels to achieve established goals. Leaders with their charisma and inspiration can bind employees and followers to rise beyond personal goals to convene towards team building and organizational convergence (Cacioppe, 1997).

Empowerment as a motivational tool can be exercised to enhance commitment levels giving an employee ample room to innovate. Empowering employees also enable organizations to hold on to valuable employees in times of crunch when the focal point remains cost-effective (Savery et al, 1997). It has been argued that employee participation makes company goals achievable because involving an employee in the process ensures their support (Salancik, 1997).

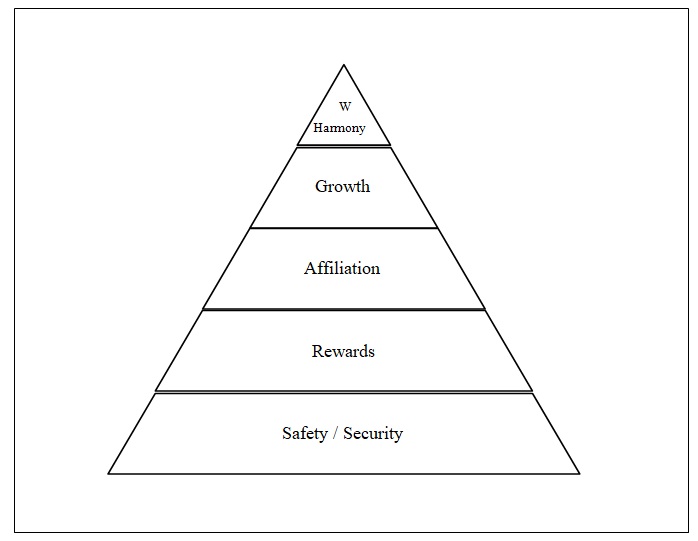

Job enrichment, employee involvement, and career development are a few of the job characteristics that foster commitment at all levels within the realm of the organization (Nijof et al, 1998). They continue to emphasize that effective HR policies and practices are indispensable for employee career growth. Mayer and Smith (2000) also assessed that organizational commitment is positively related to employee perception of HRM policies and to what extent those policies are implemented and practiced in the organization. Stum (2001) explores what elements within an organization have the most impact on employee commitment. He refers to the need hierarchy of ‘commitment needs’ that leads to enhanced performance. From job security to intrinsic need of belongingness towards team building leading to individual growth and finally, towards work-life harmony, this pyramid proposes that it is organizational policies inculcated by leaders, that will eventually either elate or restrain employee commitment. ‘Commitment needs’ hierarchy is shown in the following figure 2.1.

Burns (1978) defined the transformational leader as someone who not only ensures follower movement along Maslow’s hierarchy but also moves them to transcend their self-interests by role modeling citizenship behaviors such as altruism, conscientiousness, sportsmanship, courtesy, and civic virtue (Bass, 1999).

In this situation, collective commitment in employees is a psychological contract. It is implicit or implied expectations of an employee from the organization and vice versa and is a significant aspect of determining work attitudes and subsequent commitment levels. Mullins (2000) explains the concept of psychological contract saying that it is a set of unwritten mutual expectations developed through employee-organization relationship. Stalker (2000, as cited in Mullins, 2000) proposed a formula to keep a balance between the unwritten needs of an employee with that of the organization to ensure commitment within the work environment. He says five attitudes caring, communicating, listening, knowing, and rewarding through moderating role played by a transformational leader can significantly affect commitment from an employee perspective.

Leadership and Organisational Commitment

“…commitment is a strikingly powerful and subtle way of coopting the individual to the point of view of the organization.”

(Salancik, 1997, p 80)

For almost a decade now world business economies are perplexed over ever elating employee turnover figures making it a challenge for companies to attract and retain competence and competitive valuable human resource capital. In recent times of global economic crisis business markets have become turbulent and volatile. Organizations must retain valuable human capital in times of crunch and capitalize on available knowledge, experience, and adroitness to evade tangible and intangible costs associated with dwindling levels of commitment resulting in high turnovers.

Keeping pace with the turbulent and volatile external environment calls for progressive and adaptive thinking where every member is a transformational leader who aspires for simplified informal cultures, team-oriented and flexible structures with traverse communication and collegial decision making.

According to research conducted by Berson and Avolio (2004) in a large telecommunication organization in Israel that included 2200 employees, revealed that transformational leaders disseminate strategic visions to ensure that their followers and subordinates manifest elated levels of commitment towards organizational goals, willingness to contribute more and work with greater zeal and vigor as highly cohesive groups (Avolio, 1999; Bass and Avolio, 1994; Burns, 1978).

Proposition: The leader should be visionary, flexible, and willing to delegate the authority to make the subordinates share the responsibilities, to let them own the decisions they make at different levels to ensure a higher level of commitment among employees.

National and Organisational Cultures in Pakistan

Organizational cultures are usually seen as an extension of national and societal cultures. According to Hofstede (1983) Pakistan carries a collectivistic culture, rates high on both uncertainty avoidance and power distance, possesses both masculine and feminine qualities, and rates extremely low on long-term orientation.

National Cultural Pakistan.

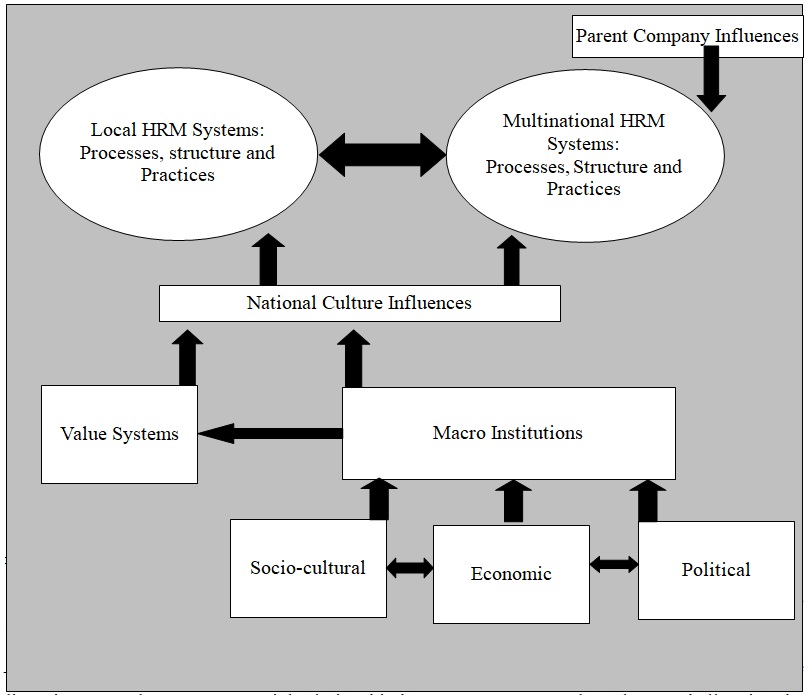

To understand the impact of important national factors on determining leadership styles in Pakistan following matrix is adapted from Budhwar and Debrah (2004).

Pakistan’s Corporate Culture

Khilji (2004) provides a recent cultural analysis asserting that typically Pakistan carries a collectivist character where people are extremely status conscious and manifest large power distance. Government organizations reveal bureaucratic culture with formal hierarchies where power is centralized and exhibit pervasive distinction between elite and non-elite. Employee autonomy, participation, and bottom-up communication are alien concepts. Even in the private sector firms adhere to transactional forms preserving a culture that manifests positional authority, rigid structures, and formal bureaucratic cultures.

In Pakistan HR being in the evolution phase, structured HR policies and practices subsist creating a vacuum. There are unsatisfactory salary plans, improper feedback mechanisms, lack of career development progression, and no viable performance management mechanism.

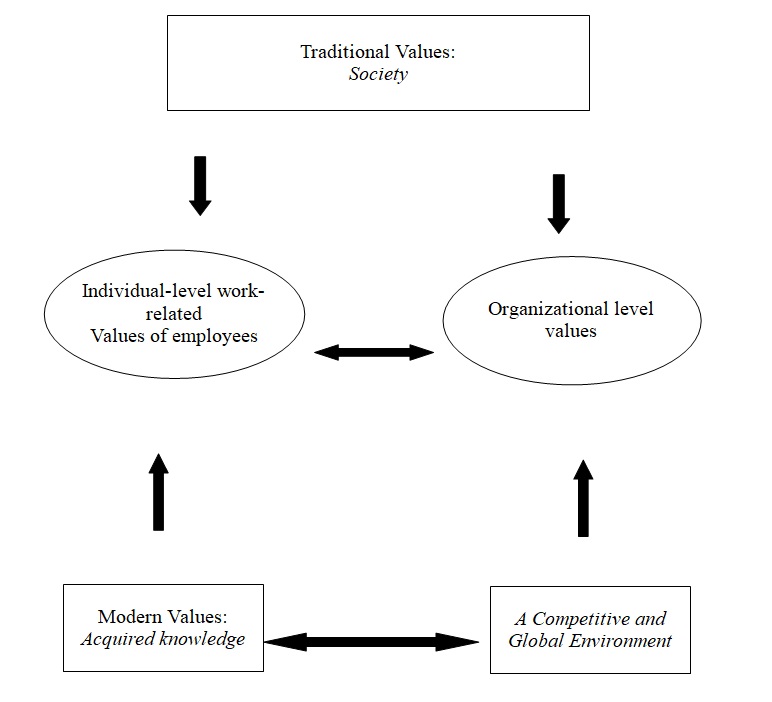

Multinationals operating in the country have brought the prevalent culture under scrutiny and intense critique but Khilji (2003) argues that in Pakistan national culture is ingrained to an extent that parent company of multinationals failed to institutionalize corporate values shared in the home country. Khilji (2004) asserts that with globalization and a decade of deregulation through national values remain embedded in the tradition but a shift in the work-environment related values is emerging. Her empirical study validates that younger groups of employees exposed to and inspired by American corporate values grasped through business studies syllabi have brought along a transition towards transformation but face resentment from older cohorts of employees.

She hopes that when these young entrants occupy senior managerial positions, they could converge with the traditional work-related values with contemporary practices. These results in a transformed culture that opens vistas for decentralized decision-making policy that aspires for autonomy and substantial participation effectively allowing channels for communication. This can be better depicted in the following framework in Figure II, which was developed by Khilji (2003) for her research on multinationals and their practices in Pakistan. She asserts that most MNCs operating in Pakistan have taken an initiative to develop new practices and systems that entail national values and parent company vision. She strongly implies that cultures are converging where subsidiaries adapt to local needs and requirements while preserving the essence of parent company strategies and policies. With the influx of multinationals, effective human resource management is becoming a strategic partner in organizations taking on a more proactive role.

In Pakistan orthodox style of leadership prevails where leaders are usually seen as dictators who exercise positional authority and bureaucracy is considered the eminent way of controlling and directing as discussed earlier. However, with the influx of multinationals, the trends appear to be diverging, towards a more congenial relationship between managers and employees challenging the concept of elitism.

Proposition: The presence of foreign banks and global competition, the local banks of Pakistan’s face can make them innovative and can offer quality products and solutions to their clients.

Universality of Management Practices and Leadership Styles

Newman and Nollen’s (1996) study focused on financial performance outcomes for work units in 18 countries, and they argue that multinational enterprises need to adapt to the local host country’s national values and cultures to achieve business strategic objectives. They proclaim by quoting that quality circles were institutionalized in Japan to ensure consistency and excellence, but the same concept failed to appropriate the same results when adopted in the U.S.

This school of thought (Hofstede, 1980; Trompenaars and Hampden-Turner,1994; Nelson and Gopalan, 2003) argues in favor of convergence of cultures and management practices towards localization for business efficiency. Hofstede (1983) reckoned that management is ‘culturally dependent‘ and for optimization, management practices should ‘fit the local culture‘ but also acknowledges that there have been instances where multinationals successfully institutionalized divergent organizational cultural values (Hofstede, 2001). A recent study of GLOBE (House et al, 2001) also opines that national cultures play a vital role in shaping organizational environments while explicitly using the term ‘mirroring‘. Pieper (1990) appears to comply with House et al. (2001) when he says “… organizational cultures neither dominate nor erase national cultures, rather in the case of MNCs appears to accentuate it” (p. 251) but emphasize that for MNCs to build corporate image cultural diversity must be managed effectively “…under the rubric of organizational culture firms require foreign nationals to accommodate to the parent company – and implicitly to parent culture style of interacting harboring professionals who are beyond ‘passport’.” (pg. 251)

In the case of MNCs national cultures are usually seen as a constraint on management practices but Gerhart’s (2008) recent empirical study on contrary to the popular notion depicts the least variance in organizational cultures due to national or societal values and insinuates “… organizations may have more discretion in choosing whether to localize or standardize organization culture and related management practices than is suggested by conventional wisdom.”

Similarly, when Toyota went global, many believed that its Eastern culture was more conducive to high-quality manufacturing and western countries would not be able to replicate the Toyota Production System due to deviating perception of quality and control mechanisms between individualistic and collectivist societies but Toyota proved that its approaches can realize similar results everywhere and became a global manufacturer (Evans and Lindsay, 2005; as cited in Naor et al. 2009). In an era of globalization when multinational corporations invest overseas by initiating ‘startups and entering into joint ventures, mergers, and acquisitions‘, Naor et al. (2009) argue that plants can establish an organizational culture that is different from the national culture in which they are embedded.

Proposition: As there is a gradual shift from the transactional style of leadership style to the transformational one in Pakistan’s banks, it can enhance the performance of banking organizations.

Need for Leadership in Pakistan

When MNCs find such a situation to establish a culture or organizational behavior that is different from the national culture, a need for a different type of leadership arises. It can be considered as a social need and should stimulate among individuals while working in a group. This depends on the society the company is working. The next need is a contextual need that refers to the work environment. This depends on the work environment and the nature of the work. Regarding the banking sector of Pakistan, the contextual need for leadership will be regarding transparency and transformational style. In some contextual needs, the employees wish for leaders’ intervention and in the banking sector, it is about innovation in the products and solutions as the execution of them will be routine. Hence, a shift towards transformational leadership in the banking sector of Pakistan is a necessity to innovate the activities as well as being democratic in activities by lessening the importance of hierarchy (Mahmood A Bodha., Ghulam Hussain, 2010).

Transformational Leadership in the Banking and Financial Sector

Empirical studies in the banking and finance sector of many countries by academic researchers affirm that transformational leadership positively affect organizational commitment and job satisfaction (Walumbwa et al. 2004; Walumbwa et al. 2005; Wang and Walumbwa,2007; Emery and Barker, 2007 ) and negatively related to job and work withdrawal ( Walumbwa et al. 2004; Kark and Shamir, 2002 as cited in Walumbwa et al. 2004). Their research across varied cultures from China, Thailand, India to Kenya in Africa and the USA revealed similar results.

Emery and Barker (2007) while conducting an empirical study on the service industry chose the banking sector and a national food chain in the USA to garner an understanding of the impact of leadership style on organizational commitment and job satisfaction. Their research sample comprised of 77 branch managers from three regional banking organizations and 47 store managers from the national food chain. Their study reflected the findings of Bass and Avolio (1987) that transformational leadership is a behavior process and entails three factors: charisma, individualized consideration, and intellectual stimulation and that these factors do impact how employees view organizational commitment, job satisfaction, and their relationship with the leaders.

Emery and Barker’s (2007) results contradicted the findings of the Bass (1985) model that suggested that transformational leadership is more predictive of individual and group performance in organizations that have a high propensity for risk taking and receptivity to change. Their data of the study affirmed that the transformational leadership style was even preferred by the managers of the service industry that is viewed as stable and having mechanistic structures.

Additional findings of Emery and Barker’s (2007) study conferred the notion that charisma adds unique variance beyond contingent reward behavior about leader effectiveness, and they further assert that charismatic flair has its influence across all management levels and is not necessarily imperative for top tier only.

Emery and Barker (2007) study sample had a relatively even distribution of both genders, thus asserting that female managers like their male counterparts prefer institutionalizing transformational leadership style that contains similar levels of charisma, individual consideration, and intellectual stimulation. Previous study findings found women to be receptive and, in some research studies, more receptive than men to transformational leadership as compared to transactional leadership behaviors (Druskat, 1994; Bass et al., 1996; Bass and Riggio, 2006). Their findings indicate the results can be generalized across similar organizational service structures.

Walumbwa et al. (2004) studied the impact of various transformational leadership constructs on work outcomes like organizational commitment and job satisfaction in the banking and finance sectors of China and India while exploring the mediating role of collective efficacy. Collective efficacy referred to each assessment of his/her group’s collective capability to perform the job-related behaviors and plays a vital role in elating motivational levels since employees rely in some context on others to accomplish their assigned tasks (Walumbwa et al., 2004). Their study was inspired from the earlier study of Bass (1985) and results of the study affirmed that transformational leaders motivate their subordinates to converge with their self-interests towards collective interests by imparting necessary empowerment instilling a sense of responsibility and accomplishment among all varied cohorts of followers.

It is interesting to note that though the transformational leadership constructs used in this study were developed and analyzed in the West, its applicability and transferability to Asian cultures, where societies score high on collectivism and power distance (Hofstede, 1980) raised doubts in the minds of the researchers. Building on the research of Bass and Avolio (1987), Walumbwa et al. (2004) used all four constructs of transformational leadership, including charisma, inspirational motivation, intellectual stimulation, and individualized consideration but dealt with these constructs as a one-dimensional factor since these constructs are highly correlated.

Walumbwa et al. (2004) research findings are consistent with the previous studies conducted in the West and endorse that transformational leadership style that entails charismatic flair, inspires motivation in subordinates, stimulate innovation and creativity and encourages collective performance, substantially influence organizational commitment and job satisfaction and curtail withdrawal behaviors in employees. Their research also proclaims the universality of transformational leadership behaviors across cultures and borders within the banking and financial organizations, the notion supported by the Global Leadership and Organisational Behavior Effectiveness (GLOBE) research program that elements of charismatic-transformational leadership are valued leader qualities in all countries and cultures (Bass and Riggio, 2006; Dorfman et al., 2004; House et al., 2004). Though there can be cultural contingencies, as well as organizational factors, that can substantially affect the impact of transformational leadership, in particular, instances. However, authentic transformational leadership tends to have a positive impact in all cultures and organizations because transformational leaders have goals and values that transcend their self-interests and strive towards collective tasks and goals of the followers (Burns, 1978; cited in Bass and Riggio, 2006)

In another study, Walumbwa and Lawler (2003) studied the relationship between transformational leadership constructs, work-related attitudes, and withdrawal behaviors in the context of cultural orientation in the banking and financial sector of three emerging economies of China, India, and Kenya.

Walumbwa and Lawler (2003) studied affective organizational commitment that ascribes to an individual’s psychological attachment to the organization. In this study Walumbwa and Lawler (2003) focused only on one cultural dimension, collectivism as it is one of the most widely studied dimension and be related to leadership styles and outcomes (Adler, 2002; Agarwal et al., 1999, House et al., as cited in Walumbwa and Lawler, 2003). For this study horizontal and vertical dimensions were used where horizontal collectivism refers to the cultural pattern in which the individual sees the self as an aspect of the group and vertical collectivism is a cultural pattern in which the individual sees the self as an aspect of the group, but individual differences within the group are acknowledged and recognized. Their theoretical model is presented below:

Their study manifested that through intellectual stimulation among subordinates, transformational leaders permeate psychological attachment with the organization and encourage employees to transcend their interests to achieve collective goals thus ensuring long-term elated levels of organizational commitment subsequently reducing withdrawal behaviors and positively influencing the perception of job satisfaction.

In a similar study, Schaubroeck et al. (2007) studied how transformational leaders inspire through well-articulated vision, encourage through empowerment, stimulate cognitive behaviors and motivate followers to realize mutual goals in 218 financial service teams in various branches of a bank in Hong Kong and the United States. Their research substantiates the early findings that transformational leadership behaviors and traits stir team values by communicating the high level of confidence in the team’s ability to achieve desired outcomes, encouraging analytical behaviors, and promoting cooperation and reliance of members within real work team parameters. This study further supports Walumbwa et al (2004)’s findings that transformational leadership behaviors can be inculcated in all organizations and that it can be embedded in multifarious cultures across continents.

This embedding nature of multifarious cultures can be understood by Wang and Walumbwa’s (2007)’s empirical study of 45 different local banks located in China, Kenya, and Thailand. They assert that supportive supervisory behaviors exhibited across all management levels yield higher commitment towards the organization where leaders or supervisors attend to followers’ needs, provide guidance, and act as mentors. The focus of their research was to identify the moderating effect of transformational leadership style on employees, organizational commitments, and their perception of family-friendly human resource policies. They (Wang and Walumbwa, 2007) proclaim that leadership is considered as an imperative factor that determines employee perceptions in the workplace subsequently influencing followers to work at attitudes and behaviors.

In essence, it can be argued that within the banking and financial sectors across countries and cultures, transformational leadership substantially stirs higher levels of organizational commitment in employees entailing enhanced job satisfaction and organizational performance.

Leadership in Banking Sector of Pakistan

To achieve and sustain competitive advantage, banks should be receptive to change and innovation, and Khandelwal (2007) and Ejaz et al (2009) assert that this trend of constant innovation requires a leader, who has transformational leadership traits. Like other industries and sectors, banks also need to differentiate their services and products from their competitors.

Research Methodology

Research Approach